SandRidge Energy Files for Bankruptcy Protection -- 2nd Update

May 16 2016 - 6:55PM

Dow Jones News

By Patrick Fitzgerald

SandRidge Energy Inc. became the latest victim of the prolonged

downturn in energy sector, filing for bankruptcy protection Monday

after reaching a deal with its creditors to swap $3.7 billion in

debt for control of the oil and gas company.

The Oklahoma City company filed for chapter 11 protection in

U.S. Bankruptcy Court in Houston after reaching a deal with the

majority of its lenders and bondholders on the terms of a

"prearranged" debt-restructuring pact.

SandRidge Chief Executive James Bennett said the proposed debt

swap, which requires court approval, would allow the reorganized

company to concentrate on oil and gas exploration and development

in the company's active Oklahoma and Colorado project areas.

The company will stay open during the chapter 11 case and

expects to exit bankruptcy "with minimal disruption to our

business," Mr. Bennett said.

SandRidge says it has enough cash to fund its continuing

operations without a bankruptcy loan. Among its initial bankruptcy

request is the authority to pay operating expenses associated with

production activities, royalties and wages to its workers. The

company also intends to pay all suppliers and vendors in full

during the bankruptcy.

SandRidge was founded in 2006 by Tom Ward, who had co-founded

Chesapeake Energy Corp. with Aubrey McClendon, who died in March,

in 1989. After leaving Chesapeake, Mr. Ward paid $500 million to

take control of a natural-gas producer, which he renamed SandRidge

and built into a leading shale producer with a market

capitalization of more than $11 billion,

But the company stumbled during the financial crisis and

struggled to recover. Activist investors replaced Mr. Ward a few

years ago and installed Mr. Bennett as CEO. TPG-Axon Capital

Management LP, which led the campaign to oust Mr. Ward, and Mount

Kellett Capital Management LP each lost more than $150 million in

the company's decline as did veteran Canadian investor Prem Watsa,

according to securities filings.

Under Mr. Bennett's leadership, the company sold the Gulf

drilling fields back to one of the private-equity firms from which

it had bought them. It received just over half the price it had

paid about two years earlier.

SandRidge joins the ranks of oil and gas drillers to file for

bankruptcy in recent weeks as low oil prices continue to roil the

energy sector. Linn Energy, Midstates Petroleum Co. and Ultra

Petroleum Corp. have all recently filed for bankruptcy in Texas.

Also, Breitburn Energy Partners LP filed for bankruptcy Monday in

New York.

Those companies join Samson Resources Corp., Magnum Hunter

Resources Corp., Emerald Oil Inc., Swift Energy Co., and dozens

more that had earlier sought bankruptcy.

More than 70 North American exploration-and-production companies

have filed for bankruptcy protection since the beginning of 2015,

based on data from law firm Haynes and Boone LP.

Additional energy companies may follow suit. Exco Resources Inc.

said Friday that it hired advisers and formed a committee to

explore alternatives, including seeking bankruptcy protection.

Separately, a subsidiary of American Energy Partners LP, the

Oklahoma City oil and gas company founded by Mr. McClendon after he

was ousted by activist investors, has defaulted on a $450 million

loan after the executive's death, according to people familiar with

the situation.

Representatives for Exco and American Energy Monday couldn't

immediately be reached for comment.

SandRidge drills for oil and gas in Oklahoma, Kansas and Texas,

where it has 4,411 gross producing wells and more than 2 million

gross acres under lease. As of Dec. 31, it had four rigs in

operation.

At the end of last year, the company employed more than 1,100

people but has since reduced its head count to 657, according to

court papers. The company listed assets of $7 billion and debts of

about $4 billion in its chapter 11 petition filed with the

bankruptcy court.

The law firm Kirkland & Ellis LLP is handling the chapter 11

case, and Houlihan Lokey, Inc. is SandRidge's financial

adviser.

Sandridge's case number is 16-32488. U.S. Bankruptcy Judge

Marvin Isgur has been assigned the case, and an initial hearing is

slated for Wednesday afternoon in Houston.

--Stephanie Gleason, Shasha Dai, and Ryan Dezember contributed

to this article

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

(END) Dow Jones Newswires

May 16, 2016 18:40 ET (22:40 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

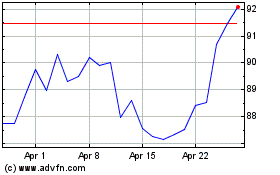

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

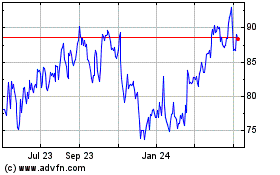

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024