____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of April 2016

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

EMBRAER RELEASES FIRST quarter 2016 results

HIGHLIGHTS

-

In the first quarter of 2016 (1Q16), Embraer delivered 21 commercial and 23 executive (12 light and 11 large) jets, representing an increase of 38% in total deliveries compared to 1Q15;

-

The Company’s firm order backlog ended the quarter at US$ 21.9 billion, compared to US$ 20.4 billion at the end of 1Q15 and $22.5 billion in backlog at the end of 2015;

-

As a result of higher aircraft deliveries in both the Commercial Aviation and Executive Jets segments, 1Q16 revenues were US$ 1,309.0 million, an increase of 24% compared to 1Q15;

-

EBIT and EBITDA

1

margins were 6.5% and 12.8%, respectively, in 1Q16 (compared to 7.5% and 14.1% in 1Q15), and EBIT and EBITDA for the quarter were US$ 85.7 million and US$ 167.6 million, respectively (versus US$ 79.6 million and US$ 149.1 million in 1Q15);

-

1Q16 Net income attributable to Embraer Shareholders and Earnings per basic ADS totaled US$ 103.9 million and US$ 0.5690, respectively;

-

Adjusted Net Loss, which excludes non-cash deferred income taxes and social contribution largely related to the impact of foreign exchange variation on non-monetary assets, was a loss of US$ (1.7) million in 1Q16;

-

Embraer ended 1Q16 with a total cash position of US$ 3,443.3 million and total debt of US$ 3,663.2 million, yielding a net debt position of US$ 219.9 million in the quarter;

-

The Company reiterates all aspects of its financial and delivery outlook for 2016.

Main financial indicators

[2]

|

|

|

|

|

|

in millions of U.S dollars, except % and earnings per share data

|

|

IFRS

|

(1)

|

(1)

|

(1)

|

|

4Q15

|

1Q15

|

1Q16

|

|

Revenue

|

2,074.4

|

1,055.9

|

1,309.0

|

|

EBIT

|

65.3

|

79.6

|

85.7

|

|

EBIT Margin %

|

3.1%

|

7.5%

|

6.5%

|

|

EBITDA

|

163.6

|

149.1

|

167.6

|

|

EBITDA Margin %

|

7.9%

|

14.1%

|

12.8%

|

|

Adjusted Net Income ²

|

29.7

|

48.3

|

(1.7)

|

|

Net income (loss) attributable to Embraer Shareholders

|

111.2

|

(61.7)

|

103.9

|

|

Earnings (loss) per share - ADS basic (US$)

|

0.6091

|

(0.3370)

|

0.5690

|

|

Net Cash (Debt)

|

7.2

|

(535.6)

|

(219.9)

|

|

(1) Derived from unaudited financial information.

|

|

|

|

1

EBIT, EBITDA, and their respective margins are non-GAAP measures. For more detailed information please refer to page 9.

2

Adjusted Net Income is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred income tax and social contribution for the period. Furthermore, under IFRS for Embraer’s Income Tax benefits (expenses) the Company is required to record taxes resulting from unrealized gains or losses due to the impact of the changes in the

Real

to US Dollar exchange rate over non-monetary assets (primarily Inventory, Intangibles, and PP&E). It is important to note that taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are accounted for in the Company’s consolidated Cash Flow statement, under Deferred income tax and social contribution, which totaled US$ (148.1) million in 4Q15, US$ 110.0 million in 1Q15, and US$ (105.6) million in 1Q16.

|

|

1

|

São José dos Campos, Brazil, April 29, 2016

- (BM&FBOVESPA: EMBR3, NYSE: ERJ).

The Company's operating and financial information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) in accordance with IFRS. The financial data presented in this document as of and for the quarters ended March 31, 2015 (1Q15), December 31, 2015 (4Q15) and March 31, 2016 (1Q16), are derived from the unaudited financial statements, except where otherwise stated.

REVENUES and gross margin

Embraer delivered a total of 21 commercial and 23 executive aircraft (12 light jets and 11 large jets) in 1Q16, compared to a total of 20 commercial and 12 executive aircraft (10 light jets and 2 large jets) in 1Q15. Revenues in 1Q16 totaled US$ 1,309.0 million, representing an increase of 24% versus 1Q15, due largely to higher deliveries in the Executive Jets and Commercial Aviation segment, somewhat offset by revenue declines in the Defense & Security and Other Businesses segments. Gross margin declined from 23.7% in 1Q15 to 20.0% in 1Q16, largely as a result of lower profitability in the Executive Jets segment.

EBIT and ebit Margin

Embraer generated EBIT of US$ 85.7 million in 1Q16, with an EBIT margin of 6.5%, which compares to the US$ 79.6 million in EBIT and 7.5% EBIT margin reported in 1Q15. The aforementioned lower gross margin in the quarter was the main driver of the year-over-year decline in EBIT margin in 1Q16, combined with an increase in Selling expenses in 1Q16 relative to 1Q15. This was partially offset by dilution of fixed operating expenses due to the higher level of revenues in the quarter as compared to the prior year’s quarter.

Administrative expenses totaled US$ 39.0 million in 1Q16, which was a decline from the US$ 43.2 million reported in 1Q15, demonstrating the Company’s ongoing commitment to cost efficiency. Selling expenses in 1Q16 were US$ 101.4 million, an increase from the US$ 86.1 million reported in 1Q15, due to the increase in revenues during the period and additional marketing-related expenses in the Executive Jets segment. Research expense of US$ 6.6 million in 1Q16 was slightly lower than the US$ 7.4 million of research expense recognized in 1Q15. Other operating income (expense), net in 1Q16 was an expense of US$ 28.5 million compared to an expense of US$ 33.9 million in 1Q15.

A more favorable exchange rate also contributed to the decrease in most of the Company’s operating expense line items in 1Q16, considering that the average Brazilian

Real

to U.S. dollar exchange rate in 1Q16 depreciated 36% relative to the average exchange rate in 1Q15.

net RESULTS

Net income attributable to Embraer and Earnings per basic ADS for 1Q16 were US$ 103.9 million and US$ 0.5690, respectively. Net margin was 7.9% in the quarter compared to negative 5.8% in 1Q15, principally due to an income tax gain of US$ 32.1 million in 1Q16 versus income tax expense of US$ (118.0) million in 1Q15. The decrease in income tax expense is mainly the result of foreign exchange variation from the beginning to the end of 1Q16, in which the

Real

appreciated 9% versus the U.S. dollar, generating non-cash deferred income tax gains on non-monetary assets.

