- GAAP net loss of ($868.1) million,

($0.96) per average common share

- Normalized core earnings of $0.30 per

average common share

- Common stock book value per share of

$11.61, economic leverage of 6.2:1

- Credit investment portfolio increases

to 25% of stockholders’ equity

- Share repurchases totaling $217.0

million since November 2015

- Strategic diversification strategy

continues with agreement to acquire Hatteras Financial Corp. for

$1.5 billion

Annaly Capital Management, Inc. (NYSE:NLY) (the “Company”) today

announced its financial results for the quarter ended March 31,

2016.

“Amidst one of the most volatile quarters in history and global

fixed income yield levels reaching all-time lows, Annaly’s

diversified platform once again delivered stable, normalized core

earnings and an attractive return on equity for our shareholders,”

commented Kevin Keyes, Chief Executive Officer and President.

Subsequent to the first quarter on April 11th, 2016, Annaly

agreed to acquire Hatteras Financial Corp. for aggregate

consideration of approximately $1.5 billion. “The Hatteras

transaction is the largest mortgage REIT M&A deal ever,” Mr.

Keyes remarked. “This acquisition enhances the scale and

diversification of Annaly’s investment platform, is accretive to

both earnings and book value and further solidifies our position as

the industry’s leading hybrid mortgage REIT.”

Financial

Performance

The following table summarizes certain key performance

indicators as of and for the quarters ended March 31, 2016,

December 31, 2015, and March 31, 2015:

March 31, 2016 December 31,

2015 March 31, 2015 Book value per common share

$11.61 $11.73 $12.88 Economic leverage at period-end (1) 6.2:1

6.0:1 5.7:1 GAAP net income (loss) per common share ($0.96) $0.69

($0.52) Normalized core earnings per common share (2) $0.30 $0.31

$0.34 Annualized return (loss) on average equity (29.47%) 22.15%

(14.41%) Annualized normalized core return on average equity (2)

9.91% 10.30% 10.34% Normalized net interest margin (2) (3) 1.54%

1.71% 1.68% Normalized net interest spread (2) 1.27% 1.37% 1.32%

Normalized average yield on interest earning assets (2) 3.00% 3.05%

2.96% (1) Computed as the sum of recourse debt, TBA

derivative notional outstanding and net forward purchases of

investments divided by total equity. Recourse debt consists of

repurchase agreements, other secured financing and Convertible

Senior Notes. Securitized debt, participation sold and mortgages

payable are non-recourse to the Company and are excluded from this

measure. (2) Adjusted to reflect the effect of the premium

amortization adjustment (“PAA”) due to quarter-over-quarter changes

in long-term constant prepayment rates (“CPR”) estimates.

(3) Represents the sum of the Company’s annualized normalized

economic net interest income (inclusive of interest expense on

interest rate swaps used to hedge cost of funds) plus TBA dollar

roll income (less interest expense on swaps used to hedge dollar

roll transactions) divided by the sum of its average interest

earning assets plus average outstanding TBA derivative balances.

Average interest earning assets reflects the average amortized cost

of our investments during the period.

The Company reported a GAAP net loss for the quarter ended March

31, 2016 of ($868.1) million, or ($0.96) per average common share,

compared to GAAP net income of $669.7 million, or $0.69 per average

common share, for the quarter ended December 31, 2015, and a GAAP

net loss of ($476.5) million, or ($0.52) per average common share,

for the quarter ended March 31, 2015. The decrease for the quarter

ended March 31, 2016 compared to each of the quarters ended

December 31, 2015 and March 31, 2015 is primarily due to

unfavorable changes in realized and unrealized gains (losses) on

interest rate swaps.

The Company’s non-GAAP normalized metrics reflect the premium

amortization adjustment representing the quarter-over-quarter

change in estimated long-term CPR. In accordance with GAAP, the

Company recognizes income under the retrospective method on a

substantial portion of its Residential Investment Securities

classified as available-for-sale. Premiums and discounts associated

with the purchase of Residential Investment Securities are

amortized or accreted into income over the remaining projected

lives of the securities. Using a third-party supplied model and

market information to project future cash flows and expected

remaining lives of securities, the effective interest rate

determined for each security is applied as if it had been in place

from the date of the security’s acquisition. The amortized cost of

the investment is then adjusted to the amount that would have

existed had the new effective yield been applied since the

acquisition date. The adjustment to amortized cost is offset with a

charge or credit to interest income. Changes in interest rates and

other market factors will impact prepayment speed projections and

the amount of premium amortization recognized in any given period.

The Company’s GAAP metrics include the unadjusted impact of

amortization and accretion associated with the retrospective

method.

