SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 15, 2016

OptimizeRx Corporation

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-53605 |

|

26-1265381 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 400

Water Street, Suite 200, Rochester, MI |

|

48307 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 248-651-6568

| |

|

|

| |

(Former

name or former address, if changed since last report) |

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 7 – Regulation FD Disclosure

Item 7.01 Regulation FD Disclosure

On March 15, 2016, the Company made an investor

presentation that included the slides furnished as Exhibit 99.1 to this Current Report on Form 8-K. The slides contained in Exhibit

99.1 are also posted on the Company’s website at www.optimizeRx.com.

The Company has prepared certain projections and assumptions with

respect to the future operations of the Company in connection with the investor presentation furnished with this Current Report

on Form 8-K. The Company undertakes no duty or obligation to update these projections and assumptions, or provide new projections

and assumptions, with respect to its operations in the future.

The projections and assumptions contain forward-looking statements

within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. These

forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those

projected. Further information on factors that could affect the Company’s financial and other results is set forth in the

projections and assumptions and included in the Company’s Forms 10-Q and 10-K, filed with the Securities and Exchange Commission.

The information in Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Section

8 – Other Events

Item

8.01 Other Events

On March 15, 2016, the Company held a conference call to discuss the Company’s 2015 year-end earnings

and other matters of business, a transcript of which is furnished herewith as Exhibit 99.2 and is incorporated herein by reference.

The information in Item 8.01 of this Current Report on Form 8-K (including Exhibit 99.2) shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Section

9 – Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits

| 99.1 |

Investor presentation

|

| 99.2 |

Conference call transcript dated March 15, 2016 |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| OptimizeRx Corporation |

|

| |

|

| /s/

Doug Baker |

|

Doug

Baker

Chief Financial Officer |

|

| |

|

| Date:

March 17, 2016 |

|

3

Exhibit 99.1

Corporate Presentation March 2016 OTCQB: OPRX

OTCQB: OPRX This presentation contains forward - looking statements within the definition of Section 27A of the Securities Act of 1933, as amended and such section 21E of the Securities Act of 1934, amended. These forward - looking statements should not be used to make an investment decision. The words 'estimate,' 'possible' and 'seeking' and similar expressions identify forward - looking statements, which speak only as to the date the statement was made. The company undertakes no obligation to publicly update or revise any forward - looking statements, whether because of new information, future events, or otherwise. Forward - looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted, or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward - looking statements. The risks and uncertainties to which forward - looking statements are set forth in our Annual Report on Form 10 - K as filed with the Securities and Exchange Commission and available on our website at optimizerx.com or the SEC site at sec.gov. Important Cautions Regarding Forward Looking Statements 2

OTCQB: OPRX $1.1 $2.0 $4.7 $6.5 $7.2 2011 2012 2013 2014 2015 Annual Revenue $ millions Stock Price (3/9/2016 ) $0.97 52 Week Low - High $0.76 - $1.40 Avg. Daily Vol. (30 day) 24,980 Shares Outstanding 29.0M Public Float, est. 31% Insider Holdings ~35% Institutional Holdings 1 ~32% Market Cap $28.1M Enterprise Value $20.0M Fiscal Year End Dec. 31 Employees (@ Dec, 2015) 15 Data source: S&P Capital IQ (ttm) – trailing twelve months as of December 31, 2015 (mrq) – most recent quarter as of December 31, 2015 1) Includes non - filer with 400,000 shares as well as family offices. Net Revenue ( ttm ) $7.2M Net Loss ( ttm ) $0.6M Accounts Receivable ( ttm ) $ 2.8M Cash ( mrq ) $8.2M Total Assets ( mrq ) $12.3M Total Debt ( mrq ) $0.0M Total Liabilities ( mrq ) $ 3.4M Key Stats (OTCQB: OPRX) 3

OTCQB: OPRX Who We Are • We provide a unique SaaS platform that helps doctors and pharmaceutical companies deliver more affordable and compliant healthcare • Our flagship product, SampleMD ™ , provides physicians with electronically - dispensed vouchers and copay coupons right within their ePrescribing process, thereby replacing traditional drug samples • SampleMD is delivered across the healthcare industry’s largest point - of - prescribe promotional network ─ with more than 350 electronic health record (EHR) partners reaching 250K+ healthcare professionals 4 OptimizeRx has developed patented technology that alerts doctors to savings and automatically delivers the information to pharmacies with the ePrescription

OTCQB: OPRX Samples Declining EHR/ ePrescribing Rising Rx Co - Pay Decreased accessibility = less productive sale calls In 2015, pharmaceutical companies wasted $1 Billion - $1.5 billion annually on “infeasible” calls Prescriber Access 5 Major Changes Effecting U.S. Pharma Market 77% 78% 67% 64% 65% 55% 51% 45% 2008 2009 2010 2011 2012 2013 2014 FH 2015 Sales Rep Access to Prescribers Falling Source: ZS Associates’ 2014 AccessMonitor Survey. Based on data for more than 240,000 prescribers. “FH” = first half. only 20% get to speak to the doctor 1 Pharma sales reps increasingly unable to directly promote to doctors.

OTCQB: OPRX Prescriber Access Rising Rx Co - Pay EHR/ ePrescribing Samples Declining 6 Major Changes Effecting U.S. Pharma Market $4B samples market shifting to other areas of more effective patient support, including free trial vouchers & copay discounts Source: Medical Economics, “Saying no to samples,” by Allison Tsai, November 20, 2009. Drug samples now banned in many clinics 70M 80M 90M 100M 110M 120M 2007 2008 2009 2010 2011 (millions) Pharma Sales Rep Visits with Samples

OTCQB: OPRX Samples Declining Prescriber Access Rising Rx Co - Pay EHR / ePrescribing By 2016, estimated prescriptions will be electronically sent per year (a tipping point) & growing thereafter 2 billion 7 Major Changes Effecting U.S. Pharma Market [VALUE] M [VALUE] M 2 Billion [VALUE] M [VALUE] M [VALUE] M [VALUE] M 2010 2011 2016 ePrescribing Projected Growth 1) The National Progress Report on ePrescribing & Safe - Rx Rankings, Surescripts , 2012 2) CDC/NCHS, National Ambulatory Medical Care Survey and National Ambulatory Medical Care Survey, Electronic Health Records Survey. Government pushing less expensive generic therapies via automated electronic health record (EHR) & ePrescribe alerts

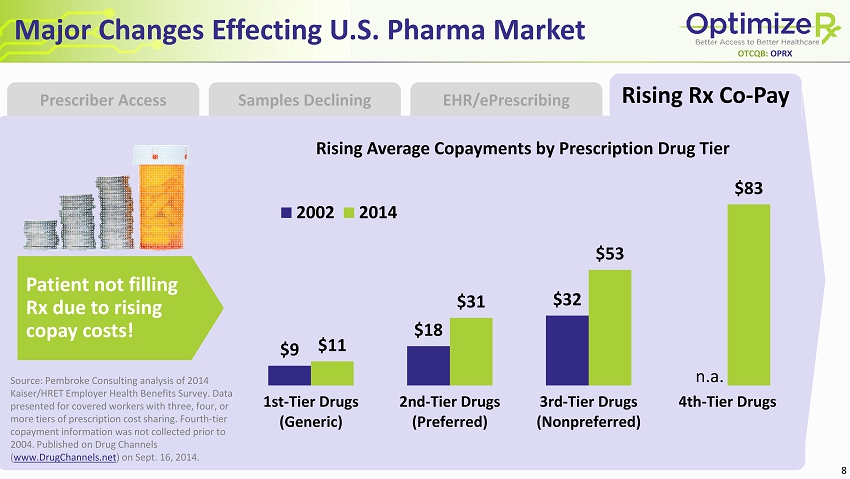

OTCQB: OPRX Prescriber Access Samples Declining EHR/ ePrescribing Rising Rx Co - Pay 8 Major Changes Effecting U.S. Pharma Market Patient not filling Rx due to rising copay costs! $9 $18 $32 $11 $31 $53 $83 1st-Tier Drugs (Generic) 2nd-Tier Drugs (Preferred) 3rd-Tier Drugs (Nonpreferred) 4th-Tier Drugs Rising Average Copayments by Prescription Drug Tier 2002 2014 Source: Pembroke Consulting analysis of 2014 Kaiser/HRET Employer Health Benefits Survey. Data presented for covered workers with three, four, or more tiers of prescription cost sharing. Fourth - tier copayment information was not collected prior to 2004. Published on Drug Channels ( www.DrugChannels.net ) on Sept. 16, 2014. n.a .

