Airbus Gains New Financing Ally in U.S.

April 24 2016 - 9:10PM

Dow Jones News

Airbus Group SE will open itself up to financing from an

unlikely source when the first jet is delivered Monday from its new

factory in Alabama: the U.S. Export-Import Bank.

The government-owned bank's guarantees have helped finance

hundreds of Boeing Co. jets over the years. Airbus has used similar

European agencies to help its sales, but now building aircraft in

the U.S. will allow some of the European plane maker's customers to

tap Ex-Im for the first time.

The first aircraft delivered from the new Airbus plant in Mobile

are destined for JetBlue Airways Corp. and American Airlines Group

Inc., which like other U.S. carriers are barred from receiving

European export-credit support because of global trade rules.

But Airbus hasn't ruled out using the factory to build planes

for export, and those sales would be eligible for U.S. help.

"If an Airbus plane from Mobile had 50% U.S. content, we'd

finance 50%," Fred Hochberg, Ex-Im's chairman, said in an

interview.

Airbus said for now all its jet deliveries from Mobile are to

North American customers. "If we were to sell a Mobile-assembled

aircraft to an international carrier, it could be eligible for some

level of Exim financing," an Airbus spokeswoman said.

Building jetliners in Boeing's backyard is Airbus's

highest-profile move yet to bolster its presence in the U.S. The

plane maker is betting its jetliner business with U.S. carriers

will benefit from a domestic presence.

Airbus has invested around $600 million in the new factory,

which is expected to produce four of its single-aisle jets a month

by the end of 2017. The company opened a similar facility in

Tianjin, China, in 2008.

A side benefit could be access to U.S. government financing.

Boeing has led a lobbying battle to keep Ex-Im open, claiming it

is at a competitive disadvantage to Airbus without access to

comparable U.S. financing. Despite the bank's reopening in December

after a six-month closure, Boeing's customers are still stymied by

an on-going political fight that has left the bank unable to

approve deals over $10 million.

"It's premature to speculate on the hypothetical," use of the

bank by Airbus, said a Boeing spokesman.

Critics of the bank said any move by the bank to back Airbus

sales could backfire.

"Certainly, lawmakers are going to be asking, 'What in the world

is going on?' " said Dan Holler at Heritage Action for America, a

conservative-leaning think tank.

During the height of the financial crisis, export-credit

agencies backed as much as 30% of plane deliveries. The total has

retreated to less than 10% last year as commercial lending has

become easily available.

Mr. Hochberg said that even though the use of Ex-Im for aircraft

deals has shrunk in recent years, its value rises when alternatives

dry up.

Aerospace accounted for almost half of Ex-Im's business in

fiscal 2015, and Mr. Hochberg has steered it into other areas

including satellites, rocket launches and business jets.

The next step is to expand its role in aircraft services. Ex-Im

has held talks with Gogo Inc. about supporting the Chicago-based

onboard Wi-Fi provider's sales to overseas airlines.

"An Ex-Im guarantee goes a long way," said Varvara Alva, Gogo's

treasurer.

Ex-Im is considering providing financing support for airplane

repairs such as work Deutsche Lufthansa AG's technical unit

undertakes in Puerto Rico. Lufthansa said the offer is of interest,

though not applicable immediately since the work it currently

performs there is for U.S. airlines.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

April 24, 2016 20:55 ET (00:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

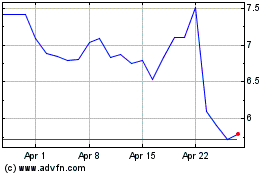

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

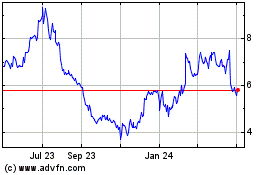

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024