Usage-based auto insurance (UBI) is a growing segment of the

automotive insurance market, the result of a technological

revolution as the Internet of Things (IoT) continues to further

influence various industries, including automotive.

In 2015, close to 12 million consumers globally subscribed to

this type of insurance, according to a new report from IHS

Automotive, part of IHS, Inc. (NYSE: IHS) and a leading source of

critical information and insight to the global automotive industry.

The number of consumer subscribers to UBI is expected to grow to

142 million globally by 2023, according to the IHS report.

This specific type of automobile insurance uses real-time

information about a driver’s actual driving ability and habits to

assess actuarial risk, capturing information from the in-vehicle

telematics system. In the decade or so since its initial launch,

UBI has inspired as much frustration as hope from its believers and

practitioners. Expectations were high from the start, but these

expectations were long thwarted by market stagnation and the

reluctance of insurers to embrace the solution.

“The current UBI landscape is in transition with robust

expansion,” said Stacey Oh, manager, automotive technology at IHS

Automotive. “New insurers are entering the market, new markets are

being opened and new solutions are being launched.”

However, providers are still identifying and developing the

strongest business models, the best value proposition and the most

suitable data capture device as those providers seek to alleviate

divergence with the auto industry. The added challenge of

constantly evolving technology -- including telematics, the

connected car and mobility itself -- are influencing factors.

Current regional leaders, markets to watch

Today, Italy is the only country in which UBI has a double digit

share of the insurance market, representing 10 percent of the

market there in 2015, according to the IHS Automotive report.

Government intervention was a strong influencer there. In 2012, in

response to fraudulent insurance claims, Italy’s Prime Minister

instituted a decree stipulating that if an insurance company

already offered a UBI product with a “black box,” it must offer the

box to the customer at no charge and offer a significant upfront

premium discount for consumers.

Italy and the United Kingdom are by far the most mature UBI

markets in Europe. Activity is growing in France, Germany and

Spain, though the solution remains very niche-like in these

markets. Insurers are unsure of what business propositions work

best and consumers are still unfamiliar with the product. Privacy

concerns, especially in Germany, make consumers wary of sharing

data.

Due to its market potential, the U.S. will lead the way in UBI

marketing and innovation in the coming year, IHS says. America is

the largest car insurance market in the world, with more than 260

million vehicles in operation in 2015. According to IHS estimates,

there were more than 5 million UBI policyholders in 2015 in the

U.S., by far the most of any other country. Italy was a distant

second, with just 3.6 million subscribers out of 36.8 million

vehicles in operation in 2015.

Another key market to watch is China. The Chinese government

began granting foreign insurance carriers access to the market in

2012, and approximately 15 insurers will launch UBI pilot programs

this year. The sheer size of the automotive market allows for the

UBI subscriber volumes to grow from 50,000 in 2015 to over 22

million by 2023, according to IHS Automotive forecasts.

Other influencing factors

The future of UBI is also explored in this report, with sections

on Millennials, pay-per-mile (Uber) and pay-per-ride insurance,

ADAS and the autonomous car. The pay-per-ride model will become

increasingly important as millennials impose their preferences on

the market. Whether or not the customer works for an Uber-type

company or simply prefers leasing a car whenever necessary, he will

want to be insured only for that trip or the distance driven. And,

with UBI, he could choose to travel at a time when the trip

insurance premium is lowest.

As UBI evolves, the technology that created it is also

evolving—and, as a result, so is society. A smartphone-only

solution will eventually dominate the global UBI market, but likely

only for a short time. The connected car is well on its way, and

the vehicle itself may well be the ultimate UBI device. By the time

connected cars are common on the world’s roads, it could also be

that, because of product innovation and the rise of alternative

mobility models such as ride sharing and car leasing, the UBI

market will not be anything like that of today.

About the Methodology:

The IHS Usage Based Insurance Report is based on more than 40

interviews from across the value chain, from insurance carriers,

data aggregators, telecommunications companies, to automotive OEMs.

More than 70 companies are mentioned throughout the report as it

offers a comprehensive review of the business models, barriers to

uptake, market drivers, case studies, pilot programs, value

propositions and device debates. The forecast section is regional

and country level, based on IHS Automotive forecasts which include

Passenger Cars (PC) as well as Light Commercial Vehicles (LCV). UBI

attach rates as the share of autos in-use with UBI-based insurance

policies, as well as UBI subscriber numbers and UBI growth rates

are provided.

About IHS Automotive

(www.ihs.com/automotive)

IHS Automotive, part of IHS Inc. (NYSE: IHS), offers clients the

most comprehensive content and deepest expertise and insight on the

automotive industry available anywhere in the world today. With the

2013 addition of Polk, IHS Automotive now provides expertise and

predictive insight across the entire automotive value chain from

product inception—across design and production—to the sales and

marketing efforts used to maximize potential in the marketplace. No

other source provides a more complete picture of the global

automotive industry. IHS is the leading source of information,

insight and analytics in critical areas that shape today’s business

landscape. IHS has been in business since 1959 and became a

publicly traded company on the New York Stock Exchange in 2005.

Headquartered in Englewood, Colorado, USA, IHS is committed to

sustainable, profitable growth and employs nearly 9,000 people in

33 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and

product names may be trademarks of their respective owners. © 2016

IHS Inc. All rights reserved.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160509006084/en/

IHS Inc.Michelle Culver,

+1-248-728-7496michelle.culver@ihs.comorPress Team,

+1-303-305-8021press@ihs.com

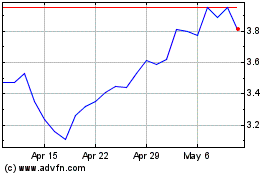

IHS (NYSE:IHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

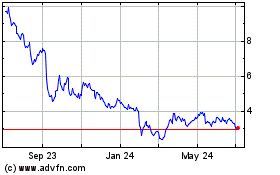

IHS (NYSE:IHS)

Historical Stock Chart

From Apr 2023 to Apr 2024