[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF

THE SECURITIES EXCHANGE ACT OF 1934

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Securities for which there is a reporting obligation pursuant

to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the

Company’s classes of capital or common stock as of the close of the period

covered by the annual report. 73,534,710

Indicate by check mark if the registrant is a well-known

seasoned Company, as defined in Rule 405 of the Securities Act. Yes ___ No

_X_

If this report is an annual or transition report, indicate by

check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934. Yes ___ No

_X_

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 12 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past ninety days. Yes

_X_

No ____

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes

_X_

No ____

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer or a non-accelerated filer. See

definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of

the Exchange Act.

Indicate by check mark which basis of accounting the registrant

has used to prepare the financial statements included in this filing:

If “Other” has been checked in response to the previous

question, indicate by check mark which financial statement item the registrant

has elected to follow: Item 17 ___ Item 18 ___

If this is an annual report, indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act).

Yes No

X

N/A

such as for a saleable product, a clarifying statement is

included to ensure that the reader is fully informed as to what is being

reported. The public disclosure of a Mineral Reserve must be demonstrated by a

Pre-Feasibility Study or Feasibility Study.

Mineral Resource:

is defined

in the CIM Definition Standards (2014) as referenced by NI 43-101 as a

concentration or occurrence of solid material of economic interest in or on the

Earth’s crust in such form, grade or quality and quantity that there are

reasonable prospects for eventual economic extraction. The location, quantity,

grade or quality, continuity and other geological characteristics of a Mineral

Resource are known, estimated or interpreted from specific geological evidence

and knowledge, including sampling.

Eurasian Minerals Inc. (the “Company” or “Eurasian” or “EMX”)

was incorporated under the laws of the Yukon Territory of Canada on August 21,

2001 as 33544 Yukon Inc. and, on October 10, 2001, changed its name to Southern

European Exploration Ltd. On November 24, 2003, the Company completed the

reverse take-over of Marchwell Capital Corp., a TSX Venture Exchange (“TSX-V”)

listed company incorporated in Alberta on May 13, 1996 and which subsequently

changed its name to Eurasian Minerals Inc. On September 21, 2004, EMX continued

into British Columbia from Alberta under the

Business Corporations Act.

EMX’s head office is located at Suite 501 – 543 Granville

Street, Vancouver, British Columbia V6C 1X8, Canada, and its registered and

records office is located at Northwest Law Group, Suite 704 – 595 Howe Street,

Vancouver, British Columbia V6C 2T5, Canada.

Eurasian is a reporting Company under the securities

legislation of British Columbia and Alberta and is listed on the TSX-V, as a

Tier 1 Company, and the NYSE MKT (formerly known as the American Stock Exchange

or AMEX). Eurasian’s common shares without par value (“Common Shares”) are

traded on the TSX-V under the symbol EMX and on the NYSE MKT under the symbol

EMXX.

Eurasian is principally in the business of exploring for, and

generating royalties from, metals and minerals properties, as well as

identifying royalty opportunities for purchase. Eurasian’s business is carried

out as a royalty and prospect generator. Under the royalty and prospect

generation business model, it acquires and advances early-stage mineral

exploration projects and then options the projects to, and thereby forms

relationships with, other parties in consideration of a retained royalty

interest, as well as annual advanced royalty and other cash or share payments

and exploration carried out by the other parties. Through its various

agreements, Eurasian also provides technical and commercial assistance to such

companies as the projects advance. By optioning interests in its projects to

third parties for a royalty interest, Eurasian:

This approach helps preserve the Company’s treasury, which can

be utilized for further project acquisitions and other business initiatives.

The Company’s royalty and exploration portfolio consists of

properties in North America, Turkey, Europe, Haiti, Australia, and the

Asia-Pacific region. Eurasian started receiving royalty income as of August 17,

2012 when it acquired Bullion

Monarch Mining, Inc. (“Bullion Monarch” or “BULM”). This

royalty cash flow serves to provide a foundation to support the Company’s growth

over the long term.

Strategic investments are an important complement to the

Company’s royalty and prospect generation initiatives. These investments are

made in unrecognized or under-valued exploration companies identified by

Eurasian. EMX helps to develop the value of these assets, with exit strategies

that can include royalty positions or equity sales.

In this Annual Report, unless otherwise specified, all dollar

amounts are expressed in Canadian Dollars (“CDN$” or “$”). The Government of

Canada permits a floating exchange rate to determine the value of the Canadian

Dollar against the U.S. Dollar (“US$”).

The Company is a Canadian issuer that is permitted, under the

multijurisdictional disclosure system adopted in the United States, to prepare

this annual report on Form 20-F (this “Annual Report”) pursuant to Section 13 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in

accordance with Canadian disclosure requirements, which are different from those

of the United States. The Company is a “foreign private issuer” as defined in

Rule 3b-4 under the Exchange Act and Rule 405 under the Securities Act of 1933,

as amended. Equity securities of the Company are accordingly exempt from

Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule

3a12-3 thereunder.

This Annual Report, including the documents incorporated by

reference herein, may contain forward-looking statements. These forward-looking

statements may include statements regarding perceived merit of properties,

exploration results and budgets, mineral reserves and resource estimates, work

programs, capital expenditures, operating costs, cash flow estimates, production

estimates and similar statements relating to the economic viability of a

project, timelines, strategic plans, completion of transactions, market prices

for metals or other statements that are not statements of fact. These statements

relate to analyses and other information that are based on forecasts of future

results, estimates of amounts not yet determinable and assumptions of

management. Statements concerning mineral resource estimates may also be deemed

to constitute “forward-looking statements” to the extent that they involve

estimates of the mineralization that will be encountered if the property is

developed.

Any statements that express or involve discussions with respect

to predictions, expectations, beliefs, plans, projections, objectives,

assumptions or future events or performance (often, but not always, identified

by words or phrases such as “expects”, “anticipates”, “believes”, “plans”,

“projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”,

“objectives”, “potential”, “possible” or variations thereof or stating that

certain actions, events, conditions or results “may”, “could”, “would”,

“should”, “might” or “will” be taken, occur or be achieved, or the negative of

any of these terms and similar expressions) are not statements of historical

fact and may be forward-looking statements.

Forward-looking statements are based on a number of material

assumptions, including those listed below, which could prove to be significantly

incorrect:

Forward-looking statements are subject to a variety of known

and unknown risks, uncertainties and other factors that could cause actual

events or results to differ from those reflected in the forward-looking

statements, including, without limitation:

This list is not exhaustive of the factors that may affect any

of the Company’s forward-looking statements. Forward-looking statements are

statements about the future and are inherently uncertain, and actual

achievements of the Company or other future events or conditions may differ

materially from those reflected in the forward-looking statements due to a

variety of risks, uncertainties and other factors, including, without

limitation, those referred to under the heading “Key Information” (as defined

below), which is incorporated by reference herein.

The Company’s forward-looking statements are based on the

beliefs, expectations and opinions of management on the date the statements are

made, and the Company does not assume any obligation to update forward-looking

statements if circumstances or management’s beliefs, expectations or opinions

should change, except as required by law. For the reasons set forth above,

investors should not place undue reliance on forward-looking statements.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND

ADVISERS

1.A.1. Directors

Table No. 1 lists as of

03/29/2016 the names of the Directors of the Company.

