Zillow Beats Expectations, Lifts Sales View

May 03 2016 - 6:00PM

Dow Jones News

Zillow Group Inc. narrowed its loss for the first quarter as the

online real-estate company's revenue climbed amid a growing user

base.

Following the bigger-than-expected sales increase, Zillow lifted

its revenue forecast for the year. Shares in the company, up 43%

over the past three months, gained 12% in after-hours trading.

The Seattle company, which operates online real-estate portals

used by house hunters and real-estate agents, acquired its former

rival Trulia last year. In its latest move to grow its footprint,

Zillow in February closed its purchase of Naked Apartments, a New

York City rental-search platform, for $13 million.

Zillow said it averaged more than 166 million unique visitors

during March, up 22% from a year earlier and a level the company

said marks a record high. For the full quarter, Zillow said average

monthly unique users were about 156 million, helping to push its

market share up to 65% of the mobile and Web real estate

audience.

Real estate revenue jumped 34% during the period to $152.5

million, while mortgage revenue surged 65% to $16.5 million. Those

increases offset a 34% drop in display revenue, a decrease Zillow

attributed to a shift to de-emphasize display advertising. Zillow

has traditionally brought in a big chunk of its money from

advertising purchased by realtors. Revenue comparisons exclude

sales from the Market Leader business which was divested in the

third quarter of last year.

Over all, the company reported a loss of $47.6 million, or 27

cents a share, narrower than its year-earlier loss of $58.4

million, or 40 cents a share. Excluding acquisition-related costs

and income taxes, among other items, Zillow posted a loss of 13

cents a share, compared with earnings of 2 cents a share a year

earlier.

Revenue rose 25% to $186 million, excluding sales from Market

Leader. Analysts projected an adjusted loss of 17 cents a share and

revenue of $176.8 million in revenue, according to FactSet.

The company recorded a $15.7 million in legal costs during the

first quarter, stemming from a lawsuit with News Corp, which owns

Zillow competitor Move Inc. News Corp. also owns Dow Jones &

Co., publisher of The Wall Street Journal. That expense roughly

doubled from the fourth quarter. Zillow said legal costs from the

suit will range between $50 million and $55 million this year.

Zillow said it now expects to log $825 million to $835 million

in sales this year, up from earlier guidance of $805 million to

$815 million. For the current quarter, the company anticipates $203

million to $208 million in revenue, above the $193.6 million

analysts have estimated.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

May 03, 2016 17:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

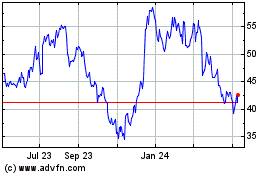

Zillow (NASDAQ:ZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

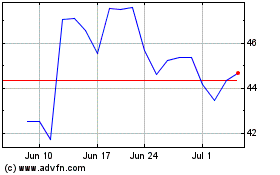

Zillow (NASDAQ:ZG)

Historical Stock Chart

From Apr 2023 to Apr 2024