Booz Allen Hamilton Profit, Sales Climb as Backlog Reaches Record

May 18 2016 - 8:30AM

Dow Jones News

Booz Allen Hamilton Holding Corp.'s profit rose and revenue grew

in its latest quarter on increased client demand, as the government

consulting firm said its backlog reached a record high for the end

of its fiscal year.

For the current year ending in March, Booz Allen projected

revenue to increase in the range of 2% to 5%. Analysts polled by

Thomson Reuters expected 4% growth. The company also said it

anticipates adjusted per-share earnings between $1.65 and $1.75, as

analysts expected $1.72.

The McLean, Va.-based firm mostly relies on contracts from the

U.S. government to grow its top line. Its total backlog climbed 26%

to $11.8 billion at the end of March, a record high for the end of

its fiscal year. The company said the improvement was due to

greater investments in bid and proposal activity amid a more stable

government contracting environment.

During its fiscal fourth quarter, Booz Allen named Lloyd W.

Howell Jr. as chief financial officer, replacing Kevin Cook, who

announced his retirement after more than two decades at the

company.

Over all, Booz Allen posted a profit of $65.5 million, or 43

cents a share, compared with $43.4 million, or 29 cents a share, a

year ago. Excluding certain items, the company earned 41 cents a

share.

Revenue rose 6.1% to $1.42 billion. Analysts, polled by Thomson

Reuters, expected 41 cents a share on $1.37 billion.

Shares of Booz Allen Hamilton have risen 4% in the past three

months and were inactive premarket.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

May 18, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

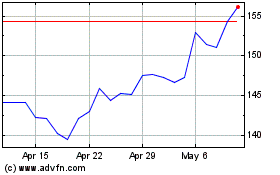

Booz Allen Hamilton (NYSE:BAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

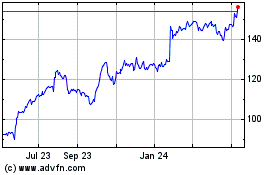

Booz Allen Hamilton (NYSE:BAH)

Historical Stock Chart

From Apr 2023 to Apr 2024