UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant

to Section 14(c)

of the Securities Exchange Act of 1934

|

Check the appropriate box:

|

|

☐

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☒

|

Definitive Information Statement

|

|

|

Medical Alarm Concepts Holding, Inc.

|

|

|

(Name of Registrant As Specified In Its Charter)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

MEDICAL ALARM CONCEPTS HOLDING, INC.

NOTICE OF ACTION TAKEN BY WRITTEN

CONSENT

OF THE MAJORITY SHAREHOLDER IN LIEU

OF A MEETING

To the Shareholders of

Medical Alarm Concepts Holding, Inc.

We are writing to

inform you that on March 15, 2016, the shareholder holding a majority of our voting capital stock has executed a written consent

in lieu of a shareholders meeting, which we refer to herein as the “Written Consent”, to approve:

|

|

·

|

An amendment to our Amended and Restated Articles of Incorporation to increase the total number of shares of authorized capital stock to 410,000,000 shares consisting of (i) 400,000,000 shares of Common Stock and (ii) 10,000,000 shares of Preferred Stock from 20,725,000 shares consisting of (i) 20,000,000 shares of Common Stock and (ii) 725,000 shares of Preferred Stock.

|

This

above item, or “Proposal,” is more fully described in the accompanying Information Statement. The Written

Consent was taken pursuant to Section 78.320 of the Nevada Revised Statutes and our bylaws, each of which permits that

any action which may be taken at a meeting of the shareholders may also be taken by the written consent of the holders of

the numbers of voting capital stock required to approve the action at a meeting. The accompanying Information Statement

is being furnished to all of our shareholders in accordance with Section 14(c) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and the rules promulgated by the U.S. Securities and Exchange

Commission (“SEC”) thereunder, solely for the purpose of informing out shareholders of the action taken by the

Written Consent before it becomes effective. Because we are incorporating certain information by reference, the actions

under the Written Consent cannot be taken or become effective sooner than 20 calendar days after the Information Statement

is first sent or given to the Company’s shareholders. Because the accompanying Information Statement is first

being mailed to shareholders on or about April 13, 2016, the Proposal described herein will become effective on or

after May 3, 2016.

This is not a notice

of a special meeting of shareholders and no shareholder meeting will be held to consider any matter which is described herein.

THE

ACCOMPANYING INFORMATION STATEMENT IS BEING MAILED TO SHAREHOLDERS ON OR ABOUT APRIL 13, 2016. WE ARE NOT ASKING YOU

FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The Company is not subject to the Exchange Act and accordingly is distributing this Information Statement

voluntarily for the benefit of its shareholders.

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

/s/ Ronnie Adams

|

|

|

Ronnie Adams, Chief Executive Officer

|

|

|

|

April 13, 2016

MEDICAL

ALARM CONCEPTS HOLDING, INC.

200 West Church Road, Suite B

King of Prussia, PA 19406

April 13, 2016

INFORMATION STATEMENT

GENERAL INFORMATION

In this Information

Statement we refer to Medical Alarm Concepts Holding, Inc., a Nevada corporation, as the “Company,” “we,”

“us,” or “our.”

The Information

Statement is furnished in connection with an action by written consent (the “Written Consent”) of the holder of a majority

of the Company’s issued and outstanding voting capital stock (the “Majority Shareholder”). The actions

taken by the Written Consent will not become effective until at least 20 business days after the Information Statement is sent

or given to our shareholders in accordance with the requirements of the rules of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). The close of business on March 15, 2016, the date that the Majority Shareholder gave its

written consent, is the record date (the “Record Date”) for the determination of shareholders entitled to notice of

the action by the Written Consent.

Pursuant to the

Written Consent, the Majority Shareholder approved an amendment to our Amended and Restated Articles of Incorporation (the “Articles”)

to increase the total number of shares of authorized capital stock to 410,000,000 shares consisting of (i) 400,000,000 shares of

Common Stock and (ii) 10,000,000 shares of Preferred Stock from 20,725,000 shares consisting of (i) 20,000,000 shares of Common

Stock and (ii) 725,000 shares of Preferred Stock (the “Proposal”).

