Annaly Capital to Buy Hatteras Financial for $1.5 Billion

April 11 2016 - 7:50AM

Dow Jones News

Mortgage investor Annaly Capital Management Inc. said it would

buy Hatteras Financial Corp. for about $1.5 billion dollars in a

cash and stock deal in a move to expand its adjustable-rate

holdings.

Both companies, which are structured as real-estate investment

trusts, have about 88.6% of their assets in mortgage-backed

securities. Annaly's portfolio is primarily fixed-rate securities,

while three-quarters of Hatteras Financial's interest-earning

portfolio was in adjustable-rate holdings.

The deal values Hatteras Financial at $15.85 per share, an 11%

premium over Friday's close. Hatteras Financial shareholders have

the option of receiving $5.55 in cash and 0.9894 shares of Annaly

stock, or $15.85 in cash or 1.5226 shares of Annaly stock. In all,

the deal will be made up of 65% in stock and about 35% in cash.

The deal has been unanimously approved by the boards of both

companies.

Annaly signed 30-month consulting agreements with four Hatteras

executives, including Chief Executive Michael Hough. The deal is

expected to close by the end of the third quarter of 2016.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 11, 2016 07:35 ET (11:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

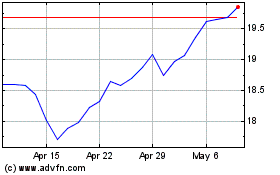

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

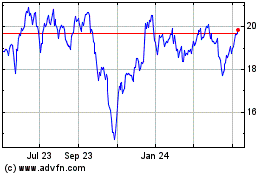

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024