- Q4 EV parts sales increased 51.6% YoY to $57.5

million- 2015 EV parts sales increased 68.4% YoY to $196.1 million-

Q4 the JV Company sold 12,100 EV products, a 231.0% increase YoY-

2015 the JV Company sold 24,220 EV products, a 121.5% increase YoY-

Q4 Non-GAAP net income increased 250.9% YoY to $13.9 million, or

$0.30 EPS-Full year Non-GAAP net income increased 100.9% YoY to

$28.5 million, or $0.61 EPS

Kandi Technologies Group, Inc. (the “Company,”

“we” or “Kandi”) (NASDAQ:KNDI), announced a correction to its press

release issued on Monday, March 14, 2016 entitled, "Kandi

Technologies Reports Fourth Quarter and Full Year 2015 Financial

Results."

In the press release issued at 7:00 am ET, the

year-over-year percentage changes for Net Revenues, Gross Profit,

and Net Income included in the full year 2015 income statement

table under the JV Company Financial Results were miscalculated.

The correct calculation included in the income statement table of

the JV Company is as follows:

|

|

|

2015 |

|

|

2014 |

|

Y-o-Y% |

|

Net Revenues (US$mln) |

$ |

362.7 |

|

$ |

215.5 |

|

|

68.3 |

% |

|

Gross Profit (US$mln) |

$ |

59.6 |

|

$ |

41.9 |

|

|

42.4 |

% |

|

Gross Margin |

|

16.4 |

% |

|

19.4 |

% |

|

- |

|

|

Net Income |

$ |

23.3 |

|

$ |

7.5 |

|

|

209.9 |

% |

|

% of Net revenues |

|

6.4 |

% |

|

3.5 |

% |

|

- |

|

| |

|

|

|

|

|

|

|

|

|

The complete press release with corrected

information is as follows:

JINHUA, CHINA-- (March 14, 2016) - Kandi

Technologies Group, Inc. (the “Company,” “we” or “Kandi”)

(NASDAQ GS: KNDI), today announced its financial results for the

fourth quarter and year ended December 31, 2015

Fourth Quarter Highlights

- Total revenues grew 11.2% to $58.8 million for the fourth

quarter of 2015, from $52.9 million for the same period of

2014.

- Electric Vehicle (“EV”) parts sales increased 51.6% to $57.5

million for the fourth quarter of 2015, compared with $37.9 million

in the same period of 2014.

- Kandi Electric Vehicles Group Co., Ltd. (the "JV Company"),

sold 12,100 EV products in the fourth quarter, a 231.0% increase

compared with the same period last year. Total EV products sales

comprised 6,474 EV products to the Micro Public Transportation

(“MPT”) program and 5,626 EV products through the distribution

channel under the direct sales program.

- GAAP net income for the fourth quarter of 2015 was $0.8

million, or $0.02 per fully diluted share, compared with $1.7

million, or $0.07 per fully diluted share in the same period of

2014.

- Non-GAAP adjusted net income1, which excludes stock award

expenses and changes in the fair value of financial derivatives,

was $13.9 million in the fourth quarter of 2015, compared with $4.0

million of the same period of 2014. Non-GAAP adjusted earnings per

share1 was approximately $0.30 per fully diluted share for the

fourth quarter of 2015 compared with $0.09 per fully diluted share

for the same quarter of 2014.

Full Year 2015 Highlights

- Total revenues grew 18.1% to $201.1 million in 2015, from

$170.2 million in 2014.

- EV parts sales increased 68.4% to $196.1 million in 2015,

compared with $116.4 million in 2014.

- The JV Company sold 24,220 EV products in 2015, a 121.5%

increase compared with 2014. Total EV products sales comprised

14,947 EV products to the MPT program and 9,273 EV products through

the distribution channel under the direct sales program.

- GAAP net income in 2015 was $14.7 million, or $0.31 per fully

diluted share, compared with $12.3 million, or $0.29 per fully

diluted share in 2014.

- Non-GAAP adjusted net income1, which excludes stock award

expenses and changes in the fair value of financial derivatives,

was $28.5 million in 2015, compared with $14.2 million in 2014.

Non-GAAP adjusted earnings per share1 was approximately $0.61 per

fully diluted share for the full year of 2015 compared with $0.33

per fully diluted share for the same quarter of 2014.