Our Board of Directors

unanimously approved the amendment to our

Articles on March 14, 2016. Also on March 14, 2016,

the Board of Directors set the Record Date as March 15, 2016.

This Information

Statement contains a brief summary of the material aspects of the Proposal approved by the Board and the Majority Shareholder.

WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

ABOUT THE INFORMATION STATEMENT

What is the Purpose of the Information

Statement?

This Information

Statement is being furnished to you pursuant to Section 14 of the Exchange Act to notify our shareholders of certain corporate

actions taken by the Majority Shareholder pursuant to the Written Consent. In order to eliminate the costs and management

time involved in obtaining proxies and in order to effect the Proposal as early as possible to accomplish the purposes hereafter

described, the Board elected to seek the written consent of the Majority Shareholder to reduce the costs and implement the Proposal

in a timely manner.

Who is Entitled to Notice?

Each outstanding

share of the Company’s voting securities on the close of business on the Record Date will be entitled to notice of the actions

to be taken pursuant to the Written Consent.

What Constitutes the Voting Shares

of the Company?

The

voting power entitled to vote on the Proposal consists of the vote of the holders of a majority of the Company’s voting securities

as of the Record Date. As of the Record Date, the Company’s voting securities consisted of 7,874,177 shares of Common Stock

and 138,888 shares of Series C Preferred Stock (“Series C Preferred Stock”). Each share of Common Stock is entitled

to one vote per share on matters submitted to the Stockholders. Holders of shares of Series C Preferred Stock vote together with

the holders of Common Stock on all matters and do not vote as a separate class.

A

holder of shares of Series C Preferred Stock is entitled to that number of votes, on a pro rata basis with all other holders of

Series C Preferred Stock, equal to that number of common shares which is not less than 51% of the vote required to approve any

action.

What Vote is Required to Approve

the Proposal?

The affirmative

vote of a majority of the voting stock outstanding on the Record Date is required for approval of the Proposal. As of the

Record Date, the Company had 7,878,676 shares of Common Stock issued and outstanding and 138,888 shares of Series C Preferred Stock.

Each share of Common Stock entitles its holder to one vote on each matter submitted to the shareholders. However, because

the Majority Shareholder held 138,888 shares of Series C Preferred Stock as of the close of business on the Record Date and through

its consent voted in favor of the Proposal, no other shareholder consents will be obtained in connection with this Information

Statement.

THE PROPOSAL

AMENDMENT TO THE AMENDED AND RESTATED

ARTICLES OF INCORPORATION TO INCREASE

THE

NUMBER OF AUTHORIZED SHARES OF COMMON

STOCK TO 400,000,000

AND AUTHORIZED SHARES OF PREFERRED

STOCK TO 10,000,000

The Company’s

Articles of Incorporation authorize the issuance of 20,000,000 shares of Common Stock, $0.0001 par value per share, and 725,000

shares of Preferred Stock, $0.0001 par value per share. On March 14, 2016, the Board of Directors of the Company approved an amendment

to the Articles of Incorporation to increase the total number of shares of authorized capital stock to 410,000,000 shares consisting

of (i) 400,000,000 shares of Common Stock, $0.0001 par value per share, and (ii) 10,000,000 shares of Preferred Stock, $0.0001

par value per share, all subject to shareholder approval.

Purpose and Effect of the Amendment

As of March 15,

2016, the Company has 20,000,000 authorized shares of Common Stock, of which 7,878,676 shares are issued and outstanding. The Company

currently has 725,000 authorized shares of Preferred Stock, of which 138,888 are issued and outstanding following the exercise

of a warrant purchased for $12,500 by the Majority Shareholder.

