UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No.

__

)

|

|

|

Filed by the

Registrant

|

|

Filed by a

Party other than the Registrant

|

|

Check the appropriate

box:

|

|

Preliminary

Proxy Statement

|

|

CONFIDENTIAL, FOR USE

OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2))

|

|

Definitive Proxy Statement

|

|

Definitive Additional

Materials

|

|

Soliciting

Material under §.240.14a-12

|

JETBLUE AIRWAYS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

No

fee required.

|

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

Fee

paid previously with preliminary materials.

|

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

JETBLUE AIRWAYS CORPORATION

27-01 Queens Plaza North

Long Island City, New York 11101

April 5, 2016

To our Stockholders:

It is our pleasure to invite you to attend

our 2016 annual meeting of stockholders, which will be held at our corporate headquarters located at 27-01 Queens Plaza North,

Long Island City, New York on Tuesday, May 17, 2016, beginning at 10:00 a.m. (Eastern Time). You may also attend the meeting virtually

via the Internet at

www.virtualshareholdermeeting.com/jblu2016,

where you will be able to vote electronically and

submit questions during the meeting. You will need the 12-digit control number included with these proxy materials to attend the

annual meeting virtually. The following notice of annual meeting of stockholders outlines the business to be conducted at the

meeting. Only stockholders of record at the close of business on March 21, 2016 will be entitled to notice of and to vote at the

annual meeting.

As in the past, we are using the Internet as

our primary means of furnishing proxy materials to stockholders. Accordingly, most stockholders will not receive copies of our

proxy materials. We instead are mailing a notice with instructions for accessing the proxy materials and voting via the Internet

(the “Notice of Internet Availability”). We encourage you to review these materials and vote your shares. This delivery

method allows us to conserve natural resources and reduce the cost of delivery while also meeting our obligations to you, our stockholders,

to provide information relevant to your continued investment in JetBlue. If you received the Notice of Internet Availability by

mail and would like to receive a printed copy of our proxy materials, please follow the instructions for requesting such materials

included in the Notice of Internet Availability.

You may vote via the Internet, by telephone or,

if you receive a paper proxy card in the mail, by mailing the completed proxy card. If you attend the annual meeting, you may vote

your shares at the annual meeting (in person or virtually via the Internet) even if you previously voted your proxy. Please vote

as soon as possible to ensure that your shares will be represented and counted at the annual meeting.

Very truly yours,

Robin Hayes

Chief Executive Officer, President and Director

On behalf of the Board of Directors of JetBlue

Airways Corporation

Table of Contents

JETBLUE AIRWAYS CORPORATION

27-01 Queens Plaza North

Long Island City, New York 11101

Notice

of Annual Meeting of Stockholders

To be held on May 17, 2016

10:00 a.m. (Eastern

Time)

27-01 Queens Plaza North, Long Island City, New York and via the

Internet

at www.virtualshareholdermeeting.com/jblu2016.

Items of Business

We are holding the 2016 annual meeting of stockholders for the following

purposes:

|

1.

|

To elect ten directors nominated by the

Board of Directors to serve until the 2017 annual meeting of stockholders;

|

|

|

|

|

2.

|

To ratify the selection of Ernst & Young LLP

(E&Y) as our independent registered public accounting firm for the fiscal year ending December 31, 2016;

|

|

|

|

|

3.

|

To approve, on an advisory basis, the compensation

of our named executive officers;

|

|

|

|

|

4.

|

To approve amendments to our certificate of incorporation

permitting the removal of directors without cause; and

|

|

|

|

|

5.

|

To transact such other business as may properly come

before the annual meeting and any postponement(s) or adjournment(s) thereof.

|

The proxy statement describes these items in more detail. As of the

date of this notice, we have not received notice of any other matters that may be properly presented at the annual meeting.

Record Date:

March 21, 2016

Voting:

YOUR VOTE IS VERY IMPORTANT.

Whether

or not you plan to attend the annual meeting of stockholders in person or virtually via the Internet, we urge you to vote and

submit your proxy in order to ensure the presence of a quorum. You have the following options for submitting your vote before

the 2016 annual meeting: Internet, toll-free telephone, mobile device or mail. If you are a beneficial owner whose shares are

held of record by a broker, your broker has discretionary voting authority to vote your shares only on routine matters, which

at our upcoming meeting will only be the ratification of the selection of our independent registered public accounting firm (Proposal

No. 2), even if the broker does not receive voting instructions from you. Non-routine matters to be considered at the meeting

are the election of directors (Proposal No. 1), the advisory vote to approve compensation of our named executive officers (Proposal

No. 3), and the approval of amendments to our certificate of incorporation to permit the removal of directors without cause (Proposal

No. 4), as described further in the proxy statement. Your broker does not have discretionary authority to vote on non-routine

matters without instructions from you, in which case a “broker non-vote” will occur and your shares will not be voted

on these matters.

Date These Proxy Materials Are First Being

Made Available on the Internet:

On or about April 5, 2016

IF YOU PLAN TO ATTEND

Only stockholders and certain other permitted attendees may attend

the annual meeting. Please note that space limitations make it necessary to limit in person attendance to stockholders and one

guest. Admission to the annual meeting will be on a first-come, first-serve basis. Registration will begin at 9:00 a.m. Either

an admission ticket or proof of ownership of JetBlue stock, as well as a form of government-issued photo identification, such as

a driver’s license or passport, must be presented in order to be admitted to the annual meeting. If you are a stockholder

of record, your admission ticket is attached to your proxy card. Stockholders holding stock in an account at a brokerage firm,

bank, broker-dealer, or other similar organization (“street name” holders) will need to bring a copy of a brokerage

statement reflecting their stock ownership as of the record date. No cameras, recording equipment, electronic devices, use of cell

phones, large bags or packages will be permitted at the annual meeting.

You will need your twelve digit control number to attend and vote

virtually.

By order of the Board of Directors

|

|

|

|

|

|

|

April 5, 2016

|

James G. Hnat

|

|

Long Island City, New York

|

General Counsel and Corporate Secretary

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 17, 2016

The notice of annual

meeting, the proxy statement and our fiscal 2015 annual report to stockholders are available on our website at

http://investor.jetblue.com.

Additionally, in accordance with Securities and Exchange Commission rules, you may access our proxy materials at

www.proxyvote.com.

2016 Proxy Statement – Summary

This summary highlights information contained elsewhere in this

Proxy Statement. This summary does not contain all of the information you should consider. You should read the entire Proxy Statement

carefully before voting.