The following table illustrates the impact of

quarter-over-quarter adjustments to long-term CPR estimates on

premium amortization expense for the quarters ended March 31, 2016,

December 31, 2015, and March 31, 2015:

March 31, 2016 December 31,

2015 March 31, 2015 (dollars in thousands)

Premium amortization expense $ 355,671 $ 159,720 $ 284,777 Less:

PAA cost (benefit) 168,408 (18,072 )

87,883 Premium amortization expense exclusive of PAA $

187,263 $ 177,792 $ 196,894

March 31, 2016 December 31, 2015

March 31, 2015 (per common share) Premium

amortization expense $ 0.38 $ 0.17 $ 0.30 Less: PAA cost (benefit)

0.19 (0.02 ) 0.09 Premium

amortization expense exclusive of PAA $ 0.19 $ 0.19

$ 0.21

Normalized core earnings for the quarter ended March 31, 2016

were $291.8 million, or $0.30 per average common share, compared to

$311.1 million, or $0.31 per average common share, for the quarter

ended December 31, 2015, and $342.0 million, or $0.34 per average

common share, for the quarter ended March 31, 2015. Normalized core

earnings decreased during the quarter ended March 31, 2016 compared

to the quarter ended December 31, 2015 on higher borrowing costs

and lower dollar roll income, partially offset by higher interest

income generated by the commercial investment portfolio. Normalized

core earnings declined during the quarter ended March 31, 2016

compared to the quarter ended March 31, 2015 due to a reduction in

normalized interest income earned on lower Residential Investment

Securities balances, partially offset by increased interest income

on a larger commercial investment portfolio during the quarter

ended March 31, 2016.

The following table presents a reconciliation between GAAP net

income (loss), and non-GAAP core earnings and normalized core

earnings for the quarters ended March 31, 2016, December 31, 2015,

and March 31, 2015.

For the quarters ended March 31,

2016 December 31, 2015 March 31,

2015 (dollars in thousands) GAAP net income (loss) $

(868,080 ) $ 669,666 $ (476,499 ) Less: Realized (gains) losses on

termination of interest rate swaps - - 226,462 Unrealized (gains)

losses on interest rate swaps 1,031,720 (463,126 ) 466,202 Net

(gains) losses on disposal of investments 1,675 7,259 (62,356 ) Net

(gains) losses on trading assets (125,189 ) (42,584 ) 6,906 Net

unrealized (gains) losses on financial instruments measured at fair

value through earnings (128 ) 62,703 33,546 Net (income) loss

attributable to noncontrolling interest 162 373 90 Plus: TBA dollar

roll income (1) 83,189 94,914

59,731 Core earnings (2) 123,349 329,205

254,082 Premium amortization adjustment cost (benefit)

168,408 (18,072 ) 87,883

Normalized core earnings $ 291,757 $ 311,133

$ 341,965 GAAP net income (loss) per average

common share $ (0.96 ) $ 0.69 $ (0.52 ) Core

earnings per average common share $ 0.11 $ 0.33

$ 0.25 Normalized core earnings per average

common share $ 0.30 $ 0.31 $ 0.34

(1) Represents a component of Net gains (losses) on

trading assets. (2) Core earnings is defined as net income

(loss) excluding gains or losses on disposals of investments and

termination of interest rate swaps, unrealized gains or losses on

interest rate swaps and financial instruments measured at fair

value through earnings, net gains and losses on trading assets,

impairment losses, net income (loss) attributable to noncontrolling

interest, and certain other non-recurring gains or losses, and

inclusive of dollar roll income (a component of Net gains (losses)

on trading assets). Normalized core earnings presents the Company’s

core earnings adjusted to reflect the effect of the PAA.

Normalized net interest margin for the quarters ended March 31,

2016, December 31, 2015, and March 31, 2015 was 1.54%, 1.71% and

1.68%, respectively. For the quarter ended March 31, 2016, the

normalized average yield on interest earning assets was 3.00% and

the average cost of interest bearing liabilities, including

interest expense on interest rate swaps used to hedge cost of

funds, was 1.73%, which resulted in a normalized net interest

spread of 1.27%. The normalized average yield on interest earning

assets for the quarter ended March 31, 2016 decreased when compared

to the quarter ended December 31, 2015 due to higher amortization

expense, exclusive of the PAA, on Residential Investment Securities

during the quarter ended March 31, 2016 and increased when compared

to the quarter ended March 31, 2015 due to higher weighted average

coupons on Residential Investment Securities, partially offset by

higher weighted average premium amortization expense, exclusive of

the PAA, on Residential Investment Securities. The rise in our

average cost of interest bearing liabilities for the quarter ended

March 31, 2016 when compared to the quarters ended December 31,

2015 and March 31, 2015 is primarily attributable to higher average

rates on repurchase agreements, partially offset by a reduction in

interest expense on swaps.

Asset

Portfolio

Residential Investment Securities

Residential Investment Securities, which are comprised of Agency

mortgage-backed securities, Agency debentures, credit risk transfer

securities and Non-Agency mortgage-backed securities, totaled $67.3

billion at March 31, 2016, compared to $67.2 billion at December

31, 2015 and $70.5 billion at March 31, 2015. The Company’s

Residential Investment Securities portfolio at March 31, 2016 was

comprised of 93% fixed-rate assets with the remainder constituting

adjustable or floating-rate investments.