OTCQB: OPRX OptimizeRx Targets Doctor’s Most Valued Pharma Offering: Drug Savings Vouchers & Co - Pay Coupons 9 Providers Who Value Vouchers or Coupons as Important Cardiologists 82% Endocrinology/ Diabetology 82% General Practice & Family Practice 85% Internal Medicine 80% Neurology 73% Oncology 74% Pediatrics 82% Psychiatry 75% Urology 83% Source: CMI Compass 71% Physicians Want to Know About Discount Programs

OTCQB: OPRX SampleMD automatically displays savings alert message to doctors upon product selection □ EHR sends electronic request to SampleMD when doctor selects a medication with our coupon We check eligibility & send uniquely identifiable savings to doctor within 1 second OptimizeRx Proprietary Technology Automates Savings When Doctor ePrescribes 10 Doctor sends prescription electronically to pharmacy along with coupon Pharma company pays OptimizeRx $4 - $5 per coupon/voucher distribution — Regardless if redeemed How it Works

OTCQB: OPRX Step 2: Selection Step 3: Print or Text Step 1: Search 11 Workflow Overview Health care provider searches for a brand within EHR and is alerted of potential savings availability for patient

OTCQB: OPRX Step 2: Selection Step 1: Search Step 3: Print or Text 12 Workflow Overview After Selection, OptimizeRx Instantly Returns Eligible Patient Support to Review & Auto - send to Pharmacy

OTCQB: OPRX Step 3: Print or Text Step 1: Search Step 2: Selection 13 Workflow Overview We also have the ability to text & email patient Currently working with EHRs to integrate into patient’s portal. Full Savings Offer is Also Available to Print & Give to Patient

OTCQB: OPRX Pharma Doctors EHR/EMRs Patients Pharmacists Promotional access to prescribers & patients at the point of prescript Information regarding drugs & the financial assistance available to patients, allowing doctors to choose their preferred drug while maintaining adherence Incremental revenue & value via plug in of system already in place Overall lower cost of prescriptions, improving adherence & outcomes Alert of savings offer to apply when initially filling med versus re - do OptimizeRx Efficiently Supports & Benefits Key Stakeholders 14

OTCQB: OPRX 520% 1260% -800% -400% 0% 400% 800% 1200% 1600% eDetailing Display Paid Search eCoupon OptimizeRx eCoupon ROI vs. Other Promotional Tactics Lowest ROI Average ROI Highest ROI 15 Multiple Independent Studies Prove Outstanding ROI to Our Customers OptimizeRx eCoupon Most Effective Digital Promotional Tactic Source:

OTCQB: OPRX • Low fixed overhead SaaS model that offers high leveraged financial opportunity • Technology & support is in place to grow business 10 fold & beyond • Proven Benefits to all Stakeholders, including pharma • Proven value to doctors, patients, health systems & pharma with 500%+ ROI • Proven proprietary technology successfully reaching 250K healthcare providers • Scalable to continue to expand market & entry barriers • 1 st mover & developer of eCoupon market • Largest ePrescribe Network • In 2010, 100M+ coupons distributed (no longer through reps) Our Market Position 16

OTCQB: OPRX Our Technology is Integrated in 350+ Electronic Health Record (EHR) Providers & Growing Largest point of prescribe promotional network: 350+ EHRs , with 200+ EHRs exclusive to OptimizeRx , including Allscripts = high barriers to entry 17 August 2015: OptimizeRx & Allscripts expanded its exclusive partnership to automate voucher and copay savings support within its Touchworks ® EHR platform. Some of the largest health systems in the country use Touchworks EHR — enabling OptimizeRx to reach 45,000+ new prescribers in 2H - 2016 .

OTCQB: OPRX Our Clients Are the Leading Pharmaceutical Companies in the World 18 Over 670 Rx brands that have copay coupons!

OTCQB: OPRX Focused on Growing Both Sides of the Business Revenue Drivers More Brands More Platforms Primary Business Focus: More Brands & Platforms 19

OTCQB: OPRX SampleMD Standard Pricing Metrics Set Up Fee (Plugging in disruptive technology) $25K Reporting $2K per month Cost Per Coupon Distribution (regardless if redeemed) $5.00 per coupon How We Make Money 20 NOTE: We do have Enterprise Wide discounts to incentivize Manufacturers to add portfolio of products to drive increased volum e

OTCQB: OPRX Market Penetration OptimizeRx eCoupon vs. Traditional Rx Coupon Promotion 5% Market Share Potential Scenario (in Millions) Revenue $30M Gross margin $15M SG&A $7.5M Net Income $7.5M As revenue grows, highly leveraged, low fixed costs generates cash 21 ~140 Million [CATEGOR Y NAME] [CATEGORY NAME] [PERCENTAG E] (7.5M Units) Rx eCoupon Market Opportunity ~140 Million [CATEGOR Y NAME] [CATEGORY NAME] [PERCENTAG E] (~1.5M Units) 1) Based on $4 per transaction Industry report conservatively made the following assumptions: • 100M in prescriptions associated with coupons in 2010 or 11% of brand prescriptions • Co - pay coupons to increase 15% per year to 500M in 2021 Each market share point acquired is worth ~$6M 1

OTCQB: OPRX “These new tools will help pharma better support physicians with the information they need, when they need it, through the channel they access most. “This will transform the physician - pharmaceutical relatio nship and positively impact people’s lives.” - Lynn O’Connor Vos, CEO of Grey Healthcare Group/WPP Strategic Investment by WPP — Largest Marketing Services Firm in the World • WPP acquired 20%+ of OptimizeRx for $4.7M 1 • Grey Healthcare Group, a subsidiary of WPP, CEO Lynn Vos joined OptimizeRx's board as a director • WPP will leverage its large network of pharmaceutical clients to help OptimizeRx acquire more brands • Co - develop new platforms to deliver vital information to physicians & patients, and help expand the EHR network WPP is the largest marketing services company in the world with 3,000 offices & 170,000 associates 1) Position date as of Sept. 29, 2015 22