Table No. 1 Directors

|

|

|

|

|

Name

|

Age

|

Date

First Elected of Appointed

|

|

|

|

|

|

Brian E. Bayley (1)(2)(3)(4)

|

63

|

May 13, 1996

|

|

David M. Cole (5)

|

54

|

November 24, 2003

|

|

Brian K. Levet (1)(2)(4)

|

63

|

March 18, 2011

|

|

Larry M. Okada (1)(2)(3)(6)

|

67

|

June 11, 2013

|

|

Michael D. Winn (3)(7)

|

54

|

November 24, 2003

|

|

(1)

|

Member of Audit Committee

|

|

(2)

|

Member of the Compensation Committee

|

|

(3)

|

Member of Corporate Governance Committee

|

|

(4)

|

Suite 1703 – 595 Burrard Street, Vancouver, BC V7X

1S8

|

|

(5)

|

10001 W. Titan Road, Littleton, Colorado 80125

|

|

(6)

|

Suite 520 – 800 West Pender Street, Vancouver, BC V6C

2V6

|

|

(7)

|

Suite C – 381 Forest Avenue, Laguna Beach, California

92651

|

1.A.2. Senior Management

Table No. 2 lists, as of 03/29/2016, the names of the Senior

Management of the Company.

Table No. 2

Senior Management

|

|

|

|

|

Name and Position

|

Age

|

Date

of First Appointment

|

|

|

|

|

|

David M. Cole (1)

|

54

|

November 24, 2003

|

|

Christina Cepeliauskas (2)

|

52

|

September 18, 2008

|

|

Kim Casswell (2)

|

59

|

November 13, 2015

|

|

(1)

|

10001 W. Titan Road, Littleton, Colorado 80125

|

|

(2)

|

Suite 501 – 543 Granville Street, Vancouver, BC V6C

1X8

|

Mr. Cole’s business functions, as President of the Company and

Chief Executive Officer, include strategic planning, business development,

operations, liaison with lawyers-regulatory authorities-financial

community/shareholders, and reporting to the Board of Directors.

Ms. Cepeliauskas’ business functions, as Chief Financial

Officer, include responsibility for overseeing all of the Company’s financial

administration, accounting, liaison with auditors-accountants and

preparation/payment/organization of the expenses/taxes/activities of the

Company, and reporting to the Board of Directors. Ms. Cepeliauskas may delegate

all or part of her duties as Chief Financial Officer to a nominee from time to

time.

Ms. Casswell’s business functions, as Corporate Secretary,

include attending and being the secretary of all meetings of the Board,

shareholders and committees of the Board and entering or causing to be entered

in records kept for that purpose minutes of all proceedings thereat; gives or

causes to be given, as and when instructed, all notices to shareholders,

Directors, officers, auditors and members of committees of the Board; is the

custodian of the stamp or mechanical device generally used for affixing the

corporate seal of the Company and of all books, records and instruments

belonging to the Company, except when some other officer or agent has been

appointed for that purpose; and in the future can have such other powers and

duties as the Board of the chief executive officer may specify.

Ms. Casswell may delegate all or part of her duties as Corporate Secretary to a

nominee from time to time.

13

1.B. Advisers

|

The Company’s Canadian legal counsel:

|

Northwest Law Group

|

|

|

Contact: Michael Provenzano

|

|

|

595 Howe Street, Suite 701

|

|

|

Vancouver, British Columbia V6C 2T5

|

|

|

Telephone: 604-687-5792

|

|

|

Facsimile: 604-687-6650

|

|

|

|

|

The Company’s bank is:

|

Bank of Montreal

|

|

|

First Bank Tower, Bentall 3

|

|

|

595 Burrard Street

|

|

|

Vancouver, British Columbia V7X 1L7

|

|

|

Contact: Colleen Saimoto

|

|

|

Telephone: 604-665-2692

|

|

|

Facsimile: 604-668-1450

|

|

1.C Auditors

|

|

|

|

|

|

The Company’s auditor is:

|

Davidson and Company LLP

|

|

|

609 Granville Street, Suite 1200

|

|

|

Vancouver, B.C. CANADA V7Y 1G6

|

|

|

Telephone: 604-687-0947

|

|

|

Facsimile: 604-687-6737

|

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

--- No Disclosure Necessary ---

ITEM 3. KEY INFORMATION

3.A.1. and 3.A.2 Selected Financial Data

The selected financial data of the Company for the fiscal years

ending December 31, 2015, 2014, 2013, 2012 and 2011 was derived from the

financial statements of the Company that have been audited by Davidson and

Company LLP, Independent Registered Public Accountants, as indicated in their

audit report, which are included elsewhere in this Annual Report.

The Company has not declared any dividends since incorporation

and does not anticipate that it will do so in the foreseeable future. The

present policy of the Company is to retain all available funds for use in its

operations and the expansion of its business.

Table No. 3 is derived from the financial statements of the

Company, which have been prepared in accordance with International Financial

Reporting Standards as issued by the International Accounting Standards Board.

14

Table No. 3

Selected Financial Data

(CDN$)

|

|

|

Year

Ended

|

|

|

Year

Ended

|

|

|

Year

Ended

|

|

|

Year

Ended

|

|

|

Year

Ended

|

|

|

|

|

December 31, 2015

|

|

|

December 31, 2014

|

|

|

December 31, 2013

|

|

|

December 31, 2012

|

|

|

December 31, 2011

|

|

|

IFRS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty income

|

$

|

1,609,553

|

|

$

|

2,247,334

|

|

$

|

3,102,888

|

|

$

|

1,750,975

|

|

$

|

-

|

|

|

Exploration expenditures (net)

|

|

4,364,675

|

|

|

5,022,658

|

|

|

3,839,703

|

|

|

8,330,201

|

|

|

3,837,224

|

|

|

Net loss

|

|

(6,875,857

|

)

|

|

(17,448,041

|

)

|

|

(13,982,612

|

)

|

|

(20,916,730

|

)

|

|

(9,748,817

|

)

|

|

Net loss per share - basic and diluted

|

|

(0.09

|

)

|

|

(0.24

|

)

|

|

(0.19

|

)

|

|

(0.35

|

)

|

|

(0.19

|

)

|

|

Wtd. Avg. Shares

|

|

73,480,833

|

|

|

73,154,139

|

|

|

72,509,793

|

|

|

59,990,386

|

|

|

51,554,032

|

|

|

Period-end Shares

|

|

73,534,710

|

|

|

73,371,710

|

|

|

72,980,209

|

|

|

72,051,872

|

|

|

51,875,118

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital

|

|

5,787,109

|

|

|

7,096,916

|

|

|

14,217,999

|

|

|

22,702,855

|

|

|

40,742,549

|

|

|

Exploration and evaluation assets (net)

|

|

2,381,540

|

|

|

2,379,886

|

|

|

3,031,368

|

|

|

4,940,941

|

|

|

6,086,396

|

|

|

Royalty interest

|

|

28,798,980

|

|

|

29,327,960

|

|

|

35,063,725

|

|

|

38,738,592

|

|

|

-

|

|

|

Total assets

|

|

50,624,129

|

|

|

54,292,093

|

|

|

70,073,220

|

|

|

82,475,787

|

|

|

52,030,105

|

|

|

Share capital

|

|

117,000,052

|

|

|

116,766,102

|

|

|

116,151,675

|

|

|

114,414,001

|

|

|

77,122,016

|

|

|

Deficit

|

|

(94,305,878

|

)

|

|

(87,430,021

|

)

|

|

(69,981,980

|

)

|

|

(55,999,368

|

)

|

|

(35,097,315

|

)

|

* Effective for the period ending December 31, 2011, the

Company changed its fiscal year end from March 31 to December 31. Items related

to the consolidated statement of loss for the year ended December 31, 2011

reflect balances for the nine months then ended.

