UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section

14(c)

of the Securities Exchange Act of 1934

|

|

|

|

Check the appropriate box:

|

|

|

|

x

|

Preliminary Information Statement

|

|

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

¨

|

Definitive Information Statement

|

|

|

|

|

|

SMARTMETRIC, INC.

|

|

|

(Name of Registrant As Specified In Its Charter)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

x

|

No fee required

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

SMARTMETRIC, INC.

NOTICE OF ACTION TAKEN BY WRITTEN CONSENT

OF THE MAJORITY SHAREHOLDERS IN LIEU

OF A MEETING

To the Shareholders of

SmartMetric, Inc.

We are writing to

inform you that on March 31, 2016, shareholders holding a majority of the voting power of our common stock, par value $0.001 per

share (“

Common Stock

”) and Series B Preferred Stock, voting together as a single class, executed a written consent

in lieu of a shareholder meeting, which we refer to herein as the “

Written Consent,

” to approve the following

proposals (each, a “

Proposal

”):

|

|

1.

|

To re-elect to the three (3) director nominees named in the Proxy to hold office until the next

annual meeting of stockholders;

|

|

|

2.

|

To ratify the appointment of Daszkal Bolton LLP as the Company’s independent auditor for

the fiscal year ending June 30, 2016;

|

|

|

3.

|

To approve an amendment to our Articles of Incorporation, as amended, to increase our authorized

capital stock (“Authorized Capital”) to increase the number of shares of authorized Common Stock to 300,000,000 from

200,000,000;

|

|

|

4.

|

To approve, on

an advisory basis, the compensation of the Company’s named executive officers

; and

|

|

|

5.

|

To recommend,

on an advisory basis, a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive

officer compensation.

|

The Proposals are

more fully described in the accompanying Information Statement. The Written Consent was taken pursuant to Section 78.320

of the Nevada Revised Statutes and our bylaws, each of which permits that any action which may be taken at a meeting of the shareholders

may also be taken by the written consent of the holders of the numbers of Common Stock, required to approve the action at a meeting.

The accompanying Information Statement is being furnished to all our shareholders in accordance with Section 14(c) of the Securities

Exchange Act of 1934, as amended (the “

Exchange Act

”), and the rules promulgated by the U.S. Securities and

Exchange Commission (“

SEC

”) thereunder, solely for the purpose of informing out shareholders of the action taken

by the Written Consent before it becomes effective. Because we are incorporating certain information by reference, the actions

under the Written Consent cannot be taken or become effective sooner than twenty (20) business days after the Information Statement

is first sent or given to the Company’s shareholders. Because the accompanying Information Statement is first being

mailed to shareholders on [*], 2016, the Proposals described herein will become effective on or after [*], 2016 (the

“

Effective Date

”).

This is not a notice

of a special meeting of shareholders and no shareholder meeting will be held to consider any matter which is described herein.

THE ACCOMPANYING

INFORMATION STATEMENT IS BEGING MAILED TO SHAREHOLDERS ON OR ABOUT [*], 2016. WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

/s/ C. Hendrick

|

|

|

C. Hendrick, Chief Executive Officer

|

|

|

and Chairman

|

[*] __, 2016

SMARTMETRIC, INC.

101 Convention Center Drive

Las Vegas, NV 89109

(305) 495-7190

[*], 2016

INFORMATION STATEMENT

GENERAL INFORMATION

In this Information

Statement we refer to SmartMetric, Inc., a Nevada corporation, as the “Company,” “we,” “us,”

or “our.”

The Information Statement

is furnished in connection with an action by written consent (the “

Written Consent

”) of a shareholder of the

Company owning 58,627,778 shares of our common stock, par value $0.001 per share (“

Common Stock

”) and 410,000

shares of Series B Preferred Stock, representing, in the aggregate, approximately 56.4%, of the total voting power of our shareholders

(the “

Majority Shareholder

”). The actions taken by the Written Consent will not become effective until

at least twenty (20) business days after the Information Statement is sent or given to our shareholders in accordance with the

requirements of the rules of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”). The

close of business on March 31, 2016, the date that the Majority Shareholders gave their written consent, is the record date (the

“

Record Date

”) for the determination of shareholders entitled to notice of the action by the Written Consent.

Pursuant to the Written

Consent, the Majority Shareholder approved the following items (each, a “

Proposal

”):

|

|

1.

|

To re-elect to the three (3) director nominees named in the Proxy to hold office until the next

annual meeting of stockholders;

|

|

|

2.

|

To ratify the appointment of Daszkal Bolton LLP as the Company’s independent auditor for

the fiscal year ending June 30, 2016;

|

|

|

3.

|

To approve an amendment to our Articles of Incorporation, as amended, to increase our authorized

capital stock (“Authorized Capital”) to increase the number of shares of authorized Common Stock to 300,000,000 from

200,000,000;

|

|

|

4.

|

To approve, on an advisory basis, the compensation of the Company’s named executive officers;

and

|

|

|

5.

|

To recommend, on an advisory basis, a three-year frequency with which the Company should conduct

future stockholder advisory votes on named executive officer compensation.

|

Our Board of Directors unanimously approved

the Proposals on March 31, 2016. Also on March 31, 2016, the Board of Directors set the Record Date as March 31, 2016.

