AllianzGI Diversified Income & Convertible Fund Announces the Conclusion of its Common Share Repurchase Plan

April 21 2016 - 4:00PM

Business Wire

AllianzGI Diversified Income & Convertible Fund (NYSE:ACV)

(the “Fund”) today announced the conclusion of a Repurchase Plan

(the “Plan”) with respect to the Fund’s common shares that had been

implemented for a defined period following the Fund’s initial

public offering. The Plan was implemented, in part, in an attempt

to provide additional liquidity in the marketplace for the common

shares and to potentially reduce declines in the market price of

the common shares in comparison to their net asset value

(“NAV”).

Generally, under the terms of the Plan, the Fund has repurchased

its common shares on the open market on any trading day when its

common shares were trading at a discount of 2% or more from their

closing NAV on the prior trading day and subject to other

conditions, in an amount equal to the lesser of $125,000 or the

maximum number of shares that it could purchase under applicable

regulations (generally, 25% of the average trading volume of the

shares over the trailing four week period). Pursuant to the terms

of the Plan, the repurchase period commenced on September 4, 2015

(the 61st day following the date on which the over-allotment period

following the Fund’s initial public offering ended) and concluded

on April 21, 2016, 230 days after the commencement of the Plan. The

Fund has determined not to continue the Plan or to implement

another common share repurchase plan at this time.

The Fund is a closed-end management investment company. The

Fund’s investment objective is to provide total return through a

combination of current income and capital appreciation, while

seeking to provide downside protection against capital loss. There

can be no assurance that the Fund will achieve its stated

objective. As with any stock, the price of the Fund’s common shares

will fluctuate with market conditions and other factors. If you

sell your common shares, the price received may be more or less

than your original investment. Shares of closed-end management

investment companies, such as the Fund, frequently trade at a

discount from their NAV.

Allianz Global Investors Fund Management LLC (“AGIFM”), an

indirect, wholly-owned subsidiary of Allianz Asset Management of

America, L.P., serves as the Fund’s investment manager and is a

member of Munich-based Allianz Group. Allianz Global Investors U.S.

LLC, an AGIFM affiliate, serves as the Fund’s sub-adviser.

The Fund’s daily New York Stock Exchange closing market prices,

net asset values per share, as well as other information, including

updated portfolio statistics and performance are available at

us.allianzgi.com/closedendfunds or by calling the Fund’s

shareholder servicing agent at (800) 254-5197.

Statements made in this release that look forward in time

involve risks and uncertainties and are forward looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such risks and uncertainties include, without limitation,

the adverse effect from a decline in the securities markets or a

decline in the Fund’s performance, a general downturn in the

economy, competition from other companies, changes in government

policy or regulation, inability to attract or retain key employees,

inability to implement its operating strategy and/or acquisition

strategy, and unforeseen costs and other effects related to legal

proceedings or investigations of governmental and self-regulatory

organizations. The Fund’s ability to pay dividends to common

shareholders is subject to the restrictions in its registration

statement, by-laws and other governing documents, as well as the

Investment Company Act of 1940.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160421006040/en/

For information on Allianz Closed-End

Funds:Financial Advisors: 800-926-4456Shareholders:

800-254-5197Media Relations: 212-739-3501

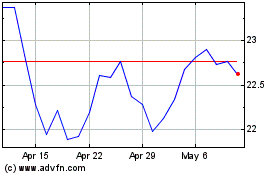

Virtus Diversified Incom... (NYSE:ACV)

Historical Stock Chart

From Mar 2024 to Apr 2024

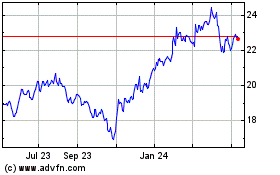

Virtus Diversified Incom... (NYSE:ACV)

Historical Stock Chart

From Apr 2023 to Apr 2024