Adjusted Net Loss, excluding the deferred income tax and social contribution gains, was US$ (1.7) million in 1Q16, compared to the Adjusted Net income of US$ 48.3 million reported in 1Q15.

|

|

2

|

monetary balance sheet accounts and other measures

Embraer ended 1Q16 with a net debt position of US$ 219.9 million compared to a net cash position of US$ 7.2 million at the end of 2015 and a net debt position of US$ 535.6 million at the end of 1Q15. The Company’s lower net debt position in 1Q16 vs. the same period last year is largely a consequence of lower working capital needs in the quarter as compared to 1Q15.

|

|

|

|

|

|

in millions of U.S.dollars

|

|

FINANCIAL POSITION DATA

|

(2)

|

(1)

|

(1)

|

|

2015

|

1Q15

|

1Q16

|

|

Cash and cash equivalents

|

2,165.5

|

1,064.8

|

1,959.4

|

|

Financial investments

|

1,372.2

|

788.9

|

1,483.9

|

|

Total cash position

|

3,537.7

|

1,853.7

|

3,443.3

|

|

Loans short-term

|

219.4

|

260.5

|

502.3

|

|

Loans long-term

|

3,311.1

|

2,128.8

|

3,160.9

|

|

Total loans position

|

3,530.5

|

2,389.3

|

3,663.2

|

|

|

|

|

|

|

Net cash (Debt)*

|

7.2

|

(535.6)

|

(219.9)

|

|

* Net cash (Debt) = Cash and cash equivalents + Financial investments short-term and

|

|

long term - Loans short-term and long-term

|

|

(1) Derived from unaudited financial information.

|

|

(2) Derived from audited financial information.

|

Net cash used by operating activities net of adjustments for financial investments was an outflow of US$ 29.0 million in 1Q16 and Free cash flow

3

for the quarter was negative US$ 216.3 million, compared to Net cash used by operating activities net of adjustments for financial investments of negative US$ 291.4 million and Free cash flow of negative US$ 439.6 million in 1Q15. The table below presents a reconciliation of the Company’s free cash flow to its operating cash flow net of adjustments for financial investments for the periods indicated.

|

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

IFRS

|

1Q15

|

2Q15

|

3Q15

|

4Q15

|

1Q16

|

|

Net cash generated (used) by operating activities (1)

|

(291.4)

|

244.8

|

70.2

|

871.7

|

(29.0)

|

|

Net additions to property, plant and equipment

|

(57.3)

|

(74.4)

|

(75.7)

|

(82.5)

|

(76.1)

|

|

Additions to intangible assets

|

(90.9)

|

(97.7)

|

(109.8)

|

(129.2)

|

(111.2)

|

|

Free cash flow

|

(439.6)

|

72.7

|

(115.3)

|

660.0

|

(216.3)

|

|

(1) Net of financial investments and unrealized gains (loss): 1Q15 $130.2, 2Q15 ($ 93.1), 3Q15 $(54.7), 4Q15 (89.9), 1Q16 (131.0)

|

Additions to total PP&E were US$ 76.1 million in 1Q16, including values related to spare parts pool programs, aircraft under lease or available for lease, and CAPEX. Of the total 1Q16 PP&E additions, CAPEX amounted to US$ 36.5 million, additions of aircraft available for lease was US$ 25.7 million and additions of pool program spare parts totaled US$ 13.9 million. It is important to note that a portion of the reported CAPEX includes expenditures related to certain contracted capital expenditures on equipment and facilities, primarily in the Defense & Security segment. These expenditures are included in the terms and conditions of their respective contracts and consequently are not considered part of the Company’s CAPEX Outlook of US$ 275 million for 2016. This contracted CAPEX totaled US$ 3.1 million in 1Q16, as outlined in the table below. Excluding these expenditures, the Company’s CAPEX for 1Q16 was US$ 33.4 million.

3 Free cash flow is a non-GAAP measure. The Company calculates Free cash flow taking into account mainly investments in PP&E, product development expenditures, which are recorded under Intangible, and changes in short-term investments (Financial investments). It´s important to mention that Operating cash flow does not include the cash invested in product development. It includes changes in Financial investments which do not represent changes in the Company’s net cash position since additions or reductions in Financial investments reflect changes in the maturity profile of the Company’s short-term investments and, as a consequence, do not represent increases or decreases in the Company’s Free cash flow. Additionally, Operating cash flow includes changes in court-mandated escrow deposits, which in its essence is not operational cash and shall be disregarded for Free cash flow calculation purposes. Therefore, Embraer’s free cash flow is represented by the operating cash flow adjusted by Net additions to property, plant and equipment (PP&E), Addition to intangible assets, Other assets and Financial investments. For more detailed information please refer to page 9.

|

|

3

|

In 1Q16, Embraer invested a total of US$ 111.2 million in product development, which was mostly offset by US$ 98.9 million in contributions from suppliers. These supplier contributions are related to the development of the E-Jets E2 program in the Commercial Aviation segment. As Development investments are expected to ramp-up for the remainder of 2016, the Company’s total Development investment net of supplier contributions in 2016 should be in line with its US$ 325 million Outlook for the year.

The following tables outline the detailed investments in PP&E and R&D for the periods indicated.

