Alaska Air Nears Virgin Deal After Frenzied Bidding

April 03 2016 - 8:50PM

Dow Jones News

Alaska Air Group Inc. is expected to announce on Monday that it

won the auction for Virgin America Inc., besting rival JetBlue

Airways Corp. in a frenzied bidding process that culminated in a

cash price of about $2.5 billion, according to people familiar with

the matter.

This new chapter in airline consolidation amid low-fare carriers

comes at a premium. The deal signed Friday night, according to one

of the people, was more than $1 billion over Virgin America's

market capitalization on Friday, which had started to rise last

month on takeover speculation.

Bidding between Alaska Airlines' parent and JetBlue was

feverish, this person said, with the price continuing to rise.

Alaska prevailed in part because of its clean balance sheet, which

will allow it to more easily borrow funds for the acquisition, the

person said.

A person familiar with the jousting said it was "a fierce back

and forth between the two sides, with multiple bids for a number of

days." But ultimately, JetBlue "put the pencil down" because the

price had gotten too high.

Alaska, an 84-year-old airline based in Seattle, has an

investment-grade credit rating, no net debt and $1.3 billion of

cash, according to its latest financial disclosures. JetBlue, which

began flying in 2000, had $876 million of cash at year-end and an

undrawn $600 million credit line. Its debt stood at $1.8 billion.

Due to low fuel prices of late, both are highly profitable.

The combination of Alaska and Virgin America, which is expected

to undergo scrutiny from the U.S. Justice Department, would create

the No. 5 U.S. airline by traffic, eclipsing JetBlue, which

currently holds that spot. But the combined company still would be

very small compared with the largest four U.S. airlines, all

expanded by recent mergers, that control more than 80% of domestic

capacity.

San Francisco-based Virgin America, which began flying in 2007,

is 54%-owned by Richard Branson's Virgin Group Ltd. and New

York-based Cyrus Capital Partners LP. The company went public in

November 2014.

Another person familiar with the situation said Virgin Group

agreed to the sale "because, effectively, they got a good offer"

and because the group's voting rights were weak in order to be

compliant with U.S. regulations that limit foreign entities from

holding more than a certain percentage of a U.S. carrier's

shares.

Cyrus Capital didn't respond to calls for comment.

The addition of Virgin America would materially boost Alaska's

presence at the important California airports in San Francisco and

Los Angeles. The two have only six routes that overlap and their

costs are similar.

For all of 2015, Virgin America's unit cost—the cost to fly a

seat a mile, excluding fuel and profit sharing—was 7.47 cents.

Alaska's unit cost in its jet division, excluding its commuter

planes, was 7.39 cents.

Dubbed an industry hybrid, Alaska is one of the few

pre-deregulation airlines to avoid bankruptcy-court protection.

The company, a traditional network airline like its larger

rivals, has been cutting its costs for more than a decade to fight

incursions into its West Coast base by discounter Southwest

Airlines Co. and others.

Today, Alaska has low costs but still offers passengers some

perks without a plethora of fees. It also expanded its route map

and now serves most major markets in the East and Midwest and

recently made a big bet on Hawaii. It routinely wins

customer-service awards, is known for being punctual and enjoys

relative labor peace.

Virgin, which has 57 aircraft, 2,600 employees and carried 7

million passengers last year, only turned profitable in 2013. But

it also wins customer-service awards and has a devoted following in

Silicon Valley. It recently launched service to Hawaii, Denver and

Love Field in Dallas and services transcontinental routes from Los

Angeles and San Francisco to the East Coast.

While Virgin is an Airbus operator and Alaska's jet fleet is

exclusively Boeing Co., some experts don't expect that to matter,

given that the economics of operating a single fleet type diminish

if the second fleet is big enough to bring advantages.

A person familiar with the matter said JetBlue was the better

fit, because of the similarities between its labor relations and

fleet with Virgin America, which would have created superior

synergies.

But Alaska made the "bold move" by bidding up the offer because

it wanted to diversity out of its Seattle base—which is being

encroached by Delta Air Lines Inc.'s buildup there—and add to its

transcontinental route portfolio.

Liz Hoffman

Write to Susan Carey at susan.carey@wsj.com, Robert Wall at

robert.wall@wsj.com and Dana Mattioli at dana.mattioli@wsj.com

(END) Dow Jones Newswires

April 03, 2016 20:35 ET (00:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

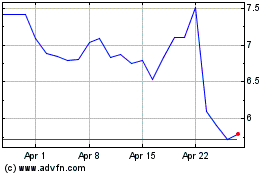

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

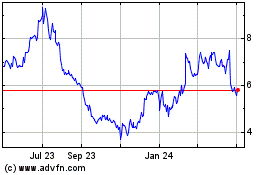

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024