By Chris Kirkham

At Paradise at Ironwood Crossing, a 2,100-home master-planned

community southeast of Phoenix, new houses starting as low as

$170,000 are snapped up within weeks of hitting the market.

The starter homes in this suburban enclave are among the most

affordable in the metro area, said Dennis Webb, vice president of

operations at builder Fulton Homes, and are among the company's top

sellers.

But escalating land prices and local development fees mean that

continuing to build new homes in that price range is no longer

viable, Mr. Webb said.

"There's not enough profit to be made on that entry-level

house," he said.

Across the U.S., new-home construction has remained at

historical lows throughout the housing recovery of the last five

years, but the share of starter homes priced below $200,000 has

dwindled more than any other segment, according to U.S. Census

data.

New homes under $200,000 made up 19% of U.S. sales last year,

down from 38% four years earlier. By contrast, homes sold between

$300,000 and $500,000 accounted for 34% of new home sales last

year, up from 22% in 2011.

Data from real-estate tracker Trulia shows a similar trend: The

share of new homes built in the bottom third of price distribution

shrank from 16% of the market in 2000 to 7.9% by 2015. New homes in

the top third of the price distribution grew from 57% of total

construction in 2000 to nearly 69% last year, according to an

analysis by Ralph McLaughlin, the group's chief economist.

The shift reflects drastic changes in the business of home

building and the profile of buyers since the housing bust,

developers said.

Many builders ventured to the far fringes of the suburbs in the

mid-2000s in search of cheap land for a seemingly endless pool of

buyers. When the housing market tanked the value of that land

plummeted as demand dried up.

At the same time, tightened lending standards in recent years

have had the biggest impact on first-time buyers, effectively

leaving them on the sidelines. That prompted builders to cater to

demand from buyers who could afford larger, pricier homes.

Many surveys show millennials still eventually aspire to

homeownership in the suburbs, but they are waiting until later in

life to purchase homes than previous generations.

Although many major builders, particularly D.R. Horton Inc.,

have once again started marketing to first-time home buyers over

the last two years, that share of overall home buyers remains at a

nearly three-decade low of 32%, according to the National

Association of Realtors.

"The move-up market has been much more profitable per house than

the entry level," said housing economist Brad Hunter, chief

economist at HomeAdvisor, an online home services marketplace.

"Builders decided 'Well, let me deploy my resources where I can get

the best return.'"

Adding to the complication: Land prices have shot up as the

economic recovery has progressed, further driving up the minimum

price points for new homes as builders compete for prime lots that

are closer to job centers.

Although land remains the least expensive on the periphery of

major metro areas, many builders have been hesitant to pursue

projects in those areas, mindful of how that strategy backfired a

decade ago.

Across the U.S., prices for finished lots are nearly back to the

peak levels of 2006, according to the most recent figures from John

Burns Real Estate Consulting of Irvine, Calif. Values for finished

lots have increased 59% since the market bottomed in 2009,

according to an index of lot prices throughout the country.

In popular suburbs of Dallas, such as Frisco, Texas, prices for

lots have increased from $50,000 to as much as $120,000 over the

same period, according to builders and developers in the area.

In markets such as Dallas, Austin and Denver, lot prices have

surpassed previous peaks. Even hard-hit markets such as Phoenix are

nearly back to the lot prices of the boom years.

Some major publicly traded builders such as Lennar Corp., D.R.

Horton and Standard Pacific Corp. (now CalAtlantic Group Inc.)

snapped up cheap land when prices hit bottom in 2009 and 2010. But

many other builders started acquiring land only as the recovery

picked up in 2013, when lots were more expensive.

"If you were buying land at significantly higher prices, you

immediately prevented yourself from building a lower-priced product

on that land," said Rick Palacios Jr., director of research at John

Burns Real Estate Consulting.

The land at Paradise at Ironwood Crossing outside Phoenix, for

example, was purchased by Fulton Homes a decade ago at a lower

price point. That allowed for more flexibility in the asking

prices.

Marianne Lubich said she was thrilled to find the home she moved

into last September with her son, less than a half-hour from work

and just 10 minutes away from a major shopping area. She had looked

closer to her office in Chandler, Ariz., but a new home would have

cost too much -- even existing homes were pricey.

"I'm like 'Geez, I can get a brand new home for this price?"

said Ms. Lubich, whose final price tag came to about $212,000, with

several upgrades. "I got a lot for my money."

Donnie Evans, president of Altura Homes in the Dallas area, said

increased land and permitting costs in many Dallas suburbs have

taken a chunk of prospective buyers out of the market over the last

two years. Homes at the lowest end that his company used to sell

for $120,000 two years ago are now going for $190,000, and so on up

the chain.

"Home building is like a pyramid: The lower you go, the bigger

your base is," Mr. Evans said. But the only way to make such deals

work is to go to the far edges of the metro area, he said -- areas

up to 50 miles from job centers.

Not all builders have shied away from the entry-level segment.

D.R. Horton introduced a concept called Express Homes about two

years ago. That division has come to represent nearly a quarter of

the company's home deliveries and 16% of home sales revenue. These

houses, priced as low as $130,000 in some parts of the south,

feature basic floor plans without extra options or upgrades -- a

"turnkey operation," as the company calls it. Such standard designs

allow the company to build homes at a faster pace, increasing sales

volumes and controlling costs .

But the scale of Express Homes and LGI Homes, another

entry-level builder, is limited to certain regions -- mainly Texas,

parts of the South and low-cost areas of California such as the

Central Valley -- where the difference between the low end and the

high-end isn't as wide. Most of the developments are farther away

from primary job centers in more expensive markets, such as the Bay

Area and Denver, and fewer in number so far.

"That is a small piece of the country," said George Casey, a

former home building executive and chief executive of consulting

firm Stockbridge Associates. "You can't do what they do

everywhere."

Other builders have suggested the market for traditional starter

homes, a quintessentially American concept dating back to soldiers'

return from World War II, might be changing with generational

preferences. A recent survey from Bank of America found that 75% of

first-time home buyers would bypass a starter home for one that

would meet their long-term needs, even if it meant waiting.

"Having a first-time home buyer market is very, very important,"

said Pat Hamill, chief executive of Oakwood Homes in the Denver

area, because it allows buyers to progress upward through the

system, building equity along the way that can be used to purchase

a larger or more desirable home.

"I don't know what happens when you take that segment out of the

marketplace."

Write to Chris Kirkham at chris.kirkham@wsj.com

(END) Dow Jones Newswires

May 06, 2016 06:00 ET (10:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

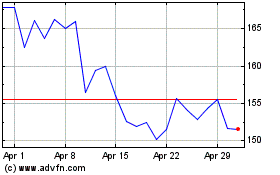

Lennar (NYSE:LEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lennar (NYSE:LEN)

Historical Stock Chart

From Apr 2023 to Apr 2024