SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULE 13d-1(a) AND

AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

(Amendment No. 1)*

Navidea

Biopharmaceuticals, Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

640518106

(CUSIP Number)

Joseph SanFilippo

Chief Financial Officer

Platinum Management (NY) LLC

250 West 55th Street, 14th Floor

New York, New York 10019

(212) 582-2222

With

copies to:

Morris F. DeFeo, Jr., Esq.

Crowell & Moring LLP

1001 Pennsylvania Ave, NW

Washington, DC 20004-2595

(202) 624-2500

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 14, 2016

(Date of Event which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box x.

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the

Act (however, see the Notes).

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Platinum Partners Value Arbitrage Fund L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman Islands |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

13,748,890 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

13,748,890 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

13,748,890 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 8.59% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

Page 2 of 9 pages

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Platinum Management (NY) LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman Islands |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

13,748,890 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

13,748,890 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

13,748,890 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 8.59% |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

Page 3 of 9 pages

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Platinum Partners Liquid Opportunity Master Fund L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman Islands |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

1,581,193 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

1,581,193 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,581,193 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.99% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

Page 4 of 9 pages

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Platinum Liquid Opportunity Management (NY) LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

1,581,193 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

1,581,193 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,581,193 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.99% |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

Page 5 of 9 pages

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Mark Nordlicht |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

15,330,083 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

15,330,083 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

15,330,083 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 9.58% |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

Page 6 of 9 pages

EXPLANATORY NOTE

This Amendment No. 1 to Schedule 13D (“Amendment No. 1”) is being filed with respect to the Reporting Persons’ beneficial ownership

in Navidea Biopharmaceuticals, Inc. (“Navidea” or the “Issuer”). This Amendment No. 1 supplements the Schedule 13D previously filed with the Securities and Exchange Commission (the “SEC”) on March 9, 2016 (the

“Schedule 13D”). Each Item below amends and supplements the information disclosed under the corresponding Item of the Schedule 13D. Unless otherwise indicated herein, capitalized terms used but not defined in this Amendment No. 1

shall have the same meaning herein as are ascribed to such terms in the Schedule 13D. Except as set forth herein, this Amendment No. 1 does not modify any of the information previously reported by the Reporting Persons in the Schedule 13D.

| ITEM 4. |

Purpose of Transaction. |

As previously disclosed in the Schedule 13D, the Reporting

Persons purchased the Common Stock based on the belief that such securities, when purchased, were undervalued and represented an attractive investment opportunity. Although no Reporting Person has any specific plan or proposal to acquire or dispose

of the Common Stock, consistent with its investment purpose, and subject to the restrictions set forth in the “Agreement” (as defined below), each Reporting Person at any time and from time to time may acquire additional Common Stock or

dispose of any or all of its Common Stock depending upon an ongoing evaluation of the investment in the Common Stock, prevailing market conditions, other investment opportunities, liquidity requirements of the Reporting Persons, and/or other

investment considerations. The purpose of the acquisitions of the Common Stock was for investment, and the acquisitions of the Common Stock were made in the ordinary course of business and were not made for the purpose of acquiring control of the

Issuer.

On March 14, 2016, Navidea entered into an Agreement (the “Agreement”) with the Reporting Persons, pursuant to

which the Reporting Persons agreed to reaffirm their existing loan agreement with Navidea and to certain standstill provisions.

Certain

of the Reporting Persons (the “Sub Lender” as such term is defined in the Agreement) are lenders under the existing loan agreement with Navidea dated as of July 25, 2012, as amended on June 25, 2013, March 4, 2014 and

May 8, 2015 (as amended, the “Loan Agreement”). The Issuer has previously disclosed the terms of the Loan Agreement and amendments thereto in Current Reports on Form 8-K as filed with the SEC on July 30, 2012, June 26,

2013 (as amended June 28, 2013), March 7, 2014 and May 15, 2015, respectively.

Navidea requested that the Sub Lender

affirm the availability of additional advances under the Loan Agreement, and Sub Lender has agreed to do so pursuant to the Agreement. As a condition to the Agreement’s effectiveness and to the performance of the Reporting Persons’

obligations under the Agreement, Navidea has agreed to appoint and nominate Dr. Mark Greene and Dr. Anthony Fiorino immediately following the date of the Agreement (the “New Directors”) to fill vacancies on the Board of Directors

(“Board”) in the classes of directors whose terms will expire at the annual meeting of stockholders in 2017 and 2018, respectively. Other stockholders unaffiliated with the Reporting Persons had informed Navidea that they intended to

nominate the New Directors at the 2016 annual meeting of stockholders (the “2016 Annual Meeting”). In addition, the Agreement contemplates that Mr. Brendan Ford, a current member of the Board , will resign from the Board effective

upon the filing of the Issuer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, with the SEC.

Under the

Agreement, the Reporting Persons have agreed not to conduct a proxy contest for the election of directors with respect to the 2016 Annual Meeting or any other annual meeting of stockholders during the Standstill Period (as such term is defined

below) (each, an “Applicable Meeting”), and to vote in favor of all directors nominated by the Board for election at the 2016 Annual Meeting or any Applicable Meeting and for all other routine matters at such meetings supported by the

Board.

