UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 14, 2016

Career Education Corporation

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

0-23245 |

|

36-3932190 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 231 North Martingale Road

Schaumburg, IL |

|

60173 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (847) 781-3600

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On March 14, 2016, the Compensation Committee (the “Committee”) of the Board of Directors of Career Education Corporation (the

“Company”) approved a form of 2016 performance-based restricted stock unit agreement under the Career Education Corporation 2008 Incentive Compensation Plan (the “2008 Plan”), which form is attached as Exhibit

10.1.

On March 14, 2016, the Committee also granted performance-based restricted stock units under the 2008 Plan in accordance with this form (the

“2016 Performance-Based RSUs”) to certain eligible employees, including executive officers of the Company. The objectives of the 2016 Performance-Based RSU awards are to build and support an ownership culture at the Company, to

focus grantees on achieving the Company’s strategic plan which will support student outcomes and create stockholder value, and to encourage retention of talent within the organization. Awards to the Company’s “named executive

officers” (as such term is defined in Item 402(a)(3) of Regulation S-K), including those who are expected to be named executive officers in the Company’s 2016 proxy statement, were as follows:

|

|

|

|

|

| Named Executive Officer |

|

2016 Performance-Based RSUs

Awarded (#) |

|

| Todd S. Nelson |

|

|

125,000 |

|

| Jeffrey D. Ayers |

|

|

70,000 |

|

| Jeffrey R. Cooper |

|

|

28,000 |

|

| Andrew H. Hurst |

|

|

69,500 |

|

The amount and terms of each award of 2016 Performance-Based RSUs are determined by the Committee in its sole discretion and

are set forth in an individual’s award agreement on the attached form. Each 2016 Performance-Based RSU constitutes a right to receive one share of the Company’s common stock on the applicable vesting date subject to achievement of the

applicable performance measure(s). The 2016 Performance-Based RSUs vest 20% on March 14, 2017, 50% on March 14, 2018 and 30% on March 14, 2019, subject in each case to the achievement of defined EBITDA performance measure(s).

If a grantee’s employment is terminated because of death or disability, then the remaining unvested portion of the 2016 Performance-Based RSUs will

immediately vest as of the grantee’s termination date. If a grantee’s employment is terminated for any other reason, then any unvested 2016 Performance-Based RSUs will automatically terminate and be forfeited. Upon a change of control

of the Company, the grantee will have such rights with respect to the 2016 Performance-Based RSUs as are provided for in the 2008 Plan.

The foregoing

description of the form 2016 Performance-Based RSU award agreement does not purport to be complete and is qualified in its entirety by reference to the form agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit

10.1 and is incorporated herein by reference.

The award of 2016 Performance-Based RSUs to the named executive officers listed above is in

addition to the regular annual long-term incentive awards made pursuant to 2008 Plan. For 2016, these regular annual long-term incentive awards were made to the named executive officers as follows: 50% in performance units which use a

relative total shareholder return (TSR) performance measure over a three-year performance period; 30% in stock options which become exercisable in four equal annual installments; and 20% in time-based restricted stock units, settled half in stock

and half in cash, which vest in four equal annual installments. These regular annual long-term incentive awards were made pursuant to previously disclosed form award agreements.

2

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description of Exhibits |

|

|

| 10.1 |

|

Form of 2016 Restricted Stock Unit Ownership Equity Award Agreement under the Career Education Corporation 2008 Incentive Compensation Plan (the “2008 Plan”) (Performance-Based) |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| CAREER EDUCATION CORPORATION |

|

|

| By: |

|

/s/ David Rawden |

|

|

David Rawden |

|

|

Interim Chief Financial Officer |

Date: March 18, 2016

4

Exhibit Index

|

|

|

| Exhibit

Number |

|

Description of Exhibits |

|

|

| 10.1 |

|

Form of 2016 Restricted Stock Unit Ownership Equity Award Agreement under the Career Education Corporation 2008 Incentive Compensation Plan (the “2008 Plan”) (Performance-Based) |

5

Exhibit 10.1

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

CAREER EDUCATION CORPORATION

2008 INCENTIVE COMPENSATION PLAN

PERFORMANCE-BASED RESTRICTED STOCK UNIT AGREEMENT

This PERFORMANCE-BASED RESTRICTED STOCK UNIT AGREEMENT (this “Agreement”) dated

, 2016 (the “Grant Date”) is by and between Career Education Corporation, a Delaware corporation (the

“Company”), and (the “Grantee”).

