Halliburton's Loss Deepens--2nd Update

May 03 2016 - 1:57PM

Dow Jones News

By Alison Sider and Anne Steele

Halliburton Co. and Baker Hughes Inc. are taking sharply

divergent paths after recently calling off a merger, once valued at

$35 billion, due to regulatory opposition.

Halliburton Chief Executive Dave Lesar said Tuesday in his first

live remarks since the failed merger was announced Sunday that his

company still wants to be a one-stop-shop for exploration and

production companies, and said it would seek other ways to grow and

increase its reach worldwide.

"If we had been successful, adding the Baker Hughes assets would

have given us that scale quickly," Mr. Lesar said in a conference

call. "But our strategy has not changed."

That was in contrast to remarks Tuesday from Baker Hughes Chief

Executive Martin Craighead, who said his company plans a more

specialized business model, pulling back from some markets and

services such as fracking in the U.S., to focus on developing and

selling new technologies.

"There are certain markets where certain product lines frankly

aren't earning their right to play," he said.

Halliburton and Baker Hughes called off their merger Sunday

after the deal encountered intense regulatory pressure on several

continents.

The second and third largest oil-field services providers had

hoped to join forces to challenge Schlumberger Ltd., their largest

rival.

Mr. Lesar said the companies knew they would face scrutiny from

regulators and believed that trying to acquire Baker Hughes was

worth the risk.

Obtaining U.S. antitrust approval for large, complex

transactions in any industry has become more difficult in recent

years, he said. And the sudden, sharp drop in oil prices made it

hard to divest businesses and eroded the potential benefit from the

deal.

"The unprecedented deterioration of the oil and gas industry

decimated the economics of the deal," Mr. Lesar said.

On Tuesday, Halliburton reported a loss of $2.41 billion, or

$2.81 a share, for the first three months of the year. The

company's quarterly loss widened from $643 million, or 76 cents a

share, a year earlier, because of drastically lower revenue from

its North American business and charges from the failed Baker

Hughes tie-up.

Excluding special items, adjusted earnings from continuing

operations were 7 cents a share. Total revenue slid 40% to $4.2

billion.

The company said it recorded Baker Hughes acquisition-related

costs of $378 million, or 44 cents a share, in the quarter.

Halliburton had previously said it recorded companywide charges

related to asset impairments and severance costs of about $2.1

billion, or $2.39 a share, in the first quarter.

Baker Hughes on Monday said it would use its $3.5 billion

break-up fee to shore up its balance sheet, buying back stock and

debt.

The company plans to scale back on hydraulic fracturing work in

the U.S., which Mr. Craighead said has become commoditized, with

customers unwilling to pay for better service or technology.

Baker Hughes also said it would step up its work selling

equipment and technology to other companies, particularly in

international markets.

"We will be more selective and creative as we look at

opportunities for our product lines globally," Mr. Craighead

said.

Though he said he didn't listen to the comments by the chief

executive of the company he had planned to combine with, now a

rival, Mr. Lesar said he believes the best way to prepare for a

rebound in oil field activity is to work in every shale formation,

offering a full suite of services.

"If you are an integrated company, you essentially can't pick

and choose where you provide, who you provide it to, where you

operate and what customers you work for," Mr. Lesar said.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 03, 2016 13:42 ET (17:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

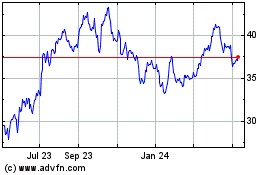

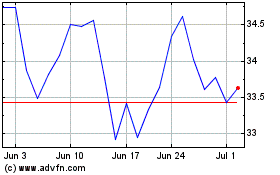

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024