3.A.3. Exchange Rates

In this Annual Report, unless otherwise specified, all dollar

amounts are expressed in Canadian Dollars (“CDN$”). The Government of Canada

permits a floating exchange rate to determine the value of the Canadian Dollar

against the U.S. Dollar (“US$”).

Table No. 4 sets forth the exchange rates for the Canadian

Dollar at the end of five most recent fiscal years ended December 31, the

average rates for the period, and the range of high and low rates for the

period. The data for each month during the most recent six months is also

provided.

For purposes of this table, the exchange rate means the Bank of

Canada noon rate. The table sets forth the number of Canadian Dollars required

to buy one U.S. dollar. The average exchange rate means the average of the

exchange rates on the last day of each month during the period.

Table No. 4

U.S. Dollar/Canadian Dollar

|

Last 6 months

ended

|

|

Average

|

|

|

High

|

|

|

Low

|

|

|

Close

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February 2016

|

|

1.3794

|

|

|

1.4003

|

|

|

1.3510

|

|

|

1.3535

|

|

|

January 2016

|

|

1.4179

|

|

|

1.4602

|

|

|

1.3831

|

|

|

1.3970

|

|

|

December 2015

|

|

1.3709

|

|

|

1.3955

|

|

|

1.3342

|

|

|

1.3869

|

|

|

November 2015

|

|

1.3278

|

|

|

1.3375

|

|

|

1.3073

|

|

|

1.3367

|

|

|

October 2015

|

|

1.3063

|

|

|

1.3278

|

|

|

1.2890

|

|

|

1.3073

|

|

|

September 2015

|

|

1.3263

|

|

|

1.3409

|

|

|

1.3135

|

|

|

1.3400

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Quarter & Last 5 Years

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended December 31, 2015

|

|

1.2783

|

|

|

1.3955

|

|

|

1.1613

|

|

|

1.3869

|

|

|

Fiscal Year Ended December 31, 2014

|

|

1.1041

|

|

|

1.1643

|

|

|

1.0627

|

|

|

1.1627

|

|

|

Fiscal Year Ended December 31, 2013

|

|

1.0298

|

|

|

1.0703

|

|

|

0.9835

|

|

|

1.0694

|

|

|

Fiscal Year Ended December 31, 2012

|

|

0.9996

|

|

|

1.0413

|

|

|

0.9675

|

|

|

0.9966

|

|

|

Fiscal Year Ended December 31, 2011

|

|

0.9888

|

|

|

1.0561

|

|

|

0.9440

|

|

|

1.0197

|

|

As of March 24, 2016, the exchange rate was CDN$1.3269 to US$1.

15

3.B. Capitalization and Indebtedness

--- No Disclosure Necessary ---

3.C. Reasons For The Offer And Use Of Proceeds

--- No Disclosure Necessary ---

3.D. Risk Factors

Investment in the Common Shares involves a significant degree

of risk and should be considered speculative due to the nature of Eurasian’s

business and the present stage of its development. Prospective investors should

carefully review the following factors together with other information contained

in this Annual Report before making an investment decision.

Mineral Property Exploration Risks

The business of mineral exploration and extraction involves a

high degree of risk. Few properties that are explored ultimately become

producing mines. At present, none of the Company’s properties has a known

commercial ore deposit. The main operating risks include ensuring ownership of

and access to mineral properties by confirmation that option agreements, claims

and leases are in good standing and obtaining permits for drilling and other

exploration activities.

Eurasian is currently earning an interest in some of its

properties through option agreements and acquisition of title to the properties

is only completed when the option conditions have been met. These conditions

generally include making property payments, incurring exploration expenditures

on the properties and can include the satisfactory completion of pre-feasibility

studies. If the Company does not satisfactorily complete these option conditions

in the time frame laid out in the option agreements, the Company’s title to the

related property will not vest and the Company will have to write-off any

previously capitalized costs related to that property.

The market prices for precious and base metals can be volatile

and there is no assurance that a profitable market will exist for a production

decision to be made or for the ultimate sale of the metals even if commercial

quantities of precious and other metals are discovered.

Revenue and Royalty Risks

Eurasian cannot predict future revenues or operating results of

the area of mining activity. Management expects future revenues from the Carlin

Trend Royalty Claim Block, including the Leeville royalty property in Nevada, to

fluctuate depending on the level of future production and the price of gold.

Specifically, there is a risk that the operator of the property, Newmont Mining

Company (“Newmont”), will cease to operate in the Company’s area of interest,

therefore there can be no assurance that ongoing royalty payments will

materialize or be received by Eurasian.

Financing and Share Price Fluctuation Risks

Eurasian has limited financial resources and has no assurance

that additional funding will be available for further exploration and

development of its projects. Further exploration and development of one or more

of the Company’s projects may be dependent upon the Company’s ability to obtain

financing through equity or debt financing or other means. Failure to obtain

this financing could result in delay or indefinite postponement of further

exploration and development of its projects which could result in the loss of

one or more of its properties.

The securities markets can experience a high degree of price

and volume volatility, and the market price of securities of many companies,

particularly those considered to be development stage companies, such as

Eurasian, may experience wide fluctuations in share prices which will not

necessarily be related to their operating performance, underlying asset values

or prospects. There can be no assurance that share price fluctuations will not

occur in the future, and if they do occur, the severity of the impact on

Eurasian’s ability to raise additional funds through equity issues.

16

Foreign Countries and Political Risks

The Company operates in countries with varied political and

economic environments. As such, it is subject to certain risks, including

currency fluctuations and possible political or economic instability which may

result in the impairment or loss of mineral concessions or other mineral rights,

opposition from environmental or other non-governmental organizations, and

mineral exploration and mining activities may be affected in varying degrees by

political stability and government regulations relating to the mineral

exploration and mining industry. Any changes in regulations or shifts in

political attitudes are beyond the control of the Company and may adversely

affect its business. Exploration and development may be affected in varying

degrees by government regulations with respect to restrictions on future

exploitation and production, price controls, export controls, foreign exchange

controls, income taxes, expropriation of property, environmental legislation and

mine and site safety.

Notwithstanding any progress in restructuring political

institutions or economic conditions, the present administration, or successor

governments, of some countries in which Eurasian operates may not be able to

sustain any progress. If any negative changes occur in the political or economic

environment of these countries, it may have an adverse effect on the Company’s

operations in those countries. The Company does not carry political risk

insurance.

Competition

The Company competes with many companies that have

substantially greater financial and technical resources than it in the

acquisition and development of its projects as well as for the recruitment and

retention of qualified employees.

Return on Investment Risk

Investors cannot expect to receive a dividend on an investment

in the Common Shares in the foreseeable future, if at all.

No Assurance of Titles or Borders

The acquisition of the right to exploit mineral properties is a

very detailed and time consuming process. There can be no guarantee that the

Company has acquired title to any such surface or mineral rights or that such

rights will be obtained in the future. To the extent they are obtained, titles

to the Company’s surface or mineral properties may be challenged or impugned and

title insurance is generally not available. The Company’s surface or mineral

properties may be subject to prior unregistered agreements, transfers or claims

and title may be affected by, among other things, undetected defects. Such third

party claims could have a material adverse impact on the Company’s operations.