GENERAL INFORMATION

(see pages 6-9)

|

Meeting:

|

Annual Meeting of Stockholders

|

|

Date:

|

May 17, 2016

|

|

Time:

|

10:00 a.m. (Eastern Time)

|

|

Place:

|

27-01

Queens Plaza North, Long Island City, New York and via the Internet at

www.virtualshareholdermeeting.com/jblu2016

|

Record Date:

March 21, 2016

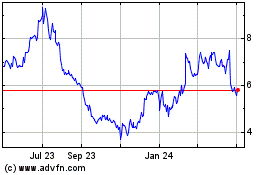

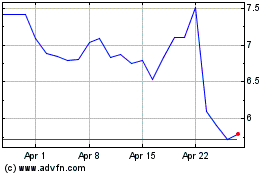

Stock Symbol:

JBLU

Exchange:

NASDAQ

Common Stock Outstanding as of Record Date:

322,046,556

Registrar & Transfer Agent:

Computershare

State of Incorporation:

Delaware

Corporate Headquarters:

27-01 Queens Plaza North, Long Island

City, NY 11101

Corporate Website:

www.jetblue.com

Investor Relations Website:

http://investor.jetblue.com

2017 Annual Meeting Deadline for Stockholder Proposals:

December

6, 2016

EXECUTIVE COMPENSATION

(see pages 24 -49)

CEO:

Robin Hayes (age: 49, tenure as CEO 1 years)*

CEO 2015 Total Direct Compensation:

$3,276,159

|

Base Salary:

|

$550,000

|

|

Annual Incentive Bonus:

|

$718,850

|

|

Long-Term Equity:

|

|

|

|

•

|

RSUs paid with respect

to 2015 performance period

|

$960,000

|

|

|

•

|

PSUs

granted in 2015 for 2015-2017 performance period

|

$700,000

|

Employment Agreement:

Yes (through 2018)

Clawback Policy:

Yes

Tax Gross Up Policy:

No new agreements for senior management

going forward

Stock Ownership Guidelines:

3x base salary for CEO, 1x base

salary for other named executive officers

CORPORATE GOVERNANCE PRACTICES

Director Nominees:

10

|

•

|

One management-employee

|

|

|

|

|

•

|

Nine independent

|

Director Term:

One year

Election Standard for Director Election:

Majority of votes

cast (abstentions are not counted as votes cast)

Supermajority Vote Requirements:

No

Board Meetings in 2015:

6

Standing Board Committees (Meetings in 2015):

|

•

|

Audit Committee:

10

|

|

|

|

|

•

|

Compensation Committee:

7

|

|

|

|

|

•

|

Corporate Governance & Nominating Committee:

5

|

|

|

|

|

•

|

Airline Safety Committee:

4

|

ITEMS OF BUSINESS:

|

1.

|

Election of Directors

|

|

2.

|

Ratification of Appointment of Independent Registered Public Accounting

Firm (Ernst & Young LLP)

|

|

3.

|

Approval, on an Advisory Basis, of the Compensation of Our Named Executive

Officers

|

|

4.

|

Approval of Amendments to Our Certificate of Incorporation

to Permit the Removal of Directors Without Cause

|

* Mr. Hayes became our Chief Executive Officer effective February

16, 2015.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

5

|

PROXY

STATEMENT 2016 ANNUAL MEETING OF STOCKHOLDERS

We are making this proxy statement available to you on or about April 5,

2015 in connection with the solicitation of proxies by our board of directors (the “Board of Directors” or the “Board”)

for the JetBlue Airways Corporation 2016 annual meeting of stockholders. At JetBlue and in this proxy statement, we refer to our

employees as crewmembers. Also in this proxy statement, we sometimes refer to JetBlue as the “Company,” “we”

or “us,” and to the 2016 annual meeting of stockholders as the “annual meeting.” When we refer to the Company’s

fiscal year, we mean the annual period ended or ending on December 31 of the stated year. Information in this proxy statement for

2015 generally refers to our 2015 fiscal year, which was from January 1 through December 31, 2015.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL

MEETING AND VOTING

What is the record date?

The record date (the “Record Date”) for the annual meeting

is March 21, 2016. On the Record Date, there were 322,046,556 shares of our common stock outstanding

and there were no outstanding shares of any other class of stock.

Who is entitled to vote?

Only stockholders of record at the close of business on the Record

Date are entitled to vote at the annual meeting and any postponement(s) or adjournments thereof. Holders of shares of common stock

as of the Record Date are entitled to cast one vote per share on all matters.

What is the difference between holding shares as a holder of record

and as a beneficial owner?

Most of our stockholders hold their shares in an account at a brokerage

firm, bank, broker dealer or other nominee holder, rather than holding share certificates in their own name. As summarized below,

there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If on the Record Date, your shares were registered directly in your

name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record (also known as a “registered

holder”) who may vote at the annual meeting. As the stockholder of record, you have the right to direct the voting of your

shares by returning the enclosed proxy card to us or to vote in person or virtually at the annual meeting. Whether or not you plan

to attend the annual meeting in person or virtually, please complete, date and sign the enclosed proxy card and provide specific

voting instructions to ensure that your shares will be voted at the annual meeting.

Beneficial Owner

If on the Record Date, your shares were held in an account at a brokerage

firm, bank, broker-dealer or other similar organization, you are considered the beneficial owner of shares held “in street

name,” and the Notice is being forwarded to you by that organization. The organization holding your account is considered

the stockholder of record for purposes of voting at the annual meeting. As the beneficial owner, you have the right to instruct

your nominee holder on how to vote your shares and to attend the annual meeting. However, since you are not the stockholder of

record, you may not vote these shares in person virtually at the annual meeting unless you receive a valid proxy from your brokerage

firm, bank, broker-dealer or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm,

bank, broker-dealer or other nominee holder. If you do not make this request, you can still vote by completing your proxy card

and delivering the proxy card to your nominee holder; however, you will not be able to vote online at the annual meeting.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

6

|

How do I vote?

Registered holders may vote:

|

•

|

By Internet:

go to

www.proxyvote.com

;

|

|

|

|

|

•

|

By toll-free telephone:

call 1-800-690-6903;

|

|

|

|

|

•

|

By mobile device;

or

|

|

|

|

|

•

|

By mail (if you received a paper copy of the proxy materials by mail):

mark, sign, date and promptly mail the enclosed

proxy card in the postage-paid envelope.

|

If your shares are held in the name of a broker, bank or other holder

of record, follow the voting instructions you receive from the holder of record to vote your shares.

Why did I receive a Notice in the mail regarding the Internet

availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the

Securities and Exchange Commission (“SEC”), the Company has elected to provide access to its proxy materials over

the Internet. Accordingly, the Company is sending such Notice to the Company’s stockholders of record and beneficial

owners. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or

request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet

or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in

printed form by mail or electronically by email on an ongoing basis. The Board of Directors encourages you to take advantage

of the availability of the proxy materials on the Internet.

What does it mean if I receive more than one proxy card?

If your shares are registered differently or are held in more than

one account, you will receive more than one proxy card. Please sign and return all proxy cards to ensure that all of your shares

are voted.

How will my shares be voted at the annual meeting if I do not

specify on the proxy card how I want my shares to be voted?

If you are the record holder of your shares and do not specify on

your proxy card (or when giving your proxy by telephone or the Internet) how you want to vote your shares, your shares will be

voted:

|

•

|

FOR

the election of each of the ten director candidates nominated by the Board of Directors;

|

|

|

|

|

•

|

FOR

the ratification of the selection of Ernst & Young LLP (Ernst & Young) as our independent registered

public accounting firm for the fiscal year ending December 31, 2016;

|

|

|

|

|

•

|

FOR

advisory approval of the compensation of our named executive officers;

|

|

|

|

|

•

|

FOR

approval of amendments to our certificate of incorporation to permit the removal of directors without cause;

and

|

|

|

|

|

•

|

in accordance with the best judgment of the named proxies on any other matters properly brought

before the annual meeting and any postponement(s) or adjournment(s) thereof.

|

If you are a beneficial owner of shares and do

not specify how you want to vote, your shares may not be voted by the record holder and will not be considered as present and entitled

to vote on any matter to be considered at the annual meeting, except with respect to the ratification of the Company’s independent

auditors. If your shares are held of record by a brokerage firm bank, broker-dealer, or other nominee, we urge you to give instructions

to your brokerage firm bank, broker-dealer, or other nominee as to how you wish your shares to be voted so you may participate

in the stockholder voting on these important matters.

