Carlyle Angles for Oil Deal -- WSJ

April 15 2016 - 3:03AM

Dow Jones News

Private-equity firm looks to outflank GE for assets from

Halliburton and Baker Hughes

By Dana Mattioli and Ryan Dezember

Private-equity firm Carlyle Group LP is in serious talks to buy

a package of oilfield-services businesses from Halliburton Co. and

Baker Hughes Inc. that could be valued at more than $7 billion, as

the energy giants seek to overcome a Justice Department challenge

to their planned merger.

Talks between Carlyle and the companies are far along, though

not yet exclusive, people familiar with the matter said. The talks

mark a shift for Halliburton and Baker Hughes, which for months

have been focused on reaching a deal to sell the assets to General

Electric Co.

GE and the energy companies have had problems agreeing on a

price for the assets, some of the people said. GE is still in the

mix, they added. Carlyle's specialty, though, is creating

stand-alone businesses from castoff units of larger companies.

The need for Baker Hughes and Halliburton to strike a

divestiture deal took on increased urgency last week when the

Justice Department filed an antitrust lawsuit challenging their $35

billion proposed deal, arguing it would threaten higher prices and

reduce innovation in the oilfield-services industry. The two sides

agreed to the deal in November 2014.

As always, the talks with Carlyle could fall apart before an

agreement is reached, and even if there is one, there is no

guarantee the government won't stand in the way.

Last week, Justice Department antitrust chief Bill Baer said,

"There's no fix to this transaction." He also said the gap between

the two sides was "a chasm" and that settlement talks were never

really under way because the government and the companies

fundamentally disagreed on the competitive impacts of the

merger.

In an attempt to alleviate regulatory concerns, Halliburton and

Baker Hughes last year pledged to sell businesses with $5.2 billion

in 2013 revenue; more recently, they proposed to sell additional

businesses. Included in the divestiture portfolio are businesses

that make various types of sophisticated drill bits and others that

put the finishing touches on wells that are drilled but not yet

producing.

Following the Justice Department filing, the companies said

their divestiture plan would "facilitate the entry of new

competition in markets in which products and services are being

divested." The companies said the government's move to block their

merger "is counterproductive, especially in the context of the

challenges the U.S. and global energy industry are currently

experiencing" and added they "intend to vigorously contest" the

lawsuit.

Oilfield-services companies sell supplies and advice to energy

producers and provide services such as drilling and hydraulic

fracturing, the rock-cracking process that has enabled a boom in

U.S. oil and gas production.

Since Halliburton and Baker Hughes agreed to combine, the

industry has faced severe setbacks as persistently low crude prices

have slashed demand. Many of the mom-and-pop oilfield services

businesses that crowd the space have folded as drilling activity

slowed in response to low energy prices, while others are offering

their services at or below break-even prices.

The Justice Department said in its suit that Halliburton's

divestiture plan "appears to be among the most complex and riskiest

remedies ever contemplated in an antitrust case," requiring the

separation of businesses that share facilities, employees,

software, intellectual property and customer contracts.

In the absence of any settlement between the companies and the

Justice Department, the outcome will be decided at trial.

Carlyle, based in Washington, D.C., is among the buyout firms

with the most experience navigating the capital. The firm got its

start in the late 1980s buying businesses shed by the government in

a wave of privatizations, setting them up to run as independent

concerns, and then selling them -- often at hefty profits.

Over time, Carlyle adapted its experience in carving out defense

contractors and other businesses from the federal government to

plucking out-of-favor units from large corporations. In recent

years, the firm has invested in deals to acquire units of United

Technologies Corp., Illinois Tool Works Inc., Johnson & Johnson

and DuPont Co.

Carlyle's $4.9 billion acquisition in 2013 of DuPont's

paint-making unit, now known as Axalta Coating Systems Ltd., has

been one of the most lucrative investments in the firm's

history.

The carve-out approach has helped Carlyle invest large sums from

its private-equity business at a time when takeovers of entire

companies have become less common amid high company valuations and

the mixed performance of the last wave of big buyouts.

An acquisition of Halliburton and Baker Hughes' businesses also

would coincide with Carlyle's increased presence in energy. The

firm in 2012 acquired a controlling stake in energy-focused

private-equity firm NGP and has since raised several pools of cash

to invest in various facets of the industry.

--Alison Sider, Ted Mann and Brent Kendall contributed to this

article.

Write to Dana Mattioli at dana.mattioli@wsj.com and Ryan

Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

April 15, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

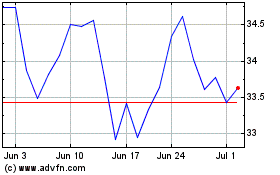

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

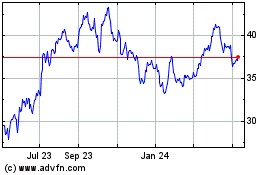

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024