Unknown Defects or Impairments in Our Royalty or Streaming

Interests

Unknown defects in or disputes relating to the royalty and

stream interests we hold or acquire may prevent us from realizing the

anticipated benefits from our royalty and stream interests, and could have a

material adverse effect on our business, results of operations, cash flows and

financial condition. It is also possible that material changes could occur that

may adversely affect management’s estimate of the carrying value of our royalty

and stream interests and could result in impairment charges. While we seek to

confirm the existence, validity, enforceability, terms and geographic extent of

the royalty and stream interests we acquire, there can be no assurance that

disputes over these and other matters will not arise. Confirming these matters,

as well as the title to mining property on which we hold or seek to acquire a

royalty or stream interest, is a complex matter, and is subject to the

application of the laws of each jurisdiction to the particular circumstances of

each parcel of mining property and to the documents reflecting the royalty or

stream interest. Similarly, royalty and stream interests in many jurisdictions

are contractual in nature, rather than interests in land, and therefore may be

subject to change of control, bankruptcy or the insolvency of operators. We

often do not have the protection of security interests over property that we

could liquidate to recover all or part of our investment in a royalty or stream

interest. Even if we retain our royalty and stream interests in a mining project

after any change of control, bankruptcy or insolvency of the operator, the

project may end up under the control of a new operator, who may or may not

operate the project in a similar manner to the current operator, which may

negatively impact us.

Operators’ Interpretation of

Our Royalty and Stream

Interests; Unfulfilled Contractual Obligations

Our royalty and stream interests generally are subject to

uncertainties and complexities arising from the application of contract and

property laws in the jurisdictions where the mining projects are located.

Operators and other parties to the agreements governing our royalty and stream

interests may interpret our interests in a manner adverse to us or otherwise may

not abide by their contractual obligations, and we could be forced to take legal

action to enforce our contractual rights. We may or may not be successful in

enforcing our contractual rights, and our revenues relating to any challenged

royalty or stream interests may be delayed, curtailed or eliminated during the

pendency of any such dispute or in the event our position is not upheld, which could have a material adverse effect on

our business, results of operations, cash flows and financial condition.

Disputes could arise challenging, among other things:

17

-

the existence or geographic extent of the royalty or stream interest;

-

methods for calculating the royalty or stream interest, including whether

certain operator costs may properly be deducted from gross proceeds when

calculating royalties determined on a net basis;

-

third party claims to the same royalty interest or to the property on

which we have a royalty or stream interest;

-

various rights of the operator or third parties in or to the royalty or

stream interest;

-

production and other thresholds and caps applicable to payments of royalty

or stream interests;

-

the obligation of an operator to make payments on royalty and stream

interests; and

-

various defects or ambiguities in the agreement governing a royalty and

stream interest.

Currency Risks

The Company’s equity financings are sourced in Canadian dollars

but much of its expenditures are in local currencies or U.S. dollars. At this

time, there are no currency hedges in place. Therefore, a weakening of the

Canadian dollar against the U.S. dollar or local currencies could have an

adverse impact on the amount of exploration funds available and work

conducted.

Joint Venture and Exploration Funding Risk

Eurasian’s strategy is to seek exploration and joint venture

partners through options and joint ventures to fund exploration and project

development. The main risk of this strategy is that the funding parties may not

be able to raise sufficient capital in order to satisfy exploration and other

expenditure terms in a particular joint venture agreement. As a result,

exploration and development of one or more of the Company’s property interests

may be delayed depending on whether Eurasian can find another party or has

enough capital resources to fund the exploration and development on its own.

Insured and Uninsured Risks

In the course of exploration, development and production of

mineral properties, the Company is subject to a number of risks and hazards in

general, including adverse environmental conditions, operational accidents,

labor disputes, unusual or unexpected geological conditions, changes in the

regulatory environment and natural phenomena such as inclement weather

conditions, floods, and earthquakes. Such occurrences could result in the damage

to the Company’s property or facilities and equipment, personal injury or death,

environmental damage to properties of the Company or others, delays, monetary

losses and possible legal liability.

Although the Company may maintain insurance to protect against

certain risks in such amounts as it considers reasonable, its insurance may not

cover all the potential risks associated with its operations. The Company may

also be unable to maintain insurance to cover these risks at economically

feasible premiums or for other reasons. Should such liabilities arise, they

could reduce or eliminate future profitability and result in increased costs,

have a material adverse effect on the Company’s results and a decline in the

value of the securities of the Company.

Some work is carried out through independent consultants and

the Company requires all consultants to carry their own insurance to cover any

potential liabilities as a result of their work on a project.

Environmental Risks and Hazards

The activities of the Company are subject to environmental

regulations issued and enforced by government agencies. Environmental

legislation is evolving in a manner that will require stricter standards and

enforcement and involve increased fines and penalties for non-compliance, more

stringent environmental assessments of proposed projects, and a heightened

degree of responsibility for companies and their officers, directors and

employees. There can be no assurance that future changes in environmental

regulation, if any, will not adversely affect Eurasian’s operations.

Environmental hazards may exist on properties in which the Company holds

interests which are unknown to the Company at present.

Fluctuating Metal Prices

Factors beyond the control of the Company have a direct effect

on global metal prices, which have fluctuated widely, particularly in recent

years, and there is no assurance that a profitable market will exist for a

production decision to be made or for the ultimate sale of the metals even if

commercial quantities of precious and other metals are discovered on any of Eurasian’s properties. Consequently, the economic viability of

any of the Company’s exploration projects and its ability to finance the

development of its projects cannot be accurately predicted and may be adversely

affected by fluctuations in metal prices.

18

Extensive Governmental Regulation and Permitting

Requirements Risks

Exploration, development and mining of minerals are subject to

extensive laws and regulations at various governmental levels governing the

acquisition of the mining interests, prospecting, development, mining,

production, exports, taxes, labor standards, occupational health, waste

disposal, toxic substances, land use, environmental protection, mine safety and

other matters. In addition, the current and future operations of Eurasian, from

exploration through development activities and production, require permits,

licenses and approvals from some of these governmental authorities. Eurasian has

obtained all government licenses, permits and approvals necessary for the

operation of its business to date. However, additional licenses, permits and

approvals may be required. The failure to obtain any licenses, permits or

approvals that may be required or the revocation of existing ones would have a

material and adverse effect on Eurasian, its business and results of operations.

Failure to comply with applicable laws, regulations and permits

may result in enforcement actions thereunder, including orders issued by

regulatory or judicial authorities requiring Eurasian’s operations to cease or

be curtailed, and may include corrective measures requiring capital

expenditures, installation of additional equipment or remedial actions. Eurasian

may be required to compensate those suffering loss or damage by reason of its

mineral exploration activities and may have civil or criminal fines or penalties

imposed for violations of such laws, regulations and permits. Any such events

could have a material and adverse effect on Eurasian and its business and could

result in Eurasian not meeting its business objectives.

Key Personnel Risk

Eurasian’s success is dependent upon the performance of key

personnel working in management and administrative capacities or as consultants.

The loss of the services of senior management or key personnel could have a

material and adverse effect on the Company, its business and results of

operations.