The Company uses a third-party model and market information to

project prepayment speeds for purposes of determining amortization

of premiums and discounts on Residential Investment Securities.

Changes to model assumptions, including interest rates and other

market data, as well as periodic revisions to the model may cause

changes to the results. The net amortization of premiums and

accretion of discounts on Residential Investment Securities for the

quarters ended March 31, 2016, December 31, 2015, and March 31,

2015, was $355.7 million (which included PAA cost of $168.4

million), $159.7 million (which included PAA benefit of $18.1

million), and $284.8 million (which included PAA cost of $87.9

million), respectively. The total net premium balance on

Residential Investment Securities at March 31, 2016, December 31,

2015, and March 31, 2015, was $4.7 billion, $5.0 billion, and $4.7

billion, respectively. The weighted average amortized cost basis of

the Company’s non interest-only Residential Investment Securities

at March 31, 2016, December 31, 2015, and March 31, 2015, was

105.0%, 105.3% and 105.1%, respectively. The weighted average

amortized cost basis of the Company’s interest-only Residential

Investment Securities at March 31, 2016, December 31, 2015, and

March 31, 2015, was 15.6%, 16.0%, and 15.7%, respectively. The

weighted average experienced CPR on our Agency mortgage-backed

securities for the quarters ended March 31, 2016, December 31,

2015, and March 31, 2015, was 8.8%, 9.7% and 9.0%, respectively.

The weighted average projected long-term CPR on our Agency

mortgage-backed securities at March 31, 2016, December 31, 2015,

and March 31, 2015, was 11.8%, 8.8% and 9.2%, respectively.

At March 31, 2016, the Company had outstanding $14.3 billion in

notional balances of TBA derivative positions. Realized and

unrealized gains (losses) on TBA derivatives are recorded in Net

gains (losses) on trading assets in the Company’s Consolidated

Statements of Comprehensive Income (Loss). The following table

summarizes certain characteristics of the Company’s TBA derivatives

at March 31, 2016:

TBA Purchase Contracts

Notional Implied Cost Basis Implied

Market Value Net Carrying Value (dollars in

thousands) Purchase contracts $ 14,273,000 $ 14,847,792 $

14,924,524 $ 76,732

During the quarter ended March 31, 2016, the Company disposed of

$3.5 billion of Residential Investment Securities, resulting in a

net realized loss of ($1.7) million. During the quarter ended

December 31, 2015, the Company disposed of $2.7 billion of

Residential Investment Securities, resulting in a net realized loss

of ($7.5) million. During the quarter ended March 31, 2015, the

Company disposed of $14.9 billion of Residential Investment

Securities, resulting in a net realized gain of $62.3 million.

Commercial Investments Portfolio

The Company’s commercial investments portfolio consists of

commercial real estate debt and equity investments and corporate

debt. Commercial real estate debt, including preferred equity,

AAA-rated commercial mortgage-backed securities, securitized loans

of consolidated variable interest entities (“VIEs”) and loans held

for sale totaled $5.9 billion at March 31, 2016 compared to $4.5

billion at December 31, 2015. Loans held for sale totaled $278.6

million at March 31, 2016, unchanged from December 31, 2015.

Investments in commercial real estate totaled $527.8 million at

March 31, 2016, down slightly from $535.9 million at December 31,

2015. Corporate debt investments totaled $639.5 million as of March

31, 2016, up from $488.5 million at December 31, 2015. The weighted

average levered return on commercial real estate debt, including

loans held for sale, as of March 31, 2016, December 31, 2015, and

March 31, 2015, was 7.63%, 7.67% and 9.32%, respectively. Excluding

loans held for sale, the weighted average levered return on

commercial real estate debt was 8.88%, 8.82% and 9.32% at March 31,

2016, December 31, 2015, and March 31, 2015, respectively. The

weighted average levered returns on investments in commercial real

estate equity as of March 31, 2016, December 31, 2015, and March

31, 2015, was 10.59%, 10.59% and 12.98%, respectively.

During the first quarter of 2016, the Company originated or

provided additional funding on pre-existing commercial real estate

debt commitments totaling $180.9 million with a weighted average

coupon of 4.9%. During the first quarter of 2016, the Company

received cash from its commercial real estate investments of $351.9

million from loan sales, partial pay-downs, prepayments and

maturities with a weighted average coupon of 8.8%. The Company also

acquired AAA-rated commercial mortgage-backed securities during the

first quarter of 2016 for a gross purchase price of $76.9 million

and a net equity investment for $12.9 million.

At March 31, 2016, December 31, 2015, and March 31, 2015,

residential and commercial credit assets (including loans held for

sale) comprised 25%, 23% and 13% of stockholders’ equity.

Capital and

Funding

At March 31, 2016, total stockholders’ equity was $11.7 billion.

