UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule 14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

|

☒

|

Preliminary

Proxy Statement

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive

Proxy Statement

|

|

☐

|

Definitive

Additional Materials

|

|

☐

|

Soliciting

Material Pursuant to §240.14a-12

|

GLOBAL

DIGITAL SOLUTIONS, INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No

fee required

|

|

|

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount

on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule

and the date of its filing.

|

|

|

(1)

|

Amount

previously paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

May

●, 2016

Dear

Stockholder:

You

are cordially invited to attend a special meeting of stockholders of Global Digital Solutions, Inc., which will be held on ●,

June ●, 2016, at 9:00 a.m., Eastern Time, at the Company’s headquarters located at777 South Flagler Drive, Suite 800

West, West Palm Beach, FL 33401

The

enclosed notice of meeting provides detailed information regarding the business proposal to be voted on at the meeting. The proposal

and the vote the Board of Directors recommends is:

|

|

|

|

Recommended

|

|

|

Proposal

|

|

|

Vote

|

|

|

Approval and adoption of an amendment to our Amended and Restated Certificate of Incorporation to increase the total number of authorized shares of the Company’s common stock from 650 million shares to 2 billion shares;

|

|

|

FOR

|

|

A formal notice of the special meeting, form of proxy, a

proxy statement containing information about the matter to be acted on at the special meeting follow this letter.

If

you plan to attend the special meeting, you will need an admission card to enter the special meeting. If your shares are registered

in your name, you are a stockholder of record. Your admission card is attached to your proxy card, and you will need to bring

it with you to the special meeting. If your shares are in the name of your broker or bank, your shares are held in street name.

Ask your broker or bank for an admission card in the form of a legal proxy to bring with you to the special meeting. If you do

not receive the legal proxy in time, bring your brokerage statement with you to the special meeting so that we can verify your

ownership of our stock on the record date and admit you to the special meeting. However, you will not be able to vote your shares

at the special meeting without a legal proxy.

Your

vote is important regardless of the number of shares you own. We encourage you to vote by proxy so that your shares will be represented

and voted at the special meeting even if you cannot attend. All stockholders can vote by written proxy card. Many stockholders

also can vote by proxy via a touch-tone telephone from the U.S. and Canada, using the toll-free number on your proxy card, or

via the Internet using the instructions on your proxy card. In addition, stockholders may vote in person at the special meeting

as described above.

|

|

Sincerely,

|

|

|

|

|

|

/s/

Richard J. Sullivan

|

|

|

RICHARD

J. SULLIVAN

|

|

|

Chairman

and Chief Executive Officer

|

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO

THE STOCKHOLDERS OF GLOBAL DIGITAL SOLUTIONS, INC.:

Notice

is hereby given that the special meeting of stockholders of Global Digital Solutions, Inc., a New Jersey corporation, or the Company,

whose headquarters are located at 777 South Flagler Drive, Suite 800, West Palm Beach, FL 33401, will be held at 777 South Flagler

Drive, Suite 800, West Palm Beach, FL on ●, June ●, 2016, at 9:00 a.m., Eastern Time, for the following purpose:

|

|

1.

|

To

approve and adopt an amendment to our Amended and Restated Certificate of Incorporation to increase the total number of authorized

shares of the Company’s common stock from 650 million shares to 2 billion shares;

|

The

Board of Directors has fixed the close of business on April 25, 2016 as the record date for the determination of stockholders

entitled to receive notice of the special meeting and vote, or exercise voting rights through a voting trust, as the case may

be, at the special meeting and any adjournments or postponements of the special meeting.