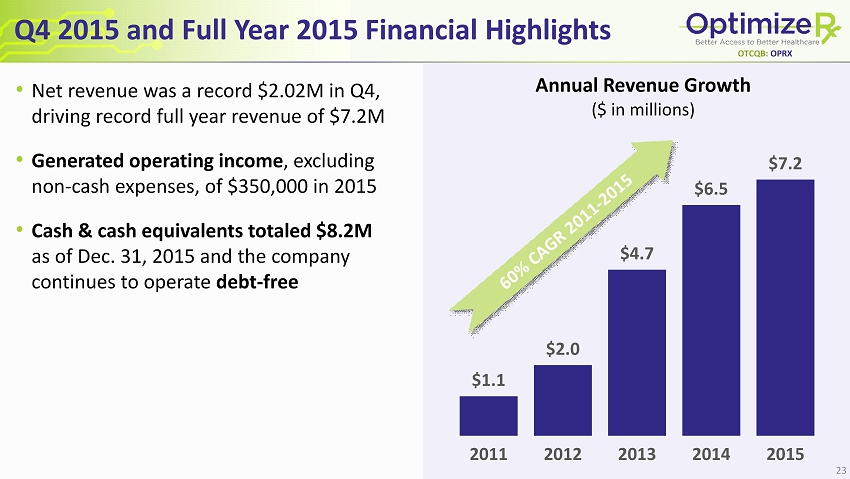

OTCQB: OPRX $1.1 $2.0 $4.7 $6.5 $7.2 2011 2012 2013 2014 2015 Annual Revenue Growth ($ in millions) Q4 2015 and Full Year 2015 Financial Highlights • Net revenue was a record $ 2.02M in Q4, driving record full year revenue of $ 7.2M • Generated operating income , excluding non - cash expenses, of $350,000 in 2015 • Cash & cash equivalents totaled $8.2M as of Dec. 31, 2015 and the company continues to operate debt - free 23

OTCQB: OPRX Moving our existing clients to enterprise via proven ROI + leveraging WPP agencies management of hundreds of brands! Rolling our NextGen , PDR, Touchworks and other network & electronic platforms! Expanding to Patient Portals & Practice Management Systems. Commitments from expansion of existing platforms to increase promotional reach minimum 25% over next 12 months Moving beyond our automated savings to automating other patient & physician support, as well as launch animal health! Growth Drivers There are 670+ Rx brands that have copay coupons 24 Product Innovation Grow Pharma Brands, Programs & Budgets Grow Physician & Patient Utilization in New Platforms Grow Physician Utilization in Current EHR Network

OTCQB: OPRX “Dr. Smith would like to speak with you. Please hold...” Key Innovation Initiatives • Developing point of pharmacy network to automate savings & print for next fill • Animal Health point of care promotion • Launch Instant Rep on Demand • Implement support in patient portals • Build out preferred pharmacy alerts & home delivery solution • Clinical Decision Support ePrior Auth partnerships Formulary Updates 25

OTCQB: OPRX Expanded Piggy - back Solutions Provide Further Promotional Revenue Opportunities 26 Patient Education Provide customized patient education materials that can be printed during the e - prescribing process On - Demand Support Enable instant connection to your territory or remote rep — or Medical Science Liaison (MSL) — to allow HCPs to engage or schedule an in - office visit EHR Brand Messaging Deliver targeted product messaging when your brand or therapeutic category is being searched and selected within the e - prescribing process EHR Sales Training Provide your sales force and managed care teams with valuable training about EHR systems, including why EHRs are important, and how customers can access company savings and support within the EHR New Product Launch / Drug File Integration Receive a customized launch plan created for you by the consulting experts at OptimizeRx ™. This plan includes direct assistance in integrating your brand’s drug file into the EHR database to allow for product search and prescription

OTCQB: OPRX Expanded Piggy - back Solutions Provide Further Promotional Revenue Opportunities 27

OTCQB: OPRX Key Takeaways • Huge Market – 2 Billion eRx transactional opportunities • Major Benefits to all Stakeholders – Beginning stages of helping deliver high value support into doctors workflow • Proven proprietary technology successfully implemented into largest promotional eRx network – Infinitely scalable to continue to expand market & entry barriers • Low fixed overhead SaaS model that offers high leveraged financial opportunity - Technology & support is in place to quadruple business • World - leading customers & partners to help us grow 28 $1.1 $2.0 $4.7 $6.5 $7.2 2011 2012 2013 2014 TTM Annual Revenue $ millions

OTCQB: OPRX Contact Us Company Contacts: William Febbo, CEO wfebbo@optimizerx.com 248 - 651 - 6568 Doug Baker, CFO dbaker@samplemd.com 248 - 651 - 6568 x807 Investor Relations Contact: Liolios Group Ron Both, Senior Managing Director oprx@liolios.com 949 - 574 - 3860 29 Headquarters: 400 Water Street STE 200 Rochester, MI 48307

Exhibit 99.2

C

O R P O R A T E P A R T I C I P A N T S

Doug

Baker, Chief Financial Officer

David

A. Harrell, Chairman & Founder

William

J. Febbo, Chief Executive Officer

C

O N F E R E N C E C A L L P A R T I C I P A N T S

Brian

Murphy, Merriman Capital

Harvey

Poppel, Poptech lp

Neal

Feagans, Private Investor

Randy

Rageth, Private Investor

Graham

Jervis, Private Investor

P

R E S E N T A T I O N

Operator:

Good

afternoon and thank you for joining us today to discuss OPTIMIZERx’s fourth quarter and year-ended December 31, 2015. With

us today are the Company’s Chairman, Dave Harrell; Chief Executive Officer, William Febbo; and its Chief Financial Officer,

Doug Baker. Following their remarks, we will open the call to your questions.

Before

we begin, I would like to read the Company’s safe harbor statements. Statements made by Management during today’s

call may contain forward-looking statements within the definition of Section 27A of the Securities Act of 1933 as amended and

Section 21E of the Securities Act of 1934 as amended. These forward-looking statements should not be used to make an investment

decision. The words estimate, possible, and seeking, and similar expressions identify forward-looking statements and they speak

only to the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking

statements whether because of new information, future events, or otherwise. Forward-looking statements are inherently subject

to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results could differ materially

from those set forth and contemplated by or underlying the forward-looking statements. The risks and uncertainties to which forward-looking

statements are subject and could affect our business and financial results, are included in the Company’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2015. This form is available on the Company’s website and on the SEC

website at sec.gov.

I

would like to remind everyone that today’s call is being recorded and it will be available for replay through April 5th,

starting later this evening. Please see today’s press release for replay instructions.

Now

with that, I would like to turn the call over to the Chief Financial Officer of OPTIMIZERx, Mr. Doug Baker. Sir, please proceed.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

Doug

Baker:

Thank

you, Shannon and thank you everyone for joining us on today’s call to discuss our results for 2015. Before we get into the

numbers, I’d like to begin by officially welcoming our new CEO, Will Febbo, who joined our team at the end of February.

Will’s 18 years of experience and has proven leadership in technology and healthcare companies, made him the ideal candidate

to lead us through our next stage of growth and development. Our Team in Michigan and our current Chairman and Former CEO, Dave

Harrell, have worked to ensure a smooth transition for Will. In addition to his ongoing responsibilities as Chairman, Dave will

continue to provide us management consulting on product innovation, business development, and market leadership over the next

year. Following my financial review, Will is going to comment on our operational performance and provide our outlook for 2016.

Now,

turning to our financial results for the quarter and year, our net revenue in the fourth quarter of 2015 increased to $2.02 million

versus $1.97 million in the same year-ago quarter. Net revenue for the full-year was up 11% to a record $7.2 million. The increases

in both periods were due to increased promotion of pharmaceutical brands and expanded distribution channels. I should note that

we estimate revenue in 2015 would have been about $650,000 higher if it were not for one of our EHRs who focuses on urology turning

off our program mid-year as a result of internal workflow issues at EHR. That would have resulted in an additional 10% growth.

