Coke Profit and Revenue Fall as Volume Is Flat--2nd Update

April 20 2016 - 11:28AM

Dow Jones News

By Anne Steele

Coca-Cola Co. on Wednesday said revenue and profit declined in

its latest quarter as soda volume was flat amid weakness

abroad.

Shares, up 13% over the past three months, fell 1.8% premarket

to $45.77, although results edged in just above Wall Street's

expectations.

Coke has been struggling with weakness overseas, with key

countries such as Russia and Brazil in recession, consumer demand

weak in Europe and Japan, and China's economy slowing. Weakening

foreign currencies also are hitting Coke, which generates about

half its sales abroad but translates results into dollars.

The company has been able to offset that in part by raising

prices and steering consumers to smaller packages that cost more

per ounce in its U.S. market.

For the first quarter, Coke reported that its beverage volumes

grew 2% both world-wide and in its key North American market.

Chief Executive Muhtar Kent said amid a "challenging global

macro environment," the company delivered "positive top-line growth

and strong underlying margin expansion."

"We are confident that we have the right strategies in place to

achieve our full-year outlook," he said.

Noncarbonated drinks, which include tea, packaged water and

sports drinks, continued to log strong growth at 7%, driven by

solid volume across all key categories except for juice and juice

drinks which declined slightly. Soda volumes were even in the

quarter globally, and in North America, where growth in Sprite,

Fanta and energy drinks was offset by a decline in the namesake

Coca-Cola brand.

Overall, Coke posted a profit of $1.48 billion, or 34 cents a

share, down from $1.56 billion, or 35 cents a share, a year

earlier.

Excluding certain items, per-share earnings were 45 cents,

edging in above the 44 cents analysts polled by Thomson Reuters had

forecast.

The company said foreign exchange shaved 12 percentage points

off its per-share earnings in the quarter.

Revenue fell 4% to $10.28 billion. Analysts polled by Thomson

Reuters had forecast revenue of $10.27 billion. The top line was

hurt by one less day compared with the prior-year period.

Also Wednesday, Coke, which has been accelerating the

restructuring of its North American operations, outlined more

changes to its bottling network.

Ulysses "Junior" Bridgeman, a former NBA player and founder of

Manna Inc., signed a letter of intent to buy territory from Coke in

Missouri, Illinois, Kansas and Nebraska. He will also acquire a

production facility in Lenexa, Kan. Bedford, N.H.-based Coca-Cola

of Northern New England will take on additional territory from the

company throughout New England, acquiring production facilities in

Needham Heights, Mass., and Hartford.

The company also said bottlers in Mississippi and Colorado would

expand their operations and bottlers in Florida and Chicago would

acquire a total of 10 production facilities. Coke also said it

plans to grant additional territory rights in Albuquerque, N.M., to

Swire Coca-Cola USA.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 20, 2016 11:13 ET (15:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

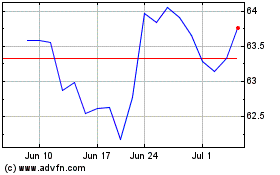

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024