Leverage at March 31, 2016, December 31, 2015, and March 31, 2015,

was 5.3:1, 5.1:1 and 4.8:1, respectively. For purposes of

calculating the Company’s leverage ratio, debt consists of

repurchase agreements, other secured financing, Convertible Senior

Notes, securitized debt, participation sold and mortgages payable.

Securitized debt, participation sold and mortgages payable are

non-recourse to the Company. Economic leverage, which excludes

non-recourse debt and includes other forms of financing such as TBA

dollar roll transactions, was 6.2:1 at March 31, 2016, compared to

6.0:1 at December 31, 2015, and 5.7:1 at March 31, 2015. At March

31, 2016, December 31, 2015, and March 31, 2015, the Company’s

capital ratio, which represents the ratio of stockholders’ equity

to total assets (inclusive of total market value of TBA derivatives

and exclusive of consolidated VIEs associated with B Piece

commercial mortgage-backed securities), was 13.2%, 13.7%, and

14.3%, respectively. On a GAAP basis, the Company produced an

annualized return (loss) on average equity for the quarters ended

March 31, 2016, December 31, 2015, and March 31, 2015 of (29.47%),

22.15% and (14.41%), respectively. On a normalized core earnings

basis, the Company provided an annualized return on average equity

for the quarters ended March 31, 2016, December 31, 2015, and March

31, 2015, of 9.91%, 10.30%, and 10.34%, respectively.

At March 31, 2016, December 31, 2015, and March 31, 2015, the

Company had a common stock book value per share of $11.61, $11.73

and $12.88, respectively.

As previously announced, the Company’s Board authorized the

repurchase of up to $1 billion of its outstanding common shares

through December 31, 2016. During the quarter ended March 31, 2016

the Company repurchased 11.1 million shares of its outstanding

common stock for total proceeds of $102.7 million. Since the

beginning of the fourth quarter 2015 to date, the Company

repurchased 23.1 million shares of its outstanding common stock for

total proceeds of $217.0 million, at an average purchase price per

share of $9.40.

At March 31, 2016, December 31, 2015, and March 31, 2015, the

Company had outstanding $54.4 billion, $56.2 billion, and $60.5

billion of repurchase agreements, with weighted average remaining

maturities of 136 days, 151 days, and 149 days, and with weighted

average borrowing rates of 1.87%, 1.83%, and 1.74%, after giving

effect to the Company’s interest rate swaps used to hedge cost of

funds, respectively. The weighted average rate on repurchase

agreements during the quarters ended March 31, 2016, December 31,

2015, and March 31, 2015, was 0.95%, 0.78%, and 0.60%,

respectively.

At March 31, 2016 and December 31, 2015, the Company had

outstanding $3.6 billion and $1.8 billion of advances from the

Federal Home Loan Bank of Des Moines, with weighted average

remaining maturities of 1,735 days and 1,423 days, respectively,

and with weighted average borrowing rates of 0.59%.

The following table presents the principal balance and weighted

average rate of repurchase agreements and FHLB advances by maturity

at March 31, 2016:

Maturity Principal Balance

Weighted Average Rate (dollars in thousands)

Within 30 days $ 20,891,928 0.70 % 30 to 59 days 4,878,678 0.82 %

60 to 89 days 9,264,997 0.96 % 90 to 119 days 4,270,155 0.95 % Over

120 days(1) 18,730,709 1.29 % Total $ 58,036,467 0.96 %

(1) Approximately 17% of the total repurchase agreements and

FHLB advances have a remaining maturity over 1 year.

The following table presents the principal balance, weighted

average rate and weighted average days to maturity on outstanding

debt at March 31, 2016:

Weighted Average Principal

Balance Rate

Days to Maturity (3)

(dollars in thousands) Repurchase agreements $ 54,448,141

0.99 % 136 Other secured financing (1) 3,588,326 0.59 % 1,735

Securitized debt of consolidated VIEs (2) 3,821,252 0.85 % 2,801

Participation sold (2) 13,061 5.58 % 396 Mortgages payable (2)

338,346 4.16 % 3,064 Total indebtedness $ 62,209,126

(1) Represents advances from the Federal Home Loan Bank of Des

Moines. (2) Non-recourse to the Company. (3)

Determined based on estimated weighted-average lives of the

underlying debt instruments.

Hedge

Portfolio

At March 31, 2016, the Company had outstanding interest rate

swaps with a net notional amount of $29.9 billion. Changes in the

unrealized gains or losses on the interest rate swaps are reflected

in the Company’s Consolidated Statements of Comprehensive Income

(Loss). The Company enters into interest rate swaps to mitigate the

risk of rising interest rates that affect the Company’s cost of

funds or its dollar roll transactions. As of March 31, 2016, the

swap portfolio had a weighted average pay rate of 2.26%, a weighted

average receive rate of 0.69% and a weighted average maturity of

6.76 years. There were no forward starting swaps at March 31,

2016.

