Pittsburgh Corning Exits Bankruptcy After 16 Years

April 27 2016 - 9:29AM

Dow Jones News

By Patrick Fitzgerald

After more than 16 years under court protection, Pittsburgh

Corning Corp., the joint venture between PPG Industries Inc. and

Corning Inc., emerged from its asbestos-related bankruptcy

Wednesday.

The Pittsburgh Corning plan channels claims against the

company's non-bankrupt parents to a $3.5 billion trust that was set

up under the plan to absorb asbestos liabilities. The trust, one of

the country's largest, is being funded by PPG, Corning and their

insurers.

Pittsburgh Corning, a maker of glass-based insulation materials

used in construction and oil and gas pipelines, spent the first

five years in bankruptcy on protecting and preserving its

assets.

"When it became apparent that Pittsburgh Corning's time in

bankruptcy was going to be extended, our focus expanded to include

strategic actions designed to reinvent our business," said James R.

Kane, the company's chief executive.

Pittsburgh Corning is one of many large companies attempting to

use bankruptcy to survive an onslaught of claims for asbestos

damage. The bankruptcy code allows companies to set up trust funds

to pay claims, insulating their future operating funds from

potential liabilities.

The trust resolves all of the Pittsburgh Corning's asbestos

personal injury claims, including those filed in the future.

In 2002, PPG agreed to pay $2.7 billion to resolve all of its

asbestos-related personal-injury litigation through Pittsburgh

Corning's bankruptcy proceedings. About a year later, Corning

reached a deal to settle all asbestos claims against Corning and

Pittsburgh Corning.

In 2013, U.S. Bankruptcy Court Judge Judith Fitzgerald confirmed

Pittsburgh Corning's bankruptcy plan. Judge Fitzgerald had rejected

an earlier version of the plan because it improperly extended

protection from liability to the company's corporate parents.

Founded in 1937, Pittsburgh Corning made pipe insulation

containing asbestos from 1962 to 1972. In April 2000, the company

filed for chapter 11 bankruptcy protection, when it became apparent

that defending and settling an additional 235,000 claims would

exhaust its resources before they could be resolved.

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

(END) Dow Jones Newswires

April 27, 2016 09:14 ET (13:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

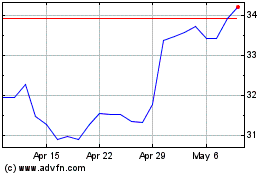

Corning (NYSE:GLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

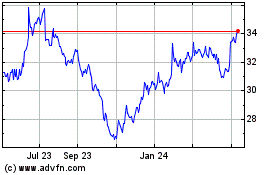

Corning (NYSE:GLW)

Historical Stock Chart

From Apr 2023 to Apr 2024