UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

|

(Mark One)

|

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR

|

|

|

|

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2015

|

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR

|

|

15(d) OF THE SECURITIES ACT OF 1934

|

|

For the transition period from ________to__________

|

Commission file number

0-22904

PARKERVISION, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Florida

|

59-2971472

|

|

(State of Incorporation)

|

(I.R.S. Employer ID No.)

|

7915 Baymeadows Way, Suite 400

Jacksonville, Florida 32256

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code:

(904) 732-6100

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $.01 par value

|

The NASDAQ Stock Market

|

|

Common Stock Rights

|

The NASDAQ Stock Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ( ) No (X)

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act. Yes ( ) No (X)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes (X) No ( )

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes (X) No ( )

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (X)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act. (Check one):

|

Large accelerated filer ( )

|

Accelerated filer ( )

|

|

Non-accelerated filer ( )

|

Smaller reporting company (X)

|

|

(Do not check if a smaller reporting company)

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act). Yes ( ) No (X)

As of June 30, 2015, the aggregate market value of the registrant’s common stock, $.01 par value, held by non-affiliates of the registrant was approximately $30,522,603 (based upon $3.80 share closing price on that date, as reported by NASDAQ and adjusted for the 1:10 reverse stock split that became effective on March 30, 2016).

As of March 30, 2016, 11,469,934 shares of the Issuer’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A amends the ParkerVision, Inc. (the “Company”, “we” or “us”) Annual Report on Form 10-K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission (“SEC”) on March 30, 2016 (the “Original Filing”). We are filing this Amendment No. 1 to include the information required by Part III of Form 10-K that was omitted from the Original Filing in reliance on general instructions G(3) to Form 10-K which provides that registrants may incorporate by reference certain information from a definitive proxy statement if such definitive proxy statement is filed with the SEC within 120 days after the end of the fiscal year. We do not anticipate filing our definitive proxy statement by April 29, 2016 and accordingly, Part III of the Original Filing is hereby amended and restated as set forth below.

In addition, as required by rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officer and principal financial officer are being filed as exhibits to this Amendment No. 1 on Form 10-K. Accordingly, Item 15 has been amended to reflect the filing of such certifications herewith.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing. Accordingly, this Amendment No. 1 should be read in conjunction with our filings with the SEC subsequent to the date of the Original Filing.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Our directors, including their ages, backgrounds and qualifications are as follows:

Directors (Class I) With Terms Expiring at the 2016 Annual Meeting.

Jeffrey Parker

, 59, has been the chairman of our Board and our chief executive officer since our inception in August 1989 and was our president from April 1993 to June 1998. From March 1983 to August 1989, Mr. Parker served as executive vice president for Parker Electronics, Inc., a joint venture partner with Carrier Corporation performing research, development, manufacturing, and sales and marketing for the heating, ventilation and air conditioning industry. Mr. Parker holds 31 United States patents. Among other qualifications, as chief executive officer, Mr. Parker has relevant insight into our operations, our industry, and related risks as well as experience bringing disruptive technologies to market.

William Hightower

, 72, has been a director of ours since March 1999. Mr. Hightower has extensive experience as an executive officer and operating officer for both public and private companies in a number of industries, including telecommunications. From September 2003 to his retirement in November 2004, Mr. Hightower served as our president. Mr. Hightower was the president and chief operating officer and a director of Silicon Valley Group, Inc. (“SVGI”) from August 1997 until his retirement in May 2001. SVGI was a publicly held company which designed and built semiconductor capital equipment tools for chip manufacturers. From January 1996 to August 1997, Mr. Hightower served as chairman and chief executive officer of CADNET Corporation, a developer of network software solutions for the architectural industry. From August 1989 to January 1996, Mr. Hightower was the president and chief executive officer of Telematics International, Inc. Among other qualifications, Mr. Hightower’s longevity on our Board provides him with a historical perspective and a relevant understanding of both our target markets and our industry as a whole.

Nam Suh

, 80, has been a director of ours since December 2003. Mr. Suh served as the president of Korea Advanced Institute of Science and Technology (KAIST) for seven years from July 2006 to February 2013. He is a member of the board of trustees of King Abdullah University of Science and Technology (KAUST) of Saudi Arabia and a member of a number of advisory organizations, including the International Advisory Board of King Fahd University of Science and Technology and the Research Advisory Board of Arcelik of Istanbul, Turkey. In 2008, he retired from the Massachusetts Institute of Technology (“MIT”) where he had been a member of the faculty since 1970. At MIT, Mr. Suh held many positions including director of the MIT Laboratory for Manufacturing and Productivity, head of the department of Mechanical Engineering, director of the MIT Manufacturing Institute, and director of the Park Center for Complex Systems. In 1984, Mr. Suh was appointed the assistant director for Engineering of the National Science Foundation by President Ronald Reagan and confirmed by the U.S. Senate. Mr. Suh serves on the board of directors of OLEV Corporation, a venture company founded in 2016 to commercialize innovative wireless charging technology for heavy-duty electric vehicles. From 2005 to 2009, Mr. Suh served on the board of directors of Integrated Device Technology, Inc., a Nasdaq-listed company that develops mixed signal semiconductor solutions. Among other qualifications, Mr. Suh has significant experience with technology innovation and the process of new product introduction, including an invention selected as one of the 10 Emerging Technologies of the world by the 2013 World Economic Forum of Davos and 50 most promising new inventions of 2010 by TIME magazine. Mr. Suh is a widely published author of approximately 300 articles and seven books on topics related to tribology, manufacturing, plastics and design. Mr. Suh has approximately 70 United States patents and many foreign patents, some of which relate to electric vehicles, polymers, tribology, and design. He has received many national and international honors and awards, including the 2009 ASME Medal and nine honorary doctorates from institutions on four continents. Mr. Suh also has a relevant professional network in the Korean community as well as relevant experience with Korean culture and commerce.

Directors (Class II) With Terms Expiring at the 2018 Annual Meeting

David Sorrells

, 57, has been our chief technology officer since September 1996 and has been a director of ours since January 1997. Mr. Sorrells is one of the leading inventors of our core technologies. From June 1990 to September 1996, Mr. Sorrells served as our engineering manager. He holds over 200 United States and foreign patents. Among other qualifications, Mr. Sorrells has an in-depth understanding of our technologies and their relevance to target markets.