|

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

|

1Q15

|

2Q15

|

3Q15

|

4Q15

|

1Q16

|

|

CAPEX

|

78.8

|

35.9

|

58.4

|

73.2

|

36.5

|

|

Contracted CAPEX (Included in CAPEX)

|

6.5

|

14.1

|

9.8

|

27.8

|

3.1

|

|

Additions of aircraft available for or under lease

|

3.2

|

8.2

|

4.2

|

8.0

|

25.7

|

|

Additions of Pool programs spare parts

|

11.4

|

31.7

|

13.1

|

15.4

|

13.9

|

|

PP&E

|

93.4

|

75.8

|

75.7

|

96.6

|

76.1

|

|

Proceeds from sale of PP&E

|

(36.1)

|

(1.4)

|

-

|

(14.1)

|

-

|

|

Net Additions to PP&E

|

57.3

|

74.4

|

75.7

|

82.5

|

76.1

|

|

|

|

in millions of U.S.dollars

|

|

|

1Q15

|

2Q15

|

3Q15

|

4Q15

|

1Q16

|

|

Additions to intangible

|

90.9

|

97.7

|

109.8

|

129.2

|

111.2

|

|

Contributions from suppliers

|

(63.8)

|

(40.4)

|

(30.4)

|

(5.4)

|

(98.9)

|

|

Development (Net of contributions from suppliers)

|

27.1

|

57.3

|

79.4

|

123.8

|

12.3

|

|

Research

|

7.4

|

10.8

|

8.6

|

14.9

|

6.6

|

|

R&D

|

34.5

|

68.1

|

88.0

|

138.7

|

18.9

|

|

|

The Company’s total debt increased from US$ 3,530.5 million at the end of 4Q15 to US$ 3,663.2 million at the end of 1Q16, due to a US$ 282.9 million increase in short-term loans while long-term loans decreased by US$ 150.2 million. The average loan maturity of debt at the end of 1Q16 was 5.9 years, in line with the Company’s business cycle.

The cost of Dollar denominated loans was relatively stable during the quarter at 5.21% per year. The cost of

Real

denominated loans decreased from 6.43% at the end of 4Q15 to 5.99% per year at the end of 1Q16. The Company’s EBITDA over the last 12 months (EBITDA LTM) to financial expenses (gross) through 1Q16 was

|

|

3.47 compared to 3.71 through 4Q15. At the end of 1Q16, 24% of total debt was denominated in

Reais

.

Embraer’s cash allocation strategy is one of its most important tools to mitigate exchange rate risks. By balancing cash allocation in

Real

and Dollar

denominated assets, the Company attempts to reduce its balance sheet exchange rate exposure. Of total cash and equivalents at the end of 1Q16, 59% was denominated in US Dollars.

Complementing its strategy to mitigate exchange rate risks, the Company entered into certain financial hedges in order to reduce its 2016 cash flow exposure.

|

|

|

|

|

4

|

The Company’s cash flow exposure is due to the fact that approximately 10% of its net revenues are denominated in

Reais

and approximately 20% of total costs are denominated in

Reais

. Having more

Real

denominated costs than revenues generates this cash flow exposure. For 2016, around 45% of the Company’s

Real

cash flow exposure is hedged if the US Dollar depreciates below an average rate floor of R$ 3.42. For exchange rates above this level, the Company will benefit up to an average exchange rate cap of R$ 6.34.

operational balance sheet accounts

|

|

|

|

|

|

in millions of U.S.dollars

|

|

FINANCIAL POSITION DATA

|

(2)

|

(1)

|

(1)

|

|

2015

|

1Q15

|

1Q16

|

|

Trade accounts receivable

|

783.4

|

759.4

|

793.4

|

|

Customer and commercial financing

|

56.2

|

67.7

|

34.7

|

|

Inventories

|

2,314.6

|

2,696.1

|

2,505.3

|

|

Property, plant and equipment

|

2,027.4

|

2,005.3

|

2,071.2

|

|

Intangible

|

1,405.4

|

1,267.1

|

1,390.7

|

|

Trade accounts payable

|

1,034.9

|

1,016.7

|

989.3

|

|

Advances from customers

|

907.9

|

801.0

|

962.2

|

|

Total shareholders' equity

|

3,843.7

|

3,771.9

|

3,945.7

|

|

(1) Derived from unaudited financial information.

|

|

(2) Derived from audited financial information.

|

The Company’s inventories increased US$ 190.7 million from the end of 2015 to US$ 2,505.3 million at the end of 1Q16, primarily due to the normal seasonal pattern of investment in inventory in preparation for higher expected deliveries in the remainder of the year. However, compared to the level in 1Q15, this quarter’s inventories declined US$ 190.8 million. Trade accounts receivable increased US$ 10.0 million during the quarter to end 1Q16 at US$ 793.4 million, reflecting the timing of payments by some clients, particularly in the Commercial Aviation segment. Trade accounts payable declined US$ 45.6 million in 1Q16 from the end of 2015, to US$ 989.3 million. Advances from customers increased US$ 54.3 million from the end of 2015 to end 1Q16 at US$ 962.2 million, due largely to payments made for certain contracts in the Defense & Security segment.

Intangibles decreased by US$ 14.7 million from the end of 2015 to US$ 1,390.7 million at the end of 1Q16 as a consequence of amortization and contributions from risk sharing partners, partially offset by investments in product development, principally related to the Company’s ongoing development of the E-2 second generation E-Jet family, which is progressing according to plan. Property, plant and equipment increased during the quarter, up US$ 43.8 million from the end of 2015 to finish 1Q16 at US$ 2,071.2 million.

Total Backlog

During 1Q16, Embraer delivered a total of 21 commercial and 23 executive aircraft. Considering all deliveries and firm orders obtained during the period, the Company’s firm order backlog ended the quarter at US$ 21.9 billion, compared to US$ 22.5 billion at the end of 2015 and US$ 20.4 billion at the end of 1Q15. The following chart presents the Company’s backlog evolution, in billions of dollars.

|

|

5

|

segment Results

The Commercial Aviation segment represented 54.3% of consolidated revenues in 1Q16, down from the 62.7% in 1Q15, though revenues increased 7.4% year-over-year. Revenues in the Executive Jets segment increased more than 140% in 1Q16 compared to 1Q15, reflecting the higher volume of deliveries in the quarter versus the year-ago period (23 vs. 12), and constituted 30.7% of consolidated revenues in 1Q16. The Defense & Security segment represented 14.5% of consolidated revenues in 1Q16, down from the 20.2% in 1Q15, due to a decline of 11.3% in segment revenues in the period. The Other businesses segment’s participation of total revenues also declined in 1Q16 relative to 1Q15, falling from 1.3% to 0.5%.

|

|

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

NET REVENUES

|

(1)

|

|

(1)

|

|

(1)

|

|

|

BY SEGMENT

|

4Q15

|

%

|

1Q15

|

%

|

1Q16

|

%

|

|

Commercial Aviation

|

1,115.3

|

53.8

|

662.3

|

62.7

|

711.1

|

54.3

|

|

Defense & Security

|

199.7

|

9.6

|

213.4

|

20.2

|

189.2

|

14.5

|

|

Executive Jets

|

746.1

|

36.0

|

167.0

|

15.8

|

401.8

|

30.7

|

|

Others

|

13.3

|

0.6

|

13.2

|

1.3

|

6.9

|

0.5

|

|

Total

|

2,074.4

|

100.0

|

1,055.9

|

100.0

|

1,309.0

|

100.0

|

|

(1) Derived from unaudited financial information.