We are currently working with them to determine when they will be back online and anticipate the associated revenue will contribute

significantly when they are back online in the second half of 2016.

Operating

expenses in the fourth quarter of 2015 were $1.5 million as compared to $0.8 million in the year-ago quarter. The increase in

expenses was primarily due to an exclusivity fee of $250,000 that we paid for development of the Allscripts Touchworks platform

as well as exclusivity across all Allscripts platforms. The increase also reflects investments in our Executive and Sales Team.

For full-year of 2015, our operating expenses decreased to $4.2 million from $4.3 million in 2014. For the full-year, our net

loss totaled $0.6 million or $0.02 a share, an improvement from a net loss of $1.0 million or $0.04 a share in 2014. When removing

the effective working capital fluctuations and cash flow from operations, we had income excluding non-cash expenses of approximately

$350,000 in 2015.

Turning

to the balance sheet, our cash and cash equivalents totaled $8.2 million at December 31, 2015, as compared to $3.4 million at

December 31, 2014. The increase was primarily due to the strategic investment of $4.7 million by WPP as well as positive cash

flow from operations of approximately $0.5 million. We also continue to operate debt free.

Now

with that, I’d like to turn the call over to (inaudible) Dave.

David

A. Harrell:

Thanks

Doug and good afternoon everybody and welcome to our conference call. I also want to begin by welcoming and stating my excitement

for Will coming on board as our new CEO. As Doug mentioned, Will has extensive (inaudible) both technology and healthcare and

also has key roles that he’s led in the capital markets making him an ideal candidate to help us lead to the next stage

of our (inaudible) at OPTIMIZERx. We have worked together again to ensure Will’s appointment as CEO, has maintained continued—continuing—continued

operations at OPTIMIZERx and I will continue to directly support him moving forward. With his leadership and proven success, I

have the utmost confidence that we will continue and accelerate OPTIMIZER’s delivery of best-in-class consumer and physicians’

platforms, as well as build shareholder value. I also look forward to being able to focus my passion to further innovate and connect

OPTIMIZER to new partners and clients who seek a better way to deliver healthcare savings and support.

With

that, I’m pleased to turn over the call to Will.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

William

J. Febbo:

Thanks

Dave and thanks everyone for joining us today, and actually Dave’s sitting here right next to me and once we get to questions

you’ll hear more from him as well. But thanks for that intro, quite a buildup, I really appreciate the confidence.

Before

I get into discussing our results, I’d first like to talk a little bit about what brought me to OPTIMIZERx. When I was first

introduced to Dave and his Team, I couldn’t help but be impressed by their vision and especially their passion for helping

pharmaceutical companies expand awareness and access to important medications and for helping doctors help patients better afford

and comply with their prescriptions. In accomplishing this mission, I was amazed at how they had been able to deliver important

product support and automate co-pay savings right within the physician’s electronic workflow while delivering a solid return

on investment for their pharmaceutical clients.

Having

worked with pharma clients for over 18 years, there has to be true value delivered to engage as many brands and companies as they

have currently. As most of you know, I came over from Merriman Capital where as a COO I helped develop and lead discussions for

WPP or Grey Healthcare Group Investment as a strategic investor. I saw Grey as a perfect strategic investor given their strong

domain expertise, client reach, and especially their leadership team, which includes their CEO, Lynn Vos O’Connor who has

recently joined our Board of Directors.

Following

Lynn’s guidance, we plan to increase our activity within WPP’s group of companies which includes access to more than

300 brands. I’m glad to say we have already seen six new brands added to the mix and that will result in revenues of approximately

$350,000 over the next six months. In joining our Board (inaudible) Lynn recognized as I did the market leadership OPTIMIZERx

has established over a relatively short period of time and how the Company has accomplished this in partnership with some of the

largest pharmaceutical companies in the world like Pfizer, Lilly, Novartis, Sanofi, and AstraZeneca, household names. These global

market leaders have automated their co-pay savings and their trial voucher programs by using OPTIMIZERx proprietary on-demand

content delivery platform. Through this platform they are able to reach more than 250,000 healthcare providers via our network

of leading EHRs. Our platform allows these companies to address the fact that electronic prescriptions are likely to exceed 2

billion in 2016 as states move to e-prescription-only like New York you’ve seen in the paper recently, and that studies

indicate that 80% of physicians are more likely to prescribe a drug that has a co-pay savings card versus one that doesn’t.

These

market trends and growing demand by our big pharma partners was clearly evident in our most recent results for the year including

more than 25% increase in promotional transactions which is our core product. These results also reflect the addition of more

pharmaceutical manufacturers and brands for our SampleMD platform. In fact, we distributed e-coupons for 85 brands in 2015 which

was up by more than 21%.

As

many of you know though, our top line growth was not as high as previous years. This was due principally to two factors; longer

sales cycles to close new brands and slower integration into the EHR partners. As a result, we plan to deploy our capital wisely

and invest in expanding our sales team, leveraging our Partnerships like WPP and others, strengthening our marketing and continuing

to innovate within the HER Partners by delivery technology solutions which reduce the integration time, a key factor in our growth.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

Also

in 2015, we expanded our network of leading EHRs including the successful launch of our e-coupon solution by Practice Fusion which

is the industry number one cloud-based EHR for doctors and patients. In the fourth quarter, we also became Allscripts’ exclusive

provider of the e-coupons on all of its platforms including integrating our e-coupon solution with their Touchworks network. Touchworks

is used by large health systems throughout the country. So, this represents a major expansion of our network. The integration

of e-coupon functionality within Touchwork—Touchworks, sorry, is expected to launch on a test basis in late 2016 and then

on a wider scale in early 2017.

In

order to support our outreach to new age EHR providers and patient platforms, last quarter we appointed James Brooks in the new

position of Senior Vice President of Business Development. James has executive sales and marketing experience and particularly

with growing sales at Fortune 500 and electronic health record companies made him a great fit for OPTIMIZERx. He brings to us

longstanding relationships with numerous EHRs which represent new opportunities for OPTIMIZERx integration and for us to reach

more doctors and patients. James is now leading a new marketing effort designed to enhance our value proposition for both the

EHR and pharma partners.

Aside

from the WPP, one recent example of our increasing partnership reach is our new partnership with TrialCard which allows their

pharmaceutical clients to incorporate our OPTIMIZERx service offering into their co-pay savings program. They are the second largest

adjudicator in the market.

We

had a great week last week in Vegas at the 2016 HIMSS conference which is where all the EHR partners gather, and it’s clear

we have a seat at the table. As the market matures, we feel confident we can be best in class partner with the likes of Dr. Herst

(phon), Allscripts, etc., so we all grow together. Tomorrow we will be presenting at the 28th Annual ROTH Conference being held

at Dana Point, California. In fact, we are already here today to attend a number of one-on-one meetings with institutional investors

and it’s been a busy day. For those of you unable to attend the event, you can watch our presentation via webcast at 11:30

Pacific Time. The webcast link is available in our ROTH Conference announcement.

In

our ROTH presentation we will be talking about how in 2016 we’re planning to acquire, integrate, and expand into new promotional

EHR and eRx platforms. We will also be talking about how we plan to expand our sales team and further leverage our strong channel

partnerships. We continue to actively participate in industry and partner events. In fact we are sponsoring and assisting and

leading the largest pharmaceutical EHR conference being held on March 21 and 22 in Philadelphia. In addition to sponsoring a conference,

we’ll participate in key speaking, industry panel leadership and round table facilitation. This highly acclaimed forum serves

as the only life science driven meeting tailored to this changing and expanding landscape.