To evidence such award and to set forth its terms, the Company and the Grantee agree as follows. All capitalized terms not otherwise defined

in this Agreement shall have the meaning set forth in the Career Education Corporation 2008 Incentive Compensation Plan, as amended (the “Plan”).

1. Grant of Restricted Stock Units. Subject to and upon the terms and conditions set forth in this Agreement and the Plan, the Committee granted

to the Grantee the following number of Restricted Stock Units (the “RSUs”) on the Grant Date, and the Grantee hereby accepts the grant of the RSUs as set forth herein:

Total Number of Restricted Stock Units Granted

and Available for Vesting under this

Agreement: (the “RSUs”)

2. Limitations on Transferability. At any time prior to the Settlement Date, the RSUs, or any interest therein, cannot be directly or indirectly

transferred, sold, assigned, pledged, hypothecated, encumbered or otherwise disposed.

3. Dates of Vesting. Subject to the provisions of Sections 5

and 6 of this Agreement, the RSUs shall cease to be restricted and shall become non-forfeitable (thereafter being referred to as “Vested Shares”) as follows:

(a) 20% on March 14, 2017, subject to achievement of OEA EBITDA for the year ending December 31, 2016 equal to or greater than Targeted 2016

OEA EBITDA.

(b) 20% on March 14, 2018, subject to (i) achievement of OEA EBITDA for the year ending December 31, 2016 equal to or greater

than Targeted 2016 OEA EBITDA, and (ii) achievement of OEA EBITDA for the year ending December 31, 2017 equal to or greater than Targeted 2016 OEA EBITDA.

(c) 30% on March 14, 2018, subject to achievement of OEA EBITDA for the year ending December 31, 2017 equal to or greater than Targeted 2017

OEA EBITDA.

(d) 30% on March 14, 2019, subject to (i) achievement of OEA EBITDA for the year ending December 31, 2017 equal to or greater

than Targeted 2017 OEA EBITDA, and (ii) achievement of OEA EBITDA for the year ending December 31, 2018 equal to or greater than Targeted 2017 OEA EBITDA.

“OEA EBITDA,” “Targeted 2016 OEA EBITDA” and “Targeted 2017 OEA EBITDA” are defined on Exhibit A. March 14, 2017, March

14, 2018 and March 14, 2019 are each referred to herein as a “Vesting Date.” If any of the RSUs do not vest on the applicable Vesting Date due to failure to achieve the applicable performance condition(s) set forth in this Section

3, then such RSUs shall be immediately cancelled and forfeited to the Company. In addition, if any RSUs do not vest on

1

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

March 14, 2017 due to failure to achieve the performance condition set forth in Section 3(a), then the RSUs subject to the performance conditions set forth in Section 3(b) shall also be cancelled

and forfeited to the Company on March 14, 2017 due to the inability to achieve the Section 3(b) performance conditions. If any RSUs do not vest on March 14, 2018 due to failure to achieve the performance condition set forth in Section 3(c),

then the RSUs subject to the performance conditions set forth in Section 3(d) shall also be cancelled and forfeited to the Company on March 14, 2018 due to the inability to achieve the Section 3(d) performance conditions.

Notwithstanding the foregoing, and subject to Sections 5 and 6 below, in the event that the Grantee incurs a Termination of Service prior to

any Vesting Date, any RSUs that were unvested at the date of such Termination of Service shall be immediately forfeited to the Company.

4. Crediting

and Settling RSUs.

