Mesabi Trust Press Release

March 14 2016 - 5:13PM

Business Wire

The Trustees of Mesabi Trust (NYSE:MSB) are reporting that

Cliffs Natural Resources Inc. (“Cliffs”), the parent company of

Northshore Mining Company (“Northshore”), announced today that it

will be restarting iron ore pellet production at its Northshore

mining operation in Minnesota by May 15, 2016. Iron ore pellet

production at Northshore has been temporarily idled since December

1, 2015. Cliffs stated that it is taking such action based on its

domestic customers’ demand for iron ore pellets and consistent with

its previously announced production plans for the year.

In its news release today, the President and Chief Executive

Officer of Cliffs was quoted as saying: “In 2015, Cliffs developed

at Northshore Mining a new product, the DR-grade pellets used as

feedstock to DRI production. As we restart operations at Northshore

in May, we will also resume the production of DR-grade pellets

destined to EAF clients.” Cliffs previously announced in November

2015 that it would maintain minimal staffing during the temporary

idle for basic maintenance duties and for on-going work to support

the DR-grade pellet trials.

With respect to the remainder of calendar year 2016, Northshore

has not advised Mesabi Trust of its expected 2016 shipments of iron

ore products or what percentage of 2016 shipments will be from

Mesabi Trust iron ore.

This press release contains certain forward-looking statements

with respect to iron ore pellet production, shipments by Northshore

in 2016, and other matters, which statements are intended to be

made under the safe harbor protections of the Private Securities

Litigation Reform Act of 1995, as amended. Actual production,

prices, price adjustments, and shipments of iron ore pellets, as

well as actual royalty payments (including bonus royalties) could

differ materially from current expectations due to inherent risks

such as general and industry economic trends, uncertainties arising

from war, terrorist events and other global events, higher or lower

customer demand for steel and iron ore, decisions by mine operators

regarding curtailments or idling production lines or entire plants,

plant closures, environmental compliance uncertainties,

difficulties related to obtaining and renewing necessary operating

permits, higher imports of steel and iron ore substitutes,

consolidation and restructuring in the domestic steel market,

indexing features in Cliffs Pellet Agreements resulting in

adjustments to royalties payable to Mesabi Trust and other factors.

Further, substantial portions of royalties earned by Mesabi Trust

are based on estimated prices that are subject to interim and final

adjustments, which can be positive or negative, and are dependent

in part on multiple price and inflation index factors under

agreements to which Mesabi Trust is not a party and that are not

known until after the end of a contract year. Although the Mesabi

Trustees believe that any such forward-looking statements are based

on reasonable assumptions, such statements speak only as of the

date of this release, and are subject to risks and uncertainties,

which could cause actual results to differ materially. Additional

information concerning these and other risks and uncertainties is

contained in the Trust’s filings with the Securities and Exchange

Commission, including its Annual Report on Form 10-K. Except as may

be required by applicable securities laws, Mesabi Trust undertakes

no obligation to publicly update or revise any of the

forward-looking statements that may be in this press release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160314006392/en/

Mesabi Trust SHR UnitDeutsche Bank Trust Company

Americas904-271-2520

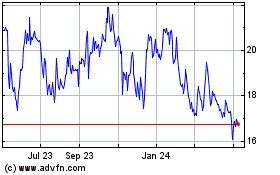

Mesabi (NYSE:MSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mesabi (NYSE:MSB)

Historical Stock Chart

From Apr 2023 to Apr 2024