As

advances in health IT take healthcare provider engagement to the next level, this is a great opportunity to benchmark the position

OPTIMIZERx as the trusted leader in EHR digital marketing solutions. Given our strong balance sheet, we are planning to make strategic

investments designed to grow our pharmaceutical products and distribution network. We expect our distribution of e-coupons to

grow significantly this year but we will also be focused on growing our clinical messaging and brand integration products and

services.

While

it is early for me to be giving specific growth forecast numbers, (inaudible) all the various activities between partnerships

and investments and sales force, we expect (inaudible) top line growth well in excess of 2015’s modest growth.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

In

summary, before we get to questions, we’re going to do four principle things. We are going to reinvigorate our revenue growth

with a larger direct sales force, leveraging WPP relationships, and continuing to form partnerships that (inaudible) better access

to brand managers. We will invest heavily in EHR partner space with leadership and technology and product extensions. The total

projectable market is well over a billion (inaudible) front of us including e-coupon, messaging and brand launch services. There

are 600 branded products of which we currently service 82. Given our lead and refreshed ownership and leadership, we feel very

confident we can continue to be very relevant in this space. We want the market to think of OPTIMIZERx as the go-to-partner for

communications between pharma, healthcare providers, pharmacies, and patients.

Now

with that, I will open it up to questions.

Operator:

Thank

you, sir. We will now begin the question-and-answer session. As a reminder, if you have a question, please press the star, followed

by the one on your touchtone phone. If you’d like to withdraw your question please press the star, followed by the two.

If you are using speaker equipment, you will need to lift the handset before making your corresponding selection. Once again that

is star, one to ask a question at this time, and we’ll pause for just a moment while we assemble the queue.

We’ll

take our first question from Brian Murphy with Merriman Capital.

Brian

Murphy:

Thanks

for taking my question. Hi Dave. Hi Doug and welcome (inaudible).

William

J. Febbo:

Thank

you, hey Brian.

Brian

Murphy:

So,

I guess at a high level, you guys are growing the top line double digits. You’re generating cash. But, you know, you’ve

got $8 million on the balance sheet. I mean, you could easily double the expense base and yet still have in excess of two years’

of operating cash. I’m just wondering how you guys are thinking right now just big picture in terms of revenue growth versus

profitability and cash flow, and maybe if you could just talk a little bit more about the kinds of levers you have to accelerate

growth if you have the opportunity to.

David

A. Harrell:

Sure.

Will is taking a very strong look at what our projections are and seems to be very excited about that, but I can tell you that

number one, we clearly see that we want to grow our revenue and really (inaudible) grab as much of this market in the next two

years as we absolutely can, and so anything from a marketing, customer facing, account management, and promotional aspect, we

will absolutely be gearing it up dramatically. We expect to certainly have profitable growth moving forward but the reality is,

we want to grab this market, we want to leverage our leadership position and we certainly now with particularly WPP and some other

key partnerships, are in a position to do that and we will invest appropriately.

Secondly,

we think we have got some great technologies that are going to get actually reviewed fully through our partnership at WPP, and

properly launched so that we can begin to expand some of those that Will mentioned. But clearly, you know, we do still want to

run a tight ship but we don’t want to invest. The opportunity is too big to not fully invest and I think Will has seen and

he brings a good perspective of it, and Will I will turn it over to you for any additional comments you have from that.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

William

J. Febbo:

Yes.

No, I think that’s a good summary, and investment is all about top line growth at this point, Brian. I think given our cash

position, there’s less concern for profitability at this stage given how much of the market we still need to capture, and

we will spend a lot of time in the next two months organizing our product set so that additional products can be sold to the same

client base. Before I even joined, David already hired two Executives; one based in Michigan, one on the East Coast. James Brook

was one of them on the East Coast and the other gentleman’s in Michigan to really help us streamline our account management

and interaction with partners. They’re doing a great job and they are the newest of the team and very excited and we’re

seeing results already.

We’ll

plan to spend additional money over the next two months. Matter of fact we just had a sales person accept a position this week

and we’re excited to get him going in the coming week, and I think having tried to build sales teams that sell to pharma,

it’s—we really have a unique product that’s going to excite the best sales people, that have the best relationships,

and then again this is why to be WPP was excited and Grey because we have a unique story, unique offering that offers a very clear

value proposition to the clients. So yes, it’s all going to be sales and marketing focused and we’re excited to make

the team bigger, and grow top line.

David

A. Harrell:

Yes,

and part of that too will be really putting in the right resource towards some of the key WPP agencies, some of the key partnerships

like our recent announcement of TrialCard which is—just to give you a little color on TrialCard, TrialCard is one of the

top-two largest backend processing companies that really manage programs for over 100 pharmaceutical brands. Certainly, we’ve

worked with TrialCard and the other three big adjudicators like McKesson and PSKW and we’ll continue to, but they have basically

looked at ways that they want to provide this as a general key offering that from their point of view every pharmaceutical client

that they have should take advantage of. So again, we want to invest in these extremely powerful partnerships as well as invest

to growing in our direct sales.

Brian

Murphy:

Got

it. That’s pretty helpful. And, just to follow up on WPP. I know that’s a very important strategic relationship for

you guys. Can you maybe talk a little bit about how that arrangement is going so far, and maybe some color on what you think they

can do for you?

William

J. Febbo:

Sure.

So—hold on, David wants to go first.

David

A. Harrell:

Well,

I want to go first because I—and I’ll turn it over to Will because I think this is a real advantage that Will brings

in. I mean, I love the fact that he understands technology, I love the fact that he’s been in the healthcare pharmaceutical

space, and I love the fact that WPP really likes him and was very supportive of him. So, the thing is Will has worked (inaudible)

WPP and the organizations and I think that’s going to be a key focus for Will too, and I think before I turn it over to

Will, up to this point we’ve had an outstanding engagement at the senior levels of each of the agencies and now the key

component will be to pull that through at the account levels. So, we’ve had tremendous buy-in. We have seen some results

already but I think Will’s focus and his team’s focus moving beyond here is to really pull that through so that we

can get in front of these brands and really help prove our—help them understand our ROI that we’ve demonstrated and

how they can leverage that as well.

So

Will, I didn’t mean to interrupt you but I was really excited that you’ve had a great working relationships for over

15 years at WPP.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

William

J. Febbo:

Yes

and Brian just a little context. I know most of the investors who are in already know how that all happened, but the introduction

of WPP into it is, they are a series—they are a holding company with lots of agencies and those agencies are critical to

advising brand managers in healthcare and there’s several of them. So, from our perspective I’m going to treat each

of those agencies within WPP as a client. As Dave said, we’ve already had top-level buy-in, we’ve had several meetings.

We’re going to have another one coming up. We’ve seen results already. Some are ahead of the other groups and we’re

going to work on getting them all equally producing, but the spirit is there and we’ll treat each one of them as individual

clients and support it and hammer and close business together because it’s a win-win. They look good as an agency of record

for any brand because they’re advising on a digital strategy, and our product is one of a kind. So it really—it’s

a good value add to both sides.

Brian

Murphy:

That’s

great color. Thanks for that. Maybe just one more quick housekeeping question and then I’ll jump back in the queue. Can

you tell me what the headcount is today and maybe where that could be at the end of the year?