The

ability to have your vote counted at the meeting is an important stockholder right. Your vote is important regardless of the number

of shares you own. We encourage you to vote by proxy so that your shares will be represented and voted at the special meeting

even if you cannot attend. All stockholders can vote by written proxy card. Many stockholders also can vote by proxy via a touch-tone

telephone from the U.S. and Canada, using the toll-free number on your proxy card, or via the Internet using the instructions

on your proxy card. In addition, stockholders may vote in person at the special meeting as described above.

|

|

By

Order of the Board of Directors,

|

|

|

|

|

|

/s/

Richard J. Sullivan

|

|

|

Richard

J. Sullivan

|

|

|

Chairman

and Chief Executive Officer

|

West

Palm Beach, Florida

May ●, 2016

TABLE

OF CONTENTS

Global

Digital Solutions, Inc.

777

South Flagler Drive, Suite 800, West Palm Beach

Florida

33401

PROXY

STATEMENT

FOR

THE SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON JUNE ●, 2016

The

Board of Directors of Global Digital Solutions, Inc., a New Jersey corporation (the “Company,” “we,” “our,”

or “us”), whose principal executive office is located at 777 South Flagler Drive, Suite 800, West Palm Beach 33401,

furnishes you with this proxy statement to solicit proxies on its behalf to be voted at the special meeting of stockholders (“special

meeting”). The special meeting will be held at the Company’s headquarters located at 777 South Flagler Drive, Suite

800, West Palm Beach, Florida 33401, on ●, June ●, 2016, at 9:00 a.m., Eastern Time, subject to adjournment or postponement

thereof. The proxies also may be voted at any adjournments or postponements of the special meeting. This proxy statement and the

accompanying form of proxy are being mailed to stockholders on or about May ●, 2016.

VOTING

AND REVOCABILITY OF PROXIES

Record

Date and Share Ownership

Owners

of record of shares of our common stock at the close of business on April 25, 2016 will be entitled to vote at the special meeting

or adjournments or postponements thereof. Each owner of record of our common stock on April 25, 2016 is entitled to one vote for

each share of common stock so held.

As

of the close of business on April 25, 2016, there were 530,931,571 shares of common stock outstanding and entitled to vote at

the special meeting (all such shares outstanding as of the record date being referred to herein as the “shares” and

all holders thereof being referred to as our “stockholders”). A majority of the shares must be present, in person

or by proxy, to conduct business at the special meeting.

We

will make available a list of holders of record of our common stock as of the close of business on April 25, 2016 for inspection

during normal business hours at our offices, 777 South Flagler Drive, Suite 800, West Palm Beach, Florida 33401, for ten business

days prior to the special meeting. This list will also be available at the special meeting. For information regarding security

ownership by management and by the beneficial owners of more than 5% of our common stock, see “Security Ownership of Certain

Beneficial Owners and Management.”

Voting

Shares

All

properly executed written proxies and all properly completed proxies voted by telephone or via the Internet and delivered pursuant

to this solicitation (and not revoked later) will be voted at the special meeting in accordance with the instructions of the stockholder.

Below is a list of the different votes stockholders may cast at the special meeting pursuant to this solicitation.

In

voting on the increase in the number of authorized shares of the Company’s common stock stockholders may vote in one of

the following ways:

|

|

1.

|

in

favor of the proposal,

|

|

|

2.

|

against

the proposal, or

|

|

|

3.

|

abstain

from voting on the proposal.

|

Stockholders

should specify their choice for the matter on the proxy. Instead of submitting a signed proxy card, stockholders may submit their

proxies by telephone or through the Internet using the control number and instructions on the proxy card. The telephone and Internet

voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to vote their shares and

to confirm that their instructions have been properly recorded. Specific instructions to be followed by stockholders interested

in voting via the telephone or the Internet are set forth on the proxy card. Telephone and Internet proxies must be used in compliance

with, and will be subject to, the information and terms contained on the proxy card. These procedures may not be available to

stockholders who hold their shares through a broker, nominee, fiduciary or other custodian.

If

no specific instructions are given, proxies which are signed and returned will be voted

FOR

the increase in the number

of authorized shares of the Company’s common stock.