(a) RSU Accounts. The Company shall establish an account on its books for each grantee who receives a grant

of RSUs (the “RSU Account”). The RSUs granted hereby shall be credited to the Grantee’s RSU Account as of the Grant Date. The RSU Account shall be maintained for record keeping purposes only and the Company shall not be obligated to

segregate or set aside assets representing securities or other amounts credited to the RSU Account. The obligation to make distributions of securities or other amounts credited to the RSU Account shall be an unfunded, unsecured obligation of the

Company.

(b) Settlement of RSU Accounts. The Company shall settle the RSU Account by delivering to the holder thereof (who may be

the Grantee or his or her Beneficiary, as applicable) a number of Shares equal to the whole number of Vested Shares underlying the RSUs then credited to the Grantee’s RSU Account (or a specified portion in the event of any partial settlement).

The Settlement Date for all RSUs credited to a Grantee’s RSU Account shall be as soon as administratively practical following when the Restrictions applicable to any portion of the RSUs granted hereby have lapsed, subject to achievement of the

applicable performance condition(s) set forth in Section 3, but in no event shall such Settlement Date be later than March 15 of the calendar year following the calendar year in which the Restrictions applicable to an the RSUs have lapsed.

5. Termination of Service. Subject to Section 6, the provisions of this Section 5 shall apply in the event the Grantee incurs a Termination of

Service at any time prior to an applicable Vesting Date set forth in Section 3:

(a) If the Grantee incurs a Termination of Service

because of his or her death or Disability, any RSUs that had not become Vested Shares prior to the date of the Termination of Service shall become Vested Shares, and, as of the relevant Settlement Date, the Grantee shall own a number of Shares equal

to the whole number of Vested Shares underlying the RSUs free of all restrictions otherwise imposed by this Agreement except for Shares used to satisfy the tax withholding obligations set forth in Section 26 of this Agreement or otherwise required

by any taxing authority.

(b) If the Grantee incurs a Termination of Service for any reason other than his or her death or Disability,

then any RSUs that had not become Vested Shares prior to the date of the Termination of Service shall be immediately forfeited to the Company.

2

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

6. Change in Control. Upon a Change in Control, the Grantee will have such rights with respect to

the RSUs as are provided for in the Plan.

7. Stock Certificates and Escrow. On each Settlement Date, the Company, at its election, shall either

(a) credit any Shares issued to the Grantee pursuant hereto through a book entry on the records kept by the Company’s stockholder record keeper, or (b) issue certificates for such Shares.

8. Liability of the Company. The inability of the Company to obtain approval from any regulatory body having authority deemed by the Company to be

necessary to the lawful issuance and transfer of any Shares pursuant to this Agreement shall relieve the Company of any liability with respect to the non-issuance or transfer of the Shares as to which such

approval shall not have been obtained. However, the Company shall use its best efforts to obtain all such approvals.

9. Adjustment in

RSUs. The Committee may make or provide for such adjustments as provided for in Section 4.2 of the Plan.

10. Plan Amendment. No

discontinuation, modification, or amendment of the Plan may, without the written consent of the Grantee, adversely affect the rights of the Grantee under this Agreement, except as otherwise provided under the Plan.

11. Stockholder Rights. The RSUs shall not represent an equity security of the Company and shall not carry any voting or dividend rights. The Grantee

shall have no rights of a stockholder of the Company with respect to any Vested Shares to be issued pursuant to a RSU until certificates for the Shares underlying the RSUs granted hereby are issued to the Grantee or such Shares are otherwise

reflected in a book entry on the records kept by the Company’s stockholder record keeper. Notwithstanding the foregoing, on the relevant Settlement Date, the Grantee shall be entitled to receive an amount in cash equal to the dividends, if any,

that would have become payable on or after the Vesting Date, but prior to the Settlement Date, with respect to the Shares issued on the Settlement Date.