William

J. Febbo:

Yes,

we’re around all in 14 and my guess is it we’ll be close to 20 by the yearend.

Brian

Murphy:

Great.

I’ll jump back in the queue. Thank you.

William

J. Febbo:

Thank

you.

Operator:

And

as a reminder, that is star, one if you would like to queue for a question at this time. We’ll take our next question from

Harvey Poppel with Poptech LP.

Harvey

Poppel:

Yes,

congratulations on coming on board Will.

William

J. Febbo:

Thanks,

Harvey. Good to hear you.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

Harvey

Poppel:

Right.

First question really is, it wasn’t clear from the public announcement of your arrival what Dave’s role might be going

forward. Perhaps you could clarify that.

William

J. Febbo:

Yes,

so part of the early discussions in the winter when Dave and I were talking about this was he could not get far away. I wouldn’t

take it if he did and that was a serious condition because, you know, from a perception standpoint and frankly just from a knowledge

and leadership standpoint, I didn’t want that to happen and we agreed on that, and I think what we came down to is focusing

on Dave’s strengths which is innovation, looking at strategic relationships that can really help grow revenue and also both

on the pharma side and EHR side. So, moving to Chairman, I have full access to him at any point and I’ve seen nothing but

since we started talking and I think we actually do very well together. We’ve had today with—one-on-ones with investors

and it’s a good combination. I’m obviously new, so I’m still getting my arms around a lot but Dave is transferring

everything. I have say the rest of the team is too. So, I expect to have full access to him for assessing things like animal health

product development. Some of the other products in that we have a consumer app that we’ve done some early work on and really

building out that business plan so that we can integrate it and grow it in a professional way.

David

A. Harrell:

From

my perspective too, I mean I think it’s a great role for me. You know classic, Founder both strengths and maybe some weaknesses

to a point I think Will brings some refreshing viewpoints and I think it’s exactly perfect timing to come in. I think we’re

well positioned from all aspects from not only our partnerships but our financial position to really look at some of these things

from a new perspective and especially from somebody that has proven very strong operational performance. But again, my passion

is to certainly get in front of as many pharmaceutical clients and EHR partners to not only look at the value that we’ve

proven out on both sides of the fence, but looking at some of their other needs that can leverage our on-demand content delivery

system. So again, I’m very excited about it. I think it’s something that’s going to make me actually potentially

even a stronger ROI for the Company.

Harvey

Poppel:

Great.

I’m sure that’s very reassuring to investors who have known you and worked with you for a long time, Dave.

David

A. Harrell:

Thank

you.

Harvey

Poppel:

A

couple of specific questions, on the Touchworks deal, you indicated that’s really not going to start to cut in until late

this year. Magnitude wise, just how big a deal is that relative to your existing base? Can you give us some sense of proportion?

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

David

A. Harrell:

Yes,

I mean, it’s such an important new opportunity for us and it really distinguishes in the market. I can tell you that Touchworks

is second only to epic in terms of these closed health systems that utilize their HER, and not every EHR is necessarily the same.

Pharma companies love our reach, they have proven it across no matter what platform and they’re all in, but particularly

those closed health systems, those are the real tough ones and Touchworks reaches an additional 50,000 doctors that their prescribing

habits, they live in the HER. They don’t write handwritten as well as electronic prescriptions, and we looked at their utilization

and it was between their other platforms, literally three times the size. So, that potential right there when launched could have

a 25% increase on our business easy. The additional thing is once that’s ready to launch, there is going to be so many more

brands that know that those closed health systems don’t take drugs samples, don’t see reps, and that’s going

to be a huge driver for us not only in Touchworks but our network across the board too.

And,

not to keep stammering too long though, again as Will mentioned too, we’re at the table with many of our other longer sales

cycled EHRs who many of them invited us to meet with them at HIMSS Conference because they are starting to look at needs that

they’re really not filling in. So, I think it’s a very exciting time and many of those groups are all involved in

very large health systems.

William

J. Febbo:

And

Harvey, just—this is Will, just to add to it, I think part of the complexity of rapid growth versus steady growth is the

integration process to EHRs, and it appears Allscripts we have tremendous relationship with them, we have generated a lot of revenue

together, and them having it beta-tested in Q4 and then live in 2017 is no reflection of them not wanting us to get there sooner.

It’s just in the queue—and this is true for integration work. So, one of the things and I mentioned it in my beginning

comments is we’re going to work really hard at getting our technology to a point where the integration is simpler and we’re

going to weight ROI decisions on how to get that up the queue on the list within our EMRs. It’s a big piece of the puzzle

and the good news is as Dave said, I was blown away by everyone from Cerner to everybody. (Inaudible) and we have met with everybody

and they all wanted to meet with us and sit down and it was very amicable and we talked about innovation together and these were

people that are already generating revenues. So, it’s not just chit-chat, it’s actually real business, and I was blown

away by the conference because it seemed like we actually were able to get some business done and not just spend three days walking

around shaking hands. So, OPTIMIZERx has a seat at the table there it’s clear. It was good to feel.

Harvey

Poppel:

Great.

I had just a few more specific questions. It’s not clear to me when you refer to brand integration and clinical messaging

I guess fell short of—from what you said in the press release in terms of revenue generation. But, it’s not clear

to me or maybe other investors what that all means. What do those words mean in terms of what you do under the rubric of brand

integration and clinical messaging?

David

A. Harrell:

Yes,

so first of all, that is a good question. I mean, last year for example we did approximately Doug and tell me if I’m wrong,

about a million dollars in some of these programs that we’re talking about particularly in hoping drugs get integrated into

the databases of these EHRs and doing some training programs to help them and managing any issues with drug brand launches. So,

I mean, that’s a million dollars that frankly didn’t happen this year and one of the key growth opportunities that

Will and certainly I have recognized, needs to happen.

The

other opportunity though is more and more of our brands really want to not just do financial messaging, they want—which

is our (inaudible) fund program, they want to do clinical messaging too, and we have great additional reach that beyond just their

work with potentially an individual EHR that we can expand on where it might be talking about a new dose, a new indication, a

new delivery system, etc., and that market currently is at least as big if not even bigger.

Harvey

Poppel:

Okay.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

David

A. Harrell:

So

again, these are two areas that if we were to hit just the same numbers last year, these are key, and one last thing is, these

are very complementary to our core financial messaging and that’s the key thing. It doesn’t distract us, it compliments

us and it makes us a strong partner at the table.

David

A. Harrell:

Yes.

I would just add Harvey, you need to—for pharma to stay at the table, you need to be offering multiple services all around

brand awareness. So, we will spend a lot of time in the next month or two with our friends we now know a lot of agencies, so our

marketing is about to get a lot better, that will make the products more clear, distinguish the value proposition for each one

but on the surface, the good news for the Company is they’re the same buyer, same client and it uses the same distribution

and we have the technology. So, it’s really about getting organized around the value proposition for each, the pricing for

some of the newer ones, and some branding.

Harvey

Poppel:

Okay.

Just continuing in that spirit then on TrialCard, those of us who are not familiar with that organization and what they do, it’s

not clear to us exactly who’s going to do what for whom going forward and how that’s going to help the Company?