This Information Statement

contains a brief summary of the material aspects of each of the Proposals approved by the Board and the Majority Shareholder.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

ABOUT THE INFORMATION STATEMENT

What is the Purpose of the Information

Statement?

This Information Statement

is being furnished to you pursuant to Section 14 of the Exchange Act to notify our shareholders of certain corporate actions taken

by the Majority Shareholder pursuant to the Written Consent. In order to eliminate the costs and management time involved

in obtaining proxies and in order to effect the Proposals as early as possible to accomplish the purposes hereafter described,

the Board elected to seek the written consent of the Majority Shareholders to reduce the costs and implement the Proposals in a

timely manner.

Who is Entitled to Notice?

Each outstanding share

of Common Stock as of record on the Record Date will be entitled to notice of the actions to be taken pursuant to the Written Consent.

What Vote is Required to Approve

the Proposals?

The affirmative vote

of a majority of the voting power of the Common Stock and Series B Preferred Stock, voting together as a single class, outstanding

on the Record Date is required for approval of the Proposals. As of the Record Date, the Company had 197,447,416

shares of Common Stock and 410,000 shares of Series B Preferred Stock issued and outstanding. Each share of Common

Stock entitles its holder to one (1) vote on each matter submitted to the shareholders, and the Series B Preferred Stock entitles

the holder to 51% of the voting power of our shareholders on each matter submitted to the stockholders. However, because

the Majority Shareholder, holding a majority of the voting power of our outstanding Common Stock and Series B Preferred Stock,

voting together as a single class, as of the close of business on the Record Date, voted in favor of the Proposals, no other shareholder

consents will be obtained in connection with this Information Statement.

PROPOSAL NO. 1

RE-ELECTION OF THREE DIRECTORS

On March 31, 2016,

the Board authorized the re-election of the nominees (the “

Nominees

”) listed below to hold office until the

next annual meeting of stockholders and until their successors are duly elected and qualified, and on March 31, 2016 the Majority

Shareholder approved such re-election by way of the Written Consent. All the Nominees are currently serving as directors.

Information With Respect to Director

Nominees

Listed below are the

nominees for election to our Board with information showing the principal occupation or employment of the nominees for director,

the principal business of the corporation or other organization in which such occupation or employment is carried on, and such

nominees’ business experience during the past five years. Such information has been furnished to the Company by the director

nominees.

|

Name

|

|

Age

|

|

Position

|

|

C. Hendrick

|

|

59

|

|

President, Chairman of the Board, Chief Executive Officer

|

|

Jay M. Needelman, CPA

|

|

47

|

|

Chief Financial Officer, Director

|

|

Elizabeth Ryba

|

|

64

|

|

Director

|

C. HENDRICK

has been President,

Chief Executive Officer and Chairman of the Board of Directors of SmartMetric since the Company’s inception in 2002. C.

Hendrick has served as President and CEO of Smart Micro Chip, Inc., an Australian corporation from 2000 to 2002. From 1999 to 2001,

C. Hendrick was President and Chief Executive Officer of Smarticom Inc. and Fast Econ, Inc., Australian corporations. From 1994

to 1998, C. Hendrick served as executive officer of Applied Computing Science (Australia), an Australian company involved in e-commerce

systems, research and development. C. Hendrick attended Dandenong College in Australia.

JAY M. NEEDELMAN, CPA,

has

been the Chief Financial Officer for SmartMetric since July 2004. Mr. Needelman has over 23 years of experience in public

accounting. A 1991 graduate of Florida State University in Tallahassee, Fl, Mr. Needelman began his career in public

accounting in Miami, Fl, in 1991. After working for two different firms, Mr. Needelman founded his own firm in late

1992.

ELIZABETH RYBA

, has been a

director of SmartMetric since April 5, 2006. Ms. Ryba has over 17 years of experience in the credit card industry. She was a promotion

director at Hearst Publishing from 2002 through 2005. Between 2001 and 2004, Ms. Ryba was a consultant at Stratus Rewards Credit

Cards where she launched a Visa Luxury credit card where points were redeemable on private jets. Between 2000 and 2001, Ms. Ryba

worked as a Marketing Consultant for SpaFinder. In 1991 through 1999 Ms. Ryba worked at Master Card where she launched a SmartCard

in Australia Ms. Ryba received her M.S. in Marketing from the University of Illinois, and her B.A. in English from the State University

of New York at Stony Brook.

Family Relationships

There are no family

relationships among the Nominees or officers of the Company.