Papken der Torossian

, 77, has been a director of ours since June 2003. Mr. der Torossian has extensive experience as chairman and chief executive of a number of semiconductor and technology-based companies. Mr. der Torossian was chief executive officer of SVGI from 1986 until 2001 when it was acquired. Prior to his joining SVGI, from 1981 until 1986, he was president and chief executive officer of ECS Microsystems, a communications and personal computer company that was acquired by Ampex Corporation where he stayed on as a manager for a year. From 1976 to 1981, Mr. der Torossian was president of the Santa Cruz Division of Plantronics where he also served as vice president of the Telephone Products Group. Prior to that, he spent four years at Spectra-Physics, Inc. and twelve years with Hewlett-Packard in a variety of management positions. Since August 2007, Mr. der Torossian has served as a director and a member of the compensation committee and nominating and governance committees of Atmel Corporation, a publicly traded company. Among other qualifications, Mr. der Torossian has over two decades of experience in engineering and has demonstrated accomplishments as chief executive officer and chairman of several high technology public and private companies. Mr. der Torossian also has a relevant network in the technology community as well as relevant operating experience with small, high growth companies.

Directors (Class III) With Terms Expiring at the 2017 Annual Meeting.

John Metcalf,

65, has been a director of ours since June 2004. From November 2002 until his retirement in July 2010, Mr. Metcalf was a chief financial officer (“CFO”) partner with Tatum LLC, the largest executive services and consulting firm in the United States. Mr. Metcalf has 18 years’ experience as a CFO. From July 2006 to September 2007, Mr. Metcalf served as CFO for Electro Scientific Industries, Inc., a provider of high-technology manufacturing equipment to the global electronics market. From June 2004 to July 2006, Mr. Metcalf served as CFO for Siltronic AG. From August 2011 to February 2013, Mr. Metcalf served on the board of directors and was chairman of the audit, compensation, and nominating committees of Trellis Earth Products, Inc, a privately held company. From June 2007 until July 2011,

Mr. Metcalf served on the board of directors and was chairman of the audit committee of EnergyConnect Group, Inc. (formerly Microfield Group, Inc.), a publicly traded company that was acquired by Johnson Controls, Inc. in July 2011. Among other qualifications, Mr. Metcalf has extensive experience in the semiconductor industry, an in-depth understanding of generally accepted accounting principles, financial statements and SEC reporting requirements, and satisfies the audit committee requirement for financial expertise.

Robert Sterne

, 64, has been a director of ours since September 2006 and also served as a director of ours from February 2000 to June 2003. Since 1978, Mr. Sterne has been a partner of the law firm of Sterne, Kessler, Goldstein & Fox PLLC (“SKGF”), specializing in patent and other intellectual property law. Mr. Sterne provides legal services to us as one of our patent and intellectual property attorneys. Among other qualifications, Mr. Sterne has an in-depth knowledge of our intellectual property portfolio and patent strategies and is considered a leader in best practices and board responsibilities concerning intellectual property.

Executive Officers

In addition to Jeffrey Parker, our Chief Executive Officer, and David Sorrells, our Chief Technology Officer, who also serve on our Board and whose backgrounds are included above, the following persons serve as our executive officers:

Cynthia Poehlman,

49, has been our chief financial officer since June 2004 and our corporate secretary since August 2007. From March 1994 to June 2004, Ms. Poehlman was our controller and our chief accounting officer. Ms. Poehlman has been a certified public accountant in the state of Florida since 1989.

John Stuckey,

45, joined our company in July 2004 as the vice-president of corporate strategy and business development and was promoted to executive vice-president of corporate strategy and business development in June 2008. Prior to July 2004, Mr. Stuckey spent five years at Thomson, Inc. where he most recently served as director of business development.

Family Relationships

There are no family relationships among our officers or directors.

Audit Committee and Financial Expert

We have an audit committee that is comprised of independent directors as determined in accordance with the rules of NASDAQ for audit committee members. Our audit committee is governed by a board-approved charter which, among other things, establishes the audit committee’s membership requirements and its powers and responsibilities. The members of the audit committee are Messrs. William Hightower, John Metcalf, and Papken der Torossian. Mr. Metcalf serves as chairman of the audit committee.

Our board of directors has determined that John Metcalf is an audit committee financial expert within the meaning of the rules and regulations of the SEC and is independent as determined in accordance with current NASDAQ listing standards for audit committee members. In addition, we must certify to NASDAQ that the audit committee has and will continue to have at least one member who has past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background that results in the individual’s “financial sophistication.” Our board has determined that Mr. Metcalf’s qualifications also satisfy NASDAQ’s definition of financial sophistication.

Shareholder Nominations

There have been no material changes to the procedures by which security holders may recommend nominees to our board of directors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), requires our officers, directors and persons who beneficially own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC and NASDAQ. Officers, directors and ten percent shareholders are charged by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

Based solely upon our review of the copies of such forms received by us and written representations from certain reporting persons that no Forms 5 were required for those persons, we believe that, during the fiscal year ended December 31, 2015, our executive officers, directors and ten percent shareholders filed all reports required by Section 16(a) of the Exchange Act on a timely basis.

Code of Ethics

The board of directors has adopted a code of ethics applicable to all of our directors, officers and employees, including our chief executive officer and our chief financial and accounting officer, that is designed to deter wrongdoing and to promote honest and ethical conduct, full, fair, accurate, timely and understandable disclosure in reports that we file or submit to the SEC and in our other public communications, compliance with applicable government laws, rules and regulations, prompt internal reporting of violations of the code to an appropriate person designated in the code and accountability for adherence to the code. A copy of the code of ethics may be found on our website at

www.parkervision.com

.

Item 11. Executive Compensation.

Summary Compensation Table

The following table summarizes the total compensation of each of our “named executive officers” as defined in Item 401(m) of Regulation S-K (the “Executives”) for the fiscal years ended December 31, 2015 and 2014. Given the complexity of disclosure requirements concerning executive compensation, and in particular with respect to the standards of financial accounting and reporting related to equity compensation, there is a difference between the compensation that is reported in this table versus that which is actually paid to and received by the Executives. The amounts in the Summary Compensation Table that reflect the full grant date fair value of an equity award, do not necessarily correspond to the actual value that has been realized or will be realized in the future with respect to these awards.

