Current Report Filing (8-k)

May 02 2016 - 5:09PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

|

April

28, 2016

|

|

Date of report (Date of earliest event reported)

|

|

SurModics, Inc.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Minnesota

|

|

0-23837

|

|

41-1356149

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

9924 West 74

th

Street

Eden Prairie, Minnesota

|

|

55344

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

|

(952) 500-7000

|

|

(Registrant’s Telephone Number, Including Area Code)

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions

(see General Instruction A.2):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02 Results of Operations And Financial Condition.

On May 2, 2016, SurModics, Inc. (the “

Company

”) issued a

press release (the “

Press Release

”) announcing the results

for the quarter ended March 31, 2016. A copy of the full text of the

Press Release is furnished as Exhibit 99.1 to this report.

The information contained in this Item 2.02, including Exhibit 99.1,

shall not be deemed to be “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended, nor shall they be deemed to

be incorporated by reference into any filing under the Securities Act of

1933, as amended, except as shall be expressly set forth by specific

reference in such a filing.

Item 8.01 Other Items.

In connection with the preparation of the financial statements for the

fiscal quarter ended March 31, 2016, the Company became aware of royalty

overpayments made by customers pursuant to license agreements for

products incorporating certain of the Company’s technologies no longer

covered by an unexpired patent. The Company did not identify that

certain amounts reported by the customers were not in accordance with

the terms of the license agreement and should have been deferred or

refunded to the customers, resulting in an overstatement of

revenue. These misstatements resulted in an estimated cumulative

overstatement of royalty revenue of approximately $1.1 million, of which

$1.0 million relates to periods from fiscal 2012 to fiscal 2015. These

misstatements were not material to any prior period; accordingly, prior

periods will not be restated. The Company’s financial results for the

fiscal quarter ended March 31, 2016, include an out-of-period adjustment

to correct this cumulative overstatement of royalty revenue.

Following the identification of the cumulative royalty overpayments

noted above, the Company’s Chief Executive Officer and Chief Financial

Officer re-evaluated the effectiveness of internal control over

financial reporting based on the framework in

Internal Control

—

Integrated

Framework (2013)

issued by the Committee of Sponsoring Organizations

of the Treadway Commission as of September 30, 2015 and December 31,

2015, and determined that a material weakness existed in the design and

operating effectiveness of the Company’s controls related to the

recognition of royalty revenue, specifically the controls to ensure that

royalty revenue is accurate and complete. As a result, the Company’s

Chief Executive Officer and Chief Financial Officer concluded that the

Company’s internal control over financial reporting was not effective as

of September 30, 2015 and December 31, 2015. The Company expects to

file an amendment with the Securities and Exchange Commission to its (a)

Annual Report on Form 10-K for the year ended September 30, 2015,

amending and revising Item 9A of Part II, “Controls and Procedures,”

with respect to (1) the Company’s conclusions regarding the

effectiveness of its disclosure controls and procedures and its internal

control over financial reporting, and (2) Deloitte & Touche LLP’s

related attestation report, and (b) Quarterly Report on Form 10-Q for

the fiscal quarter ended December 31, 2015, with respect to the

Company’s conclusions regarding the effectiveness of its disclosure

controls and procedures as a result of a material weakness in internal

control over financial reporting. Management is taking steps to address

the Company’s controls related to the recognition of royalty revenue,

including the accuracy and completeness of royalty reporting and

payments made by customers pursuant to license agreements for products

incorporating the Company’s technologies no longer covered by an

unexpired patent. Management plans to implement additional measures to

remediate the underlying causes of the material weakness described above.

The Company’s management and the Committee have discussed the matters

disclosed in this filing with Deloitte & Touche LLP, the Company’s

independent registered public accounting firm.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

.

|

|

Exhibit Number

|

|

Description

|

|

|

|

99.1

|

|

Press Release dated May 2, 2016.

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

SURMODICS, INC.

|

|

|

|

|

|

|

|

|

|

Date:

|

May 2, 2016

|

|

/s/ Andrew D. C. LaFrence

|

|

|

|

|

Andrew D. C. LaFrence

|

|

|

|

|

Vice President Finance and Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit

|

|

|

|

|

Number

|

|

Description

|

|

|

99.1

|

|

Press Release dated May 2, 2016.

|

|

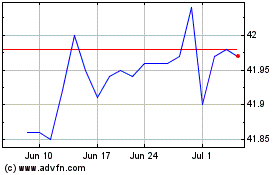

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

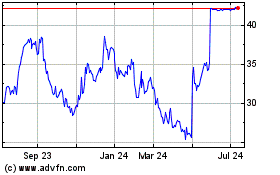

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Apr 2023 to Apr 2024