UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 11, 2016

THRESHOLD PHARMACEUTICALS, INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

001-32979 |

94-3409596 |

|

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

170 Harbor Way, Suite 300

South San Francisco, California 94080

(Address of principal executive offices)(Zip

Code)

(650) 474-8200

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Operating Officer

On March 11, 2016, the Compensation

Committee (the “Committee”) of the Board of Directors of Threshold Pharmaceuticals, Inc. (the “Company”)

approved the promotion of Mr. Stewart Kroll, the Company’s previous Senior Vice President, Clinical Operations to Chief Operating

Officer who in such capacity will perform the role of the Company’s principal operating officer, effective immediately. Mr.

Kroll, age 57, served as the Company’s Senior Vice President, Clinical Development from May 2011 until his promotion to Chief

Operating Officer on March 11, 2016. Prior to May 2011, Mr. Kroll served as the Company’s Vice President of Biostatistics

and Clinical Operations since January 2005. Mr. Kroll served as the Senior Director of Biostatistics of Corixa Corporation from

December 2000 to January 2005, and served in positions of increasing responsibility, most recently as Director of Biostatistics

of Coulter Pharmaceuticals, Inc. from January 1997 to December 2000. Mr. Kroll received his B.A. and M.A. from the University of

California, Berkeley. In addition to the stock option granted to Mr. Kroll as described under “Executive Compensation Arrangements—Stock

Option Grants” below, the Committee approved an increase to Mr. Kroll’s annual bonus target percentage under the Company’s

standing annual bonus program from 35% to 45% of his base salary in connection with his promotion to Chief Operating Officer. Other

that with respect to the foregoing compensatory arrangements, there were no new compensatory or other material arrangements entered

into, or modifications to existing compensatory arrangements entered into, nor were there any other grants or awards made to, Mr.

Kroll in connection with his appointment as the Company’s Chief Operating Officer.

Executive Compensation Arrangements

Change

of Control Severance Agreement. On March 11, 2016, the Committee approved the entering into of a new change of control severance

agreement (the “New Severance Agreement”) with Joel

A. Fernandes in connection with his promotion to Senior Vice President. Mr. Fernandes previously served as and continues

to serve as the Company’s principal financial and accounting officer. The New Severance Agreement will supersede Mr. Fernandes’

prior change of control severance agreement with the Company and will provide, among other things, that if his employment is involuntarily

terminated (which generally means his resignation following a material reduction in his duties, position or responsibilities, a

material reduction in base salary, a relocation of work location, any termination other than for cause or for which there lacks

valid grounds or failure by any successor to the Company to assume the terms of the New Severance Agreement), then Mr. Fernandes

will be entitled to a lump sum cash severance payment equivalent to 12 months base salary as in effect as of the date of termination.

In addition, if Mr. Fernandes is involuntarily terminated within 18 months following a change of control of the Company, then he

will be entitled to the following severance benefits: a lump sum payment equivalent to 12 months’ base salary and any applicable

allowances in effect as of the date of termination or, if greater, as in effect in the year in which the change of control occurs;

payment of the full amount of his target bonus for the calendar year of termination plus a pro rata portion (based on the number

of full weeks during such year) of the amount of such bonus or, if no target bonus has been established, an amount equal to his

bonus in the prior year plus a pro rata portion (based on the number of full weeks during such year) of the amount of such bonus;

immediate acceleration and vesting of all equity awards granted by the Company to Mr. Fernandes prior to the change of control;

extension of the exercise period for stock options granted prior to the change of control to up to two years following the date

of termination; and up to 12 months of health benefits. All of the benefits provided above are expressly contingent on Mr. Fernandes’

delivery to the Company of a satisfactory release of claims. The Company expects to enter into the New Severance Agreement with

Mr. Fernandes in due course. The foregoing is only a brief description of the material terms of the New Severance Agreement, does

not purport to be complete, and is qualified in its entirety by reference to the New Severance Agreement that will be filed as

an exhibit to the Company’s quarterly report on Form 10-Q for the quarter ending March 31, 2016.

Stock Option Grants. On March 14,

2016, the Board, based upon the recommendation of the Committee, granted a stock option to Dr. Barry Selick, the Company’s

Chief Executive Officer, under the Company’s 2014 Equity Incentive Plan (the “Plan”) and pursuant to the standard

form of Stock Option Grant Notice and Option Agreement under the Plan (the “Plan Agreement”). Further, on March 11,

2016, the Committee granted stock options to each of the Company’s other executive officers under the Plan and Plan Agreement:

Mr. Kroll, Mr. Fernandes and Tillman Pearce, the Company’s Chief Medical Officer.

Each stock option is exercisable for the following number of shares of the Company’s common stock (“Common Stock”):

Dr. Selick – 800,000 shares; Dr. Pearce – 200,000 shares; Mr. Kroll – 300,000 shares; and Mr. Fernandes

– 200,000 shares. Each of these stock options vest in equal monthly installments over the four year period from the applicable

grant date, subject to continued service, and carry an exercise price equal to the fair market value of the Common Stock on the

applicable grant date. These stock options were granted in connection with the Committee’s determination, upon the recommendation

of management, that there be no bonuses paid to the Company’s executive officers for 2015 performance nor any salary increases

for the executives in 2016, in part to assist the Company with its cash flow requirements.

Item 8.01 Other Information.

As previously reported, on February 10, 2016,

the Company received a notice from the staff (the “Staff”) of The NASDAQ Stock Market LLC (“Nasdaq”) stating

that, for the previous 30 consecutive business days, the minimum Market Value of Listed Securities (MVLS) for the Common Stock

was below the $35 million minimum MVLS requirement for continued listing on The NASDAQ Capital Market under Nasdaq Listing Rule

5550(b)(2) (the “MLVS Rule”). The Staff also notified the Company at that time that the Company did not meet the requirements

for listing under Nasdaq Listing Rule 5550(b)(1) (the “Equity Rule”) or Nasdaq Listing Rule 5550(b)(3) (the “Net

Income Rule” and together with the MLVS Rule and the Equity Rule, the “Rules”). As a result, the Staff notified

the Company that a deficiency exists with regard to the continued listing of the Common Stock under the Rules. However, on March

14, 2016, the Company received written notice from the Staff that, based on the Company’s Form 10-K for the fiscal year ended

December 31, 2015 filed on March 10, 2016 evidencing stockholders’ equity of $40,846,000, the Staff has determined that the

Company complies with the Rules and that this matter is now closed. The February 10, 2016 notification from the Staff has no effect

on the Company’s previously reported non-compliance with Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”),

and the Company continues to consider options available to it to potentially achieve compliance with the Bid Price Rule.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

THRESHOLD PHARMACEUTICALS, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Joel A. Fernandes |

| |

|

Joel A. Fernandes |

| |

|

Senior Vice President, Finance and Controller |

Date: March 16, 2016

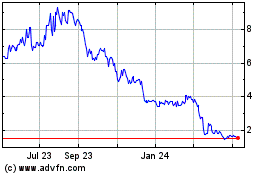

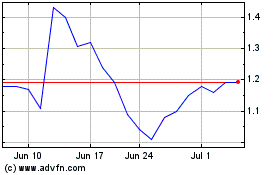

Molecular Templates (NASDAQ:MTEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Molecular Templates (NASDAQ:MTEM)

Historical Stock Chart

From Apr 2023 to Apr 2024