|

Commercial Aviation

During 1Q16, Embraer delivered 21 commercial aircraft, as follows:

|

|

|

|

|

|

DELIVERIES

|

4Q15

|

1Q15

|

1Q16

|

|

Commercial Aviation

|

33

|

20

|

21

|

|

EMBRAER 170

|

2

|

-

|

-

|

|

EMBRAER 175

|

20

|

20

|

19

|

|

EMBRAER 190

|

5

|

-

|

-

|

|

EMBRAER 195

|

6

|

-

|

2

|

During the first quarter of 2016, the most relevant event for Embraer was the roll-out, on Feb 25th, of the E190-E2, the first jet of the second generation of the E-Jets family of commercial aircraft. The aircraft´s maiden flight is scheduled for the second half of 2016, with entry into service scheduled for the first half of 2018. The ceremony was held at the Company´s plant in São José dos Campos.

|

|

6

|

Regarding the E-Jets E2 development program, Embraer has started the parts production process for the E195-E2 jet, the second model of the new generation of the E-Jets family, which will fly in 2017, with first deliveries expected to take place during the first half of 2019. The first part of the E195-E2 prototype is a lateral rib of the stub, which is in the Central Fuselage II section. This structure is made of aeronautical aluminum and was manufactured at one of the modern high-speed machining centers of the metal structures factory in São José dos Campos, Brazil.

Austrian Airlines became an E-Jets operator after launching in January its first scheduled flights with the E195 from Vienna to several Central European destinations such as Belgrade, Warsaw, Hamburg, Thessaloniki and Tirana, among others. The airline began incorporating 17 used E195s in its fleet last autumn.

During the Singapore Airshow in February, Embraer announced that it signed a long-term agreement for the Company’s Flight Hour Pool Program with Colorful Guizhou Airlines, providing a comprehensive components repair package for its E190 fleet. This is also the first contract that Embraer has signed for the program in China.

In the segment of commercial jets with 70 to 130 seats, Embraer maintains its leadership with more than 50% of the sales and 60% of the deliveries on the world market.

At the end of 1Q16, the order book (backlog) and cumulative deliveries for Commercial Aviation were as follows:

|

|

|

|

|

|

|

|

COMMERCIAL AVIATION

|

|

|

|

|

|

|

BACKLOG

|

Firm Orders

|

Options

|

Total

|

Deliveries

|

Firm Backlog

|

|

E170

|

193

|

7

|

200

|

190

|

3

|

|

E175

|

500

|

290

|

790

|

350

|

150

|

|

E190

|

578

|

88

|

666

|

523

|

55

|

|

E195

|

166

|

3

|

169

|

149

|

17

|

|

E175-E2

|

100

|

100

|

200

|

-

|

100

|

|

E190-E2

|

77

|

85

|

162

|

-

|

77

|

|

E195-E2

|

90

|

80

|

170

|

-

|

90

|

|

TOTAL E-JETS

|

1,704

|

653

|

2,357

|

1,212

|

492

|

Executive aviation

The Executive aviation segment delivered 12 light jets and 11 large jets, totaling 23 aircraft in 1Q16.

|

|

|

|

|

|

DELIVERIES

|

4Q15

|

1Q15

|

1Q16

|

|

Executive Aviation

|

45

|

12

|

23

|

|

Light Jets

|

25

|

10

|

12

|

|

Large Jets

|

20

|

2

|

11

|

In February, the General Aviation Manufacturers Association (GAMA) published the official 2015 industry deliveries report. According to the association, the Phenom 300 was the most delivered executive jet for the third consecutive year, reaching 70 new aircraft delivered to customers around the world.

Also in February, Embraer delivered the first Legacy 500 jet in China to world-renowned movie star Jackie Chan. In the same month, Embraer selected Across as its executive jet sales representative in Mexico.

In March 2016, Embraer Executive Jets celebrated the two-year anniversary of its Sorocaba Service Center and FBO (Fixed Base Operator) in Brazil. The Service Center has a total area of 216,000 sq. ft. and two hangars: one dedicated to maintenance, repair and overhaul and the other to support the operation of business aircraft.

|

|

7

|

Defense & security

In February 2016, the Embraer Phenom 100 executive jet was selected to provide multi-engine pilot training to armed forces aircrew in the United Kingdom. The contract with Affinity Flight Training Services will provide five aircraft to the U.K Ministry of Defence’s Military Flying Training System, (UKMFTS) program. The contract includes support services and an option for additional aircraft.

Regarding the KC-390 Program, the second prototype rolled off the assembly line and started the ground test campaign that precedes its first flight, scheduled to happen in the second quarter of 2016. During the FIDAE airshow (International Air and Space Fair) in Chile, the selection of the German company Rheinmetall Defence Electronics and Training for development and delivery of the training devices for the KC-390 military airlift was announced.

The Geostationary Satellite for Communications and Defense, whose integration is performed by Visiona Tecnologia Espacial, continues to advance on schedule, meeting all contractual deliveries. The satellite platform entered in the thermal vacuum chamber to perform environmental tests, the two 13-meter antennas were installed in Brasilia and Rio de Janeiro, and the ground system is in the installation and validation phase in Brasilia.

Recently, Visiona launched a satellite remote sensing service, through a constellation of 23 satellites, to supply and analyze images with the purpose to develop projects in Brazil and its neighboring countries. In 2016, Visiona has already signed six contracts.

In February 2016, Savis Tecnologias e Sistemas held a joint demonstration event with the Brazilian Army, with the presence of the Brazilian Ministry of Defense, to present SISFRON’s (Integrated Border Monitoring System) capabilities to a delegation of Ambassadors from several Arab countries (Palestine, Qatar, Lebanon, Kuwait, Tunisia, Libya, Mauritania, Algeria, United Arabian Emirates, Egypt, Sudan, Iraq, Arabian League, Morocco and Jordan). The event took place in Dourados, in the state of Mato Grosso, with the presence of the state Governor and several other civil and military authorities.