The following table summarizes certain characteristics of the

Company’s interest rate swaps at March 31, 2016:

Weighted Weighted

Weighted Average Pay Average Receive

Average Years Maturity Current Notional

Rate Rate to Maturity

(dollars in thousands) 0 - 3 years $ 4,290,419 1.79 % 0.47 %

1.87 3 - 6 years 11,925,000 1.87 % 0.73 % 4.22 6 - 10 years

10,227,550 2.49 % 0.76 % 7.88 Greater than 10 years

3,434,400 3.54 % 0.59 % 18.64 Total / Weighted

Average $ 29,877,369 2.26 % 0.69 % 6.76

The Company enters into U.S. Treasury and Eurodollar futures

contracts to hedge a portion of its interest rate risk. The

following table summarizes outstanding futures positions as of

March 31, 2016:

Notional - Long Notional - Short

Weighted Average Positions Positions

Years to Maturity (dollars in thousands)

2-year swap equivalent Eurodollar contracts $ - $ (4,375,000 ) 2.00

U.S. Treasury futures - 5 year - (1,847,200 ) 4.42 U.S. Treasury

futures - 10 year and greater - (655,600 )

6.75 Total $ - $ (6,877,800 ) 3.10

At March 31, 2016, December 31, 2015, and March 31, 2015, the

Company’s hedge ratio was 53%, 57% and 48%, respectively. Our hedge

ratio measures total notional balances of interest rate swaps,

interest rate swaptions and futures relative to repurchase

agreements and TBA notional outstanding.

Dividend

Declarations

Common dividends declared for each of the quarters ended March

31, 2016, December 31, 2015, and March 31, 2015 were $0.30 per

common share. The annualized dividend yield on the Company’s common

stock for the quarter ended March 31, 2016, based on the March 31,

2016 closing price of $10.26, was 11.70%, compared to 12.79% for

the quarter ended December 31, 2015, and 11.54% for the quarter

ended March 31, 2015.

Key

Metrics

The following table presents key metrics of the Company’s

portfolio, liabilities and hedging positions, and performance as of

and for the quarters ended March 31, 2016, December 31, 2015, and

March 31, 2015:

March 31, 2016 December 31, 2015

March 31, 2015

Portfolio Related

Metrics:

Fixed-rate Residential Investment Securities as a

percentage of total Residential Investment Securities 93% 93% 94%

Adjustable-rate and floating-rate Residential Investment Securities

as a percentage of total Residential Investment Securities 7% 7% 6%

Weighted average experienced CPR for the period 8.8% 9.7% 9.0%

Weighted average projected long-term CPR at period end 11.8% 8.8%

9.2% Weighted average levered return on commercial real estate debt

at period-end (1) 7.63% 7.67% 9.32% Weighted average levered return

on investments in commercial real estate equity at period-end

10.59% 10.59% 12.98%

Liabilities and

Hedging Metrics:

Weighted average days to maturity on repurchase agreements

outstanding at period-end 136 151 149 Hedge ratio (2) 53% 57% 48%

Weighted average pay rate on interest rate swaps at period-end (3)

2.26% 2.26% 2.37% Weighted average receive rate on interest rate

swaps at period-end (3) 0.69% 0.53% 0.35% Weighted average net rate

on interest rate swaps at period-end (3) 1.57% 1.73% 2.02% Leverage

at period-end (4) 5.3:1 5.1:1 4.8:1 Economic leverage at period-end

(5) 6.2:1 6.0:1 5.7:1 Capital ratio at period-end 13.2%

13.7% 14.3%

Performance

Related Metrics:

Book value per common share $11.61 $11.73 $12.88 GAAP net income

(loss) per common share ($0.96) $0.69 ($0.52) Core earnings per

common share $0.11 $0.33 $0.25 Normalized core earnings per common

share $0.30 $0.31 $0.34 Annualized return (loss) on average equity

(29.47%) 22.15% (14.41%) Annualized core return on average equity

4.19% 10.89% 7.69% Annualized normalized core return on average

equity 9.91% 10.30% 10.34% Net interest margin 0.79% 1.80% 1.29%

Normalized net interest margin 1.54% 1.71% 1.68% Average yield on

interest earning assets (6) 2.09% 3.15% 2.54% Normalized average

yield on interest earning assets (6) 3.00% 3.05% 2.96% Average cost

of interest bearing liabilities (7) 1.73% 1.68% 1.64% Net interest

spread 0.36% 1.47% 0.90% Normalized net interest spread 1.27%

1.37% 1.32% (1) Includes loans held for sale.

Excluding loans held for sale, the weighted average levered return

on commercial real estate debt was 8.88%, 8.82% and 9.32% at March

31, 2016, December 31, 2015, and March 31, 2015, respectively.

(2) Measures total notional balances of interest rate swaps,

interest rate swaptions and futures relative to repurchase

agreements and TBA notional outstanding. (3) Excludes

forward starting swaps. (4) Debt consists of repurchase

agreements, other secured financing, Convertible Senior Notes,

securitized debt, participation sold and mortgages payable.