Conflicts of Interest

In accordance with the laws of British Columbia, the directors

and officers of a Company are required to act honestly, in good faith and in the

best interests of the Company. Eurasian’s directors and officers may serve as

directors or officers of other companies or have significant shareholdings in

other resource companies and, to the extent that such other companies may

participate in ventures in which the Company may participate, such directors and

officers may have a conflict of interest in negotiating and concluding terms

respecting the extent of such participation. If such a conflict of interest

arises at a meeting of the Company’s directors, a director with such a conflict

will abstain from voting for or against the approval of such participation or

such terms.

Passive Foreign Investment Company

U.S. investors in common shares should be aware that based on

current business plans and financial expectations, Eurasian currently expects

that it will be classified as a passive foreign investment company (“PFIC”) for

the tax year ending December 31, 2015 and expects to be a PFIC in future tax

years. If Eurasian is a PFIC for any tax year during a U.S. shareholder’s

holding period, then such U.S. shareholder generally will be required to treat

any gain realized upon a disposition of common shares, or any so-called “excess

distribution” received on its common shares, as ordinary income, and to pay an

interest charge on a portion of such gain or distributions, unless the U.S.

shareholder makes a timely and effective “qualified electing fund” election

(“QEF Election”) or a “mark-to-market” election with respect to the common

shares. A U.S. shareholder who makes a QEF Election generally must report on a

current basis its share of Eurasian’s net capital gain and ordinary earnings for

any year in which Eurasian is a PFIC, whether or not Eurasian distributes any

amounts to its shareholders. For each tax year that Eurasian qualifies as a

PFIC, Eurasian intends to: (a) make available to U.S. shareholders, upon their

written request, a “PFIC Annual Information Statement” as described in Treasury

Regulation Section 1.1295 -1(g) (or any successor Treasury Regulation) and (b)

upon written request, use commercially reasonable efforts to provide all

additional information that such U.S. shareholder is required to obtain in

connection with maintaining such QEF Election with regard to Eurasian. Eurasian

may elect to provide such information on its website www.EurasianMinerals.com.

This paragraph is qualified in its entirety by the discussion below the heading

“Taxation – Certain United States Federal Income Tax Considerations.” Each U.S.

investor should consult its own tax advisor regarding the PFIC rules and the

U.S. federal income tax consequences of the acquisition, ownership and

disposition of common shares.

19

Corporate Governance and Public Disclosure Regulations

The Company is subject to changing rules and regulations

promulgated by a number of United States and Canadian governmental and

self-regulated organizations, including the United States Securities and

Exchange Commission (“SEC”), the British Columbia and Alberta Securities

Commissions, the NYSE MKT and the TSX-V. These rules and regulations continue to

evolve in scope and complexity and many new requirements have been created,

making compliance more difficult and uncertain. The Company’s efforts to comply

with the new rules and regulations have resulted in, and are likely to continue

to result in, increased general and administrative expenses and a diversion of

management time and attention from revenue-generating activities to compliance

activities.

Internal Controls over Financial Reporting

Applicable securities laws require an annual assessment by

management of the effectiveness of the Company’s internal control over financial

reporting. The Company may, in the future, fail to achieve and maintain the

adequacy of its internal control over financial reporting, as such standards are

modified, supplemented or amended from time to time, and the Company may not be

able to ensure that it can conclude on an ongoing basis that it has effective

internal control over financial reporting. Future acquisitions may provide the

Company with challenges in implementing the required processes, procedures and

controls in its acquired operations. Acquired Corporations may not have

disclosure controls and procedures or internal control over financial reporting

that are as thorough or effective as those required by securities laws currently

applicable to the Company.

No evaluation can provide complete assurance that the Company’s

internal control over financial reporting will detect or uncover all failures of

persons within the Company to disclose material information otherwise required

to be reported. The effectiveness of the Company’s controls and procedures could

also be limited by simple errors or faulty judgments. In addition, should the

Company expand in the future, the challenges involved in implementing

appropriate internal control over financial reporting will increase and will

require that the Company continue to improve its internal control over financial

reporting.

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Introduction

The Company’s corporate office is located at:

|

|

Suite 501, 543 Granville Street

|

|

|

Vancouver, British Columbia, Canada V6C 1X8

|

|

|

Telephone: (604) 688-6390

|

|

|

Facsimile: (604) 688-1157

|

|

|

Website: www.EurasianMinerals.com

|

|

|

Email: kcasswell@seabordservices.com

|

The contact person is: Kim Casswell, Corporate Secretary.

The Company’s registered and records office is located at Suite

704, 595 Howe Street, Vancouver, British Columbia, V6C 2T5.

The Company’s technical office is located at:

|

|

10001 W. Titan Road

|

|

|

Littleton, Colorado

|

|

|

United States of America, 80125

|

|

|

Telephone: 303-973-8585

|

|

|

Facsimile: 303-973-0715

|

The Company's fiscal year ends December 31.

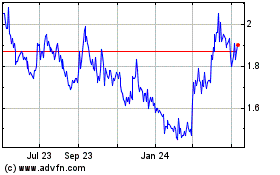

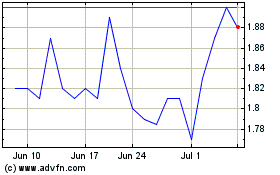

The Company's Common Shares trade on the TSX-V under the symbol

EMX and on the NYSE Market LLC under the symbol EMXX.

20

At December 31, 2015, the end of the Company's most recent

fiscal year, there were 73,534,710 Common Shares issued and outstanding.

Incorporation and Name Changes

Eurasian Minerals Inc. was incorporated under the laws of the

Yukon Territory of Canada on August 21, 2001 as 33544 Yukon Inc. and, on October

10, 2001, changed its name to Southern European Exploration Ltd. On November 24,

2003, the Company completed the reverse take-over of Marchwell Capital Corp., a

TSX-V-listed company incorporated in Alberta on May 13, 1996 and which

subsequently changed its name to Eurasian Minerals Inc. On September 21, 2004,

Eurasian continued into British Columbia from Alberta under the

Business

Corporations Act.

Eurasian’s head office is located at Suite 501 – 543 Granville

Street, Vancouver, British Columbia V6C 1X8, Canada, and its registered and

records office is located at Northwest Law Group, Suite 704 – 595 Howe Street,

Vancouver, British Columbia V6C 2T5, Canada.

Eurasian is a reporting issuer under the securities legislation

of British Columbia and Alberta and is listed on the TSX-V, as a Tier 1 issuer,

and the NYSE MKT (formerly known as the American Stock Exchange or AMEX).

Eurasian’s Common Shares without par value are traded on the TSX-V under the

symbol EMX and on the NYSE MKT under the symbol EMXX.

Fiscal Year ended December 31, 2013

Paul H. Zink ceased to be President of Eurasian Capital on

January 31, 2013.

On February 27, 2013, the Company announced that its

wholly-owned subsidiary, Eurasia Madencilik Ltd. Sti., had executed a definitive

agreement with Tumad Madencilik Sanayi ve Ticaret A.S. (“Tumad”), a private

Turkish company, giving Tumad an option to acquire Eurasian’s Trab-23 gold

(copper-molybdenum) porphyry project in northeast Turkey (the “Trab-23

Agreement”). The Trab-23 Agreement consists of: in-ground spending requirements

to further develop the asset’s value; a revenue stream of annual earn-in and

pre-production payments; and a revenue stream based upon production. See

“Mineral Properties – Turkey”.