For the Brazilian Air Force’s F-39 Gripen NG Program, there are 47 engineers from Embraer as well as 7 engineers from Atech now working in Sweden as part of the technology transfer process. The Gripen Design and Development Center is being constructed by Saab and Embraer in Gavião Peixoto (SP) and is expected to be operational in 2016.

The Service and Support area signed the following contracts: with Affinity for logistical and services support for the Phenom 100 aircraft, with the Urban Group Company regarding the refurbishment of Legacy 600 interiors, and with Burkina Faso to support its Super Tucano fleet.

In March, Bradar signed a contract with the Brazilian Navy for the development of the operational prototype of the GAIVOTA-S radar.

In the first quarter of 2016, Atech signed three amendments: the first one related to five Route Control Centers in São Paulo, Rio de Janeiro, Atlântico, Recife and Curitiba; the second related to the Aerial Flow Management Integrated System (SIGMA); and the third related the H-XBR helicopter program for the Brazilian Armed Forces. Atech has also concluded the installation and acceptance tests of the SAGITARIO air traffic control system, in the São Paulo Approach Center, and the hardware installation of the new AMHS (Air Traffic Message Handling System), which will be in operation to support the upcoming Olympic Games.

Also in March, Embraer Defense & Security announced that it will consolidate the operations of two of its affiliated companies: Savis Tecnologias e Sistemas S.A. e Bradar Indústria S.A. This consolidation will allow Embraer Defense & Security to offer integrated solutions with great potential for the domestic and foreign markets, contributing to the diversification of the Company´s customer base and the expansion of its products and services portfolio.

|

|

8

|

SEC/DOJ INVESTIGATIONS UPDATE

The Company received in September, 2010 a subpoena from the SEC and associated inquiries from the U.S. Department of Justice, or DOJ, concerning possible non-compliance with the U.S. Foreign Corrupt Practices Act, or FCPA, in relation to certain aircraft sales outside of Brazil. In response, the Company retained outside counsel to conduct an internal investigation of sales in three countries.

In light of additional information, the Company voluntarily expanded the scope of the internal investigation to include sales in other countries, reported on these matters to the SEC and the DOJ and otherwise cooperated with them. The U.S. government inquiries, related inquiries and developments in other countries and the Company’s internal investigation are continuing and the Company will continue to cooperate with the governmental authorities, as circumstances may require. The Company has begun discussions with the DOJ for a possible resolution of the allegations of non-compliance with the FCPA. A resolution of the U.S. government inquiries, and related inquiries, proceedings and developments in other countries would result in fines, which may be substantial, and possibly other substantial sanctions and adverse consequences. Based upon the opinion of its outside counsel, the Company believes that there is no adequate basis at this time for estimating accruals or quantifying any contingency with respect to these matters.

In light of the above, we embarked on a comprehensive effort to improve and expand our compliance program worldwide. This multi-year task involved reexamining every aspect of our compliance systems, and where appropriate, redesigning or adding to them. Some of the key enhancements include the creation of a Compliance Department, the appointment of a Chief Compliance Officer reporting directly to the Risk and Audit Committee of the Board of Directors, the development of a program to monitor engagement of and payments to third parties, improvements to compliance policies, procedure and controls, the enhancement of anonymous and other reporting channels, and the development of a comprehensive training and education program designed to maintain and reinforce a strong compliance culture at all levels of Embraer globally. The Company will continue to promote enhancements and update its compliance program.

Reconciliation OF IFRS and “non gaap” information

|

|

|

|

|

|

in millions of U.S.dollars

|

|

EBITDA RECONCILIATION

|

(2)

|

(1)

|

(1)

|

|

LTM* (IFRS)

|

4Q15

|

1Q15

|

1Q16

|

|

Net Income (Loss) Attributable to Embraer

|

69.2

|

162.4

|

234.8

|

|

Noncontrolling interest

|

11.6

|

14.1

|

10.9

|

|

Income tax (expense) income

|

255.4

|

291.9

|

105.3

|

|

Financial income (expense), net

|

22.9

|

42.6

|

8.1

|

|

Foreign exchange gain (loss), net

|

(27.6)

|

19.8

|

(21.5)

|

|

Depreciation and amortization

|

316.8

|

296.9

|

329.2

|

|

EBITDA LTM

|

648.3

|

827.7

|

666.8

|

|

(1) Derived from unaudited financial information.

|

|

(2) Derived from audited financial information.

|

|

* Last Twelve Months

|

We define Free cash flow as operating cash flow net of financial investments adjustment, less Net additions to property, plant and equipment, Additions to intangible assets, and Other assets. Free cash flow is not an accounting measure under IFRS. Free cash flow is presented because it is used internally as a measure for evaluating certain aspects of our business. The Company also believes that some investors find it to be a useful tool for measuring Embraer's cash position. Free cash flow should not be considered as a measure of the Company's liquidity or as a measure of its cash flow as reported under IFRS. In addition, Free cash flow should not be interpreted as a measure of residual cash flow available to the Company for discretionary expenditures, since the Company may have mandatory debt service requirements or other nondiscretionary expenditures that are not deducted from this measure. Other companies in the industry may calculate Free cash flow differently from Embraer for purposes of their earnings releases, thus limiting its usefulness for comparing Embraer to other companies in the industry.

EBITDA LTM represents earnings before interest, taxation, depreciation and amortization accumulated over a period of the last 12 months. It is not a financial measure of the Company’s financial performance under IFRS. EBIT as mentioned in this press release refers to earnings before interest and taxes, and for purposes of reporting is the same as that reported on the Income Statement as Operating Profit before Financial Income.

|

|

9

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

EBITDA RECONCILIATION

|

(1)

|

(1)

|

(1)

|

|

4Q15

|

1Q15

|

1Q16

|

|

Net Income (Loss) Attributable to Embraer

|

111.2

|

(61.7)

|

103.9

|

|

Noncontrolling interest

|

2.8

|

2.8

|

2.1

|

|

Income tax (expense) income

|

(48.3)

|

118.0

|

(32.1)

|

|

Financial income (expense), net

|

7.1

|

15.2

|

0.4

|

|

Foreign exchange gain (loss), net

|

(7.5)

|

5.3

|

11.4

|

|

Depreciation and amortization

|

98.3

|

69.5

|

81.9

|

|

EBITDA

|

163.6

|

149.1

|

167.6

|

|

EBITDA Margin

|

7.9%

|

14.1%

|

12.8%

|

|

(1) Derived from unaudited financial information.