|

(a)

|

(b)

|

|

(c)

|

|

|

(d)

|

|

|

(e)

|

|

|

(f)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

Year

|

|

Salary ($)

|

|

|

Bonus ($)

|

|

|

All Other ($)

|

|

|

Total ($)

|

|

|

Jeffrey Parker, Chief Executive Officer

|

2015

|

|

$

|

325,000

|

|

|

$

|

0

|

|

|

$

|

26,000

|

1,2

|

|

$

|

351,000

|

|

|

|

2014

|

|

|

325,000

|

|

|

|

0

|

|

|

|

174,000

|

1,3

|

|

|

499,000

|

|

|

Cynthia Poehlman, Chief Financial Officer

|

2015

|

|

|

225,000

|

|

|

|

0

|

|

|

|

2,750

|

2,4

|

|

|

227,750

|

|

|

|

2014

|

|

|

225,000

|

|

|

|

0

|

|

|

|

750

|

4

|

|

|

225,750

|

|

|

David Sorrells, Chief Technology Officer

|

2015

|

|

|

275,625

|

|

|

|

0

|

|

|

|

2,100

|

4

|

|

|

277,725

|

|

|

|

2014

|

|

|

275,625

|

|

|

|

5,000

|

|

|

|

2,100

|

4

|

|

|

282,725

|

|

|

John Stuckey, Executive Vice President

|

2015

|

|

|

250,000

|

|

|

|

0

|

|

|

|

3,263

|

2,4

|

|

|

253,263

|

|

|

|

2014

|

|

|

250,000

|

|

|

|

0

|

|

|

|

1,263

|

4

|

|

|

251,263

|

|

|

1

|

Includes an automobile allowance in the amount of $24,000.

|

|

2

|

Includes a $2,000 employer matching contribution on our 401(K) plan paid in 2015 based on 2014 contributions.

|

|

3

|

Includes reimbursement for personal life insurance premiums paid by executive, adjusted for taxes, in the amount of $150,000.

|

|

4

|

Includes the dollar value of premiums paid by us for life insurance for the benefit of the executive.

|

Outstanding Equity Awards at Fiscal Year End

The following table summarizes information concerning the outstanding equity awards, including unexercised options, unvested stock and equity incentive awards, as of December 31, 2015 for each of our Executives (as adjusted for our 1:10 reverse stock split that became effective March 30, 2016):

|

|

Option Awards

|

|

|

Number of securities underlying unexercised options (#) exercisable

|

Option Exercise Price ($)

|

Option Expiration Date

|

|

Name

|

(a)

|

(c)

|

(d)

|

|

Jeffrey Parker

|

100,000

|

$8.90

|

10/15/18

|

|

|

60,000

|

28.30

|

7/16/19

|

|

Cynthia Poehlman

|

24,000

|

8.90

|

10/15/18

|

|

|

12,500

|

28.30

|

7/16/19

|

|

David Sorrells

|

46,500

|

8.90

|

10/15/18

|

|

|

30,000

|

28.30

|

7/16/19

|

|

John Stuckey

|

23,150

|

8.90

|

10/15/18

|

|

|

12,500

|

28.30

|

7/16/19

|

Employment and Other Agreements

In June 2012, we entered into Executive Employment Agreements (“Agreements”) with each of our Executives upon the expiration of our prior employment agreements with them. The Agreements had an initial three-year term that expired on May 31, 2015 and automatically renewed for a one-year period ending May 31, 2016.

The Agreements provide each of our Executives with a base salary commensurate with his or her position in the organization, a potential annual achievement bonus based on performance as determined by the compensation committee, and long-term equity incentive awards at the discretion of the committee. In addition, the Agreement for our chief executive officer provides for an annual automobile allowance and payment of personal life insurance policy premiums up to a maximum benefit payment of $150,000 annually for the initial three-year term of the Agreement.

The Agreements contain provisions for the protection of our intellectual property and for severance benefits and non-compete restrictions in the event of termination of the Executive’s employment. The Agreements provide for payments upon termination for various events including, with or without cause termination by us, termination due to death or disability of the Executive, termination due to a change in control event and termination by the Executive for “Good Reason” as defined in the Agreements. See “Potential Payments upon Termination or Change in Control” below for a discussion of the various severance benefits payable to the Executives under the terms of the Agreements.

Upon the termination of an Executive, we may enforce non-compete provisions over a restriction period not to exceed three years provided that we compensate the Executive at his or her ending base salary on a monthly basis over the restriction period (“Non-Compete Compensation”). The non-compete provisions of the Agreements impose restrictions on (i) employment or consultation with competing companies or customers, (ii) recruiting or hiring employees for a competing company and (iii) soliciting or accepting business from our customers. We also have non-compete arrangements in place with all of our other employees that are similar to the non-compete restrictions for our Executives. Certain severance payments and other amounts may be applied as credits toward our Non-Compete Compensation obligation. In addition, under the terms of the Executive’s equity award agreements, certain termination events may give rise to accelerated vesting of unvested equity awards as more fully discussed below.

The Agreements also provide that the Executives will comply with any law, SEC rule, or listing standard for the exchange on which our shares are listed that require us to recover from the Executive any portion of incentive-based compensation received from us.

Potential Payments upon Termination or Change in Control

Potential severance benefits are payable to the Executives under the terms of the Agreements in the event the Executive’s employment is terminated without cause, due to a change in control event, or for “Good Reason” as defined in the Agreements.

Payments Made Upon Termination –

When an Executive’s employment is terminated for any reason other than for cause, he or she is entitled to receive his or her base salary through the date of termination, and any earned but unused vacation pay. When an Executive’s employment is terminated for cause, he or she is only entitled to his or her base salary through the date of termination. Furthermore, in the event an Executive’s employment is terminated for cause or an Executive resigns without “Good Reason”, all gains realized from the Executive’s sale of our common shares from vested restricted stock units (“RSUs”) or stock options during the twelve months immediately preceding the termination date shall be credited towards Non-Compete Compensation. In addition, the total value of equity instruments provided to the Executive during the entire term of his or her employment with us that are vested and outstanding at the termination date shall be credited towards the Non-Compete Compensation. The value of outstanding equity awards shall be determined using the closing market price of our common stock on the termination date.

Payments Made Upon Termination Due to a Change in Control –

In the event an Executive’s employment is terminated without cause or an Executive resigns with “Good Reason” within two years of a change in control event, in addition to the benefits listed under “Payments Made Upon Termination” above, he or she is entitled to receive a multiple of his or her base salary, an amount in lieu of annual bonus or incentive compensation, continuation of group health benefits and acceleration of certain unvested and outstanding equity awards. The base salary multiple varies by individual and ranges from 150% to 300%. The amount in lieu of annual bonus or incentive compensation is determined based on the greater of the bonus or annual incentive compensation earned in the year prior to the change in control, the average of the prior three year’s bonus or annual incentive compensation, or a prorated amount of the current year’s bonus or annual incentive compensation. The severance pay in excess of twelve months’ base salary is applied as a credit toward the Non-Compete Compensation.

In accordance with the terms of the Executive’s individual equity agreements, the Executive would also be eligible for accelerated vesting of certain equity awards in the event of a change in control. Any unvested stock options or unvested time-based RSUs will automatically vest upon a change in control. If the change in control occurrence is approved by our Board, the Board may, at its option, accelerate the vesting of any unvested time-based RSUs and repurchase them for a cash value as defined in the equity plan.