Revocability

A

stockholder submitting a proxy has the power to revoke it at any time prior to its exercise by voting in person at the special

meeting, by giving our proxy tabulator written notice bearing a later date than the proxy or by giving a later dated proxy. Any

written notice revoking a proxy should be sent to our proxy tabulator: Issuer Direct Corporation, 500 Perimeter Park Drive, Suite

D, Morrisville, North Carolina 27560.

Quorum

A quorum must be present at the special meeting in order

to conduct business. According to our bylaws, the holders of a majority of the outstanding shares entitled to vote at the special

meeting, represented in person or by proxy, constitute a quorum. If you have returned valid proxy instructions or attend the special

meeting in person, your shares will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain

from voting on the proposal introduced at the special meeting. Abstentions and “broker non-votes” (shares held by a

broker, bank or other nominee that does not have authority, either express or discretionary, to vote on the proposal) are counted

for determining whether there is a quorum. If a quorum is not present, the special meeting may be adjourned from time to time until

a quorum is present.

Required

Vote

The

affirmative vote of a majority of the votes represented in person or by proxy at the special meeting will be necessary to approve

the proposed change to increase the total number of authorized shares of the Company’s common stock. A properly executed

proxy marked “ABSTAIN” with respect to such proposal will be treated as shares present or represented and entitled

to vote on such proposal and will have the same effect as a vote against the proposal. If you hold your shares of common stock

in "street name," that is, through a broker, bank or other representative, you are considered the beneficial owner of

the shares held in street name. As the beneficial owner, you have the right to direct your broker how to vote. Brokers who have

not received instructions from beneficial owners will have the authority to vote on the proposal.

Expenses

of Solicitation

The

expense of solicitation of proxies, estimated at $5,000, will be borne by us. We have not retained a proxy solicitor to solicit

proxies; however, we may choose to do so prior to the special meeting. Proxies may also be solicited by certain of our directors,

officers and other employees, without additional compensation, personally or by written communication, telephone or other electronic

means. We are required to request brokers and nominees who hold stock in their name to furnish our proxy material to beneficial

owners of the stock and will reimburse such brokers and nominees for their reasonable out-of-pocket expenses in so doing.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information known to us regarding beneficial ownership of shares of our common stock as of

April 25, 2016, the record date, by:

|

|

☐

|

each

of our directors;

|

|

|

☐

|

each

of our named executive officers;

|

|

|

☐

|

all

of our executive officers and directors as a group; and

|

|

|

☐

|

each

person, or group of affiliated persons, known to us to be the beneficial owner of more than 5% of our outstanding shares of

common stock.

|

The

address of each stockholder listed below is: c/o Global Digital Solutions, Inc. 777 South Flagler Drive, Suite 800, West Palm

Beach, FL 33401.

|

|

|

Number of

|

|

|

|

|

|

|

|

Shares of

|

|

|

Percent of

|

|

|

|

|

Common Stock

|

|

|

Outstanding

|

|

|

|

|

Beneficially

|

|

|

Shares

|

|

|

Name and Address of Beneficial Owner

|

|

Owned (1)

|

|

|

(%)

|

|

|

|

|

|

|

|

|

|

|

Five Percent Stockholders:

|

|

|

|

|

|

|

|

Richard J. Sullivan (2)

|

|

|

34,240,000

|

|

|

|

6.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Named Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

Richard J. Sullivan (2)

|

|

|

34,240,000

|

|

|

|

6.4

|

%

|

|

Jerome J. Gomolski (3)

|

|

|

1,333,334

|

|

|

|

0.3

|

%

|

|

William J. Delgado (4)

|

|

|

8,390,889

|

|

|

|

1.6

|

%

|

|

Arthur F. Noterman (5)

|

|

|

2,083,334

|

|

|

|

0.4

|

%

|

|

Stephanie C. Sullivan (6)

|

|

|

2,083,334

|

|

|

|

0.4

|

%

|

|

Gary A. Gray (7)

|

|

|

2,500,000

|

|

|

|

0.5

|

%

|

|

All Current Directors and Officers as a group (6 persons) (8)