What can I do if I change my mind after I vote?

Any proxy may be revoked at any time prior

to its exercise at the annual meeting. A stockholder who delivers an executed proxy pursuant to this solicitation may revoke

it at any time before it is exercised by (i) executing and delivering a later-dated proxy card to our Corporate Secretary

prior to the annual meeting; (ii) delivering written notice of revocation of the proxy to our Corporate Secretary prior to

the annual meeting; (iii) voting again by telephone, by mobile device or over the Internet prior to 11:59 p.m., Eastern Time,

on May 16, 2016; or (iv) attending and voting online at the annual meeting. Attendance at the annual meeting, in and of

itself, will not constitute a revocation of a proxy. If you hold your shares through a brokerage firm, bank, broker-dealer or

other nominee, you may revoke any prior voting instructions by contacting that firm or by voting in person via legal proxy at

the annual meeting.

|

JETBLUE

AIRWAYS CORPORATION

-

2016 Proxy Statement

|

7

|

What is a quorum?

To carry on the business of the annual meeting, a minimum number of

shares, constituting a quorum, must be present. The quorum for the annual meeting is a majority of the outstanding common stock

of the Company represented in person or by proxy. Abstentions and “broker non-votes” (which are explained below) are

counted as present to determine whether there is a quorum for the annual meeting.

What are broker non-votes?

A “broker non-vote” occurs

when a beneficial owner of shares held by a broker, bank or other nominee fails to provide the record holder with voting

instructions on any non-routine matters brought to a vote at the annual meeting. “Broker non-votes” are not

counted as votes for or against the proposal in question or as abstentions. If you are a beneficial owner whose shares are

held of record by a broker, your broker has discretionary voting authority to vote your shares only on routine matters, such

as the ratification of selection of our independent registered public accounting firm (Proposal No. 2), even if the broker

does not receive voting instructions from you. Non-routine matters include the election of directors (Proposal No. 1), the

advisory vote to approve the compensation of our named executive officers (Proposal No. 3), and approval of amendments to

amend our certificate of incorporation to permit the removal of directors without cause (Proposal No. 4). Your broker does

not have discretionary authority to vote on non-routine matters without instructions from you, in which case a “broker

non-vote” will occur and your shares will not be voted on these matters.

What vote is required to adopt each of the proposals?

Proposal 1: Election of Directors

We have adopted majority voting procedures

for the election of directors in uncontested elections. If a quorum is present, a nominee for election to a position on the

Board of Directors will be elected by a majority of the votes cast at the meeting (that is, the number of shares voted

“for” the nominee must exceed the number of shares voted “against” the nominee). However, a director

who fails to receive the required number of votes at the next annual meeting of stockholders at which he or she faces

reelection is required to tender his or her resignation to the Board and the Board may either accept the resignation or

disclose its reasons for not doing so in a report filed with the SEC within 90 days of the certification of election results.

As discussed above, if your broker holds shares in your name and delivers this proxy statement to you, the broker is not

entitled to vote your shares on this proposal without your instructions. Abstentions and broker non-votes are not counted as

votes cast.

Proposal 2: Ratification of Selection

of Independent Registered Public Accounting Firm

The affirmative vote of a majority of the

votes represented at the annual meeting, either in person or by proxy, and entitled to vote on this proposal, is required to

ratify the selection of the independent registered public accounting firm. Abstentions will be counted as present for the

purposes of this vote, and therefore will have the same effect as a vote against the proposal. Broker non-votes will be

counted as present and are entitled to vote on the proposal.

Proposal 3: Approval, on an Advisory Basis,

of the Compensation of Our Named Executive Officers

The affirmative vote of a majority of the

votes represented at the annual meeting, either in person or by proxy, and entitled to vote on this proposal, is required to

approve the advisory vote on executive compensation. The results of this vote are not binding on the Board, whether or not

the proposal is passed. In evaluating the stockholder vote on an advisory proposal, the Board will consider the voting

results in their entirety. Abstentions will be counted as present for the purposes of this vote, and therefore will have the

same effect as a vote against this proposal. Broker non-votes will not be counted as present and are not entitled to vote on

the proposal.

Proposal 4: Approval of Amendments to

Our Certificate of Incorporation to Permit the Removal of Directors Without Cause

Approval of Proposal 4, the amendment of

our certificate of incorporation to permit the removal of directors without cause, requires the affirmative vote of a

majority of the votes represented at the annual meeting, either in person or by proxy, and entitled to vote on this proposal.

Abstentions will be counted as present for the purposes of this vote, and therefore will have the same effect as a vote

against the proposal. Broker non-votes will not be counted as present and are not entitled to vote on the proposal.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

8

|

How do foreign owners vote?

To comply with restrictions imposed by federal law on foreign ownership

of U.S. airlines, our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws (the “Bylaws”)

restrict foreign ownership of shares of our common stock. The restrictions imposed by federal law currently require that no more

than 25% of our voting stock be owned or controlled, directly or indirectly, by persons who are not United States citizens. Our

Bylaws provide that no shares of our common stock may be voted by or at the direction of non-citizens unless such shares are registered

on a separate stock record, which we refer to as the “foreign stock record.” Our Bylaws further provide that no shares

of our common stock will be registered on the foreign stock record if the amount so registered would exceed the foreign ownership

restrictions imposed by federal law. Any holder of JetBlue common stock who is not a United States citizen and has not registered

its shares on the foreign stock record maintained by us is not be permitted to vote its shares at the annual meeting. The enclosed

proxy card contains a certification that by signing the proxy card or voting by telephone or electronically, the stockholder certifies

that such stockholder is a United States citizen as that term is defined in the Federal Aviation Act or that the shares represented

by the proxy card have been registered on our foreign stock record. As of the Record Date for the annual meeting, shares representing

less than 25% of our total outstanding voting stock are registered on the foreign stock record.

Under Section 40102(a)(15) of the Federal Aviation Act, the term “citizen

of the United States” is defined as: (i) an individual who is a citizen of the United States, (ii) a partnership each of

whose partners is an individual who is a citizen of the United States, or (iii) a corporation or association organized under the

laws of the United States or a state, the District of Columbia or a territory or possession of the United States of which the president

and at least two-thirds of the Board of Directors and other managing officers are citizens of the United States, and in which at

least 75% of the voting interest is owned or controlled by persons that are citizens of the United States.

Who pays for soliciting the proxies?

