SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of April 2016

Commission File Number: 001-35052

Adecoagro

S.A.

(Translation of registrant’s name

into English)

Vertigo Naos Building 6,

Rue Eugene Ruppert,

L-2453, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form

40-F

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

¨

No

x

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes

¨

No

x

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

Yes

¨

No

x

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b):

N/A

EXPLANATORY NOTE

This Report of Foreign Private Issuer on Form 6-K (this

“Form 6-K”) is being filed by Adecoagro S.A. “Adecoagro” or the “Company”) with the

Securities and Exchange Commission (the “SEC”) and is incorporated by reference into (1) the Company’s

Registration Statement on Form F-3 filed with the SEC on December 6, 2013 (File No. 333-191325) (the “Registration

Statement”) and (2) The Prospectus Supplement dated March 21, 2016 relating to the Registration Statement filed on

March 22, 2016 under Rule 424(b)(7), and will be deemed to be a part thereof from the date on which this Form 6-K is filed

with the SEC, to the extent not superseded by documents or reports subsequently filed or furnished.

Forward-Looking Statements

The attached press release includes forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking

statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,”

“estimate,” “believe,” “continue,” “could,” “intend,” “may,”

“plan,” “potential,” “predict,” “should,” “will,” “expect,”

“objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,”

“effort,” “target” or the negative of these terms or other comparable terms. However, the absence of these

words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions

and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future

developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject

to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements

to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such

forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, those

discussed in our filings with the SEC and the following:(i) the company’s business prospects and future results of operations;

(ii) weather and other natural phenomena; (iii) developments in, or changes to, the laws, regulations and governmental

policies governing the company’s business, including limitations on ownership of farmland by foreign entities in certain

jurisdictions in which the company operates, environmental laws and regulations; (iv) the implementation of the company’s

business strategy, including its development of the Ivinhema mill and other current projects; (v) the company’s plans

relating to acquisitions, joint ventures, strategic alliances or divestitures; (vi) the implementation of the company’s

financing strategy and capital expenditure plan; (vii) the maintenance of the company’s relationships with customers;

(viii) the competitive nature of the industries in which the company operates; (ix) the cost and availability of financing;

(x) future demand for the commodities the company produces; (xi) international prices for commodities; (xii) the

condition of the company’s land holdings; (xiii) the development of the logistics and infrastructure for transportation

of the company’s products in the countries where it operates; (xiv) the performance of the South American and world

economies; and (xv) the relative value of the Brazilian Real, the Argentine Peso, and the Uruguayan Peso compared to other

currencies; as well as other risks included in the company’s filings and submissions with the SEC. All forward-looking statements

set forth in the attached press release are qualified by these cautionary statements and there can be no assurance that the actual

results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected

consequences to or effects on us or our business or operations. Forward-looking statements set forth in the attached press release

speak only as of the date hereof and we do not undertake any obligation to update forward-looking statements to reflect subsequent

events or circumstances, changes in expectations or the occurrence of unanticipated events.

Adecoagro S.A.

TABLE OF CONTENTS

Item

1.

Summary

of the Resolution approved by the Annual General Shareholders’ Meeting held on April 20, 2016 on the Election of

Members to the Board of Directors of the Company

.

2.

Summary of the Resolutions approved by the Extraordinary General Shareholders’ Meeting held on April 20, 2016

ADECOAGRO S.A.

Item 1. Summary of the Resolution

approved by the Annual

General Shareholders’ Meeting

held on April 20, 2016 on the Election of Members to the Board of Directors of the Company

Election

of the following members of the Board of Directors: (i) Mr. Alan Leland Boyce and Mr. Andres Velasco Brañes for a term of three

(3) years each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2019; and (ii)

Mr. Marcelo Vieira and Mr. Walter Marcelo Sanchez for a term of one (1) year each, for a term ending the date of the Annual General

Meeting of Shareholders of the Company to be held in year 2017.

Item 2. Summary of the Resolutions

approved by the Extraordinary

General Shareholders’ Meeting

held on April 20, 2016

(1)

Renewal

of Authorised Un-Issued Share capital

Renewal of the authorised un-issued share

capital of the Company of three billion US Dollars (USD3,000,000,000) consisting in two billion (2,000,000,000) of shares, each

with a nominal value of one US Dollars and fifty cents (USD1.5); renewal of the waiver of and agreement to the suppression or restriction

of any pre-emptive right or preferential subscription right, renewal of the authorisation granted to the board of directors of

the Company (the "Board of Directors") to proceed to the issue of shares (or any securities or rights exchangeable for,

convertible into, or giving subscription or like rights to, shares) within the authorised (unissued) share capital against contributions

in cash, in kind or by way of incorporation of available premium or reserves or otherwise pursuant to the terms and conditions

determined by the Board of Directors or its delegate(s) (including issue price or any terms or circumstances) while waiving, suppressing

or limiting any pre-emptive subscription rights as provided for under Luxembourg law (and any related procedure) in the case of

issues of shares within the authorised (unissued) share capital; acknowledgement and approval of the report of the Board of