Payments Made Upon Termination Without Cause –

In the event an Executive’s employment is terminated without cause and the Executive executes a release agreement with us, he or she is entitled to a severance package. The severance package includes continuation of base salary for a one-year period following the termination date, continuation of group health benefits and payment of any annual achievement bonus on a prorated basis. In the event an Executive resigns for “Good Reason,” as defined in the Agreement, and executes a release agreement with us, he or she is entitled to the same severance benefits as if he or she was terminated without cause. Good Reason is defined in the Agreement as a material diminution in the Executive’s authority, duties or responsibilities, a material diminution in the Executive’s base compensation and benefits, except for reductions applicable to all Executives, a material relocation of the Executive’s primary office or a material breach of the Agreement by us.

Payments Made Upon Termination Due to Disability –

In the event an Executive’s employment is terminated within six months of becoming disabled, as defined in the Agreement, he or she will be entitled to the benefits listed under “Payments Made upon Termination” and the severance package listed under “Payments Made upon Termination without Cause” above. If, however, the Executive’s employment is terminated after six months of becoming disabled, he or she becomes eligible for payments under a company-paid long-term disability plan with a third-party carrier in which case, the severance package is limited to the continuation of health benefits. In addition, if an Executive’s employment is terminated due to disability, he or she receives an automatic acceleration of fifty percent of any unvested options or RSUs in accordance with the terms of the individual equity agreements.

Payments Made Upon Death –

Upon the death of an Executive, the Executive’s beneficiaries shall receive the proceeds from company-paid life insurance policies purchased for the benefit of the Executive. In addition, the Executive’s beneficiaries shall receive an acceleration of fifty percent of any unvested options or RSUs in accordance with the terms of the individual equity agreements.

The following tables reflect the estimated amount of compensation due to each of our Executives in the event of termination of their employment. Actual amounts to be paid out could only be determined at the time of an Executive’s actual separation. For purposes of this disclosure, we assume the triggering event for termination occurred on December 31, 2015. The intrinsic value of equity awards upon termination is calculated based on the December 31, 2015

closing

price of our common stock of $2.32, as adjusted for the 1:10 reverse stock split effective March 30, 2016.

Jeffrey Parker, Chairman and Chief Executive Officer

|

Benefit and Payments Upon Separation

|

|

Change in Control (Not Board Approved)

|

|

|

Change in

Control (Board Approved)

|

|

|

Without Cause

or for “Good Reason”

|

|

|

Disability

|

|

|

Death

|

|

|

Salary

|

|

$

|

975,000

|

1

|

|

$

|

975,000

|

1

|

|

$

|

325,000

|

|

|

$

|

325,000

|

2

|

|

$

|

0

|

|

|

Short-term Incentive Compensation

|

|

|

130,000

|

3

|

|

|

130,000

|

3

|

|

|

0

|

|

|

|

0

|

2

|

|

|

0

|

|

|

Benefits & Perquisites

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Benefits

|

|

|

33,892

|

|

|

|

33,892

|

|

|

|

33,892

|

|

|

|

33,892

|

|

|

|

0

|

|

|

Life Insurance Proceeds

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Accrued Vacation Pay

|

|

|

12,500

|

|

|

|

12,500

|

|

|

|

12,500

|

|

|

|

12,500

|

|

|

|

12,500

|

|

|

Total

|

|

$

|

1,151,392

|

|

|

$

|

1,151,392

|

|

|

$

|

371,392

|

|

|

$

|

371,392

|

|

|

$

|

12,500

|

|

|

1

|

Under the Agreement, Mr. Parker is entitled to three times his regular annual base salary.

|

|

2

|

Assumes termination occurs within first six months of Executive becoming disabled. Following a six month period, Executive is not entitled to salary continuation or short-term incentive compensation payments.

|

|

3

|

Under the Agreement, Executive is entitled the greater of (i) an amount equal to his bonus or annual incentive compensation earned in the year prior to the change in control, (ii) the average of bonus and annual incentive compensation for the three full fiscal years prior to the change in control, or (iii) a prorated amount of the current year’s bonus or annual incentive compensation. Amount included is based on the three year average bonus and incentive compensation.

|

Cynthia Poehlman, Chief Financial Officer and Corporate Secretary

|

Benefit and Payments Upon Separation

|

|

Change in Control (Not Board Approved)

|

|

|

Change in

Control (Board Approved)

|

|

|

Without Cause

or for “Good Reason”

|

|

|

Disability (5)

|

|

|

Death

|

|

|

Salary

|

|

$

|

450,000

|

1

|

|

$

|

450,000

|

1

|

|

$

|

225,000

|

|

|

$

|

225,000

|

2

|

|

$

|

0

|

|

|

Short-term Incentive Compensation

|

|

|

15,000

|

3

|

|

|

15,000

|

3

|

|

|

0

|

|

|

|

0

|

2

|

|

|

0

|

|

|

Benefits & Perquisites

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Benefits

|

|

|

33,892

|

|

|

|

33,892

|

|

|

|

33,892

|

|

|

|

33,892

|

|

|

|

0

|

|

|

Life Insurance Proceeds

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

1,000,000

|

4

|

|

Accrued Vacation Pay

|

|

|

19,267

|

|

|

|

19,267

|

|

|

|

19,267

|

|

|

|

19,267

|

|

|

|

19,267

|

|

|

Total

|

|

$

|

518,159

|

|

|

$

|

518,159

|

|

|

$

|

278,159

|

|

|

$

|

278,159

|

|

|

$

|

1,019,267

|

|

|

1

|

Under the Agreement, Ms. Poehlman is entitled to two times her regular annual base salary.

|

|

2

|

Assumes termination occurs within first six months of Executive becoming disabled. Following a six-month period, Executive is not entitled to salary continuation or short-term incentive compensation payments.

|

|

3

|

Under the Agreement, Executive is entitled the greater of (i) an amount equal to her bonus or annual incentive compensation earned in the year prior to the change in control, (ii) the average of bonus and annual incentive compensation for the three full fiscal years prior to the change in control, or (iii) a prorated amount of the current year’s bonus or annual incentive compensation. Amount included is based on the three year average bonus and incentive compensation.

|

|

4

|

Represents proceeds payable by a third-party insurance carrier on a company-paid life insurance policy for the benefit of the Executive.