David

A. Harrell:

Yes,

TrialCard is—again as I mentioned, TrialCard is one of the top-three companies that manage the programs overall. They basically

develop the co-pay programs, process the savings from the pharmacies and really are the overall managers of the programs. In turn,

obviously we are one key channel, but in fact obviously a growing channel where they recognize that this is where the market’s

going, and they approached us over the last four months and said listen we really want to partner with you. We want to make it

easier for more of our brands that are currently not working with you because we have some brands that TrialCard happens to manage

for them that the brands themselves directly went after and told them that we want to work with OPTIMIZERx. But instead they want

to proactively go after these brands, and so I think again, these key partnerships like the WPP and TrialCard and some others

that you’re going to be hearing, they really if they are properly managed, can really help us expand our marketing force

out there because there’s no reason why any brand that has a co-pay savings shouldn’t be working with us. We just

have to resonate the ROI, we have to make sure they know how to position us and ideally and I think your point Harvey in the past

was get us in front of the clients and let us do it for them as their partners.

Harvey

Poppel:

Okay.

So, they’re basically in very, very simplistic terms an additional marketing channel, like a third party marketing channel?

David

A. Harrell:

Absolutely.

Harvey

Poppel:

Okay.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

David

A. Harrell:

The

best situation would be the WPP’s agency just talked about how great they are, OPTIMIZERx’s and the day after TrialCard

manages our programs anyway, so yes, in fact you can work through us to integrate these same programs right through OPTIMIZERx

to reach over 250,000 healthcare providers.

Harvey

Poppel:

Okay,

one final question then. Dave, you’ve been talking about products for the veterinary world for some time. I know you’ve

had some out there in 2015. Do you see anything finally happening there that’s going to generate some substantial revenue

going forward?

David

A. Harrell:

Yes

and again, thank you for bringing that up to and I will turn it over to Will on this but for a second too, but this market continues

to just rear its head with huge-huge opportunity because it’s such—it leverages the exact technology that we do on

the human health side. So, what I mean by that too it’s just a simpler market. There’s only four EHRs which really

are called practice management systems that are key, maybe five. We’re talking to all of them, and there’s only about

five key categories that matter for the high volume.

When

we start looking at this, while we have got so much other opportunity but the reality is we built an initial team of key consultants

that have guided us and opened us up to some very, very strategic discussions that I think will pan out beyond our pilot that

just started live last month with the second largest health system. It’s a small pilot though, it’s about 20 clinics.

So, I don’t want to overstate that. But, the reality is the—this has really got the attention of organizations like

Patterson, Henry Schein, who are the largest distributors here who are saying, well we think we can help you, and so it’s

a very exciting time not the steal Will’s point, I wanted to comment and he said that’s great but let’s develop

a formal business plan, let’s look at exactly what kind of organization we need to build to support this. Let’s leverage

Grey Healthcare and WPPs, client relationships are already on the (inaudible), and I think that’s exactly the types of things

that we need Will to do.

William

J. Febbo:

Yes.

I think Dave covered it there, there is probably two or three things that we’re going to dive into deep and then come back

to the market, but this one is, if you look it at a very simplistic level, it’s selling to pharma with our existing technology

and it’s actually simpler because the buyer has both sides, both pharma relationship and practice management or EHR. So,

definitely worth pursuing and the consultant team that’s been pulled together is excellent.

David

A. Harrell:

I’d

just like to piggyback when he says that, so if we could get a partner such as a Patterson and/or Henry Schein, I mean, they already

have the pharma clients and they already have the veterinarians. So, the key is we want to work with them to leverage our technology

almost like a licensing capability to bring better value to their veterinarians who are desperately looking for ways to protect

their margin and keep their pharmacy in house.

Harvey

Poppel:

Thank

you very much. I will step away now. Thanks.

David

A. Harrell:

Thanks,

Harvey.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

Operator:

We’ll

take a follow up from Brian Murphy with Merriman Capital.

Brian

Murphy:

Thanks.

How should we think about seasonality March to—December to March? Is it going to be similar to kind of what we saw last

year?

David

A. Harrell:

Yes,

I mean, the seasonality aspect comes in is that some of these brands still are not finalizing their 2016 strategies. As crazy

as that sounds, they’re late to get us assets. So, it’s always been a little bit less, you know what I mean, in terms

of that. So, I don’t—and then they fully ramp up. They give us the insertion orders and you tend to lose in some brands

some key times, and maybe that’s a point where we’re going have to start addressing it with as we get closer and closer

to these agencies, and the fact that you can’t so don’t want to have that (inaudible) experience being interrupted.

So, I would say that’s somewhat traditional.

Brian

Murphy:

Okay

great, and you know, you guys grew the number of brands, it looks like to 85 from 70 this year. It looks like your—the pharma

customers that you did business with in 2015 was 25, it looks like it was the same as 2014, first are those all the same 25 customers?

David

A. Harrell:

You

know what, I’m not too sure about that. I think we have added some key ones, Teva’s coming on board now which is the

largest generic company but they have key brands as well.

William

J. Febbo:

No,

it’s just churn. Some will drop off if they are acquired, you know that happens, but the number to watch is brand number

because those are programs. You know you could—and as long as we’re not too heavy in one and we—part of the

things that we’re reviewing now is end of patent life, where are we in that stage, we’re instituting a pretty heavy

CRM, customer management platform so we can track everything very well and be ahead of it, and we’re also looking at as

we’ve talked about, I’ve heard talked about before, I didn’t talk about it was a potential solution on the generics

side. So, that as they go—as a drug goes through its phases of life, if you really want the longest tail for revenue, you

need to be—you need the audit practice, the clinical and commercial messaging, and as it gets towards the end of its life,

there is a whole another set of services that you need to deliver, and again this is where being part of an agency as you get

baked into that process and while they may not have made their decisions win in pharma to say go, they have allocated the budgets

and now they’re waiting for the agencies to propose how to actually spend it, and the good news is we’re getting integrated

there.

David

A. Harrell:

Yes,

so I mean, the more brands we have, the less effect it will have. You’re always bringing in new brands that are blockbusters

and you might lose some new ones. I can tell you too that kind of somewhat good news is that we ran out of some budget in December

too, so were some key brands. So, we don’t want to act like could’ve, should’ve, would’ve but if we had

some of our fall EHR channel working and didn’t already have the budgets filled and focus on some of the core additional

businesses that we think we can easily can get back and leverage, I mean we certainly exceeded the numbers that we have.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

William

J. Febbo:

Thanks,

Brian. We got a couple of people in the queue, so we want to try to get a couple of more questions.

Brian

Murphy:

Got

it. Thank you.

William

J. Febbo:

Thank

you.

Operator:

We’ll

take our next question from Neal Feagans, a Private Investor.

Neal

Feagans:

Hey

guys.

David

A. Harrell:

Hey

Neal.

William

J. Febbo:

Hey

Neal.

Neal

Feagans:

Hey

first of all, boy, what an informative call. This is great and a number of my questions have been mostly or partially answered.

But, I was curious to understand a little bit about the revenue generation model for some of these other products and services.

The coupons pretty cut and dry, on the veterinary opportunity and maybe specifically the test that you’re in now with some

of these clinics, is it the same methodology? There’s a coupon and we do a revenue share with the EHR equivalent, and is

that coupon being funded by the drug manufacturer or is it more or less identical to the human drug program?

David

A. Harrell:

So,

for the test what we did is we work with NVA who took funds out of their co-op money in most cases to get this up and it was kind

of flat rate etc,. but the model will definitely be transactional based. Here is the beauty for the initial launch, we use what

we call our desktop application. So, we don’t have to share any revenue and that’s going to be one key strategy (inaudible)

as we look at even a human health side an opportunity too.

