U.S. Hot Stocks: Hot Stocks to Watch

April 20 2016 - 9:45AM

Dow Jones News

Among the companies with shares expected to trade actively in

Wednesday's session are EMC Corp. (EMC), Coca-Cola Co. (KO) and

U.S. Bancorp (USB).

EMC Corp., in the process of being taken private by Dell Inc.,

logged disappointing results in its latest quarter amid an excess

of unfilled orders. Shares rose 2.74% to $26.25 in premarket

trading.

Coca-Cola Co. on Tuesday said revenue and profit declined in its

latest quarter as soda volume was flat amid weakness abroad. Shares

fell 1.55% to $45.88 premarket.

U.S. Bancorp said profit in its latest quarter slipped as the

lender set aside more reserves to cover potential energy loan

losses and booked sharply lower mortgage-banking revenue amid

heightened competition. Shares fell 0.02% to $41.90 premarket.

Dish Network Corp. (DISH) posted surprise profit growth in the

first-quarter, even as revenue grew less than expected and

subscribership declined. Shares rose 2.49% to $48.50 premarket.

St. Jude Medical Inc. (STJ) on Wednesday raised its profit

forecast for 2016 and offered an upbeat view on the current

quarter, as the company reported revenue and earnings that topped

expectations. Shares rose 1.54% to $59.50 premarket.

Hansen Medical Inc. (HNSN) agreed to be acquired by Auris

Surgical Robotics Inc. in a deal with an equity value of roughly

$80 million.

Angie's List (ANGI) swung to an unexpected loss in the first

quarter, hurt by higher spending as the company works to overhaul

its business to a "freemium" model.

Barrett Business Services Inc. (BBSI) said that a forensic

accounting probe concluded that some expenses were shifted between

periods but there was no cumulative effect on pretax income, net

income or earnings per share. The company had said in November that

its workers compensation reserve for the June 2014 quarter was

being reviewed.

Discover Financial Services (DFS) topped first-quarter

expectations as the lender made good on its vow to accelerate loan

growth.

Google Chief Executive Sundar Pichai made $100.5 million in

total compensation in 2015, making him one of the world's

highest-paid executives, while parent company Alphabet Inc. (GOOG)

Executive Chairman Eric E. Schmidt's compensation dropped sharply

to $8 million, according to a regulatory filing. Mr. Schmidt, who

last year received $100.4 million in stock awards, didn't get any

stock awards this year.

Global Payments Inc. (GPN), a processor of credit- and

debit-card payments, will replace GameStop Corp. (GME) in the

S&P 500 index after the close of trading Friday.

Intel Corp. (INTC) plans to cut its global workforce by up to

12,000, or 11%, as the semiconductor giant transitions away from

its computer chips focus. Intel announced the job cuts Tuesday

along with a planned move of its chief financial officer to a new

role overseeing sales, manufacturing and operations and

first-quarter results, which included a lackluster 7.2% increase in

revenue.

Interactive Brokers Group Inc. (IBKR) on Tuesday reported

better-than-expected results for its fiscal first quarter as the

electronic broker benefited from an increase in commission and

execution fees.

Intuitive Surgical Inc.'s (ISRG) fourth-quarter profit rose 41%

amid increased use of its robotic-assisted systems for minimally

invasive surgery.

Lexmark International Inc. (LXK) agreed to be sold to a group of

buyers including China-based Apex Technology Co. and Asia-focused

PAG Asia Capital for $2.54 billion.

Linear Technology Corp. (LLTC) on Tuesday reported lower profit

and revenue in the March quarter amid a weak economic climate but

said that it is seeing signs of improvement.

VMware Inc. (VMW) on Tuesday posted better-than-expected

adjusted profit for its latest quarter and said it plans to buy

back $1.2 billion of its stock by the end of this year.

Yahoo Inc. (YHOO) on Tuesday reported revenue in the March

quarter dropped 18% to $859.4 million, excluding commissions paid

to search partners, the first time that figure has fallen below $1

billion since Chief Executive Marissa Mayer took the reins nearly

four years ago.

Write to Chris Wack at chris.wack@wsj.com or Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

April 20, 2016 09:30 ET (13:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

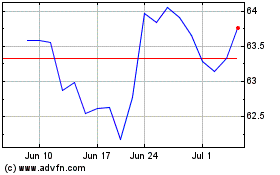

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024