We pay for the cost of soliciting the proxies. We have retained Morrow

& Co., LLC, 470 West Avenue, Stamford, CT 06902, a professional soliciting organization, to assist in soliciting proxies from

brokerage firms, custodians and other fiduciaries. The Company expects the fees for Morrow & Co., LLC to be approximately $7,500

plus expenses. In addition, our directors, officers and associates may, without additional compensation, also solicit proxies by

mail, telephone, personal contact, facsimile email or through similar methods. We will, upon request, reimburse brokerage firms

and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of our stock.

Will the annual meeting be webcast?

Yes. In addition to attending in person, you

may attend the meeting virtually via the Internet at

www.virtualshareholdermeeting.com/jblu2016

, where you will be able

to vote electronically and submit questions during the meeting. The audio broadcast will be archived on that website for at least

120 days.

What is “householding” and how does it affect me?

The SEC has adopted rules that permit companies and intermediaries

such as brokers to satisfy delivery requirements for proxy statements with respect to two or more stockholders sharing the same

address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as

“householding,” potentially provides extra convenience for stockholders and cost savings for companies. We and some

brokers household proxy materials, delivering a single proxy statement or annual report to multiple stockholders sharing an address,

unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker

or us that they or we will be householding materials to your address, householding

will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate

in householding and would prefer to receive a separate proxy statement or annual report, please notify us by sending a written

request to Investor Relations, JetBlue Airways Corporation, 27-01 Queens Plaza North, Long Island City, New York 11101 or by calling

us at (718) 286-7900. You may also notify us to request delivery of a single copy of our annual report or proxy statement if you

currently share an address with another stockholder and are receiving multiple copies of our annual report or proxy statement.

Is there a list of stockholders

entitled to vote at the annual meeting?

The names of stockholders entitled to vote at the annual meeting will

be available at the annual meeting and for ten days prior to the annual meeting for any purpose germane to the annual meeting,

between the hours of 9:00 a.m. and 4:30 p.m. (Eastern Time), at our principal executive offices at 27-01 Queens Plaza North, Long

Island City, New York 11101, by contacting our General Counsel, James Hnat.

When will the voting

results be announced?

We will announce preliminary voting results at the annual meeting.

We will report final results on our website at

www.jetblue.com

and in a filing with the SEC on a Form 8-K.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

9

|

|

PROPOSAL 1

|

ELECTION

OF DIRECTORS

|

There are currently eleven members of our Board of Directors.

Assuming the election of all nominees, immediately following the annual meeting the size of our Board of Directors will be set

at ten directors. Mr. Jens Bischof, a director since 2011, is not standing for re-election in May. The Company thanks Mr. Bischof

for his exemplary service to JetBlue. As discussed in greater detail below, the Board is recommending that you reelect all of the

nominees for a one-year term.

Based on the recommendation of the Corporate Governance and Nominating

Committee, the Board of Directors has nominated Peter Boneparth, David Checketts, Stephan Gemkow, Virginia Gambale, Robin Hayes,

Ellen Jewett, Stanley McChrystal, Joel Peterson, Frank Sica and Thomas Winkelmann, each a current director of the Company, each

to be elected as a director of the Company to serve on our Board of Directors until the 2017 annual meeting of stockholders or

until such time as until their respective successors have been duly elected and qualified or until his or her prior death, disability,

resignation, retirement, disqualification or removal from office.

We do not know of any reason why any nominee named in this proxy

statement would be unable or unwilling to serve as a director if elected. If any nominee is unable or unwilling to serve as a director

if elected, the shares of common stock represented by all valid proxies will be voted at the annual meeting for the election of

such substitute as the Board may recommend. The Board may reduce the number of directors to eliminate the vacancy or the Board

may fill the vacancy at a later date after selecting an appropriate nominee. If a quorum is present, a nominee for election to

a position on the Board of Directors will be elected by a majority of the votes cast at the meeting (that is, the number of shares

voted “for” the nominee must exceed the number of shares voted “against” the nominee). Abstentions and

broker non-votes are not counted as votes cast. However, a director who fails to receive the required number of votes at the next

annual meeting of stockholders at which he or she faces reelection is required to tender his or her resignation to the Board and

the Board may either accept the resignation or disclose its reasons for not doing so in a report filed with the SEC within 90 days

of the certification of election results.

The Board of Directors recommends that stockholders

vote “FOR” each nominee.

Nominees for Director

|

|

|

|

|

Independent

|

Standing

Committee

|

|

Name

|

Age

|

Position(s)

with the Company

|

Director

Since

|

(Y/N)

|

Memberships

|

|

Peter

Boneparth

|

56

|

Director

|

2008

|

Y

|

Audit

|

|

David

Checketts

|

60

|

Director

|

2000

|

Y

|

Compensation

|

|

Virginia

Gambale

|

56

|

Director

|

2006

|

Y

|

Audit,

Compensation

|

|

Stephan

Gemkow

|

56

|

Director

|

2008

|

Y

|

Compensation

|

|

Robin

Hayes

|

49

|

President, CEO &

Director

|

2015

|

N

|

Airline

Safety

|

|

Ellen

Jewett

|

57

|

Director

|

2011

|

Y

|

Audit

|

|

Stanley

McChrystal

|

61

|

Director

|

2010

|

Y

|

Airline

Safety, G&N

|

|

Joel

Peterson

|

68

|

Chairman of the Board

|

1999

|

Y

|

G&N

|

|

Frank

Sica

|

65

|

Vice Chairman of the

Board

|

1998

|

Y

|

G&N

|

|

Thomas

Winkelmann

|

56

|

Director

|

2013

|

Y

|

Airline

Safety

|

Director Qualifications and Biographical Information

Our Board is composed of a diverse group of leaders in their respective

fields. Many of the current directors have leadership experience at major domestic and international companies with operations

inside and outside the United States, as well as experience on other companies’ boards, which provides an understanding of

different business processes, challenges and strategies. Other directors have experience at academic institutions or from the U.S.

military which brings unique perspectives to the Board. Further, each of the Company’s directors has other specific qualifications

that make them valuable members of our Board, such as financial literacy, talent and brand management, customer service experience

and crewmember relations, as well as other experience that provides insight into issues we face.

The Board reviews diversity of viewpoints, background, experience,

accomplishments, education and skills when evaluating nominees. The Board believes this diversity is demonstrated in the range

of experiences, attributes and skills of the current members of the Board. The Board believes that such diversity is important

because it provides varied perspectives, which promotes active and constructive discussion among Board members and between the

Board and management, resulting in more effective oversight of management’s formulation and implementation of strategic initiatives.

The Board believes that directors should contribute positively to the existing chemistry and collaborative culture among the Board

members. The Board also believes that its members should possess a commitment to the success of the Company, proven leadership

qualities, sound judgment and a willingness to engage in constructive debate. While we have no formal policy on director diversity,

the Corporate Governance and Nominating Committee seeks to attract and retain directors who have these qualities to achieve an

ultimate goal of a well-rounded Board that functions well as a team, something which is critically important to the

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

10

|

Company. In determining whether an incumbent director should stand

for reelection, the Corporate Governance and Nominating Committee considers the above factors, as well as that director’s

personal and professional integrity, attendance, preparedness, participation and candor, the individual’s satisfaction of

the criteria for the nomination of directors set forth in our Corporate Governance Guidelines and other relevant factors as determined

by the Board. Periodically, the Corporate Governance and Nominating Committee reviews the Company’s short- and long-term

business plans to gauge what additional current and future skills and experience may be required of the Company’s Board and

any future Board candidates. The Corporate Governance and Nominating Committee seeks to use the results of the assessment process

as it identifies and recruits potential director candidates.