Directors

made in accordance with article 32-3 (5) of the law of 10th August 1915 on commercial companies (as amended) (the "Law")

regarding pre-emptive or subscription rights and the related waivers and authorisations; determination of validity of the renewed

authorised (unissued) share capital and related waiver and authorisation to the Board of Directors for a period starting on the

day of the present meeting and ending on the 5th anniversary of the day of the publication of the minutes of the present meeting

in the Memorial.

(2)

Renewal

of the authorisation granted to the Company, and/or any wholly-owned subsidiary (and/or any person acting on their behalf), to

purchase, acquire, receive or hold shares in the Company

.

Renewal of the authorisation under article

49-2 of the Luxembourg law of August 10, 1915, granted to the Company, and/or any wholly-owned subsidiary (and/or any person acting

on their behalf), to from time to time purchase, acquire, receive or hold shares in the Company up to twenty per cent (20 %) of

the issued share capital, on such terms as referred to below and as shall further be determined by the Board of Directors of the

Company, such authorisation being granted for another period of 5 years.

Acquisitions may be made in any manner

including without limitation, by tender or other offer(s), buy back program(s), over the stock exchange or in privately negotiated

transactions or in any other manner as determined by the Board of Directors (including derivative transactions or transactions

having the same or similar economic effect than an acquisition).

In the case of acquisitions for value:

|

|

(i)

|

in the case of acquisitions other than in the circumstances set forth under (ii), for a net purchase

price being (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock

price, in each case being the closing price, as reported by the New York City edition of the Wall Street Journal, or, if not reported

therein, any other authoritative source to be selected by the Board of Directors of the Company (the "Closing Price"),

over the ten (10) trading days preceding the date of the purchase (or as the case may be the date of the commitment to the transaction);

|

|

|

(ii)

|

in case of a tender offer (or if deemed appropriate by the Board of

|

|

|

|

Directors, a buy back program),

|

(a) in

case of a formal offer being published, for a set net purchase price or a purchase price range, each time within the following

parameters: (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock

price, in each case being the Closing Price over the ten (10) trading days preceding the publication date, provided however that

if the stock exchange price during the offer period fluctuates by more than 10 %, the Board of Directors may adjust the offer price

or range to such fluctuations;

(b) in

case a public request for sell offers is made, a price range may be set (and revised by the Board of Directors as deemed appropriate)

provided that acquisitions may be made at a price which is no less than (x) fifty per cent of the lowest stock price and (y) no

more than fifty per cent above the highest stock price, in each case being the Closing Price over a period determined by the Board

of Directors provided that such period may not start more than five (5) trading days before the sell offer start date of the relevant

offer and may not end after the last day of the relevant sell offer period;

(3)

Consequential

amendment of article 5.1.1 of the articles of incorporation of the Company as follows:

“5.1.1.

The Company has an

authorized share capital of three billion US Dollars (USD3,000,000,000), including the issued share capital, represented by two

billion (2,000,000,000) shares, each with a nominal value of one US Dollar and fifty cents (USD1.5) The Company's share capital

(and any authorization granted to the Board of Directors in relation thereto) shall be valid from 20th April 2016 and until the

fifth anniversary of publication in the Memorial of the deed of the extraordinary General Shareholder's Meeting held on 20th April

2016. The Board of Directors, or any delegate(s) duly appointed by the Board of Directors, may from time to time issue shares within

the limits of the authorized share capital against contributions in cash, contributions in kind or by way of incorporation of available

reserves at such times and on such terms and conditions, including the issue price, as the Board of Directors or its delegate(s)

may in

its or their discretion resolve and the

General Shareholder's Meeting waived and has authorized the Board of Directors to waive, suppress or limit any pre-emptive subscription

rights of shareholders provided for by law to the extent it deems such waiver, suppression or limitation advisable for any issue

or issues of shares within the authorized share capital.”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Adecoagro S.A.

|

|

|

|

|

|

Date: April 22, 2016

|

By:

|

/s/ Carlos Boero Hughes

|

|

|

Name:

|

Carlos Boero Hughes

|

|

|

Title:

|

Chief Financial Officer

|

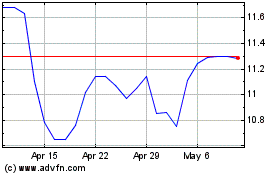

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Apr 2023 to Apr 2024