GlaxoSmithKline Sees First-Quarter Profit Fall

April 27 2016 - 8:20AM

Dow Jones News

LONDON—GlaxoSmithKline PLC said net profit fell in the first

quarter of 2016, due to a tough year-earlier comparison which was

boosted by proceeds from its three-way transaction with Novartis

AG, without that effect, profit rose on cost savings from the same

deal.

The U.K.-based pharmaceuticals company said net income for the

three months ended March 31 was £ 282 million ($410 million), a

fraction of the £ 8.1 billion reported a year earlier.

Core net income, which strips out one-time gains and

impairments, increased 15% to £ 959 million, from £ 834 million a

year ago. Revenue rose 11% to £ 6.2 billion, up from £ 5.6 billion

a year ago. Glaxo beat expectations on both fronts: analysts were

expecting core net income of £ 894 million and revenue of £ 6

billion.

Core earnings per share, Glaxo's preferred measure of profit,

increased 14% to 19.8 pence. The weakness of the pound versus the

dollar boosted Glaxo's results—stripping out exchange rate

movements, revenue and core earnings per share increased 8%.

Glaxo also provided more clarity on its 2016 outlook, saying it

expected core earnings per share to grow 10%-12% at constant

exchange rates. Previously, it had guided for a double-digit

increase. The company also confirmed plans to pay a full-year

dividend of 80p.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

April 27, 2016 08:05 ET (12:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

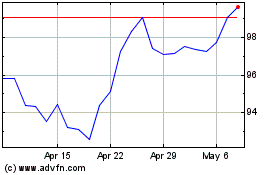

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

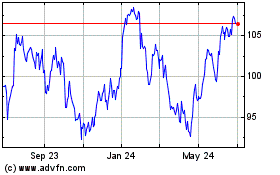

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024