Mr. Boneparth

served as Senior Advisor of Irving

Capital Partners, a private equity group, from 2009 through 2014. He served as president and Chief Executive Officer of the Jones

Apparel Group from 2002 to 2007. Mr. Boneparth is a director of Kohl’s Corporation. As a senior retail executive, Mr. Boneparth’s

qualifications and experience include finance and investment experience, talent management, international business experience,

knowledge of brand enhancement and customer service, oversight of risk management and crewmember relations.

Mr. Checketts

is the Managing

Partner of Checketts Partners Investment Management, a private equity firm founded in 2011 focused on sports, media and entertainment

investments. Its portfolio companies include ScoreBig,Inc. and Veritone Inc. Mr. Checketts served as Chairman and CEO of Legends

Hospitality Management, founded by the NY Yankees and Dallas Cowboys, from December 2011 to October 2015. Mr. Checketts founded

SCP Worldwide in 2006 which owned and operated the St. Louis Blues, Scottrade Center, the 2009 Major League Soccer Champions Real

Salt Lake, Rio Tinto Stadium and ESPN 700 Sports talk radio. From 1994 to 2001, Mr. Checketts was President and Chief Executive

Officer of Madison Square Garden Corporation. From 1991 to 1994, Mr. Checketts was the President of the New York Knicks professional

basketball team. From 1990 to 1991, he was Vice President of Development for the National Basketball Association. From 1984 to

1990, Mr. Checketts was President of the Utah Jazz professional basketball team. As an investor and chairman of an investment

firm, Mr. Checketts’ qualifications and experience include business operations, finance and investment experience, knowledge of

our competitive landscape, and experience with customer service, brand and talent management.

Ms. Gambale

has been a Managing Partner of Azimuth

Partners LLC, a strategic and advisory firm in the field of technology and data communications solutions, since 2003. Prior to

founding Azimuth Partners, Ms. Gambale was a Partner at Deutsche Bank Capital and ABS Ventures from 1999 to 2003. Prior to that,

she held the position of Chief Information Officer at both Bankers Trust Alex Brown and Merrill Lynch. Ms. Gambale serves on the

National Association of Corporate Directors Risk Oversight Advisory Council. Ms. Gambale is an adjunct faculty member for Columbia University’s Masters in Technology Leadership program and is also one of 3 members of the Executive Advisory Board of Columbia University’s Center for Technology Management. Within the past five years, Ms. Gambale served as

a director of Piper Jaffray Companies and Motive, Inc. As a former Chief Information Officer and a partner at a firm involved with

technology and data communications, Ms. Gambale’s qualifications and experience include the management of large-scale, high-transaction

volume systems and technology infrastructure, as well as investing in innovative technologies and developing the ability to adapt

and grow these technologies to significantly enhance the performance of operations, risk management and delivery of new products.

Mr. Gemkow

became

the Chief Executive Officer of Franz Haniel & Cie. GmbH in August 2012. From 2006-2012, he was the Chief Financial

Officer of Deutsche Lufthansa AG and a member of the Deutsche Lufthansa AG Executive Board. Mr. Gemkow joined Deutsche

Lufthansa AG in 1990, working in various management capacities before serving as Senior Vice President Group Finance from

July 2001 until January 2004. Mr. Gemkow then joined the Executive Board of Lufthansa Cargo AG, where he was responsible for

Finance and Human Resources. Within the past five years, Mr. Gemkow served on the boards of GfK SE, a public company in

Germany, Amadeus IT Holding S.A., and Celesio AG. Currently, Mr. Gemkow is Chairman of the Supervisory Board of TAKKT AG as

well as member of the Supervisory Board of Evonik Industries AG. As the former Chief Financial Officer of an international

airline, Mr. Gemkow’s experience and qualifications include finance and investment experience, a deep understanding

of human resources and labor relations, airline operational experience, knowledge of the competitive landscape,

experience with government and regulatory affairs, risk management, including commodities risk, customer service and

brand enhancement, international experience and general airline industry knowledge.

Mr. Hayes

became JetBlue’s Chief Executive

Officer, President and a member of the Board of Directors in February 2015. Prior to this position, Mr. Hayes was JetBlue’s

President, responsible for the airline’s commercial and operations areas including Airport Operations, Customer Support (Reservations),

Flight Operations, Inflight, System Operations, Technical Operations, as well as Communications, Marketing, Network Planning and

Sales from December 2013 until February 2015. He served as JetBlue’s Executive Vice President and Chief Commercial Officer

from August 2008 until December 2013. Prior to joining JetBlue, he was British Airways’ Executive Vice President for The

Americas. Over the span of a 19-year career with British Airways, he also served as Area General Manager for Europe, Latin America

and the Caribbean. As a senior airline executive, Mr. Hayes’ qualifications include over 25 years of aviation experience,

knowledge of the competitive landscape, brand enhancement and management.

Ms. Jewett

is Managing Partner of Canoe Point Capital,

LLC, an investment firm providing capital for early stage companies that have social purpose. From 2010 through 2015, Ms. Jewett was the Managing Director Head

of U.S. Government and Infrastructure for BMO Capital Markets covering airports and infrastructure banking. She sat on the Management Committee of the U.S. Fixed Income Division. Prior to that, Ms.

Jewett spent more than 20 years at Goldman, Sachs & Co. specializing in airport infrastructure financing, most recently serving

as head of the public sector transportation group, and previously, as head of the airport finance group. Ms. Jewett serves as President of the Board of the Brearley School. As a finance professional, Ms. Jewett’s qualifications and experience include

domestic and international finance, business and investment experience, talent management and experience in the areas of airports

and infrastructure.

General (Ret.)

McChrystal

is a retired 34-year U.S. Army veteran of multiple wars. Gen. McChrystal commanded the U.S. and

NATO’s International Security Force in Afghanistan, served as the director of the Joint Staff and was the

Commander of Joint Special Operations Command, where he was responsible for the nation’s deployed military counter

terrorism efforts. Gen. McChrystal is a graduate of the United States Military Academy at West Point, the United States Naval

Command and Staff College and was a military fellow at both the Council on Foreign Relations and the Kennedy School of

Government at Harvard University. General McChrystal is currently teaching a seminar on leadership at the Jackson Institute

for Global Affairs at Yale University and serves alongside his wife Annie on the Board of Directors for the Yellow Ribbon

Fund, a non-profit organization committed to helping wounded veterans and their families. Gen. McChrystal is a director of

Navistar International Corp. and serves on their Finance Committee. He serves as Chairman of the board of Siemens Government

Technologies, Inc., a wholly-owned indirect subsidiary and a Federal Business Entity of Siemens AG, since December 2011.

Since August 2011, he has served as a member of the Board of Advisors of General Atomics, a world leader of resources for

high-technology systems ranging from the nuclear fuel cycle to remotely operated surveillance aircraft, airborne sensors, and

advanced electric,

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

11

|

electronic, wireless and laser technologies. Within the last five years, Gen. McChrystal served in the board

of Knowledge International. As a former senior military leader, Gen. McChrystal has experience in logistics, air traffic

issues, talent management and experience with government and regulatory affairs.

