Current Report Filing (8-k)

May 17 2016 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 12, 2016

ANI PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-31812

|

|

58-2301143

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

210 Main Street West

Baudette, Minnesota

|

|

56623

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code:

(218) 634-3500

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation

Under an Off-Balance Sheet Arrangement of a Registrant.

|

On May 12, 2016, ANI Pharmaceuticals, Inc. (the “Company”

or “ANI”) entered into a credit agreement with Citizens Business Capital, a division of Citizens Asset Finance, Inc.

(the “Citizens Agreement”). The Citizens Agreement provides for a $30.0 million asset-based revolving credit loan facility,

with availability subject to a borrowing base consisting of eligible accounts receivable and inventory and the satisfaction of

conditions precedent specified in the Citizens Agreement. The Citizens Agreement provides for an accordion feature, whereby the

Company may increase the revolving commitment up to an additional $10.0 million subject to certain customary terms and conditions.

The Citizens Agreement matures on May 12, 2019, at which time all amounts outstanding will be due and payable. Borrowings under

the Citizens Agreement may be used for general corporate purposes, including financing possible future acquisitions and funding

working capital. Amounts drawn bear an interest rate equal to, at the Company's option, either a LIBOR rate plus 1.25%, 1.50% or

1.75% per annum, depending upon availability under the Citizens Agreement or an alternative base rate plus either .25%, .50% or

.75% per annum, depending upon availability under the Citizens Agreement. The Company also incurs a commitment fee on undrawn amounts

equal to 0.25% per annum.

The Citizens Agreement is guaranteed by the Company at the time

of closing and is secured by a lien on substantially all of the Company's and the Company's principal domestic subsidiary’s

assets and any future domestic subsidiary guarantors’ assets. The Citizens Agreement includes customary covenants, subject

to customary exceptions, including covenants that restrict the Company's ability to incur additional indebtedness, acquire or dispose

of assets, and make and incur capital expenditures. The Citizens Agreement also imposes a financial covenant requiring compliance

with a minimum fixed charge coverage ratio of 1.10 to 1.00 during certain covenant testing times triggered if availability under

the Citizens Agreement is below the greater of 12.5% of the revolving commitment and $3.75 million for three (3) consecutive business

days.

On May 16, 2016, the Company entered into an Exclusive Distribution

and Supply Agreement (the "Aspen Agreement") with Aspen Global Incorporated ("Aspen"). Under the Aspen Agreement,

the Company will act as Aspen's exclusive distributor of hydroxyprogesterone caproate injection 250mg/ml (the "Product")

in the United States and its territories, on a consignment basis, and Aspen will act as the Company's exclusive supplier of the

Product. The Aspen Agreement has an initial term expiring May 16, 2019, unless terminated earlier, and is subject to renewal for

an additional four year term.

|

Item 9.01.

|

Financial Statements and Exhibits

.

|

|

(d)

|

Exhibits

|

|

|

|

|

|

|

No.

|

|

Description

|

|

99.1

|

|

Press release dated May 13, 2016

|

|

99.2

|

|

Press release dated May 17, 2016

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ANI PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen P. Carey

|

|

|

|

|

Stephen P. Carey

|

|

|

|

|

Vice President, Finance and Chief Financial Officer

|

|

|

Dated: May 17, 2016

|

|

|

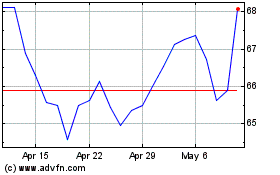

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Apr 2023 to Apr 2024