MoneyBeat: AIG Counsel Is Retiring -- WSJ

May 18 2016 - 3:02AM

Dow Jones News

By Leslie Scism

Thomas Russo, American International Group Inc.'s general

counsel who earlier had been the top in-house lawyer at Lehman

Brothers Holdings Inc., is retiring from the global insurer,

according to an internal memo to employees.

Mr. Russo's departure is the latest in a string of exits by

seasoned veterans as AIG continues to narrow its focus in the face

of pressure from shareholder activists. In December, AIG said that

four of its 15 most-senior executives were departing, as Chief

Executive Peter Hancock realigned duties and cut costs to

streamline operations and improve profitability.

Those departures were part of a broader plan to cut up to nearly

one-quarter of AIG's senior management, or more than 300 positions.

Since late October, billionaire investors Carl Icahn and John

Paulson made public separate proposals to break up the insurer into

three parts, and AIG added Mr. Paulson and a representative of Mr.

Icahn to its board earlier this month, as part of a pact to avert a

proxy fight.

Mr. Russo, 72 years old, will remain with AIG until the company

finds a successor and through a period of transition, according to

Mr. Hancock in the memo. A search for a successor will begin

immediately, he said.

Mr. Russo also worked for major law firms over his long career,

but is best known as the attorney who had a front-row seat at two

of the companies most central to the 2008-09 global financial

crisis.

He joined AIG in early 2010 when it was still owned by U.S.

taxpayers and just beginning to dig out from one of the

government's biggest single bailouts, which reached nearly $185

billion in aid. He oversaw the legal side of a divestiture program

that saw the global financial-services' giant cut its assets by

roughly half, from $1 trillion to about $500 billion to focus once

again on insurance. Taxpayers were fully repaid by the end of

2012.

Mr. Hancock wrote that Mr. Russo's accomplishments during his

six years at AIG included "having led the company through

negotiations with the U.S. Treasury and Federal Reserve Bank of New

York to repay the government and U.S. taxpayers with a profit. The

in-house team negotiated more than 90 strategic transactions to

sell AIG's noncore assets, guided six sales of AIG common stock by

the U.S. Treasury, and fended off unprecedented litigation

challenges."

Mr. Russo joined AIG from the New York office of Patton Boggs

LLP, which he joined after Lehman's bankruptcy in 2008. He was

chief legal officer at the Wall Street investment-banking firm for

over 15 years through its bankruptcy, He was a close aide of former

Lehman CEO Richard Fuld Jr.

Mr. Russo said he initially intended to retire a decade ago,

while still at Lehman, but Mr. Fuld had pressed him to stay. Two

years later, the financial crisis hit and Lehman went into

bankruptcy. Mr. Russo said he didn't want to retire "on that note,"

so had gone into corporate law and was comfortable there when,

barely a year later, he was courted by AIG's then-CEO Robert

Benmosche and government officials to join AIG.

"I took a month to make that decision," he said. "I wasn't sure

I was able to get back on the horse" and endure another potential

fall, as AIG's ability to stay in business long term "wasn't

anything close to a sure thing.... It was so traumatic what had

happened at Lehman."

In deciding to take the chance, he said he initially aimed to

stay only through Mr. Benmosche's tenure, but he became a good

friend to Mr. Hancock, and stayed on at the new CEO's urging. Once

AIG presented a strategic update to investors on Jan. 26, Mr. Russo

said he concluded "now was almost the most perfect time" to depart.

"We're on the right course and we have a lot of really good people

working on it," he said.

Having passed his 72nd birthday, he feels urgency to do "other

things" outside law, which may include taking college courses to

study subjects purely for fun, working on a movie about the New

York Yankees, and writing a book about "what I learned" at Lehman

and AIG and "other business experiences over the years."

(END) Dow Jones Newswires

May 18, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

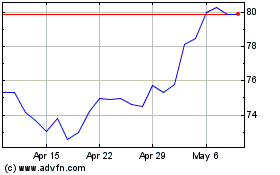

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

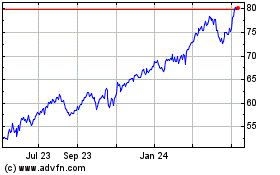

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024