Mr. Peterson

is the

founding partner of Peterson Partners, LLP, a private equity firm he founded in 1995. He is also the founding partner of

Peterson Ventures, which manages a portfolio of small, early-stage investments and Whitman I Peterson, a real estate

investment fund founded in 2008. From 1973 through 1990, Mr. Peterson served in several positions at Trammell Crow Company, a

commercial real estate development company, including Chief Executive Officer from 1988 through 1990 and Chief Financial

Officer from 1977 to 1985. Mr. Peterson has taught at the Stanford University Graduate School of Business since 1992 where he

is the Robert L. Joss Consulting Professor of Management and has served as a director for the Center for Leadership

Development and Research and on the Advisory Council to the School. He is also an overseer for the Hoover Institution, a

policy think tank at Stanford University, and serves on the board of Franklin Covey. Within the last five years, Mr. Peterson

served on the Board of Ladder Capital Finance Corp. As a private equity investor and former Chief Executive Officer and

Chief Financial Officer of a commercial real estate company, Mr. Peterson’s qualifications and experience include

knowledge of real estate, customer service, talent management and leadership development.

Mr. Sica

has served as a Managing Partner at Tailwind

Capital, a private equity firm, since 2006. From 2004 to 2005, Mr. Sica was a Senior Advisor to Soros Private Funds Management. From 2000 to 2003,

Mr. Sica was President of Soros Private Funds Management LLC, which oversaw the direct real estate and private equity investment

activities of Soros. In 1998, Mr. Sica joined Soros Fund Management, where he was a Managing Director responsible for Soros’

private equity investments. From 1988 to 1998, Mr. Sica was a Managing Director in Morgan Stanley’s Merchant Banking Division.

In 1996, Mr. Sica was elevated to Co-CEO of Morgan Stanley’s Merchant Banking Division. From 1974 to 1977, Mr. Sica was an

officer in the U.S. Air Force. Mr. Sica is a director of CSG Systems International, Inc., Safe Bulkers, Inc. and Kohl’s Corporation.

Within the past five years, Mr. Sica also served as a director of NorthStar Realty Finance Corporation. As a private equity investor,

Mr. Sica’s qualifications and experience include finance and investment experience, talent management, experience in the

areas of real estate, technology, risk management oversight (including commodities risk), general airline industry knowledge and

international business and finance experience.

Mr. Winkelmann

has been Chief Executive Officer

of Lufthansa German Airlines (Hub Munich) since January 1, 2016. He is also a member of the Group Executive Committee of Lufthansa

Group. He served as Chief Executive Officer of Germanwings GmbH from September 2006 through December 2015. Previously, he served

as Vice-President of the Americas for Lufthansa German Airlines. Mr. Winkelmann has held senior management positions for Lufthansa

in the United States since 1998. He started as Manager of Area Management Latin America and the Caribbean. Since September 2000,

as Vice-President of The Americas based in New York, Mr. Winkelmann was responsible for the entire Lufthansa organization in North

and South America. His responsibilities included all operative functions, sales, marketing and the stations. Moreover, he was a

member of the Executive Board of Eurowings Luftverkehrs AG from 2006 to 2008. Before joining Lufthansa in 1998, Mr. Winkelmann

held management positions, among others, at Deutsche Reisebüro GmbH and at Kaufhof AG in Germany and in the U.S. As a senior

airline executive, Mr. Winkelmann’s qualifications and experience include sales, marketing, revenue management, airline operations,

knowledge of North America, Latin American and the Caribbean as well as general airline industry knowledge.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

12

|

CORPORATE

GOVERNANCE PRACTICES

Majority of Independent Directors

We have a majority of independent directors serving on our Board.

We currently have only one employee director, Mr. Hayes, our Chief Executive Officer and President, on our Board of eleven members.

For more information, see “Board Meetings and Board Committee Information—Independent Directors.”

Separation of Chairman of the Board and Chief Executive Officer—Board

Leadership Structure

The Board recognizes that one of its key responsibilities is to

evaluate and determine its optimal leadership structure so as to provide independent oversight of management. We believe that the

interests of the Company and our stockholders are best served by separating the positions of Chief Executive Officer and Chairman

of the Board. We believe this governance structure empowers both the Board of Directors and the Chief Executive Officer, and promotes

balance between the authority of those who oversee our business and those who manage it on a day-to-day basis. In our independent

Chairman, our Chief Executive Officer has a counterpart who can be a thought partner. We believe this corporate structure also

permits the Board of Directors to have a healthy dynamic that enables its members to function to the best of their abilities, individually

and as a unit. Nevertheless, the Board recognizes that it is important to retain the organizational flexibility to determine whether

the roles of the Chairman of the Board and Chief Executive Officer should be separated or combined in one individual and that,

given the dynamic and competitive environment in which we operate, the right Board leadership structure may vary as circumstances

warrant. The Board may periodically evaluate whether the Board leadership structure should be changed in light of specific circumstances

applicable to us.

Annual Elections of Board Members

JetBlue’s Bylaws provide that directors are elected annually.

Majority Vote Policy

Each member of our Board of Directors is elected by a majority

of the votes cast in an uncontested election. The majority vote standard requires that a director nominee receive a majority of

the votes cast in an uncontested election in order to be formally elected. For the purpose of uncontested elections, abstentions

and broker non-votes are not counted as votes cast.

Removal of Supermajority Provisions from our Charter Documents

As approved by our stockholders, we removed supermajority voting

requirements from our Bylaws in order to give our stockholders a more meaningful vote in various corporate matters.

Executive Compensation Practices

We strive for transparent and balanced compensation

packages, as discussed more fully in the Compensation Discussion and Analysis, which starts on page 25.

Equity Ownership Guidelines

Our directors hold their equity compensation until their retirement

from our Board. Our Corporate Governance and Nominating Committee adopted stock ownership requirements for management: 3x base

salary for our CEO and 1x base salary for our other named executive officers, to be implemented and met over a five year period,

starting in calendar year 2012. Newly hired or newly appointed named executive officers have five years from the date of hire or

appointment to meet the stock ownership guidelines. As of December 2015, each of our named executive officers met or exceeded our

ownership guidelines, including common stock and unvested restricted stock units but excluding unvested performance stock units

and vested underwater stock options. We anticipate reviewing and revising our executive stock ownership guidelines periodically.

Retirement and Pension Practices

We do not provide our executives with significant post-employment

retirement or pension benefits. We sponsor a retirement plan with a 401(k) component for all of our crewmembers.

Environmental, Sustainability and Corporate Social Responsibility

Practices

Our sustainability strategy focuses on safeguarding

JetBlue’s ability to grow and profit through smart natural-resource planning and long-term consideration of our business

impact. We are achieving this by focusing our sustainability programs on change management, stakeholder engagement and risk mitigation.

This includes waste stream reduction in airports and on airplanes, greenhouse gas measuring and offsetting and biofuels research.

