Fannie's and Freddie's Plan to Cut Mortgage Balances May Be Near

April 13 2016 - 5:50PM

Dow Jones News

Fannie Mae and Freddie Mac could forgive mortgage principal for

thousands of borrowers under a new plan to be rolled out by their

regulator, the Federal Housing Finance Agency, as soon as Thursday,

according to people familiar with the matter.

The plan is likely to draw ire from consumer advocates who will

think it's not enough to address the problem, as well as from some

taxpayer advocates frustrated that the bailouts keep coming years

after the housing crisis ebbed.

In all, about 4.3 million borrowers owed more than their homes

were worth at the end of 2015, according to real estate data firm

CoreLogic, down from 12 million in 2009.

Under the plan, the existence of which was earlier reported in

The Wall Street Journal, borrowers would be eligible to have some

of their mortgage principal forgiven if they have a loan whose

balance is less than $250,000, the people said. Borrowers would

need to owe more than their homes are worth and already be at least

90 days delinquent on mortgage payments. After the reduction in

principal, they still would owe 15% more than their homes are

worth, the people said.

The strict parameters of the program are likely to make it much

smaller than some consumer advocates, who have called for principal

reduction for years, had hoped for and likely limit the number

eligible for the program to fewer than 40,000 borrowers, the people

said.

FHFA Director Melvin Watt in the past has said that the decision

on whether to reduce borrower principal is "the most challenging

evaluation the agency has undertaken during my time as

director."

Among the difficulties have been how to restrict the program in

a way that taxpayers don't lose money as a result of the reduction,

how to deal with the moral hazard of forgiving debt for some

borrowers but not others, and how to address concerns from mortgage

servicers, which will have to implement the program.

Consumer advocates have long called for principal reduction as a

way to prevent foreclosures and give owners of "underwater" homes

the incentive to keep paying their mortgage and invest in their

homes and neighborhoods.

Opponents of the method, however, worry that giving such breaks

unfairly treat owners who remained current on their loans, and

could give incentive to such owners to default down the line in the

hope of getting a similar break.

The agency has studied whether or not to implement such a

program for years. At a hearing in late 2014, Sen. Elizabeth Warren

(D., Mass.) lambasted Mr. Watt, saying "You've been in office for

nearly a year now and you haven't helped a single family…by

agreeing to a principal reduction."

On Wednesday, an FHFA spokesman in an email said, "As Director

Watt noted, we expect to announce a decision within the next 30

days [since March 22] about whether we have been able to find a

'win-win' principal reduction strategy or whether, on the other

hand, we will take principal reduction off the table entirely."

Write to Joe Light at joe.light@wsj.com

(END) Dow Jones Newswires

April 13, 2016 17:35 ET (21:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

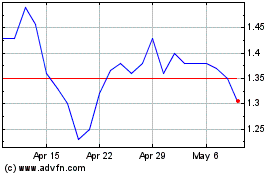

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024