Securitized debt, participation sold and mortgages payable are

non-recourse to the Company. (5) Computed as the sum of

recourse debt, TBA derivative notional outstanding and net forward

purchases of investments divided by total equity. (6)

Average interest earning assets reflects the average amortized cost

of our investments during the period. (7) Includes interest

expense on interest rate swaps used to hedge cost of funds.

Other

Information

Annaly’s principal business objectives are to generate net

income for distribution to its shareholders from its investments

and capital preservation. Annaly is a Maryland corporation that has

elected to be taxed as a real estate investment trust (“REIT”).

Annaly is managed and advised by Annaly Management Company LLC.

The Company prepares a supplement to provide additional

quarterly information for the benefit of its shareholders. The

supplement can be found at the Company’s website (www.annaly.com)

in the Investors section under Investor Presentations.

Conference

Call

The Company will hold the first quarter 2016 earnings conference

call on May 5, 2016 at 10:00 a.m. Eastern Time. The number to call

is 888-317-6003 for domestic calls and 412-317-6061 for

international calls. The conference passcode is 5990784. There will

also be an audio webcast of the call on www.annaly.com. The replay

of the call is available for one week following the conference

call. The replay number is 877-344-7529 for domestic calls and

412-317-0088 for international calls and the conference passcode is

10084548. If you would like to be added to the e-mail distribution

list, please visit www.annaly.com, click on Investor Relations,

then select Email Alerts and complete the email notification

form.

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financings; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial business; our ability

to grow our residential mortgage credit business; credit risks

related to our investments in credit risk transfer securities,

residential mortgage-backed securities and related residential

mortgage credit assets, commercial real estate assets and corporate

debt; our ability to consummate any contemplated investment

opportunities; changes in government regulations affecting our

business; our ability to maintain our qualification as a REIT for

federal income tax purposes; our ability to maintain our exemption

from registration under the Investment Company Act of 1940, as

amended; and our ability to consummate the proposed Hatteras

Acquisition on a timely basis or at all, and potential business

disruption following the Hatteras Acquisition. For a discussion of

the risks and uncertainties which could cause actual results to

differ from those contained in the forward-looking statements, see

"Risk Factors" in our most recent Annual Report on Form 10-K and

any subsequent Quarterly Reports on Form 10-Q. We do not undertake,

and specifically disclaim any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION (dollars in thousands, except per share data)

March 31, December 31, September

30, June 30, March 31, 2016

2015(1)

2015 2015 2015 (Unaudited)

(Unaudited) (Unaudited)

(Unaudited) ASSETS Cash and cash equivalents $

2,416,136 $ 1,769,258 $ 2,237,423 $ 1,785,158 $ 1,920,326

Investments, at fair value: Agency mortgage-backed securities

65,439,824 65,718,224 65,806,640 67,605,287 69,388,001 Agency

debentures 157,035 152,038 413,115 429,845 995,408 Credit risk

transfer securities 501,167 456,510 330,727 214,130 108,337

Non-Agency mortgage-backed securities 1,157,507 906,722 490,037 - -

Commercial real estate debt investments (2) 4,401,725 2,911,828

2,881,659 2,812,824 1,515,903 Investment in affiliate - - - 123,343

141,246 Commercial real estate debt and preferred equity, held for

investment (3) 1,177,468 1,348,817 1,316,595 1,332,955 1,498,406

Loans held for sale 278,600 278,600 476,550 - - Investments in

commercial real estate 527,786 535,946 301,447 216,800 207,209

Corporate debt 639,481 488,508 424,974 311,640 227,830 Reverse

repurchase agreements - - - - 100,000 Interest rate swaps, at fair

value 93,312 19,642 39,295 30,259 25,908 Other derivatives, at fair

value 77,449 22,066 87,516 38,074 113,503 Receivable for

investments sold 2,220 121,625 127,571 247,361 2,009,937 Accrued

interest and dividends receivable 232,180 231,336 228,169 234,006

247,801 Receivable for investment advisory income - - 3,992 10,589

10,268 Other assets 234,407 119,422 67,738 48,229 34,430 Goodwill

71,815 71,815 71,815 71,815 94,781 Intangible assets, net

35,853 38,536 33,424

33,365 36,383

Total assets $ 77,443,965 $ 75,190,893

$ 75,338,687 $ 75,545,680 $

78,675,677

LIABILITIES AND STOCKHOLDERS’