Our Social Responsibility programs include a seasonal farm at T5, our terminal at John F. Kennedy International Airport, planting

trees to improve air quality in our hometown communities and hosting reading programs in the cities we fly to. We engage in a

variety of community initiatives involving business partners and crewmembers including, for example, building playgrounds, making

and donating quilts to children in hospitals and donating books to the communities in which we live and work. We issue annual

Global Reporting Initiative (GRI4) compliant Responsibility Reports, all of which are publically available for comment. More information

on these efforts is available at

http://www.jetblue.com/green.

Corporate Governance Guidelines

We have adopted governance guidelines to

help us maintain the vitality of our Board, including areas relating to Board and committee composition, annual meeting attendance,

stockholder communication with the Board, qualifications and the director candidate selection process including our policy on

consideration of candidates recommended by stockholders and our Code of Business Conduct and our values—Safety, Caring,

Integrity, Passion and Fun. The Corporate Governance Guidelines cover a number of other matters, including the Board’s role

in overseeing executive compensation, compensation and expenses for non-management directors, communications between stockholders

and directors, Board committee structures and assignments and review and approval of related person transactions. These guidelines

are available at

http://investor.jetblue.com

.

Code of Business Conduct

We are committed to operating our business

with high levels of accountability, integrity and responsibility. Our Code of Business Conduct, or the Code, governs our affairs

and is a means by which we commit ourselves to conduct our business in an honest and ethical manner. The Code governs the members

of our Board of Directors, our crewmembers and third parties that represent JetBlue and includes provisions relating to how we

strive to deal with each other, our business partners, our investors and the public. The Code provides for granting of a waiver

of the Code if approved. Any waiver that is granted, and the basis for granting the waiver, will be publicly communicated as appropriate,

including by posting on our website, as soon as practicable. We granted no waivers under our Code of Business Conduct in 2015.

The Code is available at

http://investor.jetblue.com.

We intend to post any amendments and any waivers of our Code of

Business Conduct on our website within four business days of such amendment or waiver.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

13

|

Stockholder Communications with the

Board of Directors

Stockholders may communicate with our Board of Directors by sending

correspondence to the JetBlue Board of Directors, c/o Corporate Secretary, JetBlue Airways Corporation, 27-01 Queens Plaza North,

Long Island City, New York 11101. The name of any specific intended director should be noted in the correspondence. Our Corporate

Secretary will forward such correspondence to the intended recipient or as directed by such correspondence; however, our Corporate

Secretary, prior to forwarding any correspondence, has the authority to disregard any communications he deems to be inappropriate,

or to take any other appropriate actions with respect to such inappropriate communication. The Corporate Governance and Nominating

Committee approved procedures with respect to the receipt, review and processing of, and any response to, written communications

sent by stockholders and other interested persons to our Board of Directors, as set forth in our Corporate Governance Guidelines.

Any interested party, including any employee, may make confidential,

anonymous submissions regarding questionable accounting or auditing matters or internal accounting controls and may communicate

directly with the Chairman of the Board by letter to the above address, marked for the attention of the Chairman. Any written communication

regarding accounting, internal accounting controls or other financial matters are processed in accordance with procedures adopted

by the Audit Committee.

Board Oversight of Risk

Our Board of Directors oversees the management of risks inherent

in the operation of the Company’s businesses and the implementation of its strategic plan. The Board performs this oversight

role by relying on several different levels of review. In connection with its reviews of the operations of the Company’s

business and corporate functions, the Board addresses the primary risks associated with those units and functions. In addition,

the Board reviews the risks associated with the Company’s strategic plan at an annual strategic planning session and periodically

throughout the year as part of its consideration of the strategic direction of the Company. Each of the Board’s committees

also oversees the management of Company risks that fall within that committee’s areas of responsibility. In performing this

function, each committee has full access to management, as well as the ability to engage advisors. In addition, the Board monitors

the ways in which the Company attempts to prudently mitigate risks, to the extent reasonably practicable and consistent with the

Company’s long-term strategy.

The Audit Committee oversees the operation of the Company’s

enterprise risk management program, including the identification of the primary risks to the Company’s business and interim

updates of those risks, and periodically monitors and evaluates the primary risks associated with particular business units and

functions. The Company’s Corporate Audit personnel assist management in identifying, evaluating and implementing risk management

controls and methodologies to address identified risks. In connection with its risk management role, at each of its meetings the

Audit Committee meets privately with representatives from the Company’s independent registered public accounting firm, the

head of Corporate Audit and may meet with the Company’s General Counsel. The Audit Committee provides reports to the Board

which describe these activities and related conclusions. The Audit Committee periodically reports to the Board the results of the

risk management program and activities of management’s risk committee.

As part of its oversight of the Company’s executive compensation

program, the Compensation Committee considers the impact of the Company’s executive compensation program, and the incentives

created by the compensation awards that it administers, on the Company’s risk profile. Our management, with the Compensation

Committee, reviews our compensation policies and procedures, including incentives that may create and factors that may reduce the

likelihood of excessive risk taking, to determine whether such incentives and factors present a significant risk to the Company.

Related Party Transaction Policy

We have established written policies and procedures that require

approval or ratification by our Audit Committee of any transaction in excess of $120,000, which involves a “Related Person’s”

entry into an “Interested Transaction”. As defined in our policy, an “Interested Transaction” is any transaction,

arrangement or relationship or series of similar transactions, arrangements or relationships (including any indebtedness or guarantee

of indebtedness) in which (i) the aggregate amount involved will or may be expected to exceed $120,000 in any calendar year, (ii)

the Company is a participant, and (iii) any Related Person has or will have a direct or indirect interest (other than solely as

a result of being a director or a less than 10 percent beneficial owner of another entity). A “Related Person” is defined

in our policy as any (i) person who is or was (since the beginning of the last fiscal year for which the Company has filed a Form

10-K and proxy statement, even if he or she does not presently serve in that role) an executive officer, director or nominee for

election as a director, (ii) greater than 5 percent beneficial owner of the Company’s common stock, or (iii) immediate family

member of any of the foregoing. Immediate family member includes a person’s spouse, parents, stepparents, children, stepchildren,

siblings, mothers- and fathers-in-law, sons- and daughters-in-law, and brothers- and sisters-in-law and anyone residing in such

person’s home (other than a tenant or employee). Our policies and procedures further provide that only disinterested directors

are entitled to vote on any Interested Transaction presented for Audit Committee approval.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

14

|

Transactions

with Related Persons Since the Beginning of Fiscal Year 2015

The Company and its subsidiaries have transactions in the ordinary

course of business with other corporations of which the Company’s executive officers or directors or members of their immediate

families are directors, executive officers, or stockholders. Except as described below, during 2015, there were no actual or proposed

transactions to be disclosed in which we were a participant and the amount involved exceeded $120,000 and in which any related

person, including our executives and directors, had or will have a direct or indirect material interest.

Prior to March 27, 2015, Deutsche Lufthansa AG was a significant

stockholder of JetBlue’s common stock. Each of Mr. Jens Bischof, an officer of Deutsche Lufthansa AG, and Mr. Thomas Winkelmann,

CEO of Germanwings, a Lufthansa subsidiary, were members of our Board of Directors designated by Deutsche Lufthansa AG.

