Current Report Filing (8-k)

April 07 2016 - 4:39PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 1, 2016

Marriott Vacations Worldwide Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35219

|

|

45-2598330

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

6649 Westwood Blvd., Orlando, FL

|

|

32821

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (407) 206-6000

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive Agreement.

On April 1, 2016, Marriott Vacations Worldwide Corporation (the “Company”) and certain of its subsidiaries entered into a Second

Amendment (the “Second Amendment”) relating to the revolving credit facility provided by the Second Amended and Restated Credit Agreement, dated as of September 10, 2014, as amended (as amended by the Second Amendment, the

“Credit Agreement”), among the Company, its subsidiary Marriott Ownership Resorts, Inc. (the “Borrower”), the several banks and other financial institutions or entities from time to time parties thereto, JPMorgan Chase Bank,

N.A., as administrative agent (“JPMorgan” or the “Administrative Agent”), Bank of America, N.A. and Deutsche Bank Securities Inc., as co-syndication agents (the “Syndication Agents”), and Bank of America, N.A. and

Deutsche Bank Securities Inc., as co-documentation agents (the “Documentation Agents”).

Among other things, the Second

Amendment amends certain of the financial covenants contained in the Credit Agreement in a manner more favorable to the Company. The minimum consolidated tangible net worth covenant has been amended to require the Company to maintain a minimum

consolidated tangible net worth (as defined in the Credit Agreement) consisting of the sum of (1) 70 percent, rather than 75 percent, of the relevant baseline net worth and (2) 70 percent, rather than 80 percent, of increases in such net

worth resulting from certain equity offerings. In addition, the Company will be required to maintain a ratio of its borrowing base amount (as defined in the Credit Agreement) of at least 1 to 1, rather than 1:25 to 1, to the sum of (1) total

extensions of credit under the Credit Agreement and (2) the excess (if any) of all unrealized losses over all unrealized profits of certain swap agreements. The Second Amendment also adds certain technical provisions with respect to the impact

of European Union bail-in banking legislation on liabilities of certain non-U.S. financial institutions. The other terms of the Credit Agreement are substantially similar to those in effect prior to the execution of the Second Amendment.

***

The description of the

Second Amendment is qualified in its entirety by reference to the full text of the Second Amendment, which is filed as an exhibit to this Current Report on Form 8-K and are hereby incorporated by reference.

From time to time, the Administrative Agent, the Documentation Agents, the Syndication Agents and the other financial institutions party to

the Credit Agreement or their affiliates may have performed, and may in the future perform, various commercial banking, investment banking and other financial advisory services for the Company and its affiliates for which they have or will receive

customary fees and expenses. In particular, some of these financial institutions or their affiliates participate, or may in the future participate, in the Company’s vacation ownership notes receivable warehouse facility and may also have

participated, or may in the future participate, in transactions involving the securitization of vacation ownership notes receivable undertaken by the Company’s subsidiaries.

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

Exhibit 10.1

|

|

Second Amendment, dated as of April 1, 2016, to the Second Amended and Restated Credit Agreement, among Marriott Vacations Worldwide Corporation, Marriott Ownership Resorts, Inc., the several banks and other financial

institutions or entities from time to time parties thereto, JPMorgan Chase Bank, N.A., as administrative agent, Bank of America, N.A. and Deutsche Bank Securities Inc., as co-syndication agents, and Bank of America, N.A. and Deutsche Bank Securities

Inc., as co-documentation agents.

|

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

MARRIOTT VACATIONS WORLDWIDE CORPORATION

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date: April 7, 2016

|

|

By:

|

|

/s/ John E. Geller, Jr.

|

|

|

|

Name:

|

|

John E. Geller, Jr.

|

|

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

2

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Second Amendment, dated as of April 1, 2016, to the Second Amended and Restated Credit Agreement, among Marriott Vacations Worldwide Corporation, Marriott Ownership Resorts, Inc., the several banks and other financial institutions

or entities from time to time parties thereto, JPMorgan Chase Bank, N.A., as administrative agent, Bank of America, N.A. and Deutsche Bank Securities Inc., as co-syndication agents, and Bank of America, N.A. and Deutsche Bank Securities Inc., as

co-documentation agents.

|

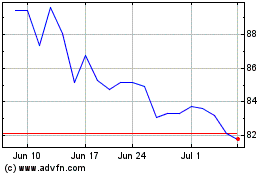

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

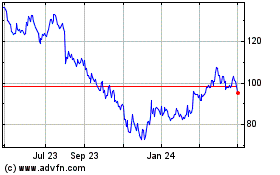

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Apr 2023 to Apr 2024