Current Report Filing (8-k)

May 02 2016 - 5:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

April 26, 2016

|

Lucas Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

450 Gears Road, Suite 780, Houston, Texas

|

|

77067

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code (713) 528-1881

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.03 Creation of a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

As described below

in Item 3.02, which information is incorporated by reference in this Item 2.03, Lucas Energy, Inc. (the “

Company

”,

“

we

” and “

us

”) sold a Convertible Promissory Note to Debra Herman, an assign of HFT Enterprises,

LLC (“

HFT

”), pursuant to that certain Convertible Promissory Note Purchase Agreement by and between the Company

and HFT dated March 29, 2016, to be effective March 11, 2016 (the “

Purchase Agreement

”), which Mrs. Herman became

party to pursuant to a joinder agreement, in the amount of $150,000 (the “

Convertible Note

”).

The Convertible Note is

due and payable on April 26, 2017, accrues interest at the rate of 6% per annum (15% upon the occurrence of an event of default),

and allows the holder thereof the right to convert the principal and interest due thereunder into common stock of the Company at

a conversion price of $1.50 per share, provided that any conversion is subject to us first receiving approval for the issuance

of shares of our common stock under the Convertible Notes sold pursuant to the Purchase Agreement ($600,000 in aggregate) under

applicable NYSE MKT rules and regulations (“

NYSE Approval

”), which we have not sought or obtained to date, and

to the extent such conversion(s) would exceed 19.9% of our total shares of outstanding common stock on the date of our entry into

the Purchase Agreement or would otherwise require stockholder approval under applicable NYSE MKT rules, stockholder approval for

such issuances (“

Stockholder Approval

”).

At no time may the Convertible

Note be converted, or the Warrants (defined below) be exercised, into shares of our common stock if such conversion or exercise,

as applicable, would result in the holder of such security and its affiliates owning an aggregate of in excess of 9.99% of the

then outstanding shares of our common stock, subject to the ability of holder to modify such limitation with 61 days prior written

notice to us (the “

Beneficial Ownership Limitation

”).

The foregoing description

of the Convertible Note does not purport to be complete and is qualified in its entirety by reference to the form of Convertible

Note, a copy of which is incorporated by reference as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by

reference.

|

|

|

Item

3.02 Unregistered Sales of Equity Securities.

We

sold the Convertible Note described above under Item 2.03, on April 26, 2016. If fully converted by the holder (without factoring

in any accrued and unpaid interest thereon, which is also convertible into our common stock as provided in the note), notwithstanding

the requirement for NYSE Approval (as discussed above) or the Beneficial Ownership Limitation, and subject where applicable to

the Stockholder Approval, a total of 300,000 shares of common stock would be required to be issued to the holder thereof and if

fully converted at maturity, when factoring in accrued interest thereon through maturity, a total of 318,504 shares of common stock

would be required to be issued to the holder in connection with such Convertible Note (i.e., without factoring in the conversion

of any other outstanding Convertible Note).

We

also agreed to grant Debra Herman, as an assign of HFT, warrants to purchase 124,285 shares of common stock with an exercise price

of $1.50 per share (the “

Warrants

”). The Warrants were granted to Mrs. Herman pursuant to the terms of a joinder

agreement entered into between the parties. No warrants are due to HFT.

The

Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended (the “

Securities

Act

”) for the sale and issuance of the Convertible Note and Warrants pursuant to (a) Section 4(a)(2) of the Securities

Act; and/or (b) Rule 506 of the Securities Act, and the regulations promulgated thereunder. With respect to the transactions described

above, no general solicitation was made either by us or by any person acting on our behalf. The transactions were privately negotiated,

and did not involve any kind of public solicitation. No underwriters or agents were involved in the foregoing sales and issuances

and the Company paid no underwriting discounts or commissions. The securities sold are subject to transfer restrictions, and the

certificate(s) evidencing the securities will contain an appropriate legend stating that such securities have not been registered

under the Securities Act and may not be offered or sold absent registration or pursuant to an exemption therefrom. The recipient

made various representations to us regarding its suitability to purchase the securities and knowledge of the risks involved in

such purchase, including confirming that it was an “

accredited investor

”.

The foregoing description

of the Warrants does not purport to be complete and is qualified in its entirety by reference to the form of Warrants, a copy of

which is incorporated by reference as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Form of Convertible Promissory Note (incorporated by reference to Exhibit A to the Convertible Promissory Note Purchase Agreement filed as

Exhibit 10.1

to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 1, 2016)

|

|

|

|

|

|

10.2

|

|

Form of Common Stock Purchase Warrant (incorporated by reference to Exhibit B to the Convertible Promissory Note Purchase Agreement filed as

Exhibit 10.1

to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 1, 2016)

|

|

|

|

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

LUCAS ENERGY, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Anthony C. Schnur

|

|

|

|

|

Name: Anthony C. Schnur

|

|

|

|

|

Title: Chief Executive Officer

|

|

Date: May 2, 2016

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Form of Convertible Promissory Note (incorporated by reference to Exhibit A to the Convertible Promissory Note Purchase Agreement filed as

Exhibit 10.1

to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 1, 2016)

|

|

|

|

|

|

10.2

|

|

Form of Common Stock Purchase Warrant (incorporated by reference to Exhibit B to the Convertible Promissory Note Purchase Agreement filed as

Exhibit 10.1

to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 1, 2016)

|

|

|

|

|

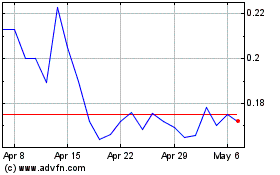

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024