EQUITY Liabilities: Repurchase agreements $ 54,448,141 $

56,230,860 $ 56,449,364 $ 57,459,552 $ 60,477,378 Other secured

financing 3,588,326 1,845,048 359,970 203,200 90,000 Convertible

Senior Notes - - - - 749,512 Securitized debt of consolidated VIEs

(4) 3,802,682 2,540,711 2,553,398 2,610,974 1,491,829 Participation

sold 13,182 13,286 13,389 13,490 13,589 Mortgages payable 334,765

334,707 166,697 146,359 146,470 Interest rate swaps, at fair value

2,782,961 1,677,571 2,160,350 1,328,729 2,025,170 Other

derivatives, at fair value 69,171 49,963 113,626 40,539 61,778

Dividends payable 277,456 280,779 284,348 284,331 284,310 Payable

for investments purchased 250,612 107,115 744,378 673,933 5,205

Accrued interest payable 163,983 151,843 145,554 131,629 155,072

Accounts payable and other liabilities 54,679

53,088 63,280

58,139 50,774 Total liabilities

65,785,958 63,284,971

63,054,354 62,950,875

65,551,087 Stockholders’ Equity:

7.875% Series A Cumulative Redeemable

Preferred Stock: 7,412,500 authorized, issued and outstanding

177,088 177,088 177,088 177,088 177,088

7.625% Series C Cumulative Redeemable

Preferred Stock 12,650,000 authorized, 12,000,000 issued and

outstanding

290,514 290,514 290,514 290,514 290,514

7.50% Series D Cumulative Redeemable

Preferred Stock: 18,400,000 authorized, issued and outstanding

445,457 445,457 445,457 445,457 445,457 Common stock, par value

$0.01 per share, 1,956,937,500 authorized, 924,853,133,

935,929,561, 947,826,176, 947,768,496, and 947,698,431 issued and

outstanding, respectively 9,249 9,359 9,478 9,478 9,477 Additional

paid-in capital 14,573,760 14,675,768 14,789,320 14,788,677

14,787,117 Accumulated other comprehensive income (loss) 640,366

(377,596 ) 262,855 (354,965 ) 773,999 Accumulated deficit

(4,487,982 ) (3,324,616 ) (3,695,884 )

(2,766,250 ) (3,364,147 ) Total

stockholders’ equity 11,648,452 11,895,974 12,278,828 12,589,999

13,119,505 Noncontrolling interest 9,555

9,948 5,505

4,806 5,085 Total equity

11,658,007 11,905,922

12,284,333 12,594,805

13,124,590 Total liabilities and equity $ 77,443,965

$ 75,190,893 $ 75,338,687

$ 75,545,680 $ 78,675,677 (1) Derived

from the audited consolidated financial statements at December 31,

2015. (2) Includes senior securitized commercial mortgage

loans of consolidated VIEs with a carrying value of $4.0 billion,

$2.6 billion, $2.6 billion, $2.6 billion and $1.4 billion at March

31, 2016, December 31, 2015, September 30, 2015, June 30, 2015 and

March 31, 2015, respectively. (3) Includes senior

securitized commercial mortgage loans of consolidated VIE with a

carrying value of $211.9 million, $262.7 million, $314.9 million,

$361.2 million and $361.2 million, at March 31, 2016, December 31,

2015, September 30, 2015, June 30, 2015 and March 31, 2015,

respectively. (4) Includes securitized debt of consolidated

VIEs carried at fair value of $3.7 billion, $2.4 billion, $2.4

billion, $2.4 billion and $1.3 billion at March 31, 2016, December

31, 2015, September 30, 2015, June 30, 2015 and March 31, 2015,

respectively.

ANNALY CAPITAL

MANAGEMENT, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS) (UNAUDITED) (dollars in

thousands, except per share data) For the quarters

ended March 31, December 31, September 30,

June 30, March 31, 2016 2015

2015 2015 2015

Net interest income:

Interest income $ 388,143 $ 576,580 $ 450,726 $ 624,277 $ 519,114

Interest expense 147,447 118,807

110,297 113,072

129,420

Net interest income 240,696

457,773 340,429

511,205 389,694

Realized and unrealized gains (losses): Realized gains

(losses) on interest rate swaps(1) (147,475 ) (159,487 ) (162,304 )

(144,465 ) (158,239 ) Realized gains (losses) on termination of

interest rate swaps - - - - (226,462 ) Unrealized gains (losses) on

interest rate swaps (1,031,720 ) 463,126

(822,585 ) 700,792

(466,202 )

Subtotal (1,179,195 )

303,639 (984,889 ) 556,327

(850,903 ) Net gains (losses) on disposal of

investments (1,675 ) (7,259 ) (7,943 ) 3,833 62,356 Net gains

(losses) on trading assets 125,189 42,584 108,175 (114,230 ) (6,906

) Net unrealized gains (losses) on financial instruments measured

at fair value through earnings 128 (62,703 ) (24,501 ) 17,581

(33,546 ) Impairment of goodwill - -

- (22,966 )

-

Subtotal 123,642

(27,378 ) 75,731 (115,782 )

21,904

Total realized and unrealized gains

(losses) (1,055,553 ) 276,261

(909,158 ) 440,545

(828,999 )

Other income (loss): Investment advisory

income - - 3,780 10,604 10,464 Dividend income from affiliate - - -

4,318 4,318 Other income (loss) (6,115 )