In April 2013 the Company announced the selection of the

Iekelvare Designated Project in Sweden pursuant to the Alliance Agreement with

Antofagasta Minerals S.A., a wholly-owned subsidiary of Antofagasta Plc, a

Chilean mining company listed on the London Stock Exchange. Iekelvare joined

Kiruna South as a Designated Project in Sweden. In March 2014 Antofagasta

advised Eurasian that it was discontinuing further funding of the Kiruna South

and Iekelvare Designated Projects.

Larry M. Okada was appointed to the Board of Directors on June

11, 2013.

On June 30, 2013, the Company announced the execution of an

Option Agreement (the “Akarca Agreement”) to sell the Akarca property in

northwest Turkey to Çolakoğlu for a combination of cash payments, gold bullion,

work commitments, and a royalty interest. The Akarca Agreement gives Çolakoğlu,

the option to acquire EMX’s 100%-owned Turkish subsidiary, AES Madencilik A.S.

("AES Turkey"), that controls the Akarca property. The Akarca Agreement required

Çolakoğlu to make an up-front payment of US$250,000 and in order to exercise the

option, drill up at least 5,000 meters by the end of the first year, and make a

US$500,000 payment on exercise of the option. See “Mineral Properties – Turkey”.

In August, the Company sold its geothermal energy assets in

Slovakia and Peru to Starlight Geothermal Ltd. (“SGL”), an arm’s length private

company based in Houston, Texas, for cash payments, an equity position of

approximately 5% in SGL’s issued and outstanding voting share capital, annual

advance minimum royalty payments until production commences and, once production

commences, a 1% gross royalty on its geothermal licenses in Slovakia and a 0.5%

gross royalty on its geothermal licenses in Peru.

On September 4, 2013, the Company announced that it had,

through its wholly-owned subsidiary, Bronco Creek Exploration Inc. (“BCE” or

“Bronco Creek”), entered into three option purchase agreements with Desert Star

granting Desert Star options to acquire the Company’s Red Top, Copper Springs,

and Copper King porphyry copper projects in Arizona. See “Mineral Properties –

North America”.

In October 2013, Bronco Creek signed three exploration and

earn-in agreements, with Savant Explorations Ltd. (TSX-V: SVT), a public company

based in Vancouver, British Columbia (“Savant”), granting Savant options to earn

in to the Company’s Jasper Canyon, Buckhorn Creek, and Frazier Creek porphyry

copper projects. See “Mineral Properties – North America”.

21

Fiscal Year ended December 31, 2014

On January 7, 2014, the Company announced the signing of an

Exploration and Option Agreement (the “Alankoy Agreement”) with Ferrite

Resources Ltd. (“Ferrite”), a privately-held Australian company, for the

disposition, by option, of the Alankoy copper-gold property in northwestern

Turkey. Ferrite has the option to earn a 100% interest in the project through

work commitments, payments, and annual advance royalties. EMX will retain an

uncapped 3% production royalty that cannot be purchased in advance or otherwise

reduced. Under the Alankoy Agreement, Ferrite paid US$35,000 upon signing the

Alankoy Agreement and must expend at least US$200,000 on exploration activities

on the project each year for the three years. In addition, Ferrite is required

to make annual deliveries of gold bullion to EMX as advance royalties. These

will consist of 75 troy ounces of gold (or cash equivalent thereof) delivered on

each of the first three anniversaries and annual advance royalties of 100 troy

ounces of gold (or cash equivalent) on all subsequent anniversaries until

commencement of commercial production. See “Mineral Properties – Turkey”.

On February 19, 2014, EMX signed an Exploration and Option

Agreement (the “NQM Agreement”) with North Queensland Mining Pty Ltd. (“NQM”), a

privately-held Australian company, respecting EMX’s Koonenberry exploration

licenses in

New South Wales, Australia. Under the NQM Agreement, Eurasian

granted NQM the option, exercisable until February 19, 2017, to acquire the EMX

subsidiary (EMX Exploration Pty Ltd.) that holds the Company’s remaining

exploration licenses in the project area, with EMX retaining a 3% production

royalty. On or before the second anniversary of the NQM Agreement date, NQM can

reduce such 3% production royalty to 2.5%, by agreeing to pay annual advance

royalties in the following amounts:

-

75 troy ounces of gold (or cash equivalent thereof) on the first

anniversary of NQM’s election to reduce the amount of the production royalty,

-

100 troy ounces of gold (or cash equivalent) on the earlier of the third

anniversary of the NQM Agreement date or the exercise of the election, and

-

100 troy ounces of gold (or cash equivalent) on all subsequent

anniversaries of the NQM Agreement date until commencement of commercial

production.

In February 2014, the Board of Directors adopted an Advance

Notice Policy in respect of the election of directors. The purpose of the Policy

is to provide shareholders, directors and management of the Company with a clear

framework for nominating persons for election as directors of the Company. No

person will be eligible for election unless nominated in accordance with the

Policy. The Policy was ratified by the Company’s shareholders at its annual

general meeting on May 13, 2014 and subsequently incorporated into the Company’s

articles.

On April 25, 2014, incentive stock options, exercisable to

purchase an aggregate of 1,531,000 Common Shares at a price of $1.20 per share

for a period of five years, were granted to officers, directors and employees

of, and consultants to, the Company.

On April 25, 2014, the Company announced that it intended to

issue an aggregate of 300,000 Common Shares in lieu of cash remuneration to two

non-executive employees and a consultant. An aggregate of 300,000 Common Shares

would be issued over a period of two years, with the initial tranche of 100,000

Common Shares being issued upon receipt of TSX-V and NYSE MKT approval, and a

further 100,000 Common Shares on each of the first and second anniversaries. The

first tranche was issued on May 30, 2014.

On May 13, 2014, James A. Morris resigned from the Board of

Directors.

On May 15, 2014, EMX announced the signing of an Exploration

and Option Agreement (the “Lomitas Agreement”), through its wholly-owned

subsidiary Bronco Creek, respecting the Lomitas Negras porphyry copper project

with Kennecott

Exploration Company (“Kennecott”), part of the Rio Tinto Group.

Pursuant to the Lomitas Agreement, Kennecott can earn a 100% interest in the

project by completing US$4,500,000 in exploration expenditures and paying

escalating option payments totaling US$900,000 within five years after the date

of the Lomitas Agreement, after which EMX will retain a 2% NSR royalty.

In June 2014, Dr. Rael Lipson was appointed to the Company’s

advisory board.

On July 4, 2014, EMX announced the signing of an Exploration

and Option Agreement (the “Cathedral Well Agreement”) by its wholly-owned

subsidiary Bronco Creek with Ely Gold and Minerals Inc. (“Ely Gold”), a

Vancouver-based mineral exploration company listed on the TSX-V, respecting

EMX’s Cathedral Well gold project. Pursuant to the Cathedral Well Agreement, Ely

Gold can earn a 100% interest in the Project by paying EMX a total of US$100,000

as follows: US$25,000 upon execution of the Cathedral Well Agreement and US$75,000

over the next three years, after which EMX will retain a 2.5% NSR royalty,

inclusive of an underlying 0.5% NSR royalty.

22

On November 13, 2014, the Company announced the execution of an

agreement with Land & Mineral Limited (“L&M”), a privately-held

Australian company, giving L&M the right to acquire Hauraki Gold Ltd.

(“Hauraki”), the wholly-owned EMX subsidiary that controls the Neavesville

Property located in the Hauraki goldfield of New Zealand’s North Island. The

purchase and sale agreement included an execution payment of $100,000 ($50,000

received in January 2015) and a series of anniversary and milestone payments

equal to a certain amount of troy ounces of gold.