12. Employment Rights. This Agreement is not a contract of employment, and the terms of employment of the Grantee or other relationship of the Grantee

with the Company shall not be affected in any way by this Agreement except as specifically provided herein. Grantee’s execution or acceptance of this Agreement shall not be construed as conferring any legal rights upon the Grantee for a

continuation of an employment or other relationship with the Company, nor shall it interfere with the right of the Company to discharge the Grantee and to treat him or her without regard to the effect which such treatment might have upon him or her

as a Grantee.

13. Disclosure Rights. Except as required by applicable law, the Company (or any of its affiliates) shall not have any duty or

obligation to disclose affirmatively to a record or beneficial holder of Common Stock, RSUs or Vested Shares, and such holder shall have no right to be advised of, any material information regarding the Company at any time prior to, upon or in

connection with receipt of the Shares.

14. Governing Law. The interpretation, performance and enforcement of this Agreement shall be governed

by and enforced in accordance with the laws of the State of Delaware (other than its laws respecting choice of law).

3

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

15. Compliance with Laws and Regulations. Notwithstanding anything herein to the contrary, the

Company shall not be obligated to either (a) cause to be issued or delivered any certificates for Shares, or (b) credit a book entry related to the Shares to be entered on the records of the Company’s stockholder record keeper, unless and

until the Company is advised by its counsel that such issuance and delivery of such certificates or entry on the records, as applicable, is in compliance with all applicable laws, regulations of governmental authority, and the requirements of any

exchange upon which Shares are traded. The Company may require, as a condition of such issuance and delivery of such certificates or entry on the records, as applicable, and in order to ensure compliance with such laws, regulations and

requirements, that the Grantee make such covenants, agreements, and representations as the Company, in its sole discretion, considers necessary or desirable.

16. Successors and Assigns. Except as otherwise expressly set forth in this Agreement, the provisions of this Agreement shall inure to the benefit

of, and be binding upon, the succeeding administrators, heirs and legal representatives of the Grantee and the successors and assigns of the Company.

17.

No Limitation on Rights of the Company. This Agreement shall not in any way affect the right of the Company to adjust, reclassify, reorganize or otherwise make changes in its capital or business structure, or to merge, consolidate,

dissolve, liquidate, sell or transfer all or any part of its business or assets.

18. Notices. Any communication or notice required or

permitted to be given hereunder shall be in writing, and, if to the Company, to its principal place of business, attention: Secretary, and, if to the Grantee, to the address appearing on the records of the Company. Such communication or notice

shall be delivered personally or sent by certified, registered, or express mail, postage prepaid, return receipt requested, or by a reputable overnight delivery service. Any such notice shall be deemed given when received by the intended

recipient. Notwithstanding the foregoing, any notice required or permitted hereunder from the Company to the Grantee may be made by electronic means, including by electronic mail to the Company-maintained electronic mailbox of the Grantee, and

the Grantee hereby consents to receive such notice by electronic delivery. To the extent permitted in an electronically delivered notice described in the previous sentence, the Grantee shall be permitted to respond to such notice or

communication by way of a responsive electronic communication, including by electronic mail.

19. Construction. Notwithstanding any

other provision of this Agreement, this Agreement is made, and the RSUs and Shares are granted, pursuant to the Plan and are in all respects limited by and subject to the express provisions of the Plan, as amended from time to time. To the extent

any provision of this Agreement is inconsistent or in conflict with any term or provision of the Plan, the Plan shall govern. The interpretation and construction by the Committee of the Plan, this Agreement and any such rules and regulations adopted

by the Committee for purposes of administering the Plan, shall be final and binding upon the Grantee and all other persons.

20. Entire

Agreement. This Agreement, together with the Plan, constitute the entire obligation of the parties hereto with respect to the subject matter hereof and shall supersede any prior expressions of intent or understanding with respect to this

transaction.

21. Amendment. This Agreement may be amended as provided under the Plan, but except as provided in the Plan no such amendment

shall adversely affect the Grantee’s rights under the Agreement without the Grantee’s written consent, unless otherwise permitted by the Plan.

