– Advances Pipeline of Ten Clinical Stage

Programs, with Ten Additional Clinical Data Readouts Anticipated

This Year –

– Expects to Complete Enrollment of Revusiran

Phase 3 ENDEAVOUR Trial in Late 2016 with Data Readout in Mid-2018

–

– On Track to Start Fitusiran Phase 3 Program

in Mid-2016; Plans to Report Updated Hemophilia Patient Data in

July –

– Provides Update on ALN-CC5 Program and

Development Path Forward; Plans to Present Initial Data in

Paroxysmal Nocturnal Hemoglobinuria (PNH) Patients in June –

– Ends Quarter with $1.2 Billion in Cash and

Increases Year-End Cash Guidance to Over $1 Billion, Including $150

Million of Restricted Marketable Securities –

Alnylam Pharmaceuticals, Inc. (Nasdaq: ALNY), the leading RNAi

therapeutics company, today reported its consolidated financial

results for the first quarter 2016, and highlighted recent progress

in advancing its pipeline.

“At Alnylam, we continue to advance a broad pipeline of

investigational RNAi therapeutics – including 10 programs in

clinical development and 2 programs in Phase 3 – across a broad

range of disease indications. A major milestone in the first

quarter was completion of enrollment in our APOLLO Phase 3 trial

for patisiran, and we’re on track to view results in mid-2017. If

positive, we expect to file our first regulatory applications for

approval later that same year. We’re also making strong progress in

our ENDEAVOUR Phase 3 trial of revusiran, where we now expect

completion of enrollment in late 2016 and data readout in mid-2018.

In our fitusiran program in hemophilia, we look forward to

presenting important new results in July, including initial results

in patients with inhibitors, and are on track to start our two

Phase 3 studies shortly thereafter,” said John Maraganore, Ph.D.,

Chief Executive Officer at Alnylam. “We’re also making progress

with our earlier stage clinical programs. In our ALN-CC5 program,

initial results in PNH patients, which will be presented at EHA

next month, point to an optimal development path forward in PNH for

eculizumab poor responders and for eculizumab sparing, with

parallel efforts in other complement-mediated diseases. Finally, we

also filed Clinical Trial Applications for ALN-HBV and ALN-TTRsc02,

and initiated our Phase 1 study for our ALN-GO1 program in primary

hyperoxaluria. We look forward to sharing our continued progress

throughout the course of a very data rich 2016.”

First Quarter 2016 and Recent Significant Corporate

Highlights

- Advanced investigational pipeline

programs in Genetic Medicine Strategic Therapeutic Area (STAr).

- Advanced investigational RNAi

therapeutics programs for the treatment of transthyrethin

(TTR)-mediated amyloidosis (ATTR amyloidosis).

- Completed enrollment in the APOLLO

Phase 3 trial with patisiran for the treatment of hereditary

TTR-mediated amyloidosis with polyneuropathy (hATTR-PN), also known

as familial amyloidotic polyneuropathy (FAP).

- Based on strong investigator and

patient interest, the study was substantially over enrolled with

225 patients.

- Data from APOLLO are expected in

mid-2017, and assuming positive results, the Company expects to

submit an NDA and MAA for patisiran by the end of 2017 and launch

in 2018.

- Announced complete 18-month data from

ongoing Phase 2 open-label extension (OLE) study with patisiran.

- Data presented at the American Academy

of Neurology (AAN) Meeting provided continued evidence that

patisiran has the potential to halt neuropathy progression in

patients with hATTR-PN. In the first reported exploratory analysis

of its kind, the degree of TTR knockdown observed in patients was

shown to correlate with improvement in neuropathy impairment

scores. Further, patisiran was found to be generally well tolerated

with no drug related serious adverse events up to 25 months of

treatment. The majority of adverse events were mild to

moderate.

- Continued enrollment in ENDEAVOUR Phase

3 study with revusiran for the treatment of hereditary TTR-mediated

amyloidosis with cardiomyopathy (hATTR-CM), also known as familial

amyloidotic cardiomyopathy (FAC).

- The Company announced today that it

expects to complete ENDEAVOUR enrollment in late 2016 and report

results in mid-2018.

- Filed Clinical Trial Application (CTA)

for ALN-TTRsc02, an ESC-GalNAc-siRNA conjugate targeting TTR for

the treatment of ATTR amyloidosis, which is expected to enable a

once- quarterly subcutaneous dosing regimen.

- Assuming a positive Phase 1 study, the

Company plans to initiate a Phase 3 trial in 2017.

- Advanced fitusiran (ALN-AT3) for the

treatment of hemophilia and rare bleeding disorders (RBD).

- Initiated dosing of hemophilia patients

with inhibitors in Part D of an ongoing Phase 1 clinical trial

evaluating a once-monthly subcutaneous dose regimen of fitusiran.

Both patients with hemophilia A with inhibitors and hemophilia B

with inhibitors have now been dosed with fitusiran.

- Continued dosing patients in an ongoing

Phase 1 OLE, where once-monthly doses of fitusiran are administered

to patients with moderate or severe hemophilia A or B with or

without inhibitors.

- Alnylam is on track to initiate two

Phase 3 trials: the first in mid-2016 in hemophilia A and B

patients with inhibitors; and, the second in late 2016 in moderate

or severe hemophilia A and B patients without inhibitors.

- The Company has initiated discussions

with global regulatory authorities to confirm specific trial

designs.

- Advanced ALN-CC5 for the treatment of

complement-mediated diseases.

- The Company announced today that it has

achieved preliminary evidence for clinical activity in a small

number of paroxysmal nocturnal hemoglobinuria (PNH) patients

enrolled in Part C of its ongoing Phase 1/2 trial, and it believes

that based on LDH data, the optimal development path for ALN-CC5 in

PNH is for eculizumab poor responders and for eculizumab sparing.

- The Company now plans to transition

toward a new Phase 2 study in PNH patients focused on that

development plan, which is expected to start by end of the

year.

- The Company plans to present initial

data from a small cohort of PNH patients in the ongoing Phase 1/2

study at the European Hematology Association (EHA) Meeting in June,

as listed below.

- The Company also expects to initiate

studies of ALN-CC5 as monotherapy and/or in combination with

anti-C5 monoclonal antibodies in additional complement-mediated

disease indications, such as atypical hemolytic uremic syndrome

(aHUS) and myasthenia gravis, starting in early 2017.

- Advanced ALN-AS1 for the treatment of

acute hepatic porphyrias.

- Transitioned to Part C in ongoing Phase

1 study where ALN-AS1 is being evaluated in porphyria patients with

recurrent attacks.

- The Company plans to initiate a Phase 3

trial in 2017, if the Phase 1 study results are positive.

- Advanced ALN-AAT for the treatment of

alpha-1 antitrypsin (AAT) deficiency-associated liver disease.

- Advanced ALN-GO1 for the treatment of

primary hyperoxaluria type 1 (PH1).

- Initiated a Phase 1/2 clinical trial

that is being conducted initially in normal healthy volunteers, and

then will be conducted in patients with PH1.

- Received Orphan Drug Designations for

ALN-GO1 from the European Medicines Agency (EMA) and

the U.S. Food and Drug Administration (FDA).

- Added ALN-F12 as a new program in

development pipeline.

- ALN-F12 is an RNAi therapeutic

targeting factor XII in development for the treatment of hereditary

angioedema and for thromboprophylaxis.

- Advanced investigational pipeline

programs in Cardio-Metabolic Disease STAr.

- The Medicines Company continued

enrollment in the Phase 2 ORION-1 trial for ALN-PCSsc.

- Advanced investigational pipeline

programs in Hepatic Infectious Disease STAr.

- Filed and obtained approval for CTA for

ALN-HBV, an RNAi therapeutic targeting the Hepatitis B Virus (HBV)

genome for the treatment of HBV infection. The Company is on

track to start a Phase 1 study in mid-2016.

- Expanded Management Team

- Expanded Management Team with

appointments of Patrick Berreby, Vice President of Supply Chain;

Jae Kim, Vice President, Clinical Development; and Andy Orth, Vice

President of Commercial Practice.

Upcoming Events in Mid- and Late 2016

- Alnylam announced today that it will:

- Present updated human volunteer data

from the ongoing ALN-CC5 Phase 1/2 study in a poster presentation

on May 22, 2016 at the 53rd Congress of the European Renal

Association – European Dialysis and Transplant Association

(ERA-EDTA) in Vienna, Austria.

- Present initial ALN-CC5 results in PNH

patients during an oral presentation on June 11, 2016 at the 21st

Congress of the European Hematology Association (EHA) Meeting in

Copenhagen, Denmark.

- Present updated fitusiran Phase 1 data

during an oral presentation on July 27, 2016 at the World

Federation of Hemophilia (WFH) 2016 World Congress in Orlando,

Florida.

- Additional upcoming milestones for

Alnylam pipeline programs include:

- In mid-2016, Alnylam plans to:

- Present 24-month Phase 2 OLE data with

patisiran, likely at the International Symposium on Amyloidosis

(ISA) Meeting to be held July 3 – 7, 2016 in Uppsala, Sweden,

pending abstract acceptance;

- Present 12-month Phase 2 OLE data with

revusiran, also likely at the ISA Meeting, pending abstract

acceptance;

- Start first fitusiran Phase 3 study in

hemophilia A and B patients with inhibitors;

- Present initial Phase 1 data for

ALN-AAT;

- Start ALN-HBV Phase 1 study; and

- Start ALN-TTRsc02 Phase 1 study.

- In late 2016, Alnylam plans to:

- Present additional Phase 1 and initial

Phase 1 OLE data with fitusiran;

- Start second fitusiran Phase 3 study in

moderate or severe hemophilia A and B patients without

inhibitors;

- Present initial ALN-AS1 data in

recurrent attack porphyria patients;

- Present initial ALN-GO1 data in PH1

patients;

- Present initial ALN-TTRsc02 Phase 1

data;

- File a CTA for a new Genetic Medicine

program; and

- Consistent with guidance from The

Medicines Company, present initial Phase 2 data for ALN-PCSsc.

Financials

“Alnylam continues to maintain a strong balance sheet, ending

the first quarter of 2016 with approximately $1.2 billion in cash,”

said Michael Mason, Vice President, Finance and Treasurer. “Our

financial strength allows us to continue to invest in a broad

pipeline of investigational RNAi therapeutics across our three

STArs, aligned with achievement of our ‘Alnylam 2020’ goals. As for

financial guidance this year, we are updating cash guidance today

to end 2016 with greater than $1.0 billion in cash, including

$150.0 million of restricted marketable securities that we received

from new credit agreements – related to the build out of our new

manufacturing facility – entered into in April 2016.”

Cash, Cash Equivalents and Total Marketable Securities

At March 31, 2016, Alnylam had cash, cash equivalents and total

marketable securities of $1.21 billion, as compared to $1.28

billion at December 31, 2015. In April 2016, the company entered

into credit agreements described below with proceeds of $150.0

million of restricted marketable securities.

Credit Agreements

In April 2016, Alnylam entered into credit agreements, related

to the build out of the Company’s new manufacturing facility, that

provide for a $150.0 million term loan facility, and mature in

April 2021. Interest on the borrowings will be calculated based on

LIBOR plus 0.45 percent. The obligations under the credit

agreements are secured by cash collateral in an amount equal to, at

any given time, at least 100 percent of the principal amount of all

term loans outstanding under the credit agreements at such

time.

GAAP Net Loss

The net loss according to accounting principles generally

accepted in the U.S. (GAAP) for the first quarter of 2016 was

$103.0 million, or $1.21 per share on both a basic and diluted

basis (including $23.5 million, or $0.28 per share of non-cash

stock-based compensation expense), as compared to a net loss of

$50.8 million, or $0.62 per share on both a basic and diluted basis

(including $8.2 million, or $0.10 per share of non-cash stock-based

compensation expense), for the same period in the previous

year.

Revenues

Revenues were $7.3 million for the first quarter of 2016, as

compared to $18.5 million for the same period last year. Revenues

for the first quarter of 2016 included $4.4 million from the

company’s alliance with Sanofi Genzyme, $2.7 million from the

company’s alliance with The Medicines Company and $0.2 million from

other sources. The decrease in revenues in the quarter ended March

31, 2016 as compared to the prior year period was due primarily to

the completion of the company’s performance obligations under the

Monsanto agreement in February 2015 and the completion of its

revenue amortization under the Takeda agreement in May 2015,

partially offset by higher revenue from its agreement with Sanofi

Genzyme. The company expects net revenues from collaborators to

increase during the remainder of 2016 due to expected increases in

expense reimbursement and an expected milestone payment under its

agreement with Sanofi Genzyme.

Research and Development Expenses

Research and development (R&D) expenses were $96.3 million

in the first quarter of 2016 which included $14.4 million of

non-cash stock-based compensation, as compared to $58.0 million in

the first quarter of 2015, which included $5.3 million of non-cash

stock-based compensation. The increase in R&D expenses for the

quarter ended March 31, 2016 as compared to the prior year period

was due primarily to higher clinical trial and manufacturing and

external services expenses resulting from the significant

advancement of the company’s Genetic Medicine pipeline. In

addition, compensation and related expenses and non-cash

stock-based compensation expenses increased during the quarter

ended March 31, 2016 as compared to the quarter ended March 31,

2015 due primarily to a significant increase in headcount during

the period as the company expands and advances its development

pipeline, as well as the vesting of certain performance-based stock

option awards during the quarter ended March 31, 2016. The company

expects that on a quarterly basis in 2016 R&D expenses will

increase from the first quarter as it continues to develop its

pipeline and advance its product candidates into clinical

trials.

General and Administrative Expenses

General and administrative (G&A) expenses were $21.1 million

in the first quarter of 2016, which included $9.1 million of

non-cash stock-based compensation, as compared to $12.7 million in

the first quarter of 2015, which included $2.9 million of non-cash

stock-based compensation. G&A expenses for the quarter ended

March 31, 2016 as compared to the prior year period increased due

primarily to an increase in non-cash stock-based compensation

expense due to an increase in headcount, as well as the vesting of

certain performance-based stock option awards during the quarter

ended March 31, 2016. The company expects that on a quarterly basis

in 2016 G&A expenses will remain relatively consistent with the

first quarter of 2016.

Conference Call Information

Management will provide an update on the company, discuss first

quarter 2016 results, and discuss expectations for the future via

conference call on Monday, May 2, 2016 at 4:30 p.m. ET.

To access the call, please dial 877-312-7507 (domestic) or

631-813-4828 (international) five minutes prior to the start time

and refer to conference ID 99665704. A replay of the call will be

available beginning at 7:30 p.m. ET on May 2, 2016. To access

the replay, please dial 855-859-2056 (domestic) or 404-537-3406

(international), and refer to conference 99665704

Sanofi Genzyme Alliance

In January 2014, Alnylam and Sanofi Genzyme, the specialty

care global business unit of Sanofi, formed an alliance to

accelerate and expand the development and commercialization of RNAi

therapeutics across the world. The alliance is structured as a

multi-product geographic alliance in the field of rare diseases.

Alnylam retains product rights in North

America and Western Europe, while Sanofi Genzyme obtained

the right to access certain programs in Alnylam's current and

future Genetic Medicines pipeline in the rest of the world (ROW)

through the end of 2019, together with certain broader

co-development/co-commercialization rights and global rights for

certain products. In the case of patisiran, Alnylam will advance

the product in North America and Western Europe,

while Sanofi Genzyme will advance the product in the ROW. In the

case of revusiran, Alnylam and Sanofi Genzyme will

co-develop/co-commercialize the product in North America and

Western Europe, while Sanofi Genzyme will advance the product in

the ROW. In the case of fitusiran, Sanofi Genzyme has elected to

opt into the program for its ROW rights, while retaining its

further opt-in right to co-develop and co-promote fitusiran with

Alnylam in North America and Western Europe, subject to certain

restrictions.

About RNAi

RNAi (RNA interference) is a revolution in biology, representing

a breakthrough in understanding how genes are turned on and off in

cells, and a completely new approach to drug discovery and

development. Its discovery has been heralded as “a major scientific

breakthrough that happens once every decade or so,” and represents

one of the most promising and rapidly advancing frontiers in

biology and drug discovery today which was awarded the 2006 Nobel

Prize for Physiology or Medicine. RNAi is a natural process of gene

silencing that occurs in organisms ranging from plants to mammals.

By harnessing the natural biological process of RNAi occurring in

our cells, the creation of a major new class of medicines, known as

RNAi therapeutics, is on the horizon. Small interfering RNA

(siRNA), the molecules that mediate RNAi and comprise Alnylam's

RNAi therapeutic platform, target the cause of diseases by potently

silencing specific mRNAs, thereby preventing disease-causing

proteins from being made. RNAi therapeutics have the potential to

treat disease and help patients in a fundamentally new way.

About LNP Technology

Alnylam has licenses to Arbutus LNP intellectual property for

use in RNAi therapeutic products using LNP technology.

About Alnylam Pharmaceuticals

Alnylam is a biopharmaceutical company developing novel

therapeutics based on RNA interference, or RNAi. The company is

leading the translation of RNAi as a new class of innovative

medicines. Alnylam's pipeline of investigational RNAi therapeutics

is focused in 3 Strategic Therapeutic Areas (STArs): Genetic

Medicines, with a broad pipeline of RNAi therapeutics for the

treatment of rare diseases; Cardio-Metabolic Disease, with a

pipeline of RNAi therapeutics toward genetically validated,

liver-expressed disease targets for unmet needs in cardiovascular

and metabolic diseases; and Hepatic Infectious Disease, with a

pipeline of RNAi therapeutics that address the major global health

challenges of hepatic infectious diseases. In early 2015, Alnylam

launched its "Alnylam 2020" guidance for the advancement and

commercialization of RNAi therapeutics as a whole new class of

innovative medicines. Specifically, by the end of 2020, Alnylam

expects to achieve a company profile with 3 marketed products, 10

RNAi therapeutic clinical programs - including 4 in late stages of

development - across its 3 STArs. The company's demonstrated

commitment to RNAi therapeutics has enabled it to form major

alliances with leading companies including Ionis, Novartis, Roche,

Takeda, Merck, Monsanto, The Medicines Company, and Sanofi Genzyme.

In addition, Alnylam holds an equity position in Regulus

Therapeutics Inc., a company focused on discovery, development, and

commercialization of microRNA therapeutics. Alnylam scientists and

collaborators have published their research on RNAi therapeutics in

over 200 peer-reviewed papers, including many in the world's top

scientific journals such as Nature, Nature Medicine, Nature

Biotechnology, Cell, New England Journal of Medicine, and The

Lancet. Founded in 2002, Alnylam maintains headquarters in

Cambridge, Massachusetts. For more information about Alnylam's

pipeline of investigational RNAi therapeutics, please visit

www.alnylam.com.

