Eastman Chemical Plans Significantly More Cost Cuts

April 28 2016 - 9:00PM

Dow Jones News

Eastman Chemical Co. says it will significantly increase

cost-cutting, following its second consecutive quarterly sales

decline.

The company's shares, up 3% over the past 12 months, fell 3% to

$76 in after-hours trading.

Eastman, which previously targeted about $200 million in annual

savings, didn't specify by how much it would increase spending cuts

but said it still targets adjusted earnings for the current year

"that approach" last year's results.

In 2015, the company reported $7.28 a share in adjusted profit.

Analysts surveyed by Thomson Reuters project $7 a share for

2016.

Founded in 1920 to produce chemicals for Eastman Kodak Co.'s

photo business, Eastman was spun off from Kodak in 1994.

Tennessee-based Eastman, which makes chemicals, plastics and

synthetic fibers used in such things soda bottles and cigarette

filters, has been hit hard by the oil-price slump and economic

slowdown, particularly in Asia.

The stronger U.S. dollar has also weighed on results, as more

than half the company's sales are abroad.

Overall, Eastman reported a first-quarter profit of $251

million, or $1.69 a share, compared with $171 million, or $1.14 a

share, a year earlier. Excluding acquisition-related charges and

other items, profit fell to $1.71 a share from $1.84 a share a year

earlier.

Revenue fell 8% to $2.24 billion.

Analysts surveyed by Thomson Reuters had projected $1.53 a share

in adjusted profit on $2.31 billion in revenue.

Gross profit margin improved to 28.4% from 26.9% a year

earlier.

The company is expected to release more information during a

conference call with analysts on Friday morning.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

April 28, 2016 20:45 ET (00:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

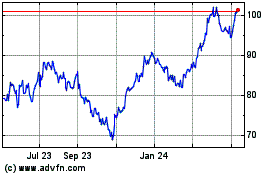

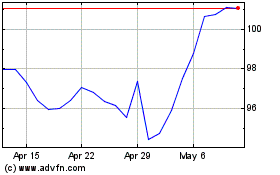

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Apr 2023 to Apr 2024