|

|

|

50,630,891

|

|

|

|

9.3

|

%

|

|

(1)

|

Applicable

percentages are based on 530,931,571 shares outstanding as of April 25, 2016 and include issued and outstanding shares of

common stock, as well as 500,000 vested but unissued restricted shares. Beneficial ownership is determined under the rules

of the SEC and generally includes voting or investment power with respect to securities. A person is deemed to be the beneficial

owner of securities that can be acquired by such person within 60 days whether upon the exercise of options or otherwise. Shares

of common stock subject to options currently exercisable or exercisable within 60 days after the date of this report, are

deemed outstanding for computing the percentage of the person holding such securities but are not deemed outstanding for computing

the percentage of any other person. Unless otherwise indicated in the footnotes to this table, the Company believes that each

of the shareholders named in the table has sole voting power.

|

|

(2)

|

Includes

(a) 7,000,000 currently exercisable stock options, (b) 3,000,000 shares owned by Bay Acquisition Corp., an entity controlled

by Mr. Sullivan, and (c) 530,000 shares owned by Mr. Sullivan's minor son. Four million of the currently exercisable stock

options are held by Vox Equity Partners LLC of which Mr. Sullivan is a co-founder.

|

|

(3)

|

Includes

1,333,334 currently exercisable stock options.

|

|

(4)

|

Includes

(a) 3,985,523 shares owned by Three Rivers Investments, LLC and (b) 3,221,032 shares owned by Bronco Communications, LLC.

Mr. Delgado is a member of both these entities and may be deemed to have voting control. Also includes 101,000 shares owned

by Mr. Delgado's minor daughter and 1,083,334 currently exercisable stock options.

|

|

(5)

|

Includes

1,583,334 currently exercisable stock options.

|

|

(6)

|

Includes

1,583,334 currently exercisable stock options.

|

|

(7)

|

Includes

1,000,000 currently exercisable stock options.

|

|

(8)

|

Includes

shares of our common stock beneficially owned by current executive officers and directors and shares issuable upon the exercise

of stock options that are currently exercisable or exercisable within 60 days of April 25, 2016, in each case as set forth

in the footnotes to this table.

|

PROPOSAL

APPROVAL

AND ADOPTION OF AN AMENDMENT TO OUR AMENEDED AND RESTATED CERTIFICATE OF INCORPORATION, AS AMENDED, TO INCREASE THE TOTAL NUMBER

OF AUTHORIZED SHARES OF THE COMPANY’S COMMON STOCK FROM 650 MILLION SHARES TO 2 BILLION SHARES

Our Amended and Restated Certificate of Incorporation, as

amended, provides that the total number of shares of common stock that we have the authority to issue is 650 million shares. Our

Board of Directors adopted a resolution recommending that the stockholders approve and adopt an amendment to our Amended and Restated

Certificate of Incorporation to increase the number of authorized shares of our common stock from 650 million shares to 2 billion

shares. As of April 25, 2016, 530,931,571 shares of the Company’s common stock are outstanding, including 500,000 vested

but unissued shares. The increase in authorized shares is desirable for several reasons: (1) the Company needs additional working

capital to fund its business and purse remedies under business acquisition contracts, one of which the Company believes is being

improperly terminated by the sellers; (2) the Company has existing revenue based factoring loan agreements, convertible debt and

accounts payable that are seriously past due, (3) the Company has obligations to issue shares under existing convertible debt instruments,

which have variable conversion prices; and (4) it is common in financing transactions for investors to insist on a share reserve,

which are shares set aside that will not be issued to others and may be issued, but not necessarily will be issued, pursuant to

the terms of the convertible debt instrument. Such reserves are often far in excess of the number of shares that could be

converted at current stock prices. The Company has an obligation under one of its existing convertible promissory notes for

excess share reserves of 400% of the hypothetical issuance as an additional share reserve. A second convertible promissory

note requires us to maintain 26.7 million shares of our common stock as excess share reserves. Such excess reserved shares are

not necessarily to be issued; they are a cushion in case the stock price falls. As such, the Company needs an excess

of authorized shares.