4

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

22. Waiver; Cumulative Rights. The failure or delay of either party to require performance by the

other party of any provision hereof shall not affect its right to require performance of such provision unless and until such performance has been waived in writing. Each and every right hereunder is cumulative and may be exercised in part or

in whole from time to time.

23. Counterparts. This Agreement may be signed in two counterparts, each of which shall be an original, but

both of which shall constitute but one and the same instrument.

24. Headings. The headings contained in this Agreement are for reference

purposes only and shall not affect the meaning or interpretation of this Agreement.

25. Severability. If any provision of this Agreement

shall for any reason be held to be invalid or unenforceable, such invalidity or unenforceability shall not effect any other provision hereof, and this Agreement shall be construed as if such invalid or unenforceable provision were omitted.

26. Tax Consequences. The Grantee acknowledges and agrees that the Grantee is responsible for all taxes and tax consequences with respect to the

grant of RSUs, the lapse of restrictions otherwise imposed by this Agreement and the issuance of Shares pursuant hereto. The Grantee further acknowledges that it is the Grantee’s responsibility to obtain any advice that the Grantee deems

necessary or appropriate with respect to any and all tax matters that may exist as a result of the grant of the RSUs, the lapse of restrictions otherwise imposed by this Agreement and the issuance of Shares pursuant hereto. Notwithstanding any other

provision of this Agreement, Shares shall not be issued to the Grantee pursuant hereto unless, as provided in Section 17 of the Plan, the Grantee shall have paid to the Company, or made arrangements satisfactory to the Company regarding the payment

of, any federal, state, local or foreign taxes of any kind required by law to be withheld with respect to the grant of the RSUs, the lapse of restrictions otherwise imposed by this Agreement and the issuance of Shares pursuant hereto.

27. Receipt of Plan. The Grantee acknowledges receipt of a copy of the Plan, and represents that the Grantee is familiar with the terms and

provisions thereof, and hereby accepts the RSUs subject to all the terms and provisions of this Agreement and of the Plan. The Shares issued pursuant hereto are granted pursuant to the terms of the Plan, the terms of which are incorporated

herein by reference, and the RSUs and such Shares shall in all respects be interpreted in accordance with the Plan. The Committee shall interpret and construe the Plan and this Agreement, and its interpretation and determination shall be

conclusive and binding upon the parties hereto and any other person claiming an interest hereunder, with respect to any issue arising hereunder or thereunder.

28. Restrictive Covenants. [The following shall be applicable to Grantees except those in the categories with special provisions set forth

below] In consideration of receiving the RSUs hereunder, and as a term and condition of the Grantee’s employment with the Company, the Grantee agrees to adhere to, and be bound by, the following restrictions. The Grantee hereby acknowledges

that the Grantee’s job responsibilities give the Grantee access to confidential and proprietary information belonging to the Company and/or its subsidiaries, and that this and other confidential information to which the Grantee has access would

be of value, and provide an unfair advantage, to a competitor in competing against the Company or its subsidiaries in any of the markets in which the Company or its subsidiaries maintains schools, provides on-line education classes or otherwise

conducts business. The Grantee further acknowledges that the following restrictions will not cause the Grantee undue hardship.

5

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

Consequently, the Grantee agrees that the restrictions below (the “Restrictive Covenants”) are reasonable and necessary to protect the Company’s and/or its

subsidiaries’ legitimate business interests.

During the Grantee’s employment with the Company and/or any of its subsidiaries and continuing

thereafter for the post-termination periods specified below, the Grantee will not, in any way, directly or indirectly, either for the Grantee or any other person or entity, whether paid or unpaid:

(a) For

months following Grantee’s voluntary resignation from Grantee’s

employment with the Company or Grantee’s termination from employment by the Company for Cause, accept employment with, own, manage, operate, consult or provide expert services to any person or entity that competes with the Company or any of its

subsidiaries in any capacity that involves any responsibilities or activities involving or relating to any Competing Educational Service, as defined herein. “Competing Educational Service” means any educational service that competes

with the educational services provided by the Company and/or any of its subsidiaries, including but not limited to coursework in the areas of visual communication and design technologies; information technology; business studies; culinary arts; and

health education, or any education service. The Grantee hereby acknowledges that the following organizations, among others, provide Competing Educational Services and, should the Grantee accept employment with, own, manage, operate, consult or

provide expert services to any of these organizations, it would inevitably require the use and/or disclosure of confidential information belonging to the Company and/or its subsidiaries and would provide such organizations with an unfair business

advantage over the Company: American Public Education, Inc., Anthem Education, Apollo Education Group, Inc., Bridgepoint Education, Inc., Capella Education Company, Career Step, LLC, Delta Career Education Corporation, DeVry Education

Group Inc., Education Management Corporation, EmbanetCompass, Grand Canyon Education Inc., ITT Educational Services Inc., Kaplan, Inc., Laureate Education, Inc., Learning Tree International Inc., Lincoln Education Services Corporation, National

American University Holdings Inc., Ross Education, LLC, Strayer Education Inc., Universal Technical Institute Inc., Zenith Education Group, Inc. and each of their respective subsidiaries, affiliates and successors. The Grantee further

acknowledges that the Company and/or its subsidiaries provide career-oriented education through physical campuses throughout the United States and web-based virtual campuses throughout the world and, therefore, it is impracticable to identify a

limited, specific geographical scope for this Restrictive Covenant. For the avoidance of doubt, in the event the Grantee is involuntarily terminated from employment with the Company other than for Cause, the Grantee will not be subject to any

post-termination non-compete restriction under this Section 28(a).

(b) For

months following Grantee’s termination of employment with the Company for

any reason, solicit, attempt to solicit, assist with the solicitation of, direct another to solicit, or otherwise entice any employee of the Company or any of its subsidiaries to leave his/her employment.

(c) At all times following the Grantee’s termination of employment with the Company for any reason, reveal, divulge, or make known to any

person, firm or corporation any confidential information, or take any other action, in violation of the Confidential Information Policy in the Company’s Code of Business Conduct & Ethics.

Should the Grantee breach the terms of these Restrictive Covenants, the Company reserves the right to enforce the terms herein in court and seek any and all

remedies available to it in

6

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

equity and law, and the Grantee agrees to pay the Company’s attorneys’ fees and costs should it succeed on its claim(s). Further, should the Grantee breach the terms of these

Restrictive Covenants, the Grantee will forfeit any right to the RSUs or Shares issued hereunder, subject to the terms and conditions of the Plan, and the Grantee agrees to pay the Company’s attorneys’ fees and costs incurred in recovering

such RSUs or Shares issued pursuant hereto.

It is the intention of the Grantee and the Company that in the event any of the covenants contained in these

Restrictive Covenants are determined to be unreasonable and/or unenforceable with respect to scope, time or geographical coverage, the Grantee and the Company agree that such covenants may be modified and narrowed by a court, so as to provide the

maximum legally enforceable protection of the Company’s and any of its subsidiaries’ interests as described in this Agreement.

[The

following shall be applicable to California and Attorney Grantees as well as Grantees who are deemed to be in a less competitively significant role] In consideration of receiving the RSUs hereunder, and as a term and condition of the

Grantee’s employment with the Company, the Grantee agrees to adhere to, and be bound by, the following restrictions. The Grantee hereby acknowledges that the Grantee’s job responsibilities give the Grantee access to confidential and

proprietary information belonging to the Company and/or its subsidiaries, and that this and other confidential information to which the Grantee has access would be of value, and provide an unfair advantage, to a competitor in competing against the

Company or its subsidiaries in any of the markets in which the Company or its subsidiaries maintains schools, provides on-line education classes or otherwise conducts business. The Grantee further acknowledges that the following restrictions will

not cause the Grantee undue hardship. Consequently, the Grantee agrees that the restrictions below (the “Restrictive Covenants”) are reasonable and necessary to protect the Company’s and/or its subsidiaries’ legitimate

business interests.