(10,447 ) (13,455 ) (22,275 )

(1,024 )

Total other income (loss) (6,115 )

(10,447 ) (9,675 ) (7,353

) 13,758

General and administrative

expenses: Compensation and management fee 36,997 37,193 37,450

37,014 38,629 Other general and administrative expenses

10,948 10,643 12,007

14,995 12,309

Total general and administrative expenses 47,945

47,836 49,457

52,009 50,938

Income (loss) before income taxes (868,917 ) 675,751

(627,861 ) 892,388 (476,485 )

Income taxes

(837 ) 6,085 (370 )

(7,683 ) 14

Net income

(loss) (868,080 ) 669,666 (627,491 ) 900,071 (476,499 )

Net income (loss) attributable to noncontrolling interest

(162 ) (373 ) (197 )

(149 ) (90 )

Net income (loss)

attributable to Annaly (867,918 ) 670,039 (627,294 ) 900,220

(476,409 )

Dividends on preferred stock 17,992

17,992 17,992

17,992 17,992

Net income (loss) available (related) to common stockholders

$ (885,910 ) $ 652,047 $ (645,286 ) $

882,228 $ (494,401 )

Net income (loss) per

share available (related) to common stockholders: Basic $ (0.96

) $ 0.69 $ (0.68 ) $ 0.93

$ (0.52 ) Diluted $ (0.96 ) $ 0.69 $ (0.68 )

$ 0.93 $ (0.52 )

Weighted average

number of common shares outstanding: Basic 926,813,588

945,072,058 947,795,500

947,731,493 947,669,831

Diluted 926,813,588 945,326,098

947,795,500 947,929,762

947,669,831

Net income

(loss) $ (868,080 ) $ 669,666 $ (627,491 )

$ 900,071 $ (476,499 )

Other comprehensive

income (loss): Unrealized gains (losses) on available-for-sale

securities 1,017,707 (648,106 ) 609,725 (1,125,043 ) 631,472

Reclassification adjustment for net (gains) losses included in net

income (loss) 255 7,655

8,095 (3,921 ) (62,356 )

Other comprehensive income (loss) 1,017,962

(640,451 ) 617,820

(1,128,964 ) 569,116 Comprehensive income

(loss) 149,882 29,215 (9,671 ) (228,893 ) 92,617 Comprehensive

income (loss) attributable to noncontrolling interest (162 )

(373 ) (197 ) (149 )

(90 )

Comprehensive income (loss) attributable to

Annaly $ 150,044 $ 29,588 $ (9,474

) $ (228,744 ) $ 92,707 (1) Interest

expense related to the Company’s interest rate swaps is recorded in

Realized gains (losses) on interest rate swaps on the Consolidated

Statements of Comprehensive Income (Loss).

Non-GAAP Financial

Measures

The following tables present a reconciliation of non-GAAP

financial measures to the most directly comparable GAAP financial

measures for the quarters ended March 31, 2016, December 31, 2015,

and March 31, 2015:

For the quarters ended March 31, 2016

December 31, 2015 March 31, 2015

Normalized

Interest Income Reconciliation

(dollars in thousands) Total interest income $ 388,143

$ 576,580 $ 519,114 Premium amortization adjustment

168,408 (18,072 ) 87,883

Normalized interest income $ 556,551 $ 558,508

$ 606,997

Economic Interest

Expense Reconciliation

GAAP interest expense $ 147,447 $ 118,807 $ 129,420 Add: Interest

expense on interest rate swaps used to hedge cost of funds

123,124 135,267 157,332

Economic interest expense $ 270,571 $ 254,074

$ 286,752

Normalized

Economic Net Interest Income Reconciliation

Normalized interest income $ 556,551 $ 558,508 $ 606,997 Less:

Economic interest expense 270,571

254,074 286,752 Normalized economic net

interest income $ 285,980 $ 304,434 $

320,245

Normalized

Economic Net Interest Income

Normalized interest income $ 556,551 $ 558,508 $ 606,997 Average

interest earning assets $ 74,171,943 $ 73,178,965 $ 81,896,255

Normalized average yield on interest earning assets 3.00 %

3.05 % 2.96 % Economic interest expense

$ 270,571 $ 254,074 $ 286,752

Average interest bearing liabilities

$ 62,379,695 $ 60,516,996 $ 70,137,382 Average cost of interest

bearing liabilities 1.73 % 1.68 %

1.64 % Normalized net interest spread 1.27 %

1.37 % 1.32 % Normalized net interest margin

1.54 % 1.71 % 1.68 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160504006672/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

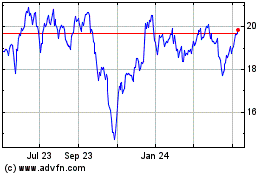

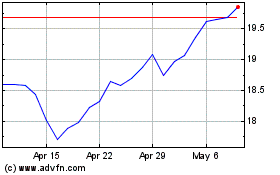

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024