Director Experience

Our Board believes

that each of the Nominees should possess the highest personal and professional ethics, integrity and values, and be committed to

representing the long-term interests of the Company’s shareholders. When evaluating candidates for election to the Board,

the Board has sought candidates with certain qualities that it believes are important, including integrity, an objective perspective,

good judgment, and leadership skills. The Nominees are highly educated and have diverse backgrounds and talents and extensive track

records of success in what we believe are highly relevant positions.

Legal Proceedings

To our knowledge, during the last ten years,

none of the Nominees has:

|

·

|

Had

a bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either

at the time of the bankruptcy or within two years prior to that time.

|

|

·

|

Been convicted in a criminal proceeding

or been subject to a pending criminal proceeding, excluding traffic violations and other minor offenses.

|

|

·

|

Been subject to any order,

judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or

temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or

banking activities.

|

|

·

|

Been found by a court of

competent jurisdiction (in a civil action), the SEC, or the Commodities Futures Trading Commission to have violated a federal

or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

|

|

·

|

Been the subject to, or a party to,

any sanction or order, not subsequently reverse, suspended or vacated, of any self-regulatory organization, any

registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its

members or persons associated with a member.

|

Committees of the Board and Related

Matters

Our business, property and affairs are managed by or under the

direction of the board of directors. Members of the board are kept informed of our business through discussion with the chief executive

and financial officers and other officers, by reviewing materials provided to them and by participating at meetings of the board

and its committees. We have not previously had an audit committee, compensation committee or nominations and governance

committee. We anticipate that the board of directors will authorize the creation of such committees, in compliance with established

corporate governance requirements in the future.

Audit Committee

We have not yet appointed

an audit committee, and our Board currently acts as our audit committee. The Company intends to appoint an audit committee comprised

entirely of independent directors, including at least one financial expert, during its 2016 fiscal year.

Audit Committee Financial Expert

The Company does not

have an audit committee financial expert since the Board currently acts as the audit committee. While the Company believe that

the members of Board are collectively capable of analyzing and evaluating our financial statements and understanding internal controls

and procedures for financial reporting the Company is currently engaged in a search to identify a qualified individual who will

meet the definition of “audit committee financial expert as that term is defined by Item 407(d)(5) of Regulation S-K.

Compensation Committee

SmartMetric does not

presently have a Compensation Committee. Our Board currently acts as our Compensation Committee.

Compensation Committee Interlocks and Insider Participation

We do not currently

have a standing Compensation Committee. Our entire Board participated in deliberations concerning executive officer compensation.

None of our officers serve on the Board of any other entity whose executive officer serves on our Board.

Nominating Committee

SmartMetric does not

presently have a Nominating Committee. Our Board currently acts as our Nominating Committee.

Code of Ethics

The Company has adopted

a Code of Ethics that applies to its Chief Executive Officer and Chief Financial Officer. A copy of the Company’s code of

ethics is available to any person without charge upon written request to the Company at SmartMetric, Inc., 101 Convention Center

Drive, Las Vegas, NV, 89109. Attn: Secretary.

Compliance with Section 16(a) of

the Securities Act of 1934

Section 16(a) of the

Securities Exchange Act of 1934, as amended, requires our executive officers and directors and persons who own more than 10% of

a registered class of our equity securities to file with the Securities and Exchange Commission initial statements of beneficial

ownership, reports of changes in ownership and annual reports concerning their ownership of the our common stock and other equity

securities, on Form 3, 4 and 5 respectively. Executive officers, directors and greater than 10% shareholders are required by the

Securities and Exchange Commission regulations to furnish our company with copies of all Section 16(a) reports they file.

Based solely on our

review of the copies of such reports received by us, and on written representations by our officers and directors regarding their

compliance with the applicable reporting requirements under Section 16(a) of the Exchange Act, we believe that, with respect to

the fiscal year ended June 30, 2015, the following persons have not filed Form 3s: C. Hendrick, Jay Needelman and Elizabeth Ryba.

Executive Compensation

Summary Compensation Table

The table below sets forth, for the fiscal

years ended June 30, 2015 and 2014, the compensation earned by each person acting as our Chief Executive Officer and our next two

most highly compensated executive officers whose total annual compensation exceeded $100,000 in fiscal 2014 (together, the “Named

Executive Officers”).

Name and

Principal

Position

|

|

Fiscal

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)

|

|

|

Option

Awards

($)

|

|

|

Non-equity

Incentive Plan

Compensation

($)

|

|

|

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

C. Hendrick (President, Chief Executive

|

|

|

2015

|

|

|

$

|

190,000

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

190,000

|

|

|

Officer, Chairman of the Board) (1)

|

|

|

2014

|

|

|

$

|

190,000

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

190,000

|

|

|

(1)

|

C. Hendrick has been President, Chief Executive Officer and director of the Company since inception. C. Hendrick receives an annual salary of $190,000.

|

Outstanding Equity Awards at End of Fiscal Year Ending June

30, 2015

None.

