Global Stocks Buoyed by Oil, Banks -- 2nd Update

May 10 2016 - 8:28AM

Dow Jones News

By Riva Gold

Global stock markets edged higher Tuesday, bolstered by

rebounding oil prices and rising European financial stocks.

Futures pointed to a 0.3% opening gain for the S&P 500 as

Brent crude rose 1.4% to $44.25 a barrel. Changes in futures don't

necessarily reflect market moves after the opening bell.

Sentiment was lifted as Brent crude oil rose 1.4% to $44.25 a

barrel, after posting its largest one-day dollar decline since

February on Monday.

The Stoxx Europe 600 was up 0.7% halfway though the session.

Shares in Credit Suisse Group rose over 5% after the lender

announced its first-quarter results, spurring broader gains in the

region's banking sector.

Stocks in Europe and the U.S. have traded within a narrow range

in recent weeks, as investors struggle to reconcile a recent

rebound in equity prices with a lackluster earnings season and

concerns about the health of the global economy.

"The market is having a real hard time moving higher," said

David Lafferty, chief market strategist at Natixis Global Asset

Management. "I see OK earnings and OK valuations, but nothing in a

world of uncertainty that's making investors want to pay up for

stocks," he said.

Following a steep rebound, the Dow Jones Industrial Average and

S&P 500 have both moved less than half a percentage point this

month.

"We don't expect particularly high returns," said Peter Elston,

chief investment officer at Seneca Investment Managers. But

government bonds are expensive, he said, leaving few

alternatives.

Earlier, the Japanese market rose after the country's finance

minister said it was "natural" for the government to intervene

should the yen continue to rise in a one-sided way. The dollar was

last up 0.7% against the yen at Yen109.1640, offering some respite

for investors as a stronger yen puts pressure on Japan's

exporters.

Stocks in Hong Kong and Shanghai were little changed after data

showed China's inflation rate was steady for a third straight

month, though producer prices beat expectations. China reports

retail sales figures later this week.

"China's been an enormous source of disinflation for a very long

time," said David Stubbs, global strategist at J.P. Morgan Asset

Management. "Anything showing China's domestic outlook is firmer

than we thought will feed into markets feeling the risks are not

that great," he said.

Australian equities rose for a fourth straight session, as the

country's four biggest banks added almost 22 points to the S&P/

ASX 200. The gains outweighed losses in commodity-sensitive stocks

as iron-ore prices continued to fall.

Later Tuesday, investors will parse the U.S. Job Openings and

Labor Turnover Survey, following Friday's employment report. The

data will offer more details on the U.S. labor market, closely

watched by Federal Reserve officials as they contemplate the course

for interest rates.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

May 10, 2016 08:13 ET (12:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

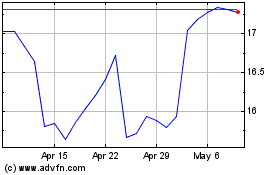

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

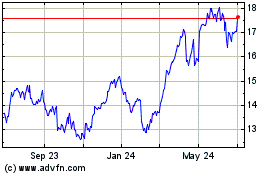

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024