A $25 billion deal for medical-products maker comes amid rush of

M&A activity

By Joseph Walker And George Stahl

Abbott Laboratories' deal to acquire medical-products maker St.

Jude Medical Inc. for $25 billion was the largest in a flurry of

health-care deal-making Thursday that could total more than $40

billion.

France's Sanofi SA said Thursday it made an unsolicited, $9.3

billion offer to purchase San Francisco-based Medivation Inc.,

which sells a lucrative prostate-cancer drug. AbbVie Inc. of North

Chicago, Ill., agreed to pay $5.8 billion, plus up to an additional

$4 billion in potential future payments, to acquire privately held

cancer-treatment developer Stemcentrx Inc. of South San Francisco,

continuing AbbVie's aggressive push to build an oncology

business.

The deals show health care remains an engine of M&A activity

despite a crackdown on tax-lowering maneuvers known as inversions

that drove a number of large deals in recent years.

Fueled by industry fundamentals more than tax-lowering

strategies, health-care companies have announced $121.12 billion in

global deal activity this year, second only to the technology

industry's $145.78 billion in deals so far this year, according to

Dealogic.

Health-care consolidation has itself sparked new deals as health

insurers, hospitals and medical-device suppliers respond to cost

pressures by gaining heft and scale to increase their negotiating

leverage with each other and gain pricing power.

In the pharmaceuticals industry, companies are looking to

invigorate their aging product pipelines and fuel growth. AbbVie

and Sanofi, for example, are each grappling with how to offset

expected revenue declines as some of their biggest products lose

patent protection and face competition for the first time. The

latest deals place a big bet that cancer medicines will continue to

command premium prices and generate big sales.

For Abbott, its acquisition is a way to bulk up its

medical-devices business to better compete against rivals Medtronic

PLC and Boston Scientific Corp. Abbott said it was also aiming to

gain a better negotiating position with its hospital customers,

which themselves have become larger and more powerful in recent

years.

Insurance companies are aiming to hold down health-care costs by

paying less for services from doctors and hospitals, who then look

to reduce supply-chain expenses by using fewer vendors in exchange

for greater discounts. That's pushing device makers like Abbott to

offset pricing pressure from their customers with deals that let

them offer greater volume and more products.

"The hospital chains have gotten larger, and more sophisticated

about what they're purchasing and what they're willing to pay,"

said Raj Denhoy, a Jefferies & Co. analyst, in an interview.

"Device companies have been on the receiving end of that, but if

you're larger you have more power to negotiate."

Abbott's deal to acquire St. Jude Medical is the largest

health-care merger so far this year. The offer values each St. Jude

share at about $85, representing a 37% premium to the stock's

closing price Wednesday.

Abbott has an eclectic mix of businesses that include

nutritional drinks like Ensure, glucose monitors for diabetes

patients, and selling branded generic pharmaceuticals in

international markets.

Abbott's medical-devices business has been seen by some analysts

as a drag on the company's otherwise encouraging growth, especially

in emerging markets like China and Latin America. Excluding the

impact of foreign currency fluctuations, Abbott's medical-device

sales rose 0.5% to $1.2 billion in the first quarter of this year,

lower than the company's overall revenue growth of 5.1%.

St. Jude's sales fell 1.4% to $5.54 billion in 2015, and its

earnings declined 12% to $880 million. The majority of the St.

Paul, Minn., company's revenue comes from heart devices including

pacemakers and implanted defibrillators. Those products complement

Abbott's line of stent devices, small tubes that prop open diseased

arteries, and could help the company cross-sell to hospitals,

analysts said.

When combined, the merged company will have annual

cardiovascular sales of $8.7 billion. The transaction still

requires shareholder and regulatory approvals. The companies expect

the deal to close in the fourth quarter.

Abbott CEO Miles White, speaking on a conference call with

analysts on Thursday, said acquiring St. Jude would give the

company a larger product portfolio and sales force to win business

in a more consolidated market.

"The value of having breadth in your product lines, the changing

way the health-care community has consolidated or purchases or

selects products, all those factors come to a point over time where

the strategic value of Abbott and St. Jude coming together becomes

compelling," Mr. White said.

Another large medical-device firm, Medtronic PLC, gave a similar

rationale when it agreed to acquire Covidien PLC in 2014, arguing

that hospitals would increasingly look to purchase medical supplies

from fewer and fewer vendors. Medtronic, which also inverted its

tax base to Ireland in the Covidien merger, is a major competitor

to St. Jude in the pacemaker and implanted defibrillator

markets.

Lehigh Valley Health Network, a hospital system based in

Allentown, Pa., buys most of its cardiology devices from two to

three companies, down from six to eight suppliers in prior years,

said Bill Matthews, the hospital system's chief procurement

officer, in an interview. Lehigh's purchasing power also has

improved as it has grown larger through acquisitions, he said.

"Bigger is better," Mr. Matthews said. Still, he worries that

the power balance may shift back to device-makers and other

suppliers as the industry consolidates. "I worry about it in terms

of how it's going to affect competition, and our ability to

continue to put pressure on pricing."

--Peter Loftus contributed to this article.

Write to Joseph Walker at joseph.walker@wsj.com and George Stahl

at george.stahl@wsj.com

(END) Dow Jones Newswires

April 29, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

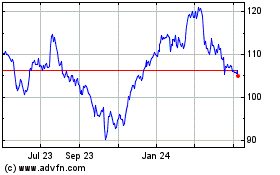

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

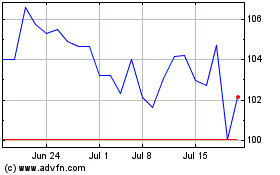

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024