|

David Sorrells, Chief Technology Officer

|

Benefit and Payments Upon Separation

|

|

Change in Control (Not Board Approved)

|

|

|

Change in

Control (Board Approved)

|

|

|

Without Cause

or for “Good Reason”

|

|

|

Disability

|

|

|

Death

|

|

|

Salary

|

|

$

|

826,875

|

1

|

|

$

|

826,875

|

1

|

|

$

|

275,625

|

|

|

$

|

275,625

|

2

|

|

$

|

0

|

|

|

Short-term Incentive Compensation

|

|

|

93,542

|

3

|

|

|

93,542

|

3

|

|

|

0

|

|

|

|

0

|

2

|

|

|

0

|

|

|

Benefits & Perquisites

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Benefits

|

|

|

36,890

|

|

|

|

36,890

|

|

|

|

36,890

|

|

|

|

36,890

|

|

|

|

0

|

|

|

Life Insurance Proceeds

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

1,000,000

|

4

|

|

Accrued Vacation Pay

|

|

|

10,601

|

|

|

|

10,601

|

|

|

|

10,601

|

|

|

|

10,601

|

|

|

|

10,601

|

|

|

Total

|

|

$

|

967,908

|

|

|

$

|

967,908

|

|

|

$

|

323,116

|

|

|

$

|

323,116

|

|

|

$

|

1,010,601

|

|

|

1

|

Under the Agreement, Mr. Sorrells is entitled to three times his regular annual base salary.

|

|

2

|

Assumes termination occurs within first six months of Executive becoming disabled. Following a six month period, Executive is not entitled to salary continuation or short-term incentive compensation payments.

|

|

3

|

Under the Agreement, Executive is entitled the greater of (i) an amount equal to his bonus or annual incentive compensation earned in the year prior to the change in control, (ii) the average of bonus and annual incentive compensation for the three full fiscal years prior to the change in control, or (iii) a prorated amount of the current year’s bonus or annual incentive compensation. Amount included is based on the three year average bonus and incentive compensation.

|

|

4

|

Represents proceeds payable by a third-party insurance carrier on a company-paid life insurance policy for the benefit of the Executive.

|

John Stuckey, Executive Vice President of Corporate Strategy and Business Development

|

Benefit and Payments Upon Separation

|

|

Change in Control (Not Board Approved)

|

|

|

Change in

Control (Board Approved)

|

|

|

Without Cause

or for “Good Reason”

|

|

|

Disability

|

|

|

Death

|

|

|

Salary

|

|

$

|

375,000

|

1

|

|

$

|

375,000

|

1

|

|

$

|

250,000

|

|

|

$

|

250,000

|

2

|

|

$

|

0

|

|

|

Short-term Incentive Compensation

|

|

|

3,575

|

3

|

|

|

3,575

|

3

|

|

|

0

|

|

|

|

0

|

2

|

|

|

0

|

|

|

Benefits & Perquisites

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Benefits

|

|

|

12,064

|

|

|

|

12,064

|

|

|

|

12,064

|

|

|

|

12,064

|

|

|

|

0

|

|

|

Life Insurance Proceeds

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

1,250,000

|

4

|

|

Accrued Vacation Pay

|

|

|

5,274

|

|

|

|

5,274

|

|

|

|

5,274

|

|

|

|

5,274

|

|

|

|

5,274

|

|

|

Total

|

|

$

|

395,913

|

|

|

$

|

395,913

|

|

|

$

|

267,338

|

|

|

$

|

267,338

|

|

|

$

|

1,255,274

|

|

|

1

|

Under the Agreement, Mr. Stuckey is entitled to one and one half times his regular annual base salary.

|

|

2

|

Assumes termination occurs within first six months of Executive becoming disabled. Following a six month period, Executive is not entitled to salary continuation or short-term incentive compensation payments.

|

|

3

|

Under the Agreement, Executive is entitled the greater of (i) an amount equal to his bonus or annual incentive compensation earned in the year prior to the change in control, (ii) the average of bonus and annual incentive compensation for the three full fiscal years prior to the change in control, or (iii) a prorated amount of the current year’s bonus or annual incentive compensation. Amount included is based on the three year average bonus and incentive compensation.

|

|

4

|

Represents proceeds payable by a third-party insurance carrier on a company-paid life insurance policy for the benefit of the Executive.

|

Compensation of Outside Directors

The following table summarizes the compensation of our non-employee directors for the year ended December 31, 2015.

|

Name

|

|

Cash Fees

Earned ($)

1

|

|

|

Total ($)

|

|

|

(a)

|

|

(b)

|

|

|

(c)

|

|

|

Papken der Torossian

|

|

$

|

55,000

|

|

|

$

|

55,000

|

|

|

William Hightower

|

|

|

50,000

|

|

|

|

50,000

|

|

|

John Metcalf

|

|

|

57,500

|

|

|

|

57,500

|

|

|

Robert Sterne

|

|

|

40,000

|

|

|

|

40,000

|

|

|

Nam Suh

|

|

|

45,000

|

|

|

|

45,000

|

|

|

1

|

Amount represents fees earned for 2015 annual board and committee retainers. The directors voluntarily deferred payment of the majority of cash fees in 2015. As of December 31, 2015, we had fees payable to each board member as follows:

|

|

Papken der Torossian

|

|

$

|

41,250

|

|

|

William Hightower

|

|

$

|

37,500

|

|

|

John Metcalf

|

|

$

|

28,750

|

|

|

Robert Sterne

|

|

$

|

30,000

|

|

|

Nam Suh

|

|

$

|

33,750

|

|

As of December 31, 2015, our non-employee directors had outstanding option awards (after giving effect to the 1:10 reverse stock split) as follows:

|

Name

|

|

Number of Securities Underlying Unexercised Options (#) Exercisable

|

|

|

Papken Der Torossian

|

|

|

34,620

|

|

|

William Hightower

|

|

|

33,960

|

|

|

John Metcalf

|

|

|

32,651

|

|

|

Robert Sterne

|

|

|

34,120

|

|

|

Nam Suh

|

|

|

34,480

|

|

Director Compensation Arrangements

Our standard non-employee director compensation program provides for cash retainers for service on the Board and Board committees. Committee fees are structured in such a way as to provide distinction between compensation for committee members and chairpersons and between the responsibilities of the various committees. We provide the following cash compensation to non-employee directors:

|

|

·

|

each non-employee director receives an annual cash retainer of $37,500;

|

|

|

·

|

each non-employee director who serves as a member of our audit committee receives an annual cash retainer of $7,500; each non-employee director who serves as a member of our compensation committee receives an annual cash retainer of $5,000; and each non-employee director who serves as a member of our nominating and corporate governance committee receives an annual cash retainer of $2,500; and

|

|

|

·

|

each non-employee director who serves as the chair of our audit committee receives an annual cash retainer of $15,000; each non-employee director who serves as the chair of our compensation committee receives an annual cash retainer of $10,000; and each non-employee director who serves as the chair of our nominating and corporate governance committee receives an annual cash retainer of $5,000.

|

Our standard compensation program also includes annual equity-based compensation to our non-employee directors. Each non-employee director will receive, following our annual shareholders' meeting, equity awards with an aggregate grant-date fair value of $125,000. The annual equity awards include RSUs and nonqualified stock options, each with a grant-date fair value of approximately $62,500. These equity awards vest on the one-year anniversary of the grant date and are forfeited if the director resigns or is removed from the Board for cause prior to the vesting date. The non-employee directors voluntarily waived receipt of their standard equity compensation package in 2015.