Pursuant to the amended agreement, L&M was to have paid the

balance of the $100,000 execution payment, being $50,000 to the Company on or by

no later than January 19, 2016. L&M is currently in default of this payment.

See “Mineral Properties – Australia and New Zealand”.

Fiscal Year ended December 31, 2015

In February 2015, Mr. Paul H. Stephens was appointed to the

Company’s advisory board.

In March 2015, Dr. Enders resigned from the position of Chief

Operating Officer and as a Director of the Board. Dr. Enders will continue as a

consultant and was appointed to the advisory board.

On May 4, 2015 the Company announced the signing of an

Exploration and Option to Purchase Agreement, through its wholly owned

subsidiary Bronco Creek, for the Superior West porphyry copper project with

Kennecott (“Superior West Agreement”). The project is located adjacent to the

Resolution porphyry copper project within the Superior Mining District,

approximately 100 kilometers east of Phoenix, Arizona.

Commercial Terms Overview.

Pursuant to the Superior West

Agreement, Kennecott can earn a 100% interest in the project by making a cash

payment upon execution of the Superior West Agreement of US$149,187, and

thereafter completing US$5,500,000 in exploration expenditures and paying annual

option payments totaling US$1,000,000 before the fifth anniversary of the

Agreement.

Upon exercise of the option the Company will retain a 2% NSR

royalty on the properties. Kennecott has the right to buy down 1% of the NSR

royalty covering 14 claims which are optioned (the “Optioned Claims”) from

underlying claim holders by payment of US$4,000,000 to EMX. Except with respect

to the Optioned Claims, the royalty is not capped and not subject to buy-down.

After exercise of the option, annual advanced minimum royalty

(“AMR”) payments are due starting at US$125,000 and commencing on the first

anniversary of the exercise of the option. The AMR payments will increase to

US$200,000 upon completion of an Order of Magnitude Study ("OMS") or Preliminary

Economic Assessment ("PEA"). Kennecott may make a one-time payment of

US$4,000,000 to extinguish the obligation to make AMR payments. In addition, if

not previously extinguished, total AMR payments after the OMS or PEA milestone

payment are capped at US$4,000,000, and all AMR payments cease upon production

from the properties.

In addition, Kennecott will make milestone payments consisting

of:

-

US$500,000 upon completion of an OMS or PEA;

-

US$1,000,000 upon completion of a Prefeasibility Study; and

-

US$2,500,000 upon completion of a Feasibility Study. The Feasibility Study

payment will be credited against future royalty payments.

On May 26, 2015 the Company reported the initial NI 43-101

resource estimate and Russian Federation project approvals for the Malmyzh

copper-gold porphyry project. The Malmyzh exploration and mining licenses,

located in the Russian Far East, are held by a Joint Venture between IG Copper

LLC (“IGC”) (51%) and Freeport-McMoRan Exploration Corporation (“Freeport”)

(49%), with IGC operating and managing the project. The Company is IGC’s largest

shareholder with 42.2% of the issued and outstanding shares (37% on a fully

diluted basis) resulting from investments totaling US $7.8 million. The

Company’s investment in IGC is in recognition of the significant potential of

the district-scale discovery at Malmyzh, as well as IGC’s success in acquiring

additional exploration properties in a prospective region under-explored for its

porphyry copper-gold potential.

23

On June 11, 2015 the Company announced that pursuant to the

Company’s Stock Option Plan, an aggregate of 1,341,500 incentive stock options,

exercisable at a price of $0.66 per share for a period of five years, has been

granted to officers, directors, employees and consultants of the Company.

On July 13, 2015 the Company announced that the National

Instrument 43-101

Standards of Disclosure for Mineral Projects

technical

report titled "NI 43-101 Technical Report on the Initial Mineral Resource

Estimate for the Malmyzh Copper-Gold Project, Khabarovsk Krai, Russian

Federation" (the "Report") dated July 10, 2015 has been filed on SEDAR at

www.sedar.com

and

on the SEC’s website at

www.sec.gov

. On

August 4, 2015

the Company announced the signing of an Exploration and

Option to Purchase Agreement, through its wholly owned subsidiary Bronco Creek,

for the Aguila de Cobre porphyry copper project (the "Aguila de Cobre Project")

with Kennecott (“Aguila de Cobre Agreement”). The Aguila de Cobre Project is

located approximately 120 kilometers west of Phoenix, Arizona in a relatively

un-explored region of the Arizona porphyry copper belt.

Commercial Terms Overview.

Pursuant to the Aguila de

Cobre Agreement, Kennecott can earn a 100% interest in the Aguila de Cobre

Project by making cash payments and performing exploration as follows (all

amounts are US$):

Cash Payments:

-

$25,000 upon execution of the Aguila de Cobre Agreement (firm commitment);

-

$25,000 on the first and second anniversaries of the Agreement;

-

$50,000 on the third anniversary of the Aguila de Cobre Agreement; and

-

$100,000 upon exercise of the Option.

Exploration:

-

Completing $250,000 of exploration expenditures (or paying the Company

that amount) by the first anniversary of the Aguila de Cobre Agreement (firm

commitment); and

-

Completing an additional $3,750,000 of exploration expenditures (or paying

the Company that amount) by the third anniversary of the Aguila de Cobre

Agreement.

Upon exercise of the option, the Company will retain a 2% NSR

royalty on the property. The royalty is not capped and not subject to buy-down.

The Aguila de Cobre Agreement contains a one-mile area of interest provision.

After exercise of the option, AMR payments are due starting at

$50,000 and commencing on the first anniversary of the exercise of the option.

The AMR payments will increase to $100,000 upon completion of an OMS or PEA,

after which Kennecott may make a one-time payment of $2,500,000 to extinguish

the obligation to make future AMR payments. In addition, if not previously

extinguished, total AMR payments after the OMS or PEA milestone payment are

capped at $2,500,000, and all AMR payments cease upon production from the

properties.

In addition, Kennecott will make milestone payments consisting

of:

-

$500,000 upon completion of an OMS or PEA;

-

$500,000 upon completion of a Prefeasibility Study; and

-

$1,000,000 upon completion of a Feasibility Study - this payment will be

credited against future royalty payments.

On October 30, 2015

the Company announced that it has

regained 100% control of the Akarca gold-silver project in Turkey (the

“Property”). The Company had an agreement with Çolakoglu Ticari Yatirim A.S.

("Çolakoglu"), a privately owned Turkish company, for an option to acquire AES

Turkey, a Turkish corporation that controls the Property. Çolakoglu has advised

the Company that it decided to forego exercising the option. Çolakoglu has made

cash payments of US $350,000 to the Company while advancing the Property through

substantial exploration and drilling programs, as well as metallurgical and

environmental studies.

The Akarca project is a grassroots discovery highlighted by six

separate gold-silver mineralized centers occurring within a district-scale area.

Exploration completed to date includes 245 core and reverse circulation holes

totaling about 26,400 meters of drilling and property-wide geologic mapping,

geochemical sampling, and geophysical surveys. This work has been conducted

primarily through partner-funded programs totaling over US $13 million that

considerably advanced the project.

On November 2, 2015 the Company announced the sale of its

interests in Haiti to joint venture partner Newmont Ventures Limited (“Newmont”

or "NVL"), a wholly owned subsidiary of Newmont Mining Corporation (NYSE: NEM),

for a US $4 million (CDN $5.3 million) cash payment and a retained 0.5% NSR

royalty interest.

