Novartis Earnings Fall on Slide in Cancer-Drug Sales --Update

April 21 2016 - 3:50AM

Dow Jones News

By Denise Roland

Novartis AG said earnings fell in the first quarter of the year,

as the company plowed investment into new drug launches to offset a

sharp dip in sales of the company's blockbuster cancer medicine

Gleevec, after a cheaper version of the drug launched in

February.

Basel, Switzerland-based Novartis said net income for the three

months ended March 31 was $2 billion, a fraction of the $13 billion

reported a year earlier, when profit was boosted by a $12.8 billion

gain from the sale of businesses to GlaxoSmithKline PLC and Eli

Lilly and Co.

The drugs company confirmed its outlook for 2016 growth, saying

it still expected revenue and core operating income to be broadly

in line with 2015.

Revenue slipped 3% to $11.6 billion from $11.9 billion a year

earlier, missing analyst expectations of $11.89 billion. Core net

income, which strips out one-time impairments or gains, fell 13% to

$2.8 billion. That beat the $2.68 billion expected by analysts.

Stripping out the effect of the strong dollar, sales were up 1% and

core net income fell 6%.

Novartis is leaning heavily on new drugs to offset declining

revenue from Gleevec, which fell 22% to $834 million, now that a

cheaper generic version of the medicine is available. The company

said it increased spending on marketing and sales by 1.1 percentage

point to 23.6% of sales to promote its newer drugs. It said revenue

from those so-called growth products increased 24% in the quarter

to $3.9 billion.

Still, sales of one of Novartis' most important drug launches,

Entresto for heart failure, were still "modest" in the first

quarter, at $17 million. The drug has so far proved a

disappointment, as a result of doctors' hesitation to switch stable

patients onto a new medicine and delays in securing reimbursement

from cost-conscious health insurers in the U.S. But the company

said it expected the drug to generate $200 million in revenue this

year, now that it has broader insurance coverage in the U.S. and

the company has deployed a larger sales force.

Another key drug, Cosentyx for psoriasis, has had a stronger

start. Revenue from that drug was $176 million. Novartis said

growth accelerated in the first quarter due to additional approvals

in rheumatic conditions.

Novartis' earnings also took a hit from increased investment

into its ailing eyecare unit Alcon, which is in the early stages of

an turnaround announced earlier this year. The company said its

growth plan for Alcon, which sells items such as contact lenses and

lens implants, was "on track." Revenue from the unit fell 3% to

$1.4 billion at constant currencies, due to competition for its

contact lenses and a slowdown in sales of cataract equipment.

Sandoz, the company's generic drug unit, notched revenue of $2.4

billion in the first quarter, up 4% at constant currencies, as

volume growth of 11 percentage points more than offset 7 percentage

points of price erosion.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

April 21, 2016 03:35 ET (07:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

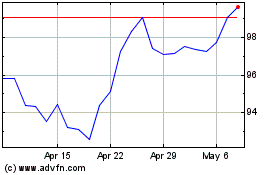

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

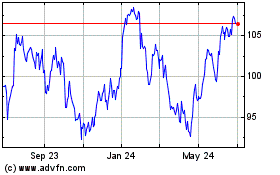

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024