The

last closing price of the Company’s common stock as of the April 25, 2016 record date was $0.0048 per share, which is extremely

low and has fallen considerably. We have no assurance that our stock price will improve and it may fall further. Consequently,

the lower stock price has resulted in a considerably higher number of issuable shares for existing convertible debt and any

similar financing that we expect to require in the future. While the Company is hopeful that the price improves, it recognizes

that in order to raise cash it will need to continue to engage in equity-based or convertible financing transactions. At

the current market price, the company would require the large number of authorized shares to be available for potential financing

transactions to fund working capital and the repayment of past due factoring loans, convertible debt and accounts payable. The

terms of a majority of the Company’s recent financings have been consistent in that they have been convertible debt, therefore

requiring shares, and moreover requiring the enhanced share reserves as described above. Accordingly, we expect that the

terms of any future debt financing transactions may have the same requirements.

As

of April 25, 2016, our capitalization was as follows:

|

Shares of our common stock authorized for issuance

|

|

|

650,000,000

|

|

|

|

|

|

|

|

|

Shares of our common stock outstanding

|

|

|

530,931,571

|

|

|

|

|

|

|

|

|

Shares of our common stock issuable upon the exercise of outstanding stock options having a weighted exercise

price of $0.19 per share under our stock plans

|

|

|

15,850,000

|

|

|

|

|

|

|

|

|

Shares of our common stock issuable under restricted stock units

|

|

|

1,000,000

|

|

|

|

|

|

|

|

|

Shares of our common stock issuable upon exercise of outstanding warrants having fixed exercise prices ranging from $0.15 to $1.00 per share

|

|

|

2,500,000

|

|

|

|

|

|

|

|

|

Shares of our common stock reserved for issuance under a Share Purchase and Sale Agreement improperly being terminated by the sellers and being disputed by the Company

|

|

|

27,000,000

|

|

|

|

|

|

|

|

|

Shares of our common stock issuable upon conversion of outstanding convertible promissory notes with an estimated variable conversion price of $0.0018 at April 25, 2016 (if currently converted at the option of the holders) (1)(2)

|

|

|

70,715,555

|

|

|

|

|

|

|

|

|

Estimated shares remaining for issuance as of April 25, 2016

|

|

|

2,002,874

|

|

|

(1)

|

The

shares represent shares underlying two outstanding convertible promissory notes, including accrued interest thereon but excluding

any penalty interest or penalties for late payment and events of default, which have occurred and are continuing. Approximately

25,010,111 of the shares listed relate to a promissory note that was due in January 2016 and that we do not have the funds

to repay and that the holder has not yet requested conversion. Since the conversion prices of the notes are variable, the

number of shares issuable upon conversion increases or decreases with changes in the market price of our common stock.

|

|

(2)

|

Does not include share reserves that are required to

be set aside per the terms of the convertible notes that are in excess of the number of shares that could be converted at the

April 25, 2016 stock price.

|

Our

Board of Directors believes that the increased number of authorized shares of common stock contemplated by the proposed amendment

is desirable because it will allow the Company to continue to raise capital as needed. Although the Company has issued approximately

531 million shares as of April 25, 2016 out of 650 million authorized, numerous financing transactions require the Company to

“reserve” or set aside non-issued shares for possible issuance in connection with such financings. Moreover, depending

on the Company’s stock price at the times of conversion, it may be necessary to have more shares to comply with the provisions

of outstanding convertible promissory notes, and to a lesser extent, outstanding stock options and warrants (none of the outstanding

stock options and warrants are currently in-the money). Failure to obtain stockholder approval for the increase in the number

of authorized shares of our common stock will have a material adverse effect on the Company and may result in the Company being

unable to continue as a going concern.

In

addition, our Board of Directors believes that the increased number of authorized shares of our common stock contemplated by the

proposed amendment is also desirable so that we may issue additional shares from time to time, without further action or authorization

by the stockholders (except as required by law), if needed for such corporate purposes as may be determined by the Board of Directors.

Such corporate purposes might include the acquisition of other businesses in exchange for shares of our stock; flexibility for

possible future financings; and attracting and retaining valuable employees and directors through the issuance of additional stock

options or other equity awards. Our Board of Directors considers the authorization of additional shares advisable to ensure prompt

availability of shares for issuance should the occasion arise.

Due

to our current financial position, it is imperative that we complete additional financings; however at the current time we do

not have a sufficient number of authorized shares of common stock to permit us to conduct certain types of financings. Depending

on the number of shares of our common stock that we issue or commit to issue pursuant to any additional financings, it could have

a significant dilutive effect on our stockholders. Any shares we may issue will likely vary based on our stock price. If our stock

price continues to decline, the dilution to our existing stockholders will become even greater than the historical dilution.

After

giving effect to the amendment to our Amended and Restated Certificate of Incorporation to approve an increase in the number of

authorized shares of our common stock, our capitalization would be as follows:

|

Shares of our common stock authorized for issuance

|

|

|

2,000,000,000

|

|

|

|

|

|

|

|

|

Shares of our common stock outstanding as of April 25, 2016

|

|

|

530,931,571

|

|

|

|

|

|

|

|

|

Shares of our common stock issuable upon the exercise of outstanding stock options having a weighted exercise

price of $0.19 per share issued under our stock plan

|

|

|

15,850,000

|

|

|

|

|

|

|

|

|

Shares of our common stock issuable under restricted stock units

|

|

|

1,000,000

|

|

|

|

|

|

|

|

|

Shares of our common stock issuable upon exercise of outstanding warrants having fixed exercise prices ranging from $0.15 to $1.00 per share

|

|

|

2,500,000

|

|

|

|

|

|

|

|

|

Shares of our common stock reserved for issuance under a Share Purchase and Sale Agreement improperly being terminated by the sellers and being disputed by the Company

|

|

|

27,000,000

|

|

|

|

|

|

|

|

|

Shares of our common stock issuable upon conversion of outstanding convertible promissory notes with an estimated variable conversion price of $0.0018 at April 25, 2016 (if currently converted at the option of the holders) (1)(2)

|

|

|

70,515,555

|

|

|

|

|

|

|

|

|

Estimated number of shares available for issuance as of April 25, 2016 (1)(2)

|

|

|

1,352,002,874

|

|

|

(1)

|

The shares represent shares underlying two outstanding

convertible promissory notes, including accrued interest thereon but excluding any penalty interest or other penalties for late

payment and events of default, which have occurred and are continuing. Approximately 25,010,111 of the shares listed relate to

a promissory note that was due in January 2016 and that we do not have the funds to repay and that the holder has not yet requested

conversion. Since the conversion prices of the notes are variable, the number of shares issuable upon conversion increases or

decreases with changes in the market price of our common stock.

|

|

(2)

|

Does not include share reserves that are required to

be set aside per the terms of the convertible instruments that are in excess of the number of shares that could be converted at

current stock prices.

|

Although

an increase in the authorized shares of our common stock could, under certain circumstances, also be construed as having an anti-takeover

effect (for example, by permitting easier dilution of the stock ownership of a person seeking to effect a change in the composition

of the Board of Directors or contemplating a tender offer or other transaction resulting in our acquisition by another company),

the proposed increase in shares authorized is not in response to any effort by any person or group to accumulate our common stock

or to obtain control of us by any means. In addition, the proposal is not part of any plan by our Board of Directors to recommend

or implement a series of anti-takeover measures.

Possible

Dilutive Effects of the Amendment

If

the amendment to the Certificate of Incorporation is approved, the additional authorized shares would be available for issuance

at the discretion of our Board of Directors and without further stockholder approval. The additional shares of authorized common

stock would have the same rights and privileges as the shares of common stock currently issued and outstanding. Holders of our

common stock have no preemptive rights.