24

The now terminated Eurasian-Newmont joint ventures (the “Joint

Ventures”) covered six designated exploration areas along a 130 kilometer trend

of northern Haiti's Massif du Nord mineral belt. Since 2013, activities in the

designated exploration areas have been limited to care and maintenance only.

Pursuant to the transaction, Newmont acquired all of the

Company's interest in the Research Permit applications on the following terms:

-

Newmont paid US $4 million (CDN $5.3 million) in cash to the Company at

closing;

-

The Joint Ventures were terminated;

-

The Company retains a 0.5% NSR royalty on the 49 Research Permit

applications covering the designated exploration areas; and

-

The Company retains the right to acquire any properties proposed to be

abandoned or surrendered by Newmont.

On November 16, 2015, the Company announced the resignation of

Valerie Barlow as Corporate Secretary and the appointment of Kim Casswell in her

place.

On November 23, 2015, the Company announced the signing of an

Exploration and Option Agreement with Black Sea Copper & Gold Corp. (“Black

Sea”), a privately-held British Columbia corporation, for the Alankoy

copper-gold property in northwestern Turkey. Black Sea has the option to earn a

100% interest in the subsidiary companies that control the property through work

commitments, payments, and annual advance royalties (“AARs”). The Company will

retain an uncapped production royalty for all minerals produced from the

project. The royalty cannot be purchased in advance or otherwise reduced.

Commercial Terms.

Pursuant to the Agreement, Black Sea

has the option to acquire the Company’s subsidiaries that hold the Alankoy

project, with the Company retaining a production royalty of 3% for gold, silver,

and other precious metals and 2% for all other minerals produced from the

project. To do so, Black Sea is to make payments to the Company and conduct

exploration as follows:

-

Pay US $25,000 upon signing the Agreement;

-

Expend at least US $75,000 on exploration activities on or before the

later of June 1, 2016 and the date on which drilling permits have been issued

(the “Commencement Date”);

-

Conduct at least 1,500 meters of exploration drilling by the first

anniversary of the Commencement Date;

-

Expend at least an additional US $200,000 on exploration activities by the

second anniversary of the Commencement Date;

-

Expend at least an aggregate of US $3,000,000 on exploration activities on

or before the sixth anniversary of the date of the Agreement; and

-

Pay 500 troy ounces of gold (or cash equivalent thereof) upon a decision

to develop a mine on the project.

In addition, Black Sea is to make annual deliveries of gold

bullion (or cash equivalent thereof) to the Company as AARs, as follows:

-

37.5 troy ounces of gold delivered on the first anniversary of the date of

the Agreement (this payment may be made in shares of Black Sea if at that time

Black Sea is publicly traded on the TSX-V);

-

75 troy ounces of gold delivered on the second and third anniversaries of

the date of the Agreement; and

-

100 troy ounces of gold delivered on all subsequent anniversaries until

commencement of commercial production.

On November 24, 2015 the Company announced the signing of an

Exploration and Option Agreement, through its wholly owned subsidiary Bronco

Creek, for the Hardshell Skarn project (the "Hardshell Project") with Arizona

Minerals Inc. (“AZ Minerals”). The Hardshell Project is located approximately 75

kilometers southeast of Tucson, Arizona within the Patagonia Mountains and

adjacent to AZ Minerals' advancing Hermosa project.

Commercial Terms Overview.

Pursuant to the Agreement, AZ

Minerals can earn a 100% interest in the Hardshell Project by making cash

payments totaling $85,000 (all amounts are US$). Upon exercise of the option the

Company will retain a 2% NSR royalty on the Hardshell Project and receive AAR

payments of $5,000 commencing on the first anniversary of the exercise of the

option. The royalty is not capped and not subject to buy-down.

On December 10, 2015 the Company announced that IGC advises

that an additional license has been granted for the Malmyzh copper-gold porphyry

project in Far East Russia. The Malmyzh licenses are held by IGC (51%) and

Freeport (49%), with IGC operating and managing the project. The new "Malmzyh

Flanks" exploration license expands the Joint Venture's land position covering the Malmyzh district for a

total of 226.9 square kilometers, and includes additional areas for potential

infrastructure development as well as extensions to known exploration

targets.

25

On December 23, 2015

the Company announced it has been

advised of the initial shipment of material for processing from the Balya

lead-zinc-silver royalty property by owner and operator Dedeman Balya Kursun

Cinko Isletmeleri A.S. The Company retains an uncapped 4% net smelter return

royalty on the Balya property, which is located in the historic Balya mining

district of northwestern Turkey. The Dedeman group (collectively "Dedeman")

includes privately-held Turkish mining companies with active operations that

produce lead, zinc, silver, and chromite.

Subsequent to 2015

On February 23, 2016 the Company announced the execution of a

purchase agreement for net smelter return royalty interests on the Maggie Creek

and Afgan gold properties from Golden Predator US Holding Corp. (“Golden

Predator”), a wholly-owned subsidiary of Till Capital Ltd. ("TCL"). Golden

Predator owns a 2% NSR royalty on all precious metals and a 1% NSR royalty on

all other minerals for the Maggie Creek property, which is located

north-northeast of Newmont Mining Corporation's ("Newmont") Gold Quarry open pit

operations on the Carlin Trend, and a 1% NSR royalty on all minerals for the

Afgan property, which occurs on the Battle Mountain-Eureka Trend. The addition

of these two royalty assets will strengthen the Company's growing Nevada gold

portfolio that includes the Leeville royalty property on the Northern Carlin

Trend, as well as the Maggie Creek South royalty property located

south-southeast of Gold Quarry.

Commercial Terms Overview.

A summary of the Agreement's

commercial terms includes:

-

Purchase by the Company of Golden Predator’s NSR royalties covering the

Maggie Creek (2% NSR on precious metals and 1% NSR royalty on all other

minerals) and Afgan (1% NSR royalty) properties;

-

Issuance by the Company of 250,000 EMX shares to TCL as consideration for

the purchase; and

-

Approval by the TSX-V and NYSE MKT as a condition precedent to closing the

transaction.

On March 7, 2016 the Company announced that the purchase of net

smelter return royalty interests has been completed for the Maggie Creek and

Afgan gold properties from Golden Predator after receiving approvals from the

TSX-V and NYSE MKT.

4.B. BUSINESS OVERVIEW

Eurasian is principally in the business of exploring for, and

generating royalties from, metals and minerals properties, as well as

identifying royalty opportunities for purchase. Eurasian’s business is carried

out as a royalty and prospect generator. Under the royalty and prospect

generation business model, it acquires and advances early-stage mineral

exploration projects and then options the projects to, and thereby forms

relationships with, other parties in consideration of a retained royalty

interest, as well as annual advanced royalty and other cash or share payments

and exploration carried out by the other parties. Through its various

agreements, Eurasian also provides technical and commercial assistance to such

companies as the projects advance. By optioning interests in its projects to

third parties for a royalty interest, Eurasian:

|

(a)

|

reduces its exposure to the costs and risks associated

with mineral exploration and project development,

|

|

(b)

|

maintains the opportunity to participate in early-stage

exploration upside; and

|

|

(c)

|

develops a pipeline for potential production royalty

payments and associated greenfields discoveries in the

future.

|

This approach helps preserve the Company’s treasury, which can

be utilized for further project acquisitions and other business initiatives.

The Company’s royalty and exploration portfolio consists of

properties in North America, Turkey, Europe, Haiti, Australia, and the