Vale Cuts Capital-Spending Plan

April 06 2016 - 11:50AM

Dow Jones News

RIO DE JANEIRO—Brazilian mining giant Vale SA further cut its

outlook for capital spending Wednesday as it seeks to preserve cash

amid the commodity downturn.

Vale plans to invest $5.5 billion this year on projects and

maintenance, down from a forecast of $6.2 billion made in early

December, the company said in a presentation filed with the local

securities regulator. The company noted that capital expenditures

in 2015 came in about $200 million higher than projections.

The world's largest producer of iron ore and nickel, Vale has

been struggling with the decline in commodity prices during recent

years. Cash flow as measured by adjusted earnings before interest,

taxes, depreciation and amortization dwindled to $7.1 billion in

2015 from a peak of $33.7 billion in 2011.

Vale has had to repeatedly tighten its capital budget in recent

years as commodity prices declined.

Vale's ability to rein in spending is limited by its desire to

complete a massive new iron-ore mining and logistics project known

as S11D in the Brazilian Amazon. With an estimated cost of $14.4

billion—most of which is already spent—the endeavor has devoured

Vale's increasingly scarce cash.

In February, Vale reversed its long-standing refusal to consider

putting so-called core assets up for sale.

The company reiterated that position Wednesday, saying it aims

to reduce net debt by up to $10 billion through 2017.

Write to Paul Kiernan at paul.kiernan@wsj.com

(END) Dow Jones Newswires

April 06, 2016 11:35 ET (15:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

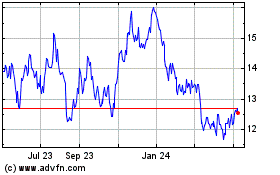

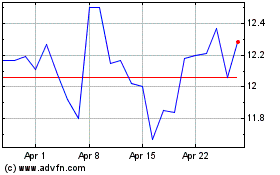

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024