In 2015, Deutsche Lufthansa AG tendered and ultimately exchanged

its €234 million convertible notes, which were secured by JetBlue common stock. The exchange was completed by the end of

the first quarter 2015. Following the tender of the notes and exchange of substantially all of the common stock, Deutsche Lufthansa

AG is no longer deemed a “Related Person”.

As previously reported, the Company receives nacelle maintenance

services from Lufthansa Technik AG, a wholly owned subsidiary of Deutsche Lufthansa AG. We recorded approximately $7 million for the

services, which were provided on an “as needed” basis in 2015.

The Company contracted to receive heavy maintenance services from

Lufthansa Technik AG, a wholly owned subsidiary of Deutsche Lufthansa AG. We recorded approximately $1 million for the services

in 2015.

In 2015, the Company executed an agreement with Oakfield Farms,

a partially owned subsidiary of Deutsche Lufthansa AG, for the provision of on board boxes. We recorded approximately $2 million

for such services in 2015.

The Company contracted with Hawker Pacific, a subsidiary of Lufthansa

Technik AG, to perform maintenance on E190 landing gear. We recorded approximately $6 million for the services in 2015.

As previously reported, the Company receives provisioning services

from LSG SkyChefs, a subsidiary of Deutsche Lufthansa AG, in certain of our BlueCities. We recorded approximately $14 million for

such services in 2015.

As previously reported, we have a contract with LH CityLine, a

subsidiary of Deutsche Lufthansa AG, by which we provide simulator training. The agreement is structured for use of simulator services

on an as needed basis. For 2015, no services were performed under this contract.

As previously reported, Lufthansa Technik AG, a wholly owned subsidiary

of Deutsche Lufthansa AG began providing us with repair services of line replaceable units. There are no minimum commitments under

this arrangement. In 2015, we expensed approximately $18 million.

The Audit Committee approved each arrangement described above

as required by our related party transaction policy.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

15

|

BOARD MEETINGS AND BOARD COMMITTEE

INFORMATION

The business of JetBlue is managed under the direction of our

Board of Directors. It has responsibility for establishing broad corporate policies, counseling and providing direction to our

management in the long-term interests of the Company, our stockholders, and for our overall performance. It is not, however, involved

in our operating details on a day-to-day basis. The Board is kept advised of our business through regular reports and analyses

and discussions with our Chief Executive Officer and other officers.

Independent Directors

Our Board of Directors currently has eleven members: Jens Bischof,

Peter Boneparth, David Checketts, Virginia Gambale, Stephan Gemkow, Robin Hayes, Ellen Jewett, Stanley McChrystal, Joel Peterson,

Frank Sica and Thomas Winkelmann. The size of our Board will be reduced to ten members effective at the conclusion of our 2016

annual meeting. Mr. David Barger, who resigned as a director effective February 15, 2015, was the only director who served on our

Board during 2015, other than Mr. Hayes, determined not to be independent.

In connection with the annual meeting and the election of directors,

our Board of Directors reviewed the independence of each director-nominee under the standards set forth in the NASDAQ listing standards.

The NASDAQ definition of independent director includes a series of objective tests. Specifically, a director is deemed independent

under the NASDAQ rules if such director is not an executive officer or employee of the Company or any other individual having a

relationship which, in the opinion of the Company’s Board, would interfere with the exercise of independent judgment in carrying

out the responsibilities of a director. Generally, the following persons are not considered independent:

|

•

|

a director who is, or at any time during the past three years was, employed by the Company;

|

|

|

|

|

•

|

a director who accepted or who has a family member who accepted any compensation from the Company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence, other than compensation for board or board committee service, compensation paid to a family member who is an employee (other than an executive officer) of the Company, or benefits under a tax-qualified retirement plan, or non-discretionary compensation.

|

In making these determinations, the Board reviewed and discussed

information provided by the directors with regard to each director’s business and personal activities as they may relate

to JetBlue and our management. Our full Board affirmatively determined that each of Peter Boneparth, David Checketts, Virginia

Gambale, Stephan Gemkow, Ellen Jewett, Stanley McChrystal, Joel Peterson, Frank Sica and Thomas Winkelmann are independent. With

respect to Ms. Gambale, Mr. Checketts and Mr. Gemkow, the Board considered all factors specifically relevant to determining whether

a director has a relationship to the Company which is material to that director’s ability to be independent from management

in connection with the duties of a Compensation Committee member. Further, with respect to Mr. Boneparth, Ms. Gambale and Ms. Jewett,

the Board considered the additional requirements of NASDAQ and the SEC specifically relevant to whether a director is independent

for purposes of serving on the Audit Committee. Based upon the Board’s review, each of our Audit Committee, Compensation

Committee, and Corporate Governance and Nominating Committee of the Board are comprised of directors who have been determined to

be independent under the applicable NASDAQ listing standards and applicable rules and regulations of the SEC. Mr. Hayes is not

independent as defined.

Board Structure and Meetings

Our Board of Directors conducts its business through meetings

of the Board and through activities of its committees. The Board of Directors and its committees meet throughout the year on a

set schedule and also hold special meetings and act by written consent from time to time as appropriate. Board agendas include

regularly scheduled executive sessions of the non-management directors to meet without the presence of management, which are presided

over by our Chairman of the Board, who is currently Joel Peterson. Our Board of Directors currently has an Audit Committee, a Compensation

Committee, a Corporate Governance and Nominating Committee and an Airline Safety Committee. The Board has delegated various responsibilities

and authority to different committees of the Board. From time to time, the Board of Directors appoints ad hoc committees to oversee

special projects for the Board. Committees regularly report on their activities and actions to the full Board of Directors. Members

of the Board have access to all of our crewmembers outside of Board meetings. The Board of Directors held a total of six meetings

during 2015. All of the directors attended at least 75% of the aggregate of all meetings of the Board and of each committee at

the times when he or she was a member of the Board or such committee during fiscal year 2015. The Company has a policy encouraging

at least a majority of our directors to attend each annual meeting of stockholders. All of the members of our Board of Directors

attended our 2015 annual meeting of stockholders held on May 21, 2015.

|

JETBLUE AIRWAYS CORPORATION

-

2016 Proxy Statement

|

16

|

COMMITTEE MEMBERSHIP AS OF MARCH 2016

|

|

|

|

|

Corporate

|

|

|

|

|

|

|

Governance

|

|

|

|

|

Audit

|

Compensation

|

and Nominating

|

Airline Safety

|

|

Director

|

Independent (Y/N)

|

Committee

|

Committee

|

Committee

|

Committee

|

|

Jens Bischof

|

Y

|

|

|

|

|

|

Peter Boneparth

|

Y

|

Chair

|

|

|

|

|

David Checketts

|

Y

|

|

X

|

|

|

|

Virginia Gambale

|

Y

|

X

|

Chair

|

|

|

|

Stephan Gemkow

|

Y

|

|

X

|

|

|

|

Robin Hayes

|

N

|

|

|

|

X

|

|

Ellen Jewett

|

Y

|

X

|

|

|

|

|

Stanley McChrystal

|

Y

|

|

|

X

|

Chair

|

|

Joel Peterson

|

Y

|

|

|

Chair

|

|

|

Frank Sica

|

Y

|

|

|

X

|

|

|

Thomas Winkelmann

|

Y

|