We reimburse our non-employee directors for their reasonable expenses incurred in attending meetings and we encourage participation in relevant educational programs for which we reimburse all or a portion of the costs incurred for these purposes.

Directors who are also our employees are not compensated for serving on our Board. Information regarding compensation otherwise received by our directors who are also named executive officers is provided under “Executive Compensation” above.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth certain information as of March 31, 2016 outstanding with respect to the stock ownership of (i) those persons or groups who beneficially own more than 5% of our common stock, (ii) each of our directors and director nominees, (iii) each of our executive officers, and (iv) all of our directors, director nominees and executive officers as a group (based upon information furnished by those persons).

As of March 31, 2016, 11,469,934 shares of our common stock were issued and outstanding. All share amounts have been adjusted for our 1:10 reverse stock split that became effective March 30, 2016.

|

Name of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Percent of Class

1

|

|

EXECUTIVE OFFICERS AND DIRECTORS

|

|

|

|

Jeffrey Parker

12

|

419,430

2

|

3.61%

|

|

Cynthia Poehlman

12

|

45,034

3

|

0.39%

|

|

David Sorrells

12

|

97,319

4

|

0.84%

|

|

John Stuckey

12

|

43,002

5

|

0.37%

|

|

William Hightower

12

|

44,375

6

|

0.39%

|

|

John Metcalf

12

|

39,566

7

|

0.34%

|

|

Robert Sterne

12

|

42,385

8

|

0.37%

|

|

Nam Suh

12

|

41,145

9

|

0.36%

|

|

Papken der Torossian

12

|

78,476

10

|

0.68%

|

|

All directors, director nominees and executive officers as a group (9 persons)

|

850,732

11

|

7.12%

|

|

5% SHAREHOLDERS

|

|

|

|

Wellington Management Group, LLP

|

1,542,125

13

|

13.44%

|

|

Gem Investment Advisors, LLC

|

783,809

14

|

6.83%

|

|

1

|

Percentage is calculated based on all outstanding shares of common stock plus, for each person or group, any shares of common stock that the person or the group has the right to acquire within 60 days pursuant to options, warrants, conversion privileges or other rights. Unless otherwise indicated, each person or group has sole voting and dispositive power over all such shares of common stock.

|

|

2

|

Includes 160,000 shares of common stock issuable upon currently exercisable options, 40,134 shares held by Mr. Parker directly, 192,259 shares held by Jeffrey Parker and Deborah Parker Joint Tenants in Common, over which Mr. Parker has shared voting and dispositive power, 7,353 shares owned through Mr. Parker’s 401(k) plan, and 19,684 shares owned of record by Mr. Parker’s three children over which he disclaims ownership.

|

|

3

|

Includes 36,500 shares of common stock issuable upon currently exercisable options.

|

|

4

|

Includes 76,500 shares of common stock issuable upon currently exercisable options.

|

|

5

|

Includes 35,650 shares of common stock issuable upon currently exercisable options.

|

|

6

|

Includes 33,960 shares of common stock issuable upon currently exercisable options.

|

|

7

|

Includes 32,651 shares of common stock issuable upon currently exercisable options.

|

|

8

|

Includes 34,120 shares of common stock issuable upon currently exercisable options.

|

|

9

|

Includes 34,480 shares of common stock issuable upon currently exercisable options.

|

|

10

|

Includes

34,620 shares of common stock issuable upon currently exercisable options.

|

|

11

|

Includes 478,481 shares of common stock issuable upon currently exercisable options held by directors and officers (see notes 2, 3, 4, 5, 6, 7, 8, 9, and 10 above).

|

|

12

|

The person’s address is 7915 Baymeadows Way, Suite 400, Jacksonville, Florida 32256.

|

|

13

|

As reported on Amendment No. 3 to Form 13G filed February 12, 2016. Wellington, as parent holding company of certain holding companies and the Wellington Investment Advisors (“Wellington Advisors”), is deemed to have beneficial ownership of shares that are held of record by investment advisory clients of Wellington Advisors. No client of Wellington Management is known to have right or power with respect to more than five percent of our common stock. The business address of Wellington Management Group, LLP (“Wellington Management”) is 280 Congress Street, Boston, Massachusetts 02210.

|

|

14

|

As reported on Amendment No. 9 to Form 13G filed February 16, 2016. Includes 772,309 shares held by Gem Partners LP (“GEM”) over which GEM, GEM Investment Advisors, LLC (“Advisors”) and Mr. Daniel Lewis (“Lewis”) have shared voting and dispositive power, 4,900 shares held by Flat Rock Partners LP (“FlatRock”) over which FlatRock, Advisors and Lewis have shared voting and dispositive power, and 6,600 shares held by Lewis over which Lewis has sole voting and dispositive power. Advisors is the general partner of GEM and Flatrock, as a result of which Advisors is deemed to be beneficial owner of such shares. Lewis, as the controlling person of Advisors is deemed to beneficially own the shares beneficially owned by them. The business address for each of Advisors, GEM, FlatRock and Lewis is 100 State Street, Suite 2B, Teaneck, New Jersey 07666.

|

Equity Compensation Plan Information

The following table gives information as of December 31, 2015 about shares of our common stock authorized for issuance under all of our equity compensation plans, as adjusted for our 1:10 reverse stock split that became effective March 30, 2016.

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options,

warrants and rights

|

|

Weighted-average exercise

price of outstanding options, warrants and rights

|

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|

|

(a)

|

|

(b)

|

|

(c)

|

|

Equity compensation plans approved by security holders

1

|

652,201

|

|

$17.90

|

|

537,943

|

|

Equity compensation plans not approved by security holders

2

|

6,000

|

|

$20.10

|

|

0

|

|

Total

|

658,201

|

|

|

|

537,943

|

|

1

|

Includes the 2000 Plan, the 2008 Plan and the 2011 Plan. The type of awards that may be issued under each of these plans is discussed more fully in Note 9 to our financial statements included in Item 8 of our Annual Report.

|

|

2

|

Includes options granted to third parties in 2012 for the purchase of an aggregate of 6,000 shares at an exercise price of $20.10 per share. These options expire June 30, 2017.

|

Item 13. Certain Relationships and Related Transactions and Director Independence.