Neal

Feagans:

Okay.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

David

A. Harrell:

But

looking forward, you’re absolutely right. When we look at integrating into the practice management, this is definitely a

50% revenue share. Now, what we asked our partners that were in discussions with is to help us assess what that is and that’s

what the process how we’re looking at is. It’s not the same profitable market obviously from the client side. So—but

it would be based on…

Neal

Feagans:

Why

is that Will, just because the drugs are way less expensive?

David

A. Harrell:

Well

this is Dave by the way. That’s okay. Yes, that’s exactly the key.

Neal

Feagans:

Okay.

David

A. Harrell:

The

margins aren’t quite there but there is still a tremendous amount of sales and profits that we can generate from.

William

J. Febbo:

Yes.

Our cost of sales as a company is dramatically lower in that space just because as we described the partners we’ll end up

working with most likely know both the veterinarian side and the pharma side. So, they have their own…

Neal

Feagans:

So,

the same driver though to the drug manufacturer that we have on the human drug?

David

A. Harrell:

Absolutely.

(Inaudible).

Neal

Feagans:

The

same rate of return argument prioritize your drug, keep the customer on your product, same basic premise as what we see with what

you’re doing now with the human side.

David

A. Harrell:

Maybe

even more because of the price elasticity and sensitivity about the margin protection that the veterinarians are facing versus

1-800-Pet-Meds etc.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

Neal

Feagans:

Okay.

All right and then kind of a similar question. When you talk about—and you say that a priority in 2016, it’s a priority

to get these brand integration products and clinical messaging products moving more aggressively. How do we get paid for example

for clinical messaging, and if this is kind of a reciprocal benefit to the EHRs and the medical community for lack of a better

word, is there not some incentive for them to help pay for and develop these technologies versus the coupon that I can see being

in a different bucket. So, kind of a two part question, how do we get paid for a clinical message or a brand integration message,

and is it us that’s going to fund developing and getting these technologies into the marketplace?

David

A. Harrell:

So,

first of all on the clinical messaging, that’s an add-on. We basically secure it for the EHRs that we have in our network

and we help them implement it. So, it’s a similar type of message that pops up for them and that’s on…

Neal

Feagans:

Do

we get paid though if that message is delivered to a specific end user?

David

A. Harrell:

Yes.

So, it’s a cost per impression basis where ours is a cost per delivery basis. Interestingly enough it’s a little bit

less than what we charge for financials but we deliver a better, confirmed value that the e-prescription was confirmed, sent with

the coupon. So, that’s a little bit of a stronger value proposition. And, by the way when you’re selling both, it

differentiates that value too by the way to the pharma companies even more. But, keep in mind most brands aren’t doing anything,

but a lot of them are doing the clinical messaging even without the financial and the financial frankly is probably the most powerful

message you can deliver. So, one of our strategies is go to the ones that are doing clinical messaging and say god bless you,

but the reality is here is the ROI and financials so we’re all for the clinical, but you should be doing the financial.

And, for the ones that are just doing the financials, we should say hey, you should do some testing here to see if there’s

some clinical messaging that compliments it.

William

J. Febbo:

And

on the technology side to your question on the cost, so we have current capacity ourselves and with partners, but we will invest

a little money this year in making it a broader and easily uploadable application. That’s not a heavy lift for us because

it’s basically we know what to do and we know how to improve it, but it should accelerate revenue growth that’s why

we’re doing it.

David

A. Harrell:

We

can deliver some of it right now.

Neal

Feagans:

You’ve

had a million messages delivered over our platform and you made x cents per message, that’s kind of the model?

David

A. Harrell:

Yes

it is.

Neal

Feagans:

Okay.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

David

A. Harrell:

It’s

cost per impression just like any (inaudible) or anything.

Neal

Feagans:

Right.

David

A. Harrell:

Now,

the drug file admission (phon) is a set fee where we offer anywhere from services where we’ll confirm which EHRs have UN

(phon) versus not that might be like a $30,000 integration versus a full drug file management program not only will we help you

get in there and leverage our relationships, we will manage any request that you have from reps, we will help train them to how

the process can go. That can be anywhere up to $100,000.

Neal

Feagans:

Okay.

David

A. Harrell:

So,

getting 10 of those would be nice stuff. I mean, if we would have 10 of those like we did, I think we had seven last year, we

would have been—this call would have even been that much more pleasant you know what I mean. So…

Neal

Feagans:

Well,

let me ask you two more quick things that are unrelated. I think you said six new brands came from the WPP relationship and you

were (inaudible) projecting—estimating $350,000 of additional revenue over the next 12 months is that correct?

David

A. Harrell:

That’s

over the next six months. So, they were smaller brands but we’re in the game and they are getting more and more used to

dealing with us and that’s a great start and…

William

J. Febbo:

It’s

the tip of the iceberg.

David

A. Harrell:

Most

of them came from one agency, so we want to build on that and I think Will did a nice job of saying, hey, we’re working

with your sister organizations and they see this as a huge strategic value to your client. Let’s share best practices and

let’s invest in helping you be more successful with your clients.

Neal

Feagans:

So,

a blockbuster drug, if you were to land a new brand that had a $6 billion, $7 billion annual sales rate, I mean, you could be

doing way more than $60,000 a year in coupon revenue.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

David

A. Harrell:

We

had a presentation last week for one drug that was over $1 million in revenue for us just on e-coupon, one drug.

Male

Speaker:

Meeting

went well…

Neal

Feagans:

One

more quick question and I don’t know right quite how to phrase it and I don’t have the correct name of the parties

in front of me, but the lawsuit that we’ve been involved with where they’re not living up to their end of the agreement

according to us yet we’re continuing to live up to our end of the agreement and pay them a substantial royalty. I’m

not a patent expert but I know a lot of companies, if they feel they have a strong case, if they feel like it’s just patent

trolling and part of this problem we have nationwide, is there any consideration being given to revisiting that, and any potential

that we kind of do an about face and decide to stand down from writing them a check every month?

William

J. Febbo:

So,

this is Will, with his fresh perspective. Clearly he is looking to look at the—fully understand this but the reality of

it is is that there is an opportunity for synergistic value and opportunity for both companies that were intended to be exceedingly

stronger together, and we fully intend to make sure that we get the positive benefits out of that relationship that we saw, and

there’s not a lot of things we can do to comment on it but that is absolutely one of the key focuses is to work with our

legal department as well as the potential discussions that we can have and with the group to look at ways—the market is

still so big that—why we entered in the agreement still makes complete sense. Yet we want to make sure we enforce what was

intended so that both parties win.

Neal

Feagans:

Okay.

All right, well listen guys, I appreciate you taking my call. Good luck, it sounds like a really exciting almost kind of a pivotal

year for the Company and you know my little request, keep us apprised of progress regularly during the quarter, don’t make

us wait three months at a time to hear it all during one hour long call. So, thanks again.

David

A. Harrell:

Okay.

Thanks for your help and support.

Operator:

We’ll

take our next question from Randy Rageth, a Private Investor.

Randy

Rageth:

Yes,

hello gentlemen.

William

J. Febbo:

Hi,

Randy.

ViaVid

has made considerable efforts to provide an accurate transcription, there may be material errors, omissions, or inaccuracies in

the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262

1-604-929-1352 www.viavid.com

David

A. Harrell:

Hey,

Randy.

Randy

Rageth:

So,

quick question, so fourth quarter revenue ‘15 was essentially flat from fourth quarter ’14, yet we had about 10 new

drugs. So, was the fourth quarter just kind of weak would you say, or what would you say to the…

David

A. Harrell: