Makers of Building Supplies See Gains in Demand

April 21 2016 - 6:50PM

Dow Jones News

A mild winter and a rejuvenated U.S. construction industry are

fueling a growth spurt for makers of household paint, drywall

sheeting and other building supplies.

Paint maker Sherwin-Williams Co. on Thursday raised its

full-year profit guidance and other companies described favorable

conditions after contractors in the Northeast and Midwest were able

to start outdoor work earlier than usual.

"They are very bullish about the paint season," Sherwin-Williams

Chief Executive John Morikis said on an investor call after

reporting forecast-beating first quarter profits.

The Cleveland-based paint manufacturer reported an 11% increase

in first-quarter revenue from its network of paint stores, which

mainly serve professional painters, and a 44% improvement in profit

from the stores. The company is in the process of acquiring rival

Valspar Corp. for more than $9 billion.

The Commerce Department said U.S. housing starts in March were

up 14.2% from a year earlier, although they fell 8.8% from February

to their lowest rate since October.

Paint maker PPG Industries Inc., which derives about 15% of its

annual sales from paint for buildings in the U.S. and Canada, also

described improving conditions.

"Certainly, this is going to be a better start to paint season

than last year," CEO Michael McGarry told analysts.

Meanwhile, at USG Corp., the maker of Sheetrock gypsum drywall

and grid ceiling tiles, CEO James Metcalf described the first

quarter as "the best quarter we've had in almost a decade." Net

income rose by nearly threefold to $67 million and sales increased

7% to $970 million on the strength of 20% increase in wallboard

volume.

Chicago-based USG wrestled for years with excess production

capacity and low market prices when housing construction failed to

rebound after the 2008 recession. In addition to cutting expenses

and shutting plants, the company doubled down on product

development, introducing lighter-weight sheets of drywall that are

easier for installers to carry. The sheets fetched higher prices

for USG, even as low housing volumes kept a lid on USG's sales.

"The market isn't as strong as it was nine years ago. We just

figured out how to get better results on lower demand," said Mr.

Metcalf in an interview.

Illinois Tool Works Inc. managed to boost the first-quarter

operating margin from its construction products business to 21%

from 17% last year, despite logging just a 1% increase in sales.

The Glenview, Ill., company supplies screws, fasteners, nail guns

and other items to big box home improvement retailers and

industrial supply distributors.

CEO Scott Santi though cautioned against interpreting the

first-quarter results as the start of a sustained upturn in the

construction business. The warm weather may have moved up the start

of some planned work that would have just started later

otherwise.

"There's really no way to factor weather in," he told analysts

this week. "We certainly exited the quarter in pretty good shape.

We're not seeing anything slow down."

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

April 21, 2016 18:35 ET (22:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

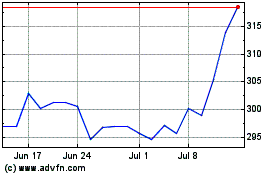

Sherwin Williams (NYSE:SHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

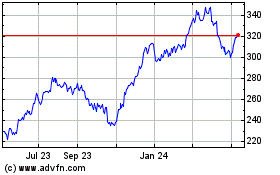

Sherwin Williams (NYSE:SHW)

Historical Stock Chart

From Apr 2023 to Apr 2024