|

EBIT and EBITDA are presented because they are used internally as measures to evaluate certain aspects of the business. The Company also believes that some investors find them to be useful tools for measuring a Company’s financial performance. EBIT and EBITDA should not be considered as alternatives to, in isolation from, or as substitutes for, analysis of the Company’s financial condition or results of operations, as reported under IFRS. Other companies in the industry may calculate EBIT and EBITDA differently from Embraer for the purposes of their earnings releases, limiting EBIT and EBITDA’s usefulness as comparative measures.

|

|

|

|

|

|

in millions of U.S.dollars

|

|

ADJUSTED NET INCOME (LOSS) RECONCILIATION

|

(1)

|

(1)

|

(1)

|

|

4Q15

|

1Q15

|

1Q16

|

|

Net Income (Loss) Attributable to Embraer

|

111.2

|

(61.7)

|

103.9

|

|

Net change in Deferred income tax & social contribution

|

(148.1)

|

110.0

|

(105.6)

|

|

After-Tax Provision for Financial Guarantees

|

66.6

|

0.0

|

0.0

|

|

Adjusted Net Income

|

29.7

|

48.3

|

(1.7)

|

|

Adjusted Net Margin

|

1.4%

|

4.6%

|

-0.1%

|

|

(1) Derived from unaudited financial information.

|

Adjusted Net Income is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred Income tax and social contribution for the period. Furthermore, under IFRS for purposes of calculating Embraer’s Income Tax benefits (expenses), the Company is required to record taxes resulting from gains or losses due to the impact of the changes in the

Real

to the US Dollar exchange rate over non-monetary assets (primarily Inventories, Intangibles, and PP&E). It is important to note that taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are accounted for in the Company’s consolidated Cash Flow statement, under Deferred income tax and social contribution.

Some Financial Ratios based on “non GAAP” information

|

|

|

|

|

|

CERTAIN FINANCIAL RATIOS - IFRS

|

(1)

|

(1)

|

(1)

|

|

4Q15

|

1Q15

|

1Q16

|

|

Total debt to EBITDA (i)

|

5.45

|

2.89

|

5.49

|

|

Net cash to EBITDA (ii)

|

0.01

|

(0.65)

|

(0.33)

|

|

Total debt to capitalization (iii)

|

0.48

|

0.39

|

0.48

|

|

LTM EBITDA to financial expense (gross) (iv)

|

3.71

|

5.87

|

3.47

|

|

LTM EBITDA (v)

|

648.3

|

827.7

|

666.8

|

|

LTM Interest and commissions on loans (vi)

|

174.6

|

140.9

|

192.2

|

|

(1) Derived from unaudited financial information.

|

(i) Total debt represents short and long-term loans and financing.

(ii) Net cash represents cash and cash equivalents, plus financial investments, minus short and long-term loans and financing.

(iii) Total capitalization represents short and long-term loans and financing, plus shareholders equity.

(iv) Financial expense (gross) includes only interest and commissions on loans.

(v) The table at the end of this release sets forth the reconciliation of Net income to adjusted EBITDA, calculated on the basis of financial information prepared with IFRS data, for the indicated periods.

(vi) Interest expense (gross) includes only interest and commissions on loans, which are included in Interest income (expense), net presented in the Company’s consolidated Income Statement.

|

|

10

|

FINANCial statements

|

|

|

|

|

|

EMBRAER S.A.

|

|

CONSOLIDATED STATEMENTS OF INCOME

|

|

(in millions of U.S.dollars, except earnings per share)

|

|

|

|

|

(1)

|

(1)

|

(1)

|

|

|

Three months ended on

|

|

|

31 Dec, 2015

|

31 Mar, 2015

|

31 Mar, 2016

|

|

Revenue

|

2,074.4

|

1,055.9

|

1,309.0

|

|

Cost of sales and services

|

(1,724.7)

|

(805.6)

|

(1,047.7)

|

|

|

|

Gross profit

|

349.7

|

250.3

|

261.3

|

|

Operating Income (Expense)

|

|

|

|

|

Administrative

|

(49.6)

|

(43.2)

|

(39.0)

|

|

Selling

|

(96.9)

|

(86.1)

|

(101.4)

|

|

Research

|

(14.9)

|

(7.4)

|

(6.6)

|

|

Other operating income (expense), net

|

(122.7)

|

(33.9)

|

(28.5)

|

|

Equity in gain or losses of associates

|

(0.3)

|

(0.1)

|

(0.1)

|

|

|

|

Operating profit before financial income

|

65.3

|

79.6

|

85.7

|

|

Financial (expenses) income, net

|

(7.1)

|

(15.2)

|

(0.4)

|

|

Foreign exchange gain (loss), net

|

7.5

|

(5.3)

|

(11.4)

|

|

|

|

Profit before taxes on income

|

65.7

|

59.1

|

73.9

|

|

Income tax expense

|

48.3

|

(118.0)

|

32.1

|

|

|

|

Net Income

|

114.0

|

(58.9)

|

106.0

|

|

Attributable to:

|

|

|

|

|

Owners of Embraer

|

111.2

|

(61.7)

|

103.9

|

|

Noncontrolling interest

|

2.8

|

2.8

|

2.1

|

|

|

|

Weighted average number of shares (in thousands)

|

|

|

|

Basic

|

730.2

|

732.3

|

730.4

|

|

Diluted

|

733.6

|

735.9

|

733.4

|

|

|

|

Earnings per share

|

|

|

|

|

Basic

|

0.1523

|

(0.0843)

|

0.1422

|

|

Diluted

|

0.1516

|

(0.0838)

|

0.1417

|

|

|

|

Earnings per share - ADS basic (US$)

|

0.6091

|

(0.3370)

|

0.5690

|

|

Earnings per share - ADS diluted (US$)

|

0.6063

|

(0.3354)

|

0.5668

|

|

(1) Derived from unaudited financial statements.

|

|

|

11

|

|

|

|

|

|

|

EMBRAER S.A.

