Alaska Air, Virgin America File Deal Paperwork

April 18 2016 - 3:00PM

Dow Jones News

Eleven days after Alaska Air Group Inc. announced plans to

acquire Virgin America Inc. for $2.6 billion, the two airlines said

they submitted paperwork Friday outlining the transaction to the

government, as required by the Hart-Scott-Rodino Antitrust

Improvement Act.

That law allows the Federal Trade Commission and the U.S.

Justice Department to review the proposed transaction ahead of time

and determine whether it is anticompetitive. In airline matters,

the Justice Department normally takes the lead. The Seattle-based

parent of Alaska Air and Virgin America, based in San Francisco,

confirmed they filed the documents.

The waiting period normally is 30 days before the parties can

close their deals, which in this case is the middle of May. But

regulators can ask for additional information in a so-called second

request. A second request extends the waiting period by 30 days

after the parties have complied by furnishing the additional

materials. If the reviewing agency at that point believes the

transaction may violate antitrust laws, it can seek an injunction

in federal court to prohibit consummation of the deal. And it can

drop its suit if the parties agree to make sufficient concessions

to preserve a degree of competition.

If Alaska succeeds in making the acquisition, it would become

the fifth-largest U.S. airline by traffic, vaulting over JetBlue

Airways Corp., which also participated in the bidding for Virgin

America. But the enlarged Alaska would be a very small No. 5. The

four largest U.S. carriers, all of which bolstered their size

through mergers in recent years, control more than 80% of domestic

capacity.

Directors of Alaska Air and Virgin America already have approved

the combination,which now requires a vote by Virgin America

shareholders. The two carriers said they expect to complete the

transaction, with regulators' approval, no later than Jan. 1,

2017.

There has been some debate among airline watchers about whether

the Justice Department will wave this deal through. The department

has approved four larger airline mergers in the past eight years,

although it threatened to break up the proposed marriage of

American Airlines and US Airways until they agreed to concessions

in 2013.

This transaction, although much smaller and with very little

route overlap, would be the fifth, and comes as some consumers and

members of Congress are still griping about the effects of

consolidation on airfares and service levels.

The FTC, which administers the Premerger Notification Program

under which the two carriers filed their paperwork, didn't respond

to requests for comment. Normally such submissions aren't made

public.

Write to Susan Carey at susan.carey@wsj.com

(END) Dow Jones Newswires

April 18, 2016 14:45 ET (18:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

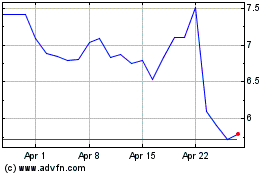

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

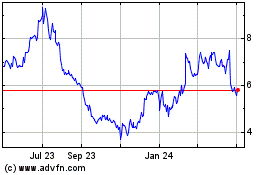

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024