Employment Agreements

On July 1, 2012, the

Company entered into an employment agreement (the “Agreement”) with C. Hendrick, the Company’s Chief Executive

Officer (“Executive”). Pursuant to the terms of the Agreement, the Company will employ Executive for a period of sixty

(60) months from the date of the Agreement. Thereafter the Agreement shall be renewed by the mutual written agreement of Company

and Executive. Executive is to receive an annual base salary of $190,000 per year. Executive is also entitled to receive a fee

equal to $50,000 per year beginning with the Company’s fiscal year ended June 30, 2012 and each fiscal year thereafter during

the term of the Agreement. The fee payment shall be made within thirty (30) days after the Company has manufactured its first product.

This fee shall increase by 25% per annum at the conclusion of each calendar year and shall be based on the continued manufacturing

and sales of products by the Company. Executive is entitled to participate in any and all benefit plans, from time to time, in

effect for senior management, along with vacation, sick and holiday pay in accordance with the Company’s policies established

and in effect from time to time. The Company shall provide Executive with the use of an automobile of Executive’s choice

at a purchase price not to exceed $60,000. Executive’s employment with the Company may be terminated at any time, with cause,

as such terms are defined in the Agreement. In the event that Executive’s employment is terminated by the Company, Company

shall pay to Executive an amount equal to the Executive’s base salary for the remaining period of the term of the Agreement

plus $350,000.

On September 30, 2015,

the Company and Executive entered into an Addendum to the Agreement (the “Addendum”) pursuant to which in consideration

for the issuance of 200,000 shares of the Company’s series B preferred stock (“Series B Shares”), the Executive

hereby grants the Company the first right to purchase or license any patents (the “Patent Option”) relating to “Smartcards”

which the Executive (i) shall apply for with the relevant patent authorities during the term of the Agreement, and (ii) are currently

applied for with the relevant patent authorities or pending as of the date hereof (the “Patent Rights”). In exchange

for the Patent Option the Company agrees, during the term of the Agreement, to pay for any fees and/or expenses related to the

application for the Executive’s Patent Rights with the relevant patent authorities, including, but not limited to, legal

or filing fees. If, upon the Company’s receipt of notice of any Patent Rights of the Executive’s in writing (“Patent

Notification”) the parties fail to successfully negotiate and execute a purchase or license agreement as it relates to the

Patent Right that is the subject of such Patent Notification within 60 calendar days of the receipt of such Patent Notification,

the Executive shall be permitted to retain or transfer the Patent Rights to a third party without any subsequent notice to the

Company.

Compensation Discussion and Analysis

We strive to provide

our Named Executive Officers with a competitive base salary that is in line with their roles and responsibilities when compared

to peer companies of comparable size in similar locations.

We plan to implement

a more comprehensive compensation program, which takes into account other elements of compensation, including, without limitation,

short and long term compensation, cash and non-cash, and other equity-based compensation such as stock options. We expect that

this compensation program will be comparable to the programs of our peer companies and aimed to retain and attract talented individuals.

Compensation of Directors

As of the date of

this information statement, our directors received no compensation for their service on the Board. A compensation program

for our independent directors, as and when they are appointed, which we anticipate will include such elements as an

annual retainer, meeting attendance fees and stock options. The details of that compensation program will be negotiated with

each independent director.

Certain Relationships and Related Transactions,

and Director Independence

There were no significant

related party transactions meeting the requirements for disclosure for the fiscal year ended June 30, 2015.

Procedures for Approval of Related Party

Transactions

Our Board of Directors

is charged with reviewing and approving all potential related party transactions. All such related party transactions

must then be reported under applicable SEC rules. We have not adopted other procedures for review, or standards for approval, of

such transactions, but instead review them on a case-by-case basis.

Director Independence

The Company currently

does not have a director that qualifies as an “independent” director as that term is defined under the National Association

of Securities Dealers Automated Quotation system. Our company, however, recognizes the importance of good corporate

governance and intends to appoint an audit committee comprised entirely of independent directors, including at least one financial

expert, in the near future.

PROPOSAL NO. 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

AUDITORS

On March 31, 2016,

the Board authorized the selection of Daszkal Bolton LLP as the independent auditors of the Company for the fiscal year ending

June 30, 2016, and on March 31, 2016 the Majority Shareholder approved such selection by way of the Written Consent. Daszkal Bolton

LLP was first engaged by us on May 4, 2010. Daszkal Bolton LLP, our independent auditors, audited our financial statements for

the 2015 fiscal year.