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(in millions of U.S.dollars)

|

|

|

|

|

|

(1)

|

|

|

|

Three Months Ended

|

|

|

31 Dec, 2015

|

31 Mar, 2015

|

31 Mar, 2016

|

|

Operating activities

|

|

|

|

|

Net income

|

114.0

|

(58.9)

|

106.0

|

|

Items not affecting cash and cash equivalents

|

|

|

|

|

Depreciation

|

36.8

|

44.6

|

43.9

|

|

Amortization

|

61.5

|

24.9

|

38.0

|

|

Contribution from suppliers

|

(12.9)

|

(6.2)

|

(8.1)

|

|

Allowance (reversal) for inventory obsolescence

|

(3.0)

|

3.6

|

5.5

|

|

Inventory and PPE provision for adjustment to realizable value

|

(5.3)

|

1.1

|

1.7

|

|

Gains (Losses) on disposal of investments

|

23.9

|

-

|

1.9

|

|

Provision for doubtful accounts

|

0.7

|

2.9

|

6.2

|

|

Deferred income tax and social contribution

|

(148.1)

|

110.0

|

(105.6)

|

|

Accrued interest

|

17.3

|

(0.5)

|

13.7

|

|

Interest over marketable security

|

-

|

-

|

7.0

|

|

Equity in the losses of associates

|

0.2

|

0.1

|

0.1

|

|

Share-based remuneration

|

0.5

|

0.7

|

0.4

|

|

Foreign exchange gain (loss), net

|

(6.0)

|

6.8

|

4.0

|

|

Residual value guarantee

|

10.0

|

(12.8)

|

(2.4)

|

|

Other

|

(2.3)

|

12.5

|

(1.4)

|

|

Changes in assets

|

|

|

|

|

Financial investments (2)

|

(82.6)

|

(117.8)

|

(145.8)

|

|

Derivative financial instruments

|

(28.1)

|

16.1

|

(10.5)

|

|

Collateralized accounts receivable and accounts receivable

|

74.9

|

(93.6)

|

9.0

|

|

Customer and commercial financing

|

(1.4)

|

0.8

|

21.5

|

|

Inventories

|

468.1

|

(294.1)

|

(200.6)

|

|

Other assets

|

(35.5)

|

(107.2)

|

12.4

|

|

Changes in liabilities

|

|

|

|

|

Trade accounts payable

|

53.0

|

46.8

|

(51.1)

|

|

Non-recourse and recourse debt

|

(13.0)

|

(2.5)

|

(0.7)

|

|

Other payables

|

(5.4)

|

(32.0)

|

4.7

|

|

Contribution from suppliers

|

5.4

|

63.8

|

98.9

|

|

Advances from customers

|

46.6

|

5.2

|

32.3

|

|

Taxes and payroll charges payable

|

89.4

|

(22.9)

|

(12.4)

|

|

Financial guarantee

|

79.6

|

0.8

|

(7.1)

|

|

Other provisions

|

(15.5)

|

15.3

|

(8.3)

|

|

Unearned income

|

73.6

|

(4.3)

|

(13.2)

|

|

Net cash generated by (used in) operating activities

|

796.4

|

(396.8)

|

(160.0)

|

|

Investing activities

|

|

|

|

|

Additions to property, plant and equipment

|

(96.6)

|

(93.4)

|

(76.1)

|

|

Proceeds from sale of property, plant and equipment

|

14.1

|

36.1

|

-

|

|

Additions to intangible assets

|

(129.2)

|

(90.9)

|

(111.2)

|

|

Investments in associates

|

(1.1)

|

-

|

(1.4)

|

|

Bonds and securities

|

(482.5)

|

0.5

|

(13.3)

|

|

Loans Conceived

|

-

|

-

|

(18.0)

|

|

Restricted cash reserved for construction of assets

|

4.2

|

-

|

4.3

|

|

Net cash used in investing activities

|

(691.1)

|

(147.7)

|

(215.7)

|

|

Financing activities

|

|

|

|

|

Proceeds from borrowings

|

391.3

|

100.8

|

89.2

|

|

Repayment of borrowings

|

(280.8)

|

(59.8)

|

(55.7)

|

|

Dividends and interest on own capital

|

(7.4)

|

(29.5)

|

(7.4)

|

|

Treasury shares

|

1.4

|

3.2

|

(1.1)

|

|

Net cash generated by financing activities

|

104.5

|

14.7

|

25.0

|

|

Increase (Decrease) in cash and cash equivalents

|

209.8

|

(529.8)

|

(350.7)

|

|

Effects of exchange rate changes on cash and cash equivalents

|

1.2

|

(118.5)

|

144.6

|

|

Cash and cash equivalents at the beginning of the period

|

1,954.5

|

1,713.0

|

2,165.5

|

|

Cash and cash equivalents at the end of the period

|

2,165.5

|

1,064.8

|

1,959.4

|

|

(1) Derived from audited annual financial statements.

|

|

(2) Include Unrealized (gain) on Financial investments, 1Q15 (12.4), 4Q15 (7.3) and 1Q16 (14.8)

|

|

|

12

|

|

|

|

|

|

EMBRAER S.A.

|

|

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

|

(in millions of U.S. dollars)

|

|

|

|

|

(1)

|

(2)

|

|

A S S E T S

|

As of December 31,

|

As of March 31,

|

|

|

2015

|

2016

|

|

Current assets

|

|

|

|

Cash and cash equivalents

|

2,165.5

|

1,959.4

|

|

Financial investments

|

622.6

|

728.0

|

|

Trade accounts receivable, net

|

781.9

|

791.8

|

|

Derivative financial instruments

|

5.2

|

15.1

|

|

Customer and commercial financing

|

10.8

|

8.4

|

|

Collateralized accounts receivable

|

91.4

|

104.6

|

|

Inventories

|

2,314.6

|

2,505.3

|

|

Income tax and Social Contribution

|

130.2

|

93.5

|

|

Other assets

|

289.4

|

343.0

|

|

|

6,411.6

|

6,549.1

|

|

Non-current assets

|

|

|

|

Financial investments

|

749.6

|

755.9

|

|

Trade accounts receivable

|

1.5

|

1.6

|

|

Derivative financial instruments

|

9.2

|

1.9

|

|

Customer and commercial financing

|

45.4

|

26.3

|

|

Collateralized accounts receivable

|

316.6

|

285.6

|

|

Guarantee deposits

|

577.3

|

578.0

|

|

Deferred income tax

|

4.5

|

2.3

|

|

Other assets

|

119.8

|

136.2

|

|

|

1,823.9

|

1,787.8

|

|

|

|

Investments

|

1.2

|

2.7

|

|

Property, plant and equipment, net

|

2,027.4

|

2,071.2

|

|

Intangible assets

|

1,405.4

|

1,390.7

|

|

|

5,257.9

|

5,252.4

|

|

|

|

TOTAL ASSETS

|

11,669.5

|

11,801.5

|

|

(1) Derived from audited financial information.