We paid approximately $428,000 and $1,705,000 in 2015 and 2014, respectively, for patent-related legal services to SKGF, of which Robert Sterne, one of our directors since September 2006, is a partner. At December 31, 2015, we had approximately $1,164,000 in unpaid fees to SKGF, primarily related to defense of our patents under IPR proceedings. In February 2016, we paid approximately $339,000 of these outstanding fees and entered into an agreement with SKGF to convert the remaining $825,000 to an unsecured note payable. The note bears interest at a rate of 8%, payable monthly, and the principal balance of the note is due December 31, 2017.

On December 23, 2015, Mr. Papken Der Torossian, one of our directors since June 2003, purchased 20,833 shares of our common stock in an unregistered sale of equity securities at a purchase price of $2.40 per share (as adjusted for our 1:10 reverse stock split that became effective March 30, 2016).

Wellington Management Group, LLP (“Wellington”) in its capacity as investment advisor, under the rules of NASDAQ, was deemed to be the beneficial owner of 214,850 shares of our common stock purchased by accredited investors on December 23, 2015 at a price of $1.90 per share (as adjusted for our 1:10 reverse stock split that became effective March 30, 2016). Wellington was deemed to be beneficial owner of more than 5% of our outstanding stock at the time of the transactions.

Review, Approval or Ratification of Transactions with Related Persons

Our audit committee, pursuant to its written charter, is responsible for reviewing and approving related-party transactions to the extent we enter into such transactions. In certain instances, the full Board may review and approve a transaction. The audit committee will consider all relevant factors when determining whether to approve a related party transaction, including whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction. We require each of our directors and executive officers to complete a questionnaire that elicits information about related party transactions. These procedures are intended to determine whether any such related party transaction impairs the independence of a director or presents a conflict of interest on the part of a director, officer or employee.

Director Independence

Our common stock is listed on NASDAQ, and we follow the rules of NASDAQ in determining if a director is independent. The board of directors also consults with our counsel to ensure that the board of directors’ determination is consistent with those rules and all relevant securities and other laws and regulations regarding the independence of directors. Consistent with these considerations, the board of directors affirmatively has determined that Messrs. William Hightower, John Metcalf, Robert Sterne, Nam Suh, and Papken der Torossian are independent directors.

Item 14. Principal Accountant Fees and Services.

The firm of PricewaterhouseCoopers LLP acts as our principal accountants. The following is a summary of fees paid to the principal accountants for services rendered.

Audit Fees.

For the years ended December 31, 2014 and 2015, the aggregate fees billed for professional services rendered for the audit of our annual financial statements, the review of our financial statements included in our quarterly reports, and services provided in connection with regulatory filings were approximately $494,000 and $379,000, respectively.

Audit Related Fees.

For the years ended December 31, 2014 and 2015, there were no fees billed for professional services by our principal accountants for assurance and related services.

Tax Fees.

For the years ended December 31, 2014 and 2015, there were no fees billed for professional services rendered by our principal accountants for tax compliance, tax advice or tax planning.

All Other Fees.

For the years ended December 31, 2014 and 2015, there were no fees billed for other professional services by our principal accountants.

All the services discussed above were approved by our audit committee. The audit committee pre-approves the services to be provided by our principal accountants, including the scope of the annual audit and non-audit services to be performed by the principal accountants and the principal accountants’ audit and non-audit fees.

PART IV

Item 15. Exhibits and Financial Statement Schedule.

(a) Documents filed as part of this report:

(3) Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

3.1

|

|

Amended and Restated Articles of Incorporation (incorporated by reference from Exhibit 3.1 of Current Report on Form 8-K filed March 29, 2016)

|

|

|

|

|

|

3.2

|

|

Bylaws, as amended (incorporated by reference from Exhibit 3.2 of Annual Report on Form 10-K for the year ended December 31, 1998)

|

|

|

|

|

|

3.3

|

|

Amendment to Certificate of Incorporation dated July 17, 2000 (incorporated by reference from Exhibit 3.1 of Quarterly Report on Form 10-Q for the quarter ended June 30, 2000)

|

|

|

|

|

|

3.4

|

|

Certificate of Designations of the Preferences, Limitations and Relative Rights of Series E Preferred Stock (incorporated by reference from Exhibit 4.02 of Form 8-K dated November 21, 2005)

|

|

|

|

|

|

3.5

|

|

Amended and Restated Bylaws (incorporated by reference from Exhibit 3.1 of Current Report on Form 8-K filed August 14, 2007)

|

|

|

|

|

|

4.1

|

|

Form of common stock certificate*

|

|

|

|

|

|

4.2

|

|

Shareholder Protection Rights Agreement between the Registrant and American Stock Transfer & Trust Company, as Rights Agent (incorporated by reference from Exhibit 4.01 of Form 8-K dated November 21, 2005)

|

|

|

|

|

|

4.3

|

|

Form of Common Stock Purchase Warrant between Registrant and 1624 PV LLC dated January 15, 2015 (incorporated by reference from Exhibit 4.6 of Annual Report on Form 10-K for the period ended December 31, 2014)

|

|

|

|

|

|

4.4

|

|

First Amendment to Shareholder Protection Rights Agreement dated as of November 20, 2015 between the Registrant and American Stock Transfer & Trust Company, as Rights Agent (incorporated by reference from Exhibit 4.1 of Form 8-K dated November 20, 2015)

|

|

|

|

|

|

4.5

|

|

Form of Rights Certificate pursuant to First Amendment to Shareholder Protection Rights Agreement dated November 20, 2015 (incorporated by reference from Exhibit 4.2 of Form 8-K dated November 20, 2015)

|

|

|

|

|

|

10.1

|

|

2000 Performance Equity Plan (incorporated by reference from Exhibit 10.11 of Registration Statement No. 333-43452) **

|

|

|

|

|

|

10.2

|

|

Form of 2002 Indemnification Agreement for Directors and Officers (incorporated by reference from Exhibit 10.1 of Quarterly Report on Form 10-Q for the period ended September 30, 2002) **

|

|

|

|

|

|

10.3

|

|

Standard Form of Employee Option Agreement (incorporated by reference from Exhibit 4.11 of Annual Report on Form 10-K for the year ended December 31, 2006)**

|

|

|

|

|

|

10.4

|

|

2008 Equity Incentive Plan (Non-Named Executives), as amended (incorporated by reference from Exhibit 4.1 of Form S-8 dated October 24, 2008) **

|

|

10.5

|

|

2011 Long-Term Incentive Equity Plan, as amended and restated (incorporated by reference from Exhibit 4.1 of Form S-8 dated July 30, 2014) **

|

|

|

|

|

|

10.6

|

|

Employment Agreement between Registrant and Jeffrey Parker dated June 6, 2012 (incorporated by reference from Exhibit 10.1 on Form 8-K dated June 6, 2012) **

|

|

|

|

|

|

10.7

|

|

Employment Agreement between Registrant and Cynthia Poehlman dated June 6, 2012 (incorporated by reference from Exhibit 10.2 on Form 8-K dated June 6, 2012) **

|

|

|

|

|

|

10.8

|

|

Employment Agreement between Registrant and David Sorrells dated June 6, 2012 (incorporated by reference from Exhibit 10.3 on Form 8-K dated June 6, 2012) **

|

|

|

|

|

|

10.9

|

|

Employment Agreement between Registrant and John Stuckey dated June 6, 2012 (incorporated by reference from Exhibit 10.4 on Form 8-K dated June 6, 2012) **

|

|

|

|

|

|

10.10

|

|

Underwriting Agreement, dated March 21, 2013, between Registrant and Ladenburg Thalmann & Co. Inc. (incorporated by reference from Exhibit 1.1 of Current Report on Form 8-K filed March 21, 2013)

|

|

|

|

|

|

10.11

|

|

Form of Securities Purchase Agreement (incorporated by reference from Exhibit 10.1 of Current Report on Form 8-K filed August 2, 2013)

|

|

|

|

|

|

10.12

|

|

List of Investors (incorporated by reference from Exhibit 10.2 of Current Report on Form 8-K filed August 2, 2013)

|

|

|

|

|

|

10.13

|

|

Form of Registration Rights Agreement (incorporated by reference from Exhibit A to Exhibit 10.1 of Current Report on Form 8-K filed August 2, 2013)

|

|

|

|

|

|

10.14

|

|

ParkerVision, Inc. Performance Bonus Plan (incorporated by reference from Exhibit 10.1 of Current Report on Form 8-K filed July 12, 2013)**

|

|

10.15

|

|

Form of Securities Purchase Agreement dated March 13, 2014 (incorporated by reference from Exhibit 10.22 of Annual Report on Form 10-K for the period ended December 31, 2013)

|

|

|

|

|

|

10.16

|

|

Form of Registration Rights Agreement dated March 13, 2014 (incorporated by reference from Exhibit 10.23 of Annual Report on Form 10-K for the period ended December 31, 2013)

|

|

|

|

|

|

10.17

|

|

Funding Agreement between Registrant and 1624 PV LLC dated December 23, 2014 (incorporated by reference from Exhibit 10.19 of Annual Report on Form 10-K for the period ended December 31, 2014)

|

|

|

|

|

|

10.18

|

|

Warrant Subscription Agreement between Registrant and 1624 PV LLC dated December 23, 2014 (incorporated by reference from Exhibit 10.20 of Annual Report on Form 10-K for the period ended December 31, 2014)

|

|

|

|

|

|

10.19

|

|

Form of Securities Purchase Agreement dated December 18, 2015 and List of Investors (incorporated by reference from Exhibit 10.1 of Current Report on Form 8-K filed December 18, 2015)

|

|

10.20

|

|

Form of Registration Rights Agreement dated December 18, 2015 (incorporated by reference from Exhibit 10.2 of Current Report on Form 8-K filed December 18, 2015)

|

|

|

|

|

|

10.21

|

|

Subscription Agreement dated December 18, 2015 between Registrant and a director (incorporated by reference from Exhibit 10.3 of Current Report on Form 8-K filed December 18, 2015)

|

|

|

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers LLP

*

|

|

|

|

|

|

31.1

|

|

Rule 13a-14 and 15d-14 Certification of Jeffrey L. Parker***

|

|

|

|

|

|

31.2

|

|

Rule 13a-14 and 15d-14 Certification of Cynthia L. Poehlman***

|

|

|

|

|

|

32.1

|

|

Section 1350 Certification of Jeffrey L. Parker and Cynthia L. Poehlman***

|

|

|

|

|

|

99.1

|

|

Earnings Press Release*

|

|

|

|

|

|

101.INS

|

|

XBRL Instance Document*

|

|

|

|

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema*

|

|

|

|

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase*

|

|

|

|

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase*

|

|

|

|

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase*

|

|

|

|

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase*

|

|

*

|

Previously filed on Form 10-K for the year ended December 31, 2015 filed March 30, 2016.

|

|

**

|

Management contract or compensatory plan or arrangement.

|

SIGNATURES

Pursuant to the requirements of Section 13 of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

PARKERVISION, INC.

|

|

|

|

By:

|

/s/ Jeffrey L. Parker

|

|

|

|

|

Jeffrey L. Parker

|

|

|

|

|

Chief Executive Officer

|

|

Pursuant to the requirements of the Exchange Act, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jeffrey L. Parker

|

|

Chief Executive Officer and

|

|

April 27, 2016

|

|

|

Jeffrey L. Parker

|

|

Chairman of the Board (Principal

|

|

|

|

|

|

|

Executive Officer)

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Cynthia L. Poehlman

|

|

Chief Financial Officer (Principal

|

|

April 27, 2016

|

|

|

Cynthia L. Poehlman

|

|

Financial Officer and Principal

|

|

|

|

|

|

|

Accounting Officer) and Corporate

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David F. Sorrells

|

|

Chief Technology Officer

|

|

April 27, 2016

|

|

|

David F. Sorrells

|

|

and Director

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ William A. Hightower

|

|

Director

|

|

April 27, 2016

|

|

|

William A. Hightower

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ John Metcalf

|

|

Director

|

|

April 27, 2016

|

|

|

John Metcalf

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Robert G. Sterne

|

|

Director

|

|

April 27, 2016

|

|

|

Robert G. Sterne

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Nam P. Suh

|

|

Director

|

|

April 27, 2016

|

|

|

Nam P. Suh

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Papken S. der Torossian

|

|

Director

|

|

April 27, 2016

|

|

|

Papken S. der Torossian

|

|

|

|

|

EXHIBIT INDEX

|

31.1

|

Rule 13a-14 and 15d-14 Certification of Jeffrey L. Parker

|

|

|

|

|

31.2

|

Rule 13a-14 and 15d-14 Certification of Cynthia L. Poehlman

|

|

|

|

|

32.1

|

Section 1350 Certification of Jeffrey L. Parker and Cynthia L. Poehlman

|

22

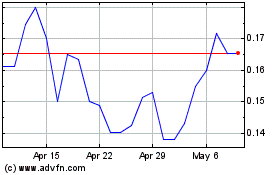

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Apr 2023 to Apr 2024