The Agreement also provides that, during the Standstill Period, the Reporting Persons and their affiliates and associates will not

beneficially own more than 9.99% (the “Percentage Ownership Limit” as defined in the Agreement) of the total outstanding shares of common stock of the Issuer, provided that the Reporting Persons will

not be forced to sell if they exceed the Percentage Ownership Limit solely as a result of a share repurchase or similar action by the Issuer, subject to certain conditions. The Reporting Persons

also agreed they will not engage in certain sale transactions, form “groups” with any third parties, seek to call a special meeting of stockholders, take any action in support of or making any proposal or request that constitutes impeding

or facilitating the acquisition of control of the Issuer, seek removal of an existing Board member, or taking certain other actions as set forth in the Agreement. The “Standstill Period” means the date that is eighteen (18) months

from the date of the Agreement, provided that a Change of Control (as defined in the Agreement) has not occurred

The foregoing

description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which is incorporated by reference as Exhibit 99.2 and is incorporated herein by reference in response to this

Item 4.

The Issuer announced the Agreement in a Press Release dated March 14, 2016 a copy of which is incorporated by reference

as Exhibit 99.3. The Issuer has also filed a Current Report on Form 8-K filed with the SEC on March 18, 2016 regarding the Agreement and the director nominations, which included the Agreement and the Press Release as exhibits thereto.

Except as disclosed above, none of the Reporting Persons has any other plans or proposals which relate to, or would result in, any of the

matters referred to in paragraphs (a) through (j), inclusive, of the instructions to Item 4 of Schedule 13D. The Reporting Persons may, at any time and from time to time, review or reconsider their position and/or change their purpose

and/or formulate plans or proposals with respect thereto as long as any such action is consistent with the Agreement.

| ITEM 6. |

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

The

description of the Agreement set forth in Item 4 above is incorporated herein by reference in response to this Item 6.

Other than the

Agreement, none of the Reporting Persons has any contracts, arrangements, understandings or relationships with respect to the securities of the Issuer, except for the Warrants to purchase Common Stock of the Issuer as set forth above in Item 5.

| ITEM 7. |

Material to be Filed as Exhibits. |

Exhibit 99.1 – Joint Filing Agreement (incorporated by reference

to Exhibit 99.1 to the Schedule 13D filed with the SEC on March 9, 2016).

Exhibit 99.2 – Agreement dated as of March 14, 2016 by and among

the Company, Platinum Partners Value Arbitrage Fund L.P., Platinum Partners Liquid Opportunity Master Fund L.P., Platinum-Montaur Life Sciences, LLC, Platinum Management (NY) LLC, Platinum Liquid Opportunity Management (NY) LLC and Mark Nordlicht

(incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K of the Issuer, as filed with the SEC on March 18, 2016).

Exhibit 99.3

– Press Release, dated March 14, 2016, entitled “Navidea and Platinum Enter Into Agreement Reaffirming Loan Obligations and Agreeing to Standstill Provisions” (incorporated by reference to Exhibit 99.1 to the Current Report on

Form 8-K of the Issuer, as filed with the SEC on March 18, 2016).

SIGNATURES

After reasonable inquiry and to the best of its knowledge and belief, the undersigned each certifies that the information with respect to it set forth in this

statement is true, complete and correct.

Dated: March 18, 2016

|

|

|

|

|

| PLATINUM PARTNERS VALUE ARBITRAGE FUND L.P. |

|

|

| By: |

|

Platinum Management (NY) LLC, as Investment Manager |

|

|

| By: |

|

/s/ Joseph SanFilippo |

|

|

Name: |

|

Joseph SanFilippo |

|

|

Title: |

|

Chief Financial Officer |

|

|

|

|

|

| PLATINUM MANAGEMENT (NY) LLC |

|

|

| By: |

|

/s/ Joseph SanFilippo |

|

|

Name: |

|

Joseph SanFilippo |

|

|

Title: |

|

Chief Financial Officer |

|

|

|

|

|

| PLATINUM PARTNERS LIQUID OPPORTUNITY MASTER FUND LP |

|

|

| By: |

|

Platinum Liquid Opportunity Management (NY) LLC, as Investment Manager |

|

|

| By: |

|

/s/ Joseph SanFilippo |

|

|

Name: |

|

Joseph SanFilippo |

|

|

Title: |

|

Chief Financial Officer |

|

|

|

|

|

| PLATINUM LIQUID OPPORTUNITY MANAGEMENT (NY) LLC |

|

|

| By: |

|

/s/ Joseph SanFilippo |

|

|

Name: |

|

Joseph SanFilippo |

|

|

Title: |

|

Chief Financial Officer |

|

| /s/ Mark Nordlicht |

| MARK NORDLICHT |

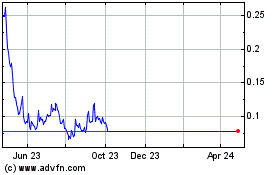

Navidea Biopharmaceuticals (AMEX:NAVB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Navidea Biopharmaceuticals (AMEX:NAVB)

Historical Stock Chart

From Apr 2023 to Apr 2024