During the Grantee’s employment with the Company and/or any of its subsidiaries and continuing thereafter for the

post-termination periods specified below, the Grantee will not, in any way, directly or indirectly, either for the Grantee or any other person or entity, whether paid or unpaid:

(a)

For months following Grantee’s voluntary resignation from Grantee’s

employment with the Company or Grantee’s termination from employment by the Company for Cause, accept employment with, own, manage, operate, consult or provide expert services to any person or entity that would require the use, disclosure or

dissemination of confidential information belonging to the Company and/or its subsidiaries. For the avoidance of doubt, in the event the Grantee is involuntarily terminated from employment with the Company other than for Cause, the Grantee will

not be subject to any post-termination restrictive covenant under this Section 28(a).

(b) For

months following Grantee’s termination of employment with the Company for

any reason, solicit, attempt to solicit, assist with the solicitation of, direct another to solicit, or otherwise entice any employee of the Company or any of its subsidiaries to leave his/her employment.

(c) At all times following the Grantee’s termination of employment with the Company for any reason, reveal, divulge, or make known to any

person, firm or corporation any confidential information, or take any other action, in violation of the Confidential Information Policy in the Company’s Code of Business Conduct & Ethics.

7

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

Should the Grantee breach the terms of these Restrictive Covenants, the Company reserves the right to enforce

the terms herein in court and seek any and all remedies available to it in equity and law, and the Grantee agrees to pay the Company’s attorneys’ fees and costs should it succeed on its claim(s). Further, should the Grantee breach the

terms of these Restrictive Covenants, the Grantee will forfeit any right to the RSUs or Shares issued hereunder, subject to the terms and conditions of the Plan, and the Grantee agrees to pay the Company’s attorneys’ fees and costs

incurred in recovering such RSUs or Shares issued pursuant hereto.

It is the intention of the Grantee and the Company that in the event any of the

covenants contained in these Restrictive Covenants are determined to be unreasonable and/or unenforceable with respect to scope, time or geographical coverage, the Grantee and the Company agree that such covenants may be modified and narrowed by a

court, so as to provide the maximum legally enforceable protection of the Company’s and any of its subsidiaries’ interests as described in this Agreement.

29. Cooperation. In the event of any pending or threatened investigation, proceeding, lawsuit, claim or legal action against or involving the

Company, the Grantee acknowledges and agrees to cooperate to the fullest extent possible in the investigation, preparation, prosecution, or defense of the Company’s case, including, but not limited to, the execution of affidavits or documents,

providing of information requested by the Company or the Company’s counsel, and meeting with Company representatives or the Company’s counsel. Nothing in this paragraph shall be construed as suggesting or implying that the Grantee

should testify in any way other than truthfully or provide anything other than accurate, truthful information.

30. Clawback Policy. By

accepting the grant of RSUs pursuant to this Agreement, the Grantee hereby acknowledges that the Board has adopted a policy pursuant to which the Grantee may be required to repay amounts otherwise paid pursuant to this Agreement to the extent (a)

such amounts were predicated upon achieving certain financial results that were subsequently the subject of a material restatement of Company financial statements filed with the Securities and Exchange Commission; (b) the Board determines the

Grantee engaged in intentional misconduct that caused or substantially caused the need for the material restatement; and (c) a lower payment would have been made to the Grantee based upon the restated financial results (collectively, the

“Policy”). By accepting the grant of RSUs pursuant to this Agreement, the Grantee hereby agrees to be bound by the Policy and any amendment or replacement thereof designed to comply with applicable law, including, without

limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act, or to comport with good corporate governance practices, and to repay amounts that Grantee may be required to be repay thereunder.

31. Condition to Accept Agreement. This Agreement will be null and void unless the Grantee indicates his or her acceptance of the award of RSUs

provided for hereunder by signing, dating and returning this Agreement to the Company on or before .