The

issuance of additional shares of common stock may, among other things, have a dilutive effect on earnings per share and on stockholders’

equity (deficit) and voting rights. Furthermore, future sales of substantial amounts of our common stock, or the perception that

these sales might occur, could adversely affect the then prevailing market price of our common stock or limit our ability to raise

additional capital. Stockholders should recognize that, as a result of this proposal, they will own a smaller percentage of shares

relative to the total authorized shares of the Company than they presently own.

Amended

Certificate of Incorporation

The increase in the number of authorized shares of our common

stock shall be changed by amendment to Article IV(a) of our Amended and Restated Certificate of Incorporation. If our stockholders

approve the proposed amendment, we will file the amendment to our Amended and Restated Certificate of Incorporation with the Secretary

of State of New Jersey after the special meeting. A copy of the proposed amendment to our Amended and Restated Certificate of Incorporation,

Fourth Amendment, is attached to this proxy statement as Annex A.

Dissenter’s

Rights of Appraisal

Neither

the BCA nor our Certificate of Incorporation or Bylaws provide our stockholders with dissenters’ or appraisal rights in

connection with this proposal.

Recommendation

of Our Board of Directors

Our

Board of Directors recommends a vote FOR approval and adoption of an amendment to our Amended and Restated Certificate of Incorporation,

as amended, to increase the total number of authorized shares of the Company’s common stock from 650 million shares to 2

billion shares.

OTHER

MATTERS

Multiple

Stockholders Sharing the Same Address

. Regulations regarding the delivery of copies of proxy materials to stockholders

permit us, banks, brokerage firms and other nominees to send one proxy statement (and annual reports when applicable) to multiple

stockholders who share the same address under certain circumstances, unless contrary instructions are received from stockholders.

This practice is known as “householding.” Stockholders who hold their shares through a bank, broker or other nominee

may have consented to reducing the number of copies of materials delivered to their address. In the event that a stockholder wishes

to request delivery of a single copy of proxy statements or annual reports or to revoke a “householding” consent previously

provided to a bank, broker or other nominee, the stockholder must contact the bank, broker or other nominee, as applicable, to

revoke such consent. In any event, if a stockholder wishes to receive a separate proxy statement for the special meeting of stockholders,

the stockholder may receive printed copies by contacting Global Digital Solutions, Inc. Attention: Jerome Gomolski, Chief Financial

Officer, at 777 South Flagler Drive, Suite 800, West Palm Beach, Florida 33401 by mail.

Any

stockholders of record sharing an address who now receive multiple copies of our proxy statements and annual reports who wish

to receive only one copy of these materials per household in the future should also contact us by mail or telephone as instructed

above. Any stockholders sharing an address whose shares of common stock are held by a bank, broker or other nominee who now receive

multiple copies of our proxy statements and annual reports, and who wish to receive only one copy of these materials per household,

should contact the bank, broker or other nominee to request that only one set of these materials be delivered in the future.

The

form of proxy and this proxy statement have been approved by our Board of Directors and are being mailed and delivered to stockholders

by its authority.

|

|

/s/

RICHARD J. SULLIVAN

|

|

|

RICHARD

J. SULLIVAN

|

|

|

Chairman

and Chief Executive Officer

|

West

Palm Beach, Florida

May ●, 2016

Annex

A

Certificate

of Amendment to the Certificate of Incorporation

(Fourth

Amendment)

Pursuant

to the provisions of Section 14A:9-2 (4) and Section 14A:9-4 (3), Corporations, General, of the New Jersey Statutes, the undersigned

corporation executes the following Certificate of Amendment to its Certificate of Incorporation:

|

1.

|

The name of the corporation is: Global Digital Solutions,

Inc.

|

|

|

2.

|

The

following amendment to the Certificate of Incorporation was approved by the directors

and thereafter duly adopted by a majority of the shareholders of the corporation acting

by vote at a special meeting of stockholders held on the _________day of June, 2016:

|

Resolved,

that Article IV(a) of the Certificate of Incorporation be amended to read as follows:

(a) Authorized Shares.