Audit Fees

The following is a

summary and description of fees for services for the fiscal years ended June 30, 2015 and 2014.

|

Services

|

|

2015

|

|

|

2014

|

|

|

Audit Fees

|

|

$

|

84,000

|

|

|

$

|

74,000

|

|

|

Audit-Related Fees

|

|

|

0

|

|

|

|

0

|

|

|

Tax Fees

|

|

|

0

|

|

|

|

0

|

|

|

All Other Fees

|

|

|

0

|

|

|

|

0

|

|

|

Total

|

|

$

|

84,000

|

|

|

$

|

74,000

|

|

Audit Fee

The Company incurred,

in the aggregate, approximately $84,000 and $74,000 for professional services rendered by its registered independent public accounting

firms for the audit of the Company’s annual financial statements for the years ended June 30, 2015 and 2014, respectively,

and for the reviews of the financial statements included in its Quarterly Reports on Form 10-Q during those fiscal years.

Audit-Related Fees

The Company incurred

approximately $0 and $0 in fees from its registered independent public accounting firms for audit-related services during

the years ended June 30, 2015 and 2014, respectively.

Tax Fees

The Company incurred

approximately $0 and $0 in fees from its registered independent public accounting firms for tax compliance or tax consulting services

during the years ended June 30, 2015 and 2014, respectively.

All Other Fees

The Company incurred

$0 and $0 for fees from its registered independent public accounting firms for services rendered to the Company, other than the

services covered in "Audit Fees", “Audit-Related Fees” and “Tax Fees” for the fiscal years ended

June 30, 2015 and 2014, respectively.

PROPOSAL NO. 3

AMENDMENT TO THE COMPANY’S AMENDED

AND RESTATED ARTICLES OF

INCORPORATION TO INCREASE THE COMPANY’S

AUTHORIZED CAPITAL

to increase the number of shares of authorized Common Stock to

300,000,000 from 200,000,000

The Company’s

Articles of Incorporation authorize the issuance of 200,000,000 shares of Common Stock, $0.001 par value per share (“

Common

Stock

”), and 5,000,000 shares of Preferred Stock, $0.001 par value per share (“

Preferred Stock

”).

On March 31, 2016, our Board of Directors approved an amendment (the “

Amendment

”) to the Company’s Articles

of Incorporation to increase the total number of shares of authorized capital stock to 305,000,000 shares, par value $0.001 per

share, consisting of (i) 300,000,000 shares of Common Stock, up from 200,000,000 shares of Common Stock, and (ii) 5,000,000 shares

of Preferred Stock, subject to shareholder approval (the “

Proposal

”). On March 31, 2016, the Majority Shareholder

approved the Amendment by way of the Written Consent.

Purpose and Effect of the Amendment

The Board of Directors

believes it continues to be in our best interest to have sufficient additional authorized but unissued shares of Common Stock available

in order to provide flexibility for corporate action in the future. Management believes that the availability of additional authorized

shares for issuance from time to time in the Board of Directors’ discretion in connection with possible acquisitions of other

companies, future financings, investment opportunities, stock splits or dividends or for other corporate purposes is desirable

in order to avoid repeated separate amendments to our Articles of Incorporation, as amended, and the delay and expense incurred

in holding special meetings of the Stockholders to approve such amendments. Following adoption of the Amendment, the total number

of authorized shares of Preferred Stock will remain five million (5,000,000) shares with par value of $0.001 per share. The Board

of Directors will continue to have the authority to authorize the issuance of the Preferred Stock from time to time in one or more

classes or series, and to designate the rights and preferences of such shares.

Notwithstanding the

foregoing, the Company currently has no arrangements or understandings for the issuance of additional shares of Common Stock and

Preferred Stock, although opportunities for acquisitions and equity financings could arise at any time. If this proposal is approved,

all or any of the authorized shares may be issued without further shareholder action (unless such approval is required by applicable

law or regulatory authorities) and without first offering those shares to the stockholders for subscription. The issuance of shares

other than on a pro-rata basis to all stockholders would reduce the proportionate interest in the Company of each share.

While we do not currently

have any plans for the authorization or issuance of any series of Preferred Stock, the issuance of such Preferred Stock could adversely

affect the rights of the holders of our Common Stock, and therefore reduce the value of such stock. It is not possible to state

the actual effect of the potential future issuance of any series of preferred stock on the rights of holders of our currently outstanding

stock unless and until our Board of Directors determines the specific rights of the holders of any such Preferred Stock; however,

these effects may include:

|

|

|

|

|

|

·

|

Restricting dividends on the Common Stock or Preferred Stock;

|

|

|

·

|

Diluting the voting power of the Common Stock;

|

|

|

·

|

Impairing the liquidation rights of the Common Stock or Preferred Stock; or

|

|

|

·

|

Delaying or preventing a change in control of the Company without further action by the shareholders.

|

The increase in the

authorized number of shares of Common Stock could have an anti-takeover effect. If the Company’s Board of Directors desire

to issue additional shares in the future, such issuance could dilute the voting power of a person seeking control of the Company,

thereby deterring or rendering more difficult a merger, tender offer, proxy contest or an extraordinary corporate transaction opposed

by the Company. In addition, because “blank check” preferred stock could be used by our Board of Directors for the

adoption of a shareholder rights plan or “poison pill,” the authorized Preferred Stock may be viewed as having the

effect of discouraging an attempt by another person or entity to acquire control of us through the acquisition of a substantial

numbers of shares of Common Stock.

