CHESAPEAKE ENERGY

Credit Pact Reached; Stock Rises Sharply

Chesapeake Energy Corp. said it has reached an amended agreement

with its lenders that affirmed the energy company's revolving

credit facility at $4 billion but expanded the collateral backing

the debt to include most of the company's assets.

The company's shares, down 71% in the past 12 months, were up 74

cents, or nearly 20%, to $4.50 in 4 p.m. New York Stock Exchange

composite trading.

According to a regulatory filing, the agreement includes "the

granting of liens and security interests on substantially all of

the company's assets, including mortgages encumbering 90% of all of

the company's proved oil and gas properties, all hedge contracts

and personal property" and other items.

Meanwhile, the next review of the credit facility's borrowing

base was postponed to June 15, 2017, from Oct. 30, 2016, according

to a regulatory filing. Afterward, the borrowing base will be

redetermined semiannually. Under the amended agreement, Chesapeake

will be allowed to incur up to $2.5 billion of first-lien debt,

with its existing lenders receiving priority when the debt is

repaid. Chesapeake's senior secured debt ratio covenant was

temporarily suspended until September 2017 and its interest

coverage ratio requirement was reduced through March of next

year.

Under the accord, the energy company is required to maintain

liquidity of at least $500 million, which would increase to $750

million if certain credit metrics aren't met at year's end.

The Oklahoma City company, co-founded by the late Aubrey

McClendon, has been working to shore up its balance sheet as

commodity prices remain low. Chesapeake grew to become one of the

dominant U.S. gas explorers during the shale boom. Fueled by cheap

debt, the company expanded aggressively in Ohio, Texas and other

parts of the U.S., becoming the second-largest U.S. natural-gas

producer behind Exxon Mobil Corp. Mr. McClendon died in a car crash

last month, a day after he was indicted on a charge of conspiring

to rig bids on oil and gas leases in Oklahoma. A pioneer the shale

energy boom, his extreme risk-taking had caused him personal and

professional financial hardships that spurred activist investors,

including Carl Icahn, to oust him as Chesapeake's chief executive

in 2013.

--Tess Stynes

AIR FRANCE

Carrier Makes Offer to Pilots

PARIS -- Air France has made an offer to its pilots in an effort

to end monthslong negotiations over cost-cutting as the airline

seeks to become more competitive.

The company asked pilots to accept lower hourly pay in exchange

for 5% to 10% more flying hours so that average revenue for pilots

won't fall, Frederic Gagey, chief executive of the French arm of

Franco-Dutch Air France-KLM, told reporters on Monday.

"The measures we proposed will increase the hours flown, while

increasing salaries at a lower pace," Mr. Gagey said.

Pilots unions have until May 2 to respond to the proposal, he

said.

The proposal made by Air France's management comes after several

months of talks with restive pilots to find ways to cut costs,

while avoiding an outright clash like the two-week strike that cost

the company almost EUR500 million ($570 million) in 2014.

Mr. Gagey said the company also committed to hire more than 600

pilots by 2020 that would raise the number in the company to 3,900

from 3,600 currently, taking into account expected departures.

Emmanuel Mistrali, spokesman for the largest union of Air France

pilots, wasn't immediately available for comment.

--Inti Landauro

NATIONAL OILWELL VARCO

Dividend to Drop as Prices Decline

National Oilwell Varco Inc. cut its dividend by 89%, as the

maker of drilling equipment and provider of oil-field services

moves to preserve capital amid a sustained decline in energy

prices.

The company also said it expects its first-quarter revenue to

decline by about 20% sequentially from the prior quarter's revenue.

Analysts were expecting a roughly 12% sequential decline. The

revenue drop would be about 55% from same quarter a year

earlier.

National Oilwell Varco's quarterly dividend will fall to five

cents a share from 46 cents per share previously. The dividend

reduction will increase its net cash flow by about $615 million a

year.

The company said it remains strong financially despite

"significantly diminished" demand for its equipment and

services.

Earlier this month the company said that mass layoffs in its

Norwegian unit would continue even after the company shed half its

workforce there. Over the past year National Oilwell Varco shed

1,800 permanent jobs and 600 contractors in Norway amid weaker

activity in the North Sea.

Shares of the company were inactive premarket. They have fallen

47% in the past 12 months.

--Austen Hufford

PATHGROUP

Bank Hired to Study A Possible Sale

Primus Capital and Brentwood Capital Partners hired an

investment bank to explore a possible sale of clinical laboratory

and anatomic pathology testing provider PathGroup Inc., said people

familiar with the situation.

Cleveland private-equity firm Primus hired New York financial

services firm MTS Health Partners LP to advise on the deal, which

has passed the first round of bidding, the people said.

PathGroup, Brentwood, Tenn., recorded about $50 million in

earnings before interest, taxes, depreciation and amortization for

2015, up from about $20 million in Ebitda when Primus invested in

the company in 2010, according to the people.

The people said a sale, based on the price multiple on recent

sales, likely would value the company at about nine to 10 times its

Ebitda, translating to a roughly $450 million-to-$500 million price

tag.

Founded in 1997, PathGroup provides diagnostic services covering

all aspects of clinical and anatomic pathology to physician

offices, hospitals, surgery centers and clinics in the midsouth and

Southeast U.S.

Primus led a minority equity investment in PathGroup six years

ago that included a co-investment by Brentwood Capital Partners,

Franklin, Tenn. The investment and new debt facilities contributed

to more than $100 million in new capital to PathGroup, investment

bank Brentwood Capital Advisors said in a news release at the

time.

Brentwood Capital Partners makes later-stage co-investments with

private-equity firms in control and noncontrol investment banking

transactions in which Brentwood Capital Advisors serves as

financial adviser.

Diagnostics and medical laboratories in the U.S. came under

pressure in the past few years on reimbursement cuts, but the

industry is poised for expansion. It is a $54.3 billion industry

with an annual growth rate of 1.5% in the next five years,

according to data provider IBISWorld, which said Medicare's and

Medicaid's coverage of most clinical diagnostic laboratory services

is bolstering industry growth.

Primus invests in high-growth companies in health-care, business

services, communications, and for-profit education industry

sectors. The firm has offices in Cleveland and Atlanta.

--Amy Or

(END) Dow Jones Newswires

April 12, 2016 02:16 ET (06:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

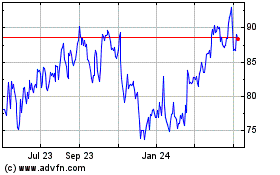

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

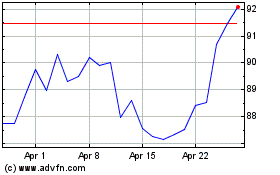

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024