|

|

(2) Derived from unaudited financial information.

|

|

|

13

|

|

|

|

|

|

EMBRAER S.A.

|

|

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

|

(in millions of U.S. dollars)

|

|

|

|

|

(1)

|

(2)

|

|

LIABILITIES

|

As of December 31,

|

As of March 31,

|

|

|

2015

|

2016

|

|

Current liabilities

|

|

|

|

Trade accounts payable

|

1,034.9

|

989.3

|

|

Loans and financing

|

219.4

|

502.3

|

|

Non-recourse and recourse debt

|

10.1

|

13.4

|

|

Other payables

|

291.1

|

314.3

|

|

Advances from customers

|

743.8

|

792.6

|

|

Derivative financial instruments

|

12.3

|

4.5

|

|

Taxes and payroll charges payable

|

70.8

|

47.0

|

|

Income tax and social contribution

|

118.1

|

128.5

|

|

Financial guarantee and residual value

|

161.5

|

165.3

|

|

Provisions

|

95.7

|

94.9

|

|

Dividends payable

|

2.7

|

10.7

|

|

Unearned income

|

320.0

|

312.7

|

|

|

3,080.4

|

3,375.5

|

|

Non-current liabilities

|

|

|

|

Loans and financing

|

3,311.1

|

3,160.9

|

|

Non-recourse and recourse debt

|

374.7

|

370.7

|

|

Other payables

|

39.6

|

32.3

|

|

Advances from customers

|

164.1

|

169.6

|

|

Taxes and payroll charges payable

|

80.6

|

91.2

|

|

Deferred income tax and social contribution

|

417.3

|

308.0

|

|

Financial guarantee and residual value

|

131.6

|

118.3

|

|

Provisions

|

108.9

|

117.6

|

|

Unearned income

|

117.5

|

111.7

|

|

|

4,745.4

|

4,480.3

|

|

|

|

TOTAL LIABILITIES

|

7,825.8

|

7,855.8

|

|

|

|

Shareholders' equity

|

|

|

|

Capital

|

1,438.0

|

1,438.0

|

|

Treasury shares

|

(38.4)

|

(35.4)

|

|

Revenue reserves

|

2,456.3

|

2,450.4

|

|

Share-based remuneration

|

35.4

|

35.8

|

|

Retained earnings

|

-

|

90.8

|

|

Accumulated Other Comprehensive Loss

|

(149.5)

|

(130.4)

|

|

|

3,741.8

|

3,849.2

|

|

Non-controlling interest

|

101.9

|

96.5

|

|

Total company's shareholders' equity

|

3,843.7

|

3,945.7

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

11,669.5

|

11,801.5

|

|

(1) Derived from audited financial information.

|

|

(2) Derived from unaudited financial information.

|

|

|

14

|

Investor Relations

Eduardo Couto, Caio Pinez, Christopher Thornsberry, Nádia Santos, Paulo Ferreira and Viviane Pinheiro.

(+55 12) 3927 1000

investor.relations@embraer.com.br

http://ri.embraer.com.br

Follow Embraer’s IR Department on twitter: @IREmbraer

|

|

|

CONFERENCE CALL INFORMATION

|

|

Embraer will host a conference call to present its 1Q16 Results on

Friday, April 29, 2016 at 10:30AM (SP) /

9:30AM (NY).

The conference call will also be broadcast live over the web at

http://ri.embraer.com.br

|

|

|

|

Telephones:

|

|

Operator Assisted (US/ Canada) Toll-Free Dial-In Number: (877) 846-1574

|

|

Operator Assisted International Dial-In Number: (708) 290-0687

|

|

Your own International Toll-Free number for Brazil: 0800 047 4803 (land line) and 0800 047 4801 (cell phone)

|

|

Code: 75962624

|

ABOUT EMBRAER

Embraer is a global company headquartered in Brazil with businesses in commercial and executive aviation, defense & security. The company designs, develops, manufactures and markets aircraft and systems, providing customer support and services.

Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft. About every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world, transporting over 145 million passengers a year.

Embraer is the leading manufacturer of commercial jets up to 130 seats. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe.

For more information, please visit www.embraer.com.br

This document may contain projections, statements and estimates regarding circumstances or events yet to take place. Those projections and estimates are based largely on current expectations, forecasts of future events and financial trends that affect Embraer’s businesses. Those estimates are subject to risks, uncertainties and suppositions that include, among others: general economic, political and trade conditions in Brazil and in those markets where Embraer does business; expectations of industry trends; the Company’s investment plans; its capacity to develop and deliver products on the dates previously agreed upon, and existing and future governmental regulations. The words “believe”, “may”, “is able”, “will be able”, “intend”, “continue”, “anticipate”, “expect” and other similar terms are intended to identify potentialities. Embraer does not undertake any obligation to publish updates nor to revise any estimates due to new information, future events or any other facts. In view of the inherent risks and uncertainties, such estimates, events and circumstances may not take place. The actual results may therefore differ substantially from those previously published as Embraer expectations.

|

|

15

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date:

April

29

, 2016

|

|

|

|

|

|

|

Embraer S.A.

|

|

|

|

|

By:

|

|

/s/ José Antonio de Almeida Filippo

|

|

|

|

Name:

|

|

José Antonio de Almeida Filippo

|

|

|

|

Title:

|

|

Executive Vice-President and Chief Financial and Investor Relations Officer

|

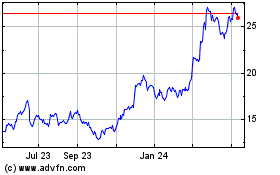

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

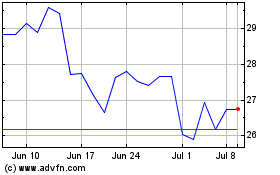

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024