A copy of the

proposed amendment to the Company’s Articles of Incorporation, as amended, is attached hereto as

Attachment A

. The

Amendment will become effective upon filing with the Nevada Secretary of State as required by the Nevada Revised Statutes. It is

anticipated that this will occur promptly following [*], 2016.

Procedure for Effecting the Amendment of our Articles of

Incorporation

The Amendment will

become effective at such time as a Certificate of Amendment to our Articles of Incorporation is filed with the Secretary of State

of Nevada. We expect to file the Amendment with the Secretary of State of Nevada effective on or about [*], 2016. Because

our Common Stock is currently quoted on the OTC Markets, the Amendment and the matters addressed therein will also require processing

by FINRA pursuant to Rule 10b-17 of the Exchange Act in order for these actions to be recognized in the market for trading purposes.

We expect to receive FINRA’s clearance prior to the date on which the Amendment takes effect.

On and after the effective

date (the “

Effective Date

”) of the Amendment, the stock certificates representing pre-Amendment shares of the

Company’s Common Stock or Preferred Stock will continue to be valid.

Shares of our Common

Stock issued after such Effective Date will have the same restrictions on their transferability as shares issued prior to the Effective

Date. Also, for purposes of determining the term of the restrictive period applicable to any shares subject to restrictions on

their transferability issued after the Effective Date in exchange for shares held prior to the Effective Date, if any, the time

period during which a shareholder has held such shares prior to the Effective Date will be included in the total holding period.

PROPOSAL NO. 4

ADVISORY

VOTE ON THE APPROVAL OF EXECUTIVE COMPENSATION

The Dodd-Frank Wall

Street Reform and Consumer Protection Act of 2010 and Section 14A of the Exchange Act entitle SmartMetric’s stockholders

to vote to approve, on an advisory basis, the compensation of SmartMetric’s named Executive Officers—meaning Chaya

Hendrick, our President and Chief Executive Officer, and Jay Needelman, our Chief Financial Officer (the “

Named Executive

Officers

”).

As

described in detail in this Information Statement under the heading "Proposal No. 1—Re-election of Three Directors—Executive

Compensation," SmartMetric strives to provide our Named Executive Officers with a competitive base salary in line with their

roles and responsibilities when compared to peer companies of comparable size in similar locations.

We

plan to implement a more comprehensive compensation program, which takes into account other elements of compensation, including,

without limitation, short and long term compensation, cash and non-cash, and other equity-based compensation such as stock options.

We expect that this compensation program will be comparable to the programs of our peer companies and aimed to retain and attract

talented individuals.

We

will also consider forming a compensation committee to oversee the compensation of our Named Executive Officers. The majority of

the members of the Compensation Committee would be independent directors.

The

Board continually reviews the compensation programs for SmartMetric’s Named Executive Officers to ensure they achieve the

desired goals.

On

March 31, 2016 the Majority Shareholder approved, on an advisory basis, the Named Executive Officer compensation disclosed in this

Information Statement. This proposal, commonly known as a "say-on-pay" proposal, gives our stockholders the opportunity

to express their views on SmartMetric’s executive compensation. This vote is not intended to address any specific item of

compensation, but rather the overall compensation of SmartMetric’s Named Executive Officers and the philosophy, policies

and practices described in this Information Statement.

The

say-on-pay vote is advisory, and therefore not binding on SmartMetric or the Board.

PROPOSAL NO. 5

ADVISORY

VOTE ON THE FREQUENCY OF HOLDING AN

ADVISORY

VOTE ON EXECUTIVE COMPENSATION

In

addition to the advisory approval of SmartMetric’s executive compensation, SmartMetric’s Majority Shareholder also

voted, by a non-binding advisory vote, for a frequency of three years, for the frequency with which stockholders would have an

opportunity to hold an advisory vote on SmartMetric’s executive compensation. This vote was taken pursuant to the requirements

of Section 14A of the Exchange Act. SmartMetric provided stockholders the option of selecting a frequency of one, two or three

years, or abstaining. For the reasons described below, SmartMetric recommended that SmartMetric stockholders select a frequency

of three years.

SmartMetric's

executive compensation program is designed to support long-term value creation. In recent years we have conducted in-depth reviews

of SmartMetric's executive compensation with outside consultants every three years. Accordingly, a vote every three years will

coincide with this more detailed review. An every three-year vote will allow for the highest level of accountability and direct

communication between SmartMetric and its stockholders. SmartMetric therefore recommended stockholders select "Three Years"

when voting on the frequency of advisory votes on executive compensation. Although the advisory vote is non-binding, SmartMetric’s

Board will review the results of the vote and take them into account in making a determination concerning the frequency of future

advisory votes on executive compensation.

