Announces 2016 Annual Meeting and Changes to

its Board of Directors

The LGL Group, Inc. (NYSE MKT: LGL) (the “Company”), announced

results for the quarter ended March 31, 2016.

Summary of Q1 2016 Results:

- Revenues were $4.8 million, down 12.0%

from Q1 2015

- Net loss of ($0.1) million, or ($0.05)

per share, improved 29.2% compared to Q1 2015

- Adjusted EBITDA per share was $0.01

versus $0.03 in Q1 2015

- Order backlog was $9.0 million, up 2.5%

from Q4 2015

The Company’s newly elected Chairman of the Board and CEO,

Michael J. Ferrantino, Sr., stated, “Although we were disappointed

by the 12% revenue decrease, we were encouraged by the $335,000

increase in our backlog over the previous quarter. Most of the

decrease is a result of the continuing price compression in the

frequency control commodities market rather than lost business. We

view this price compression as a secular trend and have been

actively transitioning our product mix, strategic focus, and

marketing efforts towards more lucrative and higher margin markets.

Profitability appears to be in reach, given our lower cost

structure, as we gain greater traction in these markets. As we

advance into our second quarter with the increase in backlog, we do

expect shipments to pick up.”

Positive Cash Flows from Operations; Solid Capital

Position

Net cash provided by operating activities was $0.1 million for

the quarters ended March 31, 2016 and 2015. Total cash and cash

equivalents was $5.6 million, or $2.09 per share, at March 31,

2016, consistent with our cash position at December 31, 2015.

Adjusted working capital (accounts receivable, net, plus inventory,

net, less accounts payable) was $5.0 million as of March 31, 2016,

compared to $5.2 million as of December 31, 2015, which reflects

the continuing effort to manage working capital levels to operating

activity.

2016 Annual Meeting of Stockholders

The Company also announced that its 2016 Annual Meeting of

Stockholders (the “2016 Annual Meeting”) will be held on Thursday,

June 16, 2016, at 9:00 a.m., local time, at the Company’s

headquarters, 2525 Shader Road, Orlando, FL 32804. The record date

for stockholders to receive notice of, and to vote at, the 2016

Annual Meeting was April 19, 2016.

Frederic V. Salerno, Jr. and Hendi Susanto have been nominated

for election to the Company’s Board of Directors (the “Board”). Mr.

Salerno is the Strategic Sourcing Manager for Brunswick Corporation

and brings over 25 years’ experience in operations and supply chain

management. Mr. Susanto is Vice President, Equity Research,

Technology Leader, for Gabelli & Company, and brings extensive

experience in evaluating investments in technology, mergers and

acquisitions, convertible debts and restructuring. Additionally,

one incumbent member of the Board, Patrick J. Guarino, has decided

to retire and will not stand for re-election at the 2016 Annual

Meeting, which, pending the results of the 2016 Annual Meeting,

will increase the size of the Board to eight members. Marc Gabelli,

former Chairman of the Board, added, “On behalf of management and

the entire Board, we extend a sincere thank you to Mr. Guarino for

his practical guidance, mentoring and contributions during his

tenure on the Board. We will surely miss his advice and council.

All of us wish him the very best in his retirement.”

About The LGL Group, Inc.

The LGL Group, Inc., through its wholly-owned subsidiary

MtronPTI, manufactures and markets highly-engineered electronic

components used to control the frequency or timing of signals in

electronic circuits. These components ensure reliability and

security in aerospace and defense communications, synchronize data

transfers throughout the wireless and internet infrastructure, and

provide low noise and base accuracy for lab instruments.

Headquartered in Orlando, Florida, the Company has additional

design and manufacturing facilities in Yankton, South Dakota and

Noida, India, with local sales offices in Sacramento, California

and Hong Kong.

For more information on the Company and its products and

services, contact Patti Smith at The LGL Group, Inc., 2525 Shader

Rd., Orlando, Florida 32804, (407) 298-2000, or visit

www.lglgroup.com and www.mtronpti.com.

Caution Concerning Forward Looking Statements

This press release may contain forward-looking statements made

in reliance upon the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21 E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include all statements that do not relate solely to

historical or current facts, and can be identified by the use of

words such as “may,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “believe,” “potential,” “should,” “continue”

or the negative versions of those words or other comparable words.