Alnylam Forward Looking Statements

Various statements in this release concerning Alnylam's future

expectations, plans and prospects, including without limitation,

Alnylam's views with respect to the potential for RNAi

therapeutics, including patisiran, revusiran, fitusiran, ALN-CC5,

ALN-AS1, ALN-AAT, ALN-GO1, ALN-PCSsc, ALN-HBV, ALN-TTRsc02, and

ALN-F12, its expectations regarding its STAr pipeline growth

strategy, its “Alnylam 2020” guidance for the advancement and

commercialization of RNAi therapeutics, its expectations for the

timing of filing of regulatory documents, including but not limited

to submission of an MAA and NDA for patisiran, its expectations

regarding the timing of the start of clinical studies and

presentation of clinical data, including for studies with

patisiran, revusiran, fitusiran, ALN-CC5, ALN-AS1, ALN-AAT,

ALN-GO1, ALN-PCSsc, ALN-HBV, and ALN-TTRsc02, its expected cash

position as of December 31, 2016, and its plans regarding the

pursuit of pre-clinical programs and commercialization of RNAi

therapeutics, constitute forward-looking statements for the

purposes of the safe harbor provisions under The Private Securities

Litigation Reform Act of 1995. Actual results may differ materially

from those indicated by these forward-looking statements as a

result of various important factors, including, without limitation,

Alnylam's ability to discover and develop novel drug candidates and

delivery approaches, successfully demonstrate the efficacy and

safety of its drug candidates, the pre-clinical and clinical

results for its product candidates, which may not be replicated or

continue to occur in other subjects or in additional studies or

otherwise support further development of product candidates for a

specified indication or at all, actions of regulatory agencies,

which may affect the initiation, timing and progress of clinical

trials, obtaining, maintaining and protecting intellectual

property, Alnylam's ability to enforce its patents against

infringers and defend its patent portfolio against challenges from

third parties, obtaining regulatory approval for products,

competition from others using technology similar to Alnylam's and

others developing products for similar uses, Alnylam's ability to

manage operating expenses, Alnylam's ability to obtain additional

funding to support its business activities and establish and

maintain strategic business alliances and new business initiatives,

Alnylam's dependence on third parties for development, manufacture,

marketing, sales and distribution of products, the outcome of

litigation, and unexpected expenditures, as well as those risks

more fully discussed in the "Risk Factors" filed with Alnylam's

most recent Annual Report on Form 10-K filed with

the Securities and Exchange Commission (SEC) and in other

filings that Alnylam makes with the SEC. In addition, any

forward-looking statements represent Alnylam's views only as of

today and should not be relied upon as representing its views as of

any subsequent date. Alnylam explicitly disclaims any obligation to

update any forward-looking statements.

ALNYLAM PHARMACEUTICALS, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS

(In thousands, except per share

amounts)

Three Months Ended March

31,

2016 2015 Net

revenues from collaborators $ 7,345 $ 18,537

Operating expenses: Research and development 96,273

58,035 General and administrative 21,100

12,724 Total operating expenses 117,373

70,759 Loss from operations (110,028 ) (52,222

)

Other income: Interest income 1,813 1,014 Other income

5,241 — Total other income 7,054

1,014 Loss before income taxes (102,974 )

(51,208 ) Benefit from income taxes — 431

Net loss $ (102,974 ) $ (50,777 ) Net loss per common share

- basic and diluted $ (1.21 ) $ (0.62 ) Weighted-average common

shares used to compute basic and diluted net loss per common share

85,277 82,074

Comprehensive

loss: Net loss $ (102,974 ) $ (50,777 ) Unrealized (loss) gain

on marketable securities, net of tax (8,224 ) 3,622

Reclassification adjustment for realized gain on marketable

securities

included in net loss

(5,156 ) — Comprehensive loss $ (116,354 ) $

(47,155 )

ALNYLAM PHARMACEUTICALS, INC.

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

(In thousands, except share

amounts)

March 31, December 31,

2016 2015 Cash,

cash equivalents and total marketable securities $ 1,208,290 $

1,280,951 Billed and unbilled collaboration receivables 8,814 8,298

Prepaid expenses and other assets 29,097 18,030 Property and

equipment, net 36,814 27,812 Investment in equity securities of

Regulus Therapeutics Inc. 33,934

51,419

Total assets

$ 1,316,949 $ 1,386,510 Accounts

payable, accrued expenses and other liabilities $ 49,620 $ 46,886

Total deferred revenue 70,896 68,317 Total deferred rent 7,382

6,593 Total stockholders’ equity (85.5 million and 85.1 million

common shares issued and outstanding and at March 31, 2016 and

December 31, 2015, respectively)

1,189,051 1,264,714

Total

liabilities and stockholders' equity $

1,316,949 $ 1,386,510

This selected financial information should be read in

conjunction with the consolidated financial statements and notes

thereto included in Alnylam’s Annual Report on Form 10-K which

includes the audited financial statements for the year ended

December 31, 2015.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160502005867/en/

Alnylam Pharmaceuticals, Inc.Investors and MediaChristine

Regan Lindenboom, 617-682-4340orInvestorsJosh Brodsky,

617-551-8276

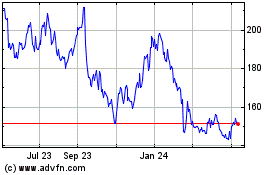

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Apr 2023 to Apr 2024