The

option of three years, which received the vote of the Majority Stockholder, will be the frequency of the advisory note on executive

compensation that has been selected by stockholders. However, because this vote is advisory and not binding on the Board or SmartMetric,

the Board may decide that it is in the best interests of SmartMetric’s stockholders and SmartMetric to hold an advisory vote

on executive compensation with a different frequency than the option approved by SmartMetric's stockholders.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table

sets forth certain information, as of March 31, 2016, with respect to the beneficial ownership of the outstanding common stock

by (i) any holder of more than five (5%) percent; (ii) each of

the Company's executive officers and directors; and (iii)

the Company's directors and executive officers as a group. Except as otherwise indicated, each of the stockholders listed below

has sole voting and investment power over the shares beneficially owned.

|

Name and Address of

Beneficial Owner

|

|

Title

|

|

Number of Shares of Common Stock (1)

|

|

|

Percentage of Class (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors and Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chaya Hendrick

9195 Collins Avenue

Surfside, FL 33154

|

|

Chief Executive Officer, Chairman of the Board of Directors

|

|

|

79,127,778

|

|

|

|

56.43

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jay Needelman, CPA

520 West 47

th

Street

Miami Beach, FL 33140

|

|

Chief Financial Officer, Director

|

|

|

0

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

Elizabeth Ryba

73 Brown Road

Scarsdale, NY 10583

|

|

Director

|

|

|

40,000

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Executive Officers and Directors as a Group (3 persons)

|

|

|

|

|

79,167,778

|

|

|

|

56.45

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% Shareholders

|

|

|

|

|

|

|

|

|

|

|

Applied Cryptography, Inc. (2)

9195 Collins Avenue

Surfside, FL 33154

|

|

|

|

|

79,127,778

|

|

|

|

56.45

|

%

|

(1) In

determining beneficial ownership of our common stock as of a given date, the number of shares shown includes shares of common stock

which may be acquired on exercise of warrants or options or conversion of convertible securities within 60 days of that date. In

determining the percent of common stock owned by a person or entity on March 31, 2016, (a) the numerator is the number of shares

of the class beneficially owned by such person or entity, including shares which may be acquired within 60 days on exercise of

warrants or options and conversion of convertible securities, and (b) the denominator is the sum of (i) 197,447,416, the total

shares of common stock outstanding on March 31, 2016, and (ii) the total number of shares that the beneficial owner may acquire

upon conversion of any preferred stock and on exercise of the warrants and options. Unless otherwise stated, each beneficial owner

has sole power to vote and dispose of its shares.

(2)

Includes (1) 58,627,778 shares of Common Stock and (2) 20,500,000 shares issuable upon conversion of 410,000 shares of Series B

preferred stock held by Applied Cryptography, Inc (“ACI”). Each share of Series B Preferred Stock shall

be entitled to vote on any matter with the holders of Common Stock voting together as one (1) class and shall have that number

of votes (identical in every other respect to the voting rights of the holder of common stock entitled to vote at any regular or

special meeting of Stockholders) equal to that number of common shares which is not less than 51% of the vote required to approve

any action, which Nevada law provides may or must be approved by vote or consent of the common shares or the holders of other securities

entitled to vote, if any. Each share of Series B Preferred Stock is convertible, at the option of the holder, into fifty (50) shares

of Common Stock upon the satisfaction of certain conditions. On May 7, 2013, ACI satisfied these conditions and the

Series B Preferred Stock became convertible. C. Hendrick, our Chairman and Chief Executive Officer, has sole voting and dispositive

power over all of the shares beneficially owned by ACI.

INTEREST OF CERTAIN PERSONS IN MATTERS

TO BE ACTED UPON

No director, executive

officer, nominee for election as a director, associate of any director, executive officer or nominee or any other person has any

substantial interest, direct or indirect, by security holdings or otherwise, in any action covered by the related resolutions adopted

by the Board of Directors, which is not shared by all other shareholders.

DISSENTERS’ RIGHTS OF APPRAISAL

Under the Nevada Revised Statutes, our

shareholders are not entitled to dissenters’ appraisal rights with respect to the Proposals, and we do not intend to independently

provide shareholders with any such right.

DISCLOSURE REGARDING FORWARD-LOOKING

STATEMENTS

This Information Statement

and the documents incorporated by reference into this Information Statement contain forward-looking statements that are subject

to risks and uncertainties. All statements other than statements of historical fact contained in this Information Statement

and the materials accompanying this Information Statement are forward-looking statements.

Frequently, but not

always, forward-looking statements are identified by the use of the future tense and by words such as ‘believes,” “expects,”

“anticipates,” “intends,” “will,” “may,” “could,” “would,”

“projects,” “continues,” “estimates,” or similar expressions. Forward-looking statements

are not guarantees of future performance and actual results could differ materially from those indicated by the forward-looking

statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our

company or its industry’s actual results, levels of activity, performance or achievements to be materially different from

any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements.

The forward-looking

statements contained or incorporated by reference in this Information Statement are forward-looking statements and are subject

to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These statements include declarations

regarding our plans, intentions, beliefs or current expectations.

The forward-looking

statements included in this Information Statement are made only as of the date of this Information Statement. The forward-looking

statements are based on the beliefs of management, as well as assumptions made by and information currently available to management

and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results

of those anticipated. These uncertainties and other risk factors include, but are not limited to: changing economic and political

conditions in the United States and in other countries; the ability to integrate effectively acquired companies; the loss of current

customers or the inability to obtain new customers; war or other acts of political unrest; changes in governmental spending

and budgetary policies; governmental laws and regulations surrounding various matters such as environmental remediation, contract

pricing, and international trading restrictions; customer product acceptance; continued access to capital markets; and foreign

currency risks.

We further caution

investors that other factors might, in the future, prove to be important in affecting our results of operations. New factors

emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of each

such factor on the business or the extent to which any factor, or a combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

Forward-looking statements

are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document

are made as of the date of this document and we do not undertake any obligation to update forward-looking statements to reflect

new information, subsequent events or otherwise, except as required by law.

ADDITIONAL INFORMATION

Distribution of the Information Statement

We will pay the costs

associated with this Information Statement, including the costs of printing and mailing. We will reimburse brokerage firms,

nominees, custodians and fiduciaries for their out-of-pocket expenses for forwarding the Information Statement to beneficial owners.

We will deliver only

one Information Statement to multiple stockholders sharing an address unless we have received contrary instructions from one or

more of the stockholders. We undertake to deliver promptly, upon written or oral request, a separate copy of the Information Statement

to a stockholder at a shared address to which a single copy of the Information Statement is delivered. A stockholder can notify

us that the stockholder wishes to receive a separate copy of the Information Statement by contacting us at the address or phone

number set forth above. Conversely, if multiple stockholders sharing an address receive multiple Information Statements and wish

to receive only one, such stockholders can notify us at the address or phone number set forth above.

Where You Can Find Additional Information

We are a reporting

company and file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read

and copy these reports, proxy statements and other information at the Commission’s public reference rooms at 100 F Street,

N.E., Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying

cost. Please call the Commission at 1-800-SEC-0330 for more information about the operation of the public reference rooms.

Our SEC filings are also available at the SEC’s web site at www.sec.gov and our website at www.nationalautomationservices.com.

We have not incorporated by reference into this Information Statement the information contained on our website and you should not

consider it to be part of this Information Statement.

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

/s/ C. Hendrick

|

|

|

C. Hendrick, Chief Executive Officer and Chairman

|

|

|

|

[*], 2016

ATTACHMENT A

Certificate

of Amendment to Articles of Incorporation

For Nevada Profit

Corporations

(Pursuant to

NRS 78.385 and 78.390 - After Issuance of Stock)

SMARTMETRIC,

INC

., a corporation organized and existing under the laws of the state of Nevada (the “

Corporation

”), hereby

certifies as follows:

|

|

1.

|

Article

III of the Corporation’s Articles

of Incorporation shall be amended and restated in its entirety to read as follows:

|

The

total number of capital stock authorized that may be issued by the Corporation shall be 305,000,000 shares, consisting of 300,000,000

shares of Common Stock, with a par value of $0.001 per share, and 5,000,000 shares of Preferred Stock, with a par value of $0.001

per share, the designations, rights and preferences of which may be determined by the Board of Directors. Said shares may be issued

by the Corporation from time to time for such consideration as may be fixed by the Board of Directors

|

|

2.

|

The foregoing amendments have been duly adopted in

accordance with the provisions of Nevada Revised Statutes 78.385 and 78.390 by the vote of a majority of the outstanding stock

of the Corporation entitled to vote thereon.

|

Effective

date of filing: (optional)

IN

WITNESS WHEREOF

, I have executed this Certificate of Amendment as of this ___day of ___, 2016.

|

|

|

|

|

C.

Hendrick, Chief Executive Officer

|

|

|

and

Chairman

|

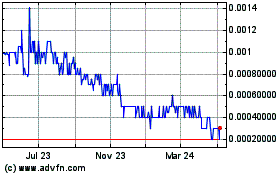

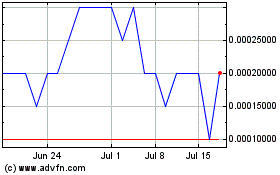

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Mar 2024 to Apr 2024

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Apr 2023 to Apr 2024