The Board of Directors

believes it continues to be in our best interest to have sufficient additional authorized but unissued shares of Common Stock and

Preferred Stock available in order to provide flexibility for corporate action in the future. In addition, the Company requires

the additional shares to be able to accommodate the conversion or exercise of all currently outstanding derivative securities and

to fulfill its contractual requirements to reserve a sufficient number of shares of Common Stock to honor such conversions, if

they are made. Management believes that the availability of additional authorized shares for issuance from time to time in the

Board of Directors’ discretion in connection with possible acquisitions of other companies, future financings, investment

opportunities, stock splits or dividends or for other corporate purposes is desirable in order to avoid repeated separate amendments

to our Articles of Incorporation, as amended, and the delay and expense incurred in holding special meetings of the Stockholders

to approve such amendments.

Following

adoption of the Amendment, the total number of authorized shares of Preferred Stock shall be ten million (10,000,000) shares with

a par value of $0.0001 per share. The board of directors shall have the authority to authorize the issuance of the Preferred Stock

from time to time in one or more classes or series.

The Company recently

sold $612,500 worth of units (the “Units”) with two accredited investors. Each Unit consists of (i) $25, 000 face amount

of 10% original issue discount unsecured convertible notes, convertible into shares of the Company’s common stock, par value

$0.0001 per share at a conversion price equal to $0.01 and (ii) one warrant to purchase 277,778 shares (the “Preferred C

Shares”) of Series C Convertible Preferred Stock, par value $0.0001 per preferred share. Other opportunities for acquisitions

and equity financings could arise at any time. If this proposal is approved, all or any of the authorized shares may be issued

without further shareholder action (unless such approval is required by applicable law or regulatory authorities) and without first

offering those shares to the stockholders for subscription. The issuance of shares otherwise than on a pro-rata basis to all stockholders

would reduce the proportionate interest in the Company of each share.

The

issuance of such preferred stock could adversely affect the rights of the holders of our common stock, and therefore reduce the

value of such stock. It is not possible to state the actual effect of the potential future issuance of any series of preferred

stock on the rights of holders of our currently outstanding stock unless and until our Board of Directors determines the specific

rights of the holders of any such additional preferred stock; however, these effects may include:

|

|

·

|

Restricting dividends on the common or preferred stock;

|

|

|

·

|

Diluting the voting power of the common stock;

|

|

|

·

|

Impairing the liquidation rights of the common or preferred stock; or

|

|

|

·

|

Delaying or preventing a change in control of the Company without further action by the stockholders.

|

The

increase in the authorized number of shares of Common Stock and Preferred Stock could have an anti-takeover effect. If the Company’s

Board of Directors desire to issue additional shares in the future, such issuance could dilute the voting power of a person seeking

control of the Company, thereby deterring or rendering more difficult a merger, tender offer, proxy contest or an extraordinary

corporate transaction opposed by the Company. because the authorization of “blank check” preferred stock could be used

by our Board of Directors for the adoption of a shareholder rights plan or “poison pill,” the preferred stock may be

viewed as having the effect of discouraging an attempt by another person or entity to acquire control of us through the acquisition

of a substantial numbers of shares of common stock.

A

copy of the proposed amendment to the Company’s Articles of Incorporation is attached hereto as Exhibit A. The amendment

will become effective upon filing with the Nevada Secretary of State as required by the Nevada Revised Statutes. It is anticipated

that this will occur not less than 20 days following April 13, 2016.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of March 15, 2016, the number of and percent of the Company’s common stock and classes of

preferred stock beneficially owned by: (1) all directors and nominees, naming them; (2) our executive officers, naming

them; (3) our directors and executive officers as a group, without naming them; and (4) persons or groups known by us

to own beneficially 5% or more of each class of our voting securities.

A

person is deemed to be the beneficial owner of securities that can be acquired by him within 60 days from March 15, 2016 upon

the exercise of options, warrants or convertible securities. Each beneficial owner’s percentage ownership is determined by

assuming that options, warrants or convertible securities that are held by him, but not those held by any other person, and which

are exercisable within 60 days of March 15, 2016 have been exercised and converted.

Amount and Nature of Beneficial Ownership

Name and Addresses of

Beneficial Owner

|

|

Common Stock Shares

Beneficially

Owned

(1)

|

|

Percent of Outstanding

Common Stock Shares Beneficially

Owned

(2)

|

|

Preferred Stock Shares

Beneficially

Owned

|

|

Percent of Outstanding

Preferred Stock Shares Beneficially

Owned

|

Ronald Adams

200 West Church Road, Suite B

King of Prussia, PA 19406

|

|

|

634,164

|

|

|

|

8.05

|

%

|

|

|

|

|

|

|

|

|

Allen Polsky

200 West Church Road, Suite B

King of Prussia, PA 19406

|

|

|

227,478

|

|

|

|

2.89

|

%

|

|

|

|

|

|

|

|

|

Biotech Debt Liquidation Fund, LLC

631 Bridgeway Sausalito, CA 94965

|

|

|

493,660

|

|

|

|

6.26

|

%

|

|

|

|

|

|

|

|

|

Alliance Media Group, Inc.

295 NW Common Loop

Suite 115257

Lake City, Fl 32055

|

|

|

500,000

|

|

|

|

6.35

|

%

|

|

|

|

|

|

|

|

|

Adrian Neilan

Ballinamona, Askeaton, Co

Limerick, Ireland

|

|

|

500,000

|

|

|

|

6.35

|

%

|

|

|

|

|

|

|

|

|

Robert McGuire

4430 Haskell Ave

Encino, Ca 91436

|

|

|

699,934

|

|

|

|

8.89

|

%

|

|

|

|

|

|

|

|

|

Cede & Co.

Box #20

Bowling Green Station

New York, NY 10004

|

|

|

1,298,772

|

|

|

|

16.49

|

%

|

|

|

|

|

|

|

|

|

JTT-EMS LTD

801-6081 No. 3 Road

Richmond, B.C., V6y 2B2

|

|

|

488,184

|

|

|

|

6.20

|

%

|

|

|

|

|

|

|

|

|

D2CF, LLC

108 Coccio Drive

West Orange, NJ 07052

|

|

|

|

|

|

|

|

|

|

|

138,888

|

|

|

|

100

|

%

|

|

Directors and executive officers as a group (2 people)

(3)(4)

|

|

|

861,642

|

|

|

|

10.94

|

%

|

|

|

|

|

|

|

|

|

|

(1)

|

|

We have determined beneficial ownership in accordance with the rules of the SEC. These

rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment

power with respect to those securities. In addition, the rules include shares of common stock issuable pursuant to the exercise

of stock options or warrants, or the conversion of convertible promissory notes, that are either immediately exercisable or convertible,

or that will become exercisable within 60 days after March 15, 2016. These shares are deemed to be outstanding and beneficially

owned by the person holding those options, warrants or convertible promissory notes for the purpose of computing the percentage

ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any

other person.

|

|

(2)

|

|

The percentage of shares beneficially owned is based on 7,878,676 shares of our common

stock issued and outstanding as of March 15, 2016.

|

|

(3)

|

|

Beneficial ownership for Ronald Adams and Allen Polsky.

|

|

(4)

|

|

Unless otherwise indicated in the footnotes, the address of the beneficial owners

is c/o Medical Alarm Concepts Holding, Inc. 200 West Church Road, Suite B, King of Prussia, PA 19406.

|

EXECUTIVE

COMPENSATION

The

following table summarizes the overall compensation earned over each of the past two fiscal years ending June 30, 2015

by each person who served as our principal executive officer during fiscal 2015.

Summary Compensation Table

|

|

|

|

|

|

|

Stock

|

|

All Other

|

|

|

|

Name and Principal Position

|

|

Year

|

|

Salary ($)

|

|

Awards ($)

|

|

Compensation ($)

|

|

Total ($)

|

|

Ronnie Adams, Chief Executive Officer

|

|

|

2015

|

|

|

$

|

56,800

|

|

|

|

—

|

|

|

$

|

6,040

|

|

|

$

|

62,840

|

|

|

|

|

|

2014

|

|

|

$

|

56,800

|

|

|

|

—

|

|

|

$

|

6,040

|

|

|

$

|

62,840

|

|

|

Allen Polsky

|

|

|

2015

|

|

|

$

|

12,000

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

12,000

|

|

|

|

|

|

2014

|

|

|

$

|

12,000

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

12,000

|

|

Directors’ Compensation

Employee directors

do not receive additional compensation for serving on the board beyond the compensation they received for serving as our officers,

as described under “Executive Compensation.”

DISSENTERS’ RIGHTS OF APPRAISAL

Under the Nevada

Revised Statutes, our shareholders are not entitled to dissenters’ appraisal rights with respect to the Proposal, and we

do not intend to independently provide shareholders with any such right.

DISCLOSURE REGARDING FORWARD-LOOKING

STATEMENTS

This Information

Statement and the documents incorporated by reference into this Information Statement contain forward-looking statements that are

subject to risks and uncertainties. All statements other than statements of historical fact contained in this Information

Statement and the materials accompanying this Information Statement are forward-looking statements.

Frequently, but

not always, forward-looking statements are identified by the use of the future tense and by words such as ‘believes,”

“expects,” “anticipates,” “intends,” “will,” “may,” “could,”

“would,” “projects,” “continues,” “estimates,” or similar expressions. Forward-looking

statements are not guarantees of future performance and actual results could differ materially from those indicated by the forward-looking

statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our

company or its industry’s actual results, levels of activity, performance or achievements to be materially different from

any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements.

The forward-looking

statements contained or incorporated by reference in this Information Statement are forward-looking statements and are subject

to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These statements include declarations

regarding our plans, intentions, beliefs or current expectations.

The forward-looking

statements included in this Information Statement are made only as of the date of this Information Statement. The forward-looking

statements are based on the beliefs of management, as well as assumptions made by and information currently available to management

and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results

of those anticipated. These uncertainties and other risk factors include, but are not limited to: changing economic

and political conditions in the United States and in other countries; the ability to integrate effectively acquired companies; the

loss of current customers or the inability to obtain new customers; customer product acceptance; and continued access

to capital markets.

We further caution

investors that other factors might, in the future, prove to be important in affecting our results of operations. New factors

emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of each

such factor on the business or the extent to which any factor, or a combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

Forward-looking

statements are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included

in this document are made as of the date of this document and we do not undertake any obligation to update forward-looking statements

to reflect new information, subsequent events or otherwise, except as required by law.

ADDITIONAL INFORMATION

Distribution of the Information Statement

We will pay the

costs associated with this Information Statement, including the costs of printing and mailing. We will reimburse brokerage

firms, nominees, custodians and fiduciaries for their out-of-pocket expenses for forwarding the Information Statement to beneficial

owners.

Where You Can Find Additional Information

We are a reporting

company and file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read

and copy these reports, proxy statements and other information at the Commission’s public reference rooms at 100 F Street,

N.E., Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying

cost. Please call the Commission at 1-800-SEC-0330 for more information about the operation of the public reference rooms.

Our SEC filings are also available at the SEC’s web site at www.sec.gov and our website at www.medicalalarmconcepts.com. We

have not incorporated by reference into this Information Statement the information contained on our website and you should not

consider it to be part of this Information Statement.

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

/s/ Ronnie Adams

|

|

|

Ronnie Adams, Chief Executive Officer

|

|

|

|

April 13, 2016

EXHIBIT A

CERTIFICATE OF AMENDMENT

Certificate

of Amendment to Articles of Incorporation

For Nevada

Profit Corporations

(Pursuant

to NRS 78.385 and 78.390 - After Issuance of Stock)

Medical

Alarm Concepts Holding, Inc., a corporation organized and existing under the laws of the state of Nevada (the “Corporation”)

hereby certifies as follows:

1.

Article

3 of the Corporation’s Amended and Restated Articles of Incorporation

shall be amended and restated in its entirety to read as follows:

3.01

Authorized

Capital Stock.

The total number of shares of stock this Corporation is authorized to issue shall be

four hundred ten million (410,000,000) shares. This stock shall be divided into two classes to be designated as "Common Stock"

and "Preferred Stock."

3.02

Common

Stock.

The total number of authorized shares of Common Stock shall be four hundred million (400,000,000)

shares with par value of $0.0001 per share.

3.03

Preferred

Stock.

The total number of authorized shares of Preferred Stock shall be ten million (10,000,000) shares

with par value of $0.0001 per share. The board of directors shall have the authority to authorize the issuance of the Preferred

Stock from time to time in one or more classes or series, and to state in the resolution or resolutions from time to time adopted

providing for the issuance thereof the following:

(a) Whether

or not the class or series shall have voting rights, full or limited, the nature and qualifications, limitations and restrictions

on those rights, or whether the class or series will be without voting rights;

(b) The

number of shares to constitute the class or series and the designation thereof;

(c) The

preferences and relative, participating, optional or other special rights, if any, and the qualifications, limitations, or restrictions

thereof, if any, with respect to any class or series;

(d) Whether

or not the shares of any class or series shall be redeemable and if redeemable, the redemption price or prices, and the time or

times at which, and the terms and conditions upon which, such shares shall be redeemable and the manner of redemption;

(e) Whether

or not the shares of a class or series shall be subject to the operation of retirement or sinking funds to be applied to the purchase

or redemption of such shares for retirement, and if such retirement or sinking funds be established, the amount and the terms and

provisions thereof;

(f) The

dividend rate, whether dividends are payable in cash, stock of the Corporation, or other property, the conditions upon which and

the times when such dividends are payable, the preference to or the relation to the payment of dividends payable on any other class

or classes or series of stock, whether or not such dividend shall be cumulative or noncumulative, and if cumulative, the date or

dates from which such dividends shall accumulate;

(g) The

preferences, if any, and the amounts thereof which the holders of any class or series thereof are entitled to receive upon the

voluntary or involuntary dissolution of, or upon any distribution of assets of, the Corporation;

(h) Whether

or not the shares of any class or series are convertible into, or exchangeable for, the shares of any other class or classes or

of any other series of the same or any other class or classes of stock of the Corporation and the conversion price or prices or

ratio or ratios or the rate or rates at which such exchange may be made, with such adjustments, if any, as shall be stated and

expressed or provided for in such resolution or resolutions; and

(i) Such

other rights and provisions with respect to any class or series as may to the board of directors seem advisable.

The

shares of each class or series of the Preferred Stock may vary from the shares of any other class or series thereof in any respect.

The Board of Directors may increase the number of shares of the Preferred Stock designated for any existing class or series by

a resolution adding to such class or series authorized and unissued shares of the Preferred Stock not designated for any existing

class or series of the Preferred Stock and the shares so subtracted shall become authorized, unissued and undesignated shares of

the Preferred Stock. If shares or series of stock established by a resolution of the Board of Directors have been issued, the designation

of the class or series, the number of the class or series and the voting powers, designations, preferences, limitations, restrictions

and relative rights of the class or series may be amended solely by a resolution of the Board of Directors.

2.

The foregoing amendments have been duly adopted in accordance with the provisions of Nevada Revised Statutes 78.385 and

78.390 by the vote of a majority of the outstanding stock of the Corporation entitled to vote thereon.

IN WITNESS

WHEREOF

, I have executed this Certificate of Amendment as of this ___ day of May 2016.

_______________________________

Ronnie

Adams, Chief Executive Officer

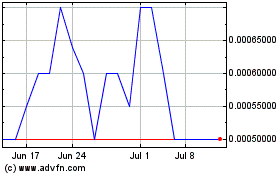

Wearable Health Solutions (PK) (USOTC:WHSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wearable Health Solutions (PK) (USOTC:WHSI)

Historical Stock Chart

From Apr 2023 to Apr 2024