SABMiller, Coca-Cola Strike Deal With South Africa Over Bottling Merger -- Update

May 04 2016 - 5:06AM

Dow Jones News

By Saabira Chaudhuri

LONDON-- SABMiller PLC and Coca-Cola Co. have struck a deal with

South Africa's government to help push through a long-pending

merger of their bottling operations in parts of Africa.

In November 2014, Coca-Cola struck a deal to combine bottling

assets with SABMiller and privately held Gutsche Family Investments

to create a joint venture spanning 12 African countries and about

40% of Coke's soft-drink volumes on the continent.

SABMiller, which has since agreed to be acquired by

Anheuser-Busch InBev NV, is slated to hold 57% of newly created

Coca-Cola Beverages Africa and Coke will own 11.3%. The remainder

will be owned by Gutsche, a major shareholder in Coke's African

bottling operations.

However, the deal has yet to close as the South African

government has harbored concerns about protecting jobs in the

country.

SABMiller on Wednesday outlined the terms of its deal with the

South African government, saying the new soft-drink bottling

operation--which will be Africa's largest if approved--will keep

employment at current levels for three years after the deal is

approved. Layoffs of senior staff will be limited.

The company also agreed to invest 800 million South African

rands ($54.34 million) to support farmers and help retailers, in

addition to a number of smaller commitments like allowing small

retailers to allot 10% of space in Coca-Cola coolers to the drinks

of smaller competitors if needed.

As part of the 2014 bottling deal, Coke said it would pay $260

million for the world-wide rights to SABMiller's Appletiser, a

carbonated apple juice, and the rights to another 19 nonalcoholic

brands in Africa and Latin America.

Wednesday the companies agreed to sell 20% of shares in

Appletiser South Africa to "appropriate black shareholders who will

be expected to participate actively in the business" and to grow

Appletiser's production in South Africa with an eye on exporting

the product in Africa and beyond.

"I am very happy that we have reached this agreement and hope we

now have a clear path to the conclusion of this transaction and the

creation of Coca-Cola Beverages Africa," said Alan Clark,

SABMiller's Chief Executive, in a statement.

South Africa's competition tribunal needs to approve the

bottling merger for the deal to close. A hearing on the proposed

merger kicks off May 9.

Wednesday's agreements come after last month AB InBev said it

had reached an agreement with the South African government to

create a $69 million investment fund and other commitments designed

to help it secure regulatory approval in the country for its deal

to buy SABMiller. The Belgian brewer's pending acquistion has

created uncertainty around Coke's bottling arrangements in Africa

since ABInBev is PepsiCo Inc.'s bottler in Latin America. Pepsi and

Coke are arch rivals, while--to complicate things further--Coke is

also often cited as being a possible acquisition target for AB

InBev.

--Tapan Panchal contributed to this article

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

May 04, 2016 04:51 ET (08:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

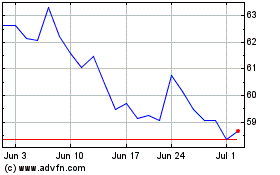

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

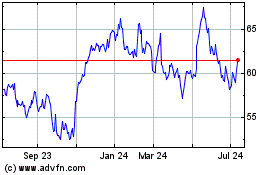

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024