These forward-looking statements are not guarantees of future

actions or performance. These forward-looking statements are based

on information currently available to us and our current plans or

expectations, and are subject to a number of uncertainties and

risks that could significantly affect current plans, anticipated

actions and our future financial condition and results. Certain of

these risks and uncertainties are described in greater detail in

our filings with the Securities and Exchange Commission. We are

under no obligation to (and expressly disclaim any such obligation

to) update or alter our forward-looking statements, whether as a

result of new information, future events or otherwise.

THE LGL GROUP, INC.

Condensed Consolidated Statements of

Operations – UNAUDITED

(Dollars in Thousands, Except Per Share

Amounts)

For the three months ended March 31, 2016

2015 REVENUES $ 4,756 $ 5,404 Costs and

expenses: Manufacturing cost of sales 3,257 3,605 Engineering,

selling and administrative 1,661 1,960

OPERATING LOSS (162 ) (161 ) Total other income

(expense) 36 (17 ) LOSS BEFORE INCOME TAXES

(126 ) (178 ) Income tax provision — —

NET LOSS $ (126 ) $ (178 ) Weighted average number of

shares used in basic and diluted EPS calculation 2,665,434

2,616,485 BASIC AND DILUTED NET LOSS PER

COMMON SHARE $ (0.05 ) $ (0.07 )

THE LGL GROUP, INC.

Condensed Consolidated Balance

Sheets

(Dollars in Thousands)

March 31, 2016 December 31, ASSETS

(Unaudited) 2015 Cash and cash equivalents $ 5,576 $

5,553 Accounts receivable, less allowances of $34 at March 31, 2016

and December 31, 2015, respectively 2,544 2,606 Inventories, net

3,550 3,546 Prepaid expenses and other current assets 359

247 Total Current Assets 12,029 11,952 Property, plant, and

equipment, net 3,023 3,165 Intangible assets, net 461 475 Other

assets 208 211 Total Assets $ 15,721 $ 15,803

LIABILITIES AND STOCKHOLDERS’ EQUITY Total Liabilities 2,139

2,076 Total Stockholders’ Equity 13,582 13,727

Total Liabilities and Stockholders’ Equity $ 15,721 $ 15,803

Reconciliations of GAAP to Non-GAAP Measures

To supplement our consolidated condensed financial statements

presented on a GAAP basis, the Company uses certain non-GAAP

measures, including Adjusted EBITDA, which we define as net income

(loss) adjusted to exclude depreciation and amortization expense,

interest income (expenses), provision (benefit) for income taxes,

stock-based compensation expense and other items we believe are

discrete events which have a significant impact on comparable GAAP

measures and could distort an evaluation of our normal operating

performance. These adjustments to our GAAP results are made with

the intent of providing both management and investors a more

complete understanding of the underlying operational results and

trends and our marketplace performance. The presentation of this

additional information is not meant to be considered in isolation

or as a substitute for net earnings or diluted earnings per share

prepared in accordance with generally accepted accounting

principles in the United States.

Reconciliation of 2016 GAAP Loss Before

Income Taxes to Non-GAAP Adjusted EBITDA:

For the three months ended (000’s, except

shares and per share March 31, March 31,

amounts) 2016 2015 Net loss before

income taxes $ (126 ) $ (178 ) Interest expense 6 5 Depreciation

and amortization 204 228 Non-cash stock compensation (16 ) 13 Gain

on disposal of assets (43 ) — Adjusted EBITDA

$ 25 $ 68 Weighted average number of shares

used in basic and diluted EPS calculation 2,665,434

2,616,485

Adjusted EBITDA per share

$ 0.01 $ 0.03

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160512006494/en/

The LGL Group, Inc.Patti Smith,

407-298-2000pasmith@lglgroup.com

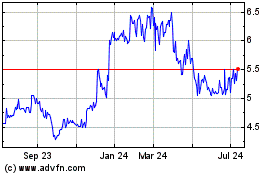

LGL (AMEX:LGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

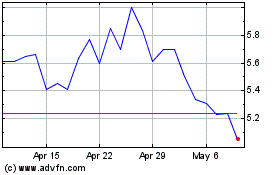

LGL (AMEX:LGL)

Historical Stock Chart

From Apr 2023 to Apr 2024