Baker Hughes Lays Out Cost Cuts, Buybacks After Halliburton Deal Dies -- 2nd Update

May 02 2016 - 9:39AM

Dow Jones News

By Austen Hufford

Baker Hughes Inc. laid out a plan to cut costs and buy back

stock and debt, outlining its path forward a day after its planned

merger with Halliburton Co. was scrapped.

Baker Hughes said it would cut $500 million of costs and weigh a

restructuring of its business, while buying back $1.5 billion of

shares and $1 billion of debt. The funds for the buybacks will come

from the $3.5 billion breakup fee Baker Hughes got from Halliburton

as the deal was called off.

On Sunday, Halliburton and Baker Hughes walked away from their

merger, once valued at nearly $35 billion, after regulators on

several continents claimed it would hurt competition in the

oil-field services business.

The companies had been working for more than a year to get the

complex deal completed and had been planning to potentially sell

billions in assets to appease regulators.

Baker Hughes had amassed $306 million in merger-related costs,

after taxes, in 2015 and the first quarter of this year, according

to regulatory filings.

Oil-field services firms, which are hired to drill and frack

wells, were among the first to feel the pain from lower oil prices,

and have been forced to make some of the deepest cuts and to

curtail operations.

But Baker Hughes has been constrained by its merger agreement

from making sweeping changes without Halliburton's approval. The

company said last week that it carried $110 million of costs during

the first quarter that it wasn't able to cut because of the

merger.

Monday, Baker Hughes said it was "taking immediate steps" to

remove those previously uncuttable costs and was also "evaluating

broader structural changes" to further reduce expenses and improve

efficiency.

The company said it was assessing where it will provide its

current full-service model and intends to provide tailored services

to select countries as a way of bringing products to market with

lower investment and fewer risks.

In the pressure pumping business, which involves injecting water

and other materials into a well to break apart rock formations to

release oil and gas, Baker Hughes said it would "retain a selective

footprint" in the U.S. onshore business as it cited overcapacity,

commoditized pricing and low barriers to entry. Both Halliburton

and Baker Hughes have significant market share in the business.

Baker Hughes also said it intends to refinance its $2.5 billion

credit facility, which expires in September.

Shares of the company rose 0.2% to $48.45 in premarket

trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

May 02, 2016 09:24 ET (13:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

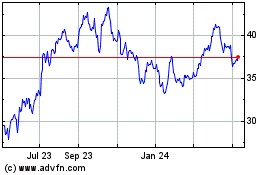

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

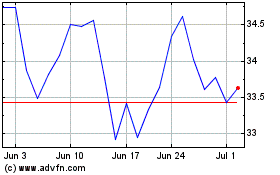

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024