[Signature Page Follows]

8

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

IN WITNESS WHEREOF, this Agreement has been duly executed as of the day and

year first written above.

CAREER EDUCATION CORPORATION

[Name]

[Title]

ACCEPTANCE (OR REJECTION) OF AWARD BY GRANTEE

The undersigned, the Grantee, hereby: (select one of the options below)

|

|

|

| |

|

ACCEPTS the award of RSUs as set forth in this Agreement and agrees to be bound by the terms and conditions of this Agreement and the Plan. |

|

|

| |

|

REJECTS the award of RSUs contemplated by this Agreement and forfeits all rights relating thereto. Please note that a rejection of this award has no impact on any other award of options, restricted stock or restricted stock

units you have previously received, including any restrictive covenants you are subject to pursuant to the agreement(s) governing your previous awards. |

|

|

|

|

|

|

|

|

|

|

|

| Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Signature of Grantee) |

|

|

|

|

|

|

|

|

|

|

Print Name: |

Please sign and return a fully executed .pdf of this Performance-Based Restricted Stock Unit Agreement by

to

via

.

Failure to do so will result in forfeiture of the award. Please retain a copy of this signed Performance-Based Restricted Stock Unit Agreement for your records.

9

Restricted Stock Unit Agreement

2016 Performance-Based Ownership Equity Award

Exhibit A

Performance Condition Definitions

“OEA EBITDA” means, with respect to any year, the consolidated earnings, including both continuing and discontinued operations, of the total

Company (and its affiliates) for such year, determined before (a) interest, taxes, depreciation, amortization and asset impairments, and (b) lease termination and unused space charges (as recorded in the Company’s accounting records under

account number 604610) and legal settlements; and as adjusted (i.e., neutralized) for (c) the difference between actual legal fees and the estimated amounts used in determining Targeted 2016 OEA EBITDA or Targeted 2017 OEA EBITDA, as

applicable. When determining OEA EBITDA for the year ending December 31, 2018, the estimated amounts used in determining Targeted 2017 OEA EBITDA shall be used for purposes of calculating any adjustment pursuant to clause (c) above. The amount

for each of the items in clause (a) shall be as reported on the consolidated statement of income (loss) and comprehensive income (loss) within the Company’s Form 10-K for the year ending on December 31, 2016, December 31, 2017 and

December 31, 2018, as applicable (which are prepared in accordance with the generally accepted accounting principles in the U.S. and filed with the U.S. Securities and Exchange Commission). The amount for each of the actual items in clauses (b)

and (c) shall be as reported within such Form 10-K; provided, however, that if the information reported in such Form 10-K is not sufficiently specific to provide data for a specific amount, then the data will be obtained from the Company’s

Finance Department and will be based on the underlying accounting records upon which information in the Form 10-K is based.

“Targeted 2016 OEA

EBITDA” means the targeted OEA EBITDA for 2016 as approved by the Committee on or prior to the Grant Date. In the event of the sale, disposition, acquisition, restructuring, discontinuance of operations or other extraordinary corporate

event in respect of a material business on or prior December 31, 2017, the Committee shall review and adjust Targeted 2016 OEA EBITDA so that the achievement of the remaining performance conditions set forth in Section 3(a) and 3(b) following such

event is no more or less probable than the achievement prior to such event.

“Targeted 2017 OEA EBITDA” means the targeted OEA EBITDA for

2017 as approved by the Committee on or prior to the Grant Date. In the event of the sale, disposition, acquisition, restructuring, discontinuance of operations or other extraordinary corporate event in respect of a material business on or

prior to December 31, 2018, the Committee shall review and adjust Targeted 2017 OEA EBITDA so that the achievement of the remaining performance conditions set forth in Section 3(c) and 3(d) following such event is no more or less probable than the

achievement prior to such event.

10

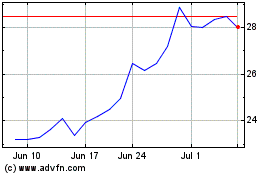

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Apr 2023 to Apr 2024