The aggregate number of shares which the corporation shall have the authority to issue is Two Billion Thirty

Five Million (2,035,000,000) shares. Two Billion (2,000,000,000) shares shall be designated "Common Stock", and shall

have a par value of $.001. Thirty Five Million (35,000,000) shares shall be designated "Preferred Stock", and shall

have a par value of $.001 per share.

|

|

3.

|

The

number of shares outstanding at the time of the adoption of the amendment was: 530,931,571.

The total number of shares entitled to vote thereon was: 530,931,571.

|

|

|

4.

|

The

number of shares voting for and against such amendment is as follows: (If the shares

of any class or series are entitled to vote as a class, set forth the number of shares

of each such class and series voting for and against the amendment, respectively).

|

|

|

Number

of Shares Voting

for

Amendment

|

Number

of Shares Voting

Against

Amendment

|

|

|

|

|

Dated

this ___ day of June, 2016.

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS OF

GLOBAL DIGITAL SOLUTIONS, INC.

The

undersigned, revoking all prior proxies, hereby appoints Richard J. Sullivan and Jerome J. Gomolski, or either of them, as proxy

or proxies, with full power of substitution and revocation, to vote all shares of common stock of GLOBAL DIGITAL SOLUTIONS, INC.

(the “Company”) of record in the name of the undersigned at the close of business on April 25, 2016 at the Special

Meeting of Stockholders to be held on June ●, 2016, at 9:00 a.m., Eastern Time, at 777 South Flagler Drive, Suite 800, West

Palm Beach, Florida 33401, or any adjournment or postponement thereof, upon the matter listed on the reverse side.

This

proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted

in accordance with the Board of Directors’ recommendation.

VOTE

BY INTERNET - www.iproxydirect.com

Use

the Internet to transmit your voting instructions until 11:59 P.M. Eastern Time June ●, 2016. Have your proxy card

in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction

form.

Electronic

Delivery of Future PROXY MATERIALS

If

you would like to reduce the costs incurred by Global Digital Solutions, Inc. in mailing proxy materials, you can consent to receiving

all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic

delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive

or access proxy materials electronically in future years.

VOTE

BY PHONE - 1-866-752-8683

Use

any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time June ●, 2016. Have your proxy

card in hand when you call and then follow the instructions.

VOTE

BY MAIL

Mark,

sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to: Attention Shareholder

Services, Issuer Direct Corporation, 500 Perimeter Park Drive, Suite D, Morrisville, North Carolina 27560.

|

TO

VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

|

☒

|

KEEP

THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY

|

THIS

PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

GLOBAL

DIGITAL SOLUTIONS, INC.

The Board of Directors recommends you vote “FOR”

the following proposal.

|

|

|

For

|

|

Against

|

|

Abstain

|

|

|

|

|

|

|

|

|

|

To

approve and adopt an amendment to our Amended and Restated Certificate of Incorporation to increase the total number of authorized

shares of the Company’s common stock from 650 million shares to 2 billion shares.

|

|

☐

|

|

☐

|

|

☐

|

Please

sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary,

please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership,

please sign in full corporate or partnership name, by authorized officer.

|

Signature

[PLEASE SIGN WITHIN SPACE]

|

|

Date

|

|

Signature

(Joint Owners)

|

|

Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

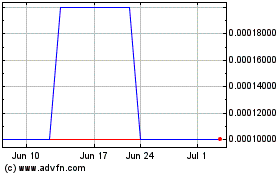

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

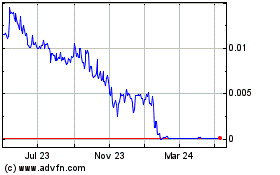

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Apr 2023 to Apr 2024