- Working capital surplus was $59.9 million as of December 31,

2015. Cash, cash equivalents and restricted cash totaled $32.9

million as of December 31, 2015.

“Our outstanding results in 2015 include

exceeding revenue and EV sales targets with the JV Company by

selling 24,220 EV products, a 121.5% increase year-over-year,”

commented Mr. Hu Xiaoming, Chairman and Chief Executive Officer of

Kandi, “As the JV Company became China’s top seller for pure EV

products in 2015, its EV products received extremely positive

market recognition, highlighted by model K17 named as China 2015

Pure Electric Passenger Vehicle of the Year at the 6th Global New

Energy Vehicle Conference. The direct sales program was launched in

the second quarter and achieved 9,273 in EV products sales in 2015

through the distribution channel under this program, accounting for

38.3% of total EV products sold during the year. We are confident

in being able to increase the contribution of direct sales as a

percentage of total sales in 2016.”

“China’s government has continued to strongly

support the growth of the EV industry,” Mr. Hu continued. “Most

recently through an industry-wide subsidy investigation, the

government is committed to maintaining the healthy development of

the EV industry, which will benefit scaled EV products

manufacturers like the JV Company. Meanwhile, the central

government has extended its continuous support and confidence in

developing the new energy vehicle (NEV) industry by enacting

additional policies, including reducing traffic controls and

purchase quotas on NEVs, encouraging government purchases and

promoting EV car-share programs. By focusing on our unique growth

engines, which are the rapid expansion of the Micro Public

Transportation program and the direct sales program through the

distribution channel, we look forward to leading the growth of

China’s EV industry in 2016.”

“Our significant achievements in 2015 include

excellent financial results, particularly with sales and gross

margin meeting our expectation,” added Mr. Wang Cheng (Henry),

Chief Financial Officer of Kandi, “During the year, key milestones,

including the successful launch of the direct sales program and the

expansion of the MPT program to 16 cities were accomplished. With a

solid foundation built for our EV business, we believe that the

Company will continue to achieve strong financial performance in

2016.”

Fourth Quarter and Full Year 2015

Financial Results

Net Revenues and Gross Profit

|

|

4Q15 |

3Q15 |

4Q14 |

Q-o-Q% |

Y-o-Y% |

|

Net Revenues (US$mln) |

$ |

58.8 |

|

$ |

50.5 |

|

$ |

52.9 |

|

|

16.4 |

% |

|

11.2 |

% |

|

Gross Profit (US$mln) |

$ |

8.4 |

|

$ |

7.1 |

|

$ |

5.8 |

|

|

18.6 |

% |

|

45.2 |

% |

|

Gross Margin |

|

14.4 |

% |

|

14.1 |

% |

|

11.0 |

% |

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues for the fourth quarter increased

16.4% sequentially, and 11.2% from the year-ago period. The

increase in net revenues was mainly due to growth of EV products

sales from the JV Company. Gross margin in the fourth quarter

increased to 14.4%, compared with 11.0% in the same quarter last

year. Margin increase was a result of cost control from

battery packing production.

|

|

|

2015 |

|

|

2014 |

|

Y-o-Y% |

|

Net Revenues (US$mln) |

$ |

201.1 |

|

$ |

170.2 |

|

|

18.1 |

% |

|

Gross Profit (US$mln) |

$ |

28.4 |

|

$ |

23.4 |

|

|

21.4 |

% |

|

Gross Margin |

|

14.1 |

% |

|

13.7 |

% |

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net revenues for the full year 2015 increased

18.1% from 2014. The increase in net revenues was mainly due to

growth of EV products sales from the JV Company. Gross margin for

the full year 2015 increased to 14.1%, compared with 13.7% in 2014.

Margin increase was a result of cost control from battery packing

production.

Operating Income (Loss)

|

|

4Q15 |

3Q15 |

4Q14 |

Q-o-Q% |

Y-o-Y% |

|

Operating Expenses (US$mln) |

$ |

13.9 |

|

$ |

9.6 |

|

$ |

3.0 |

|

|

45.0 |

% |

|

367.4 |

% |

|

Operating Income (Loss) (US$mln) |

($ |

5.4 |

) |

($ |

2.4 |

) |

$ |

2.8 |

|

|

121.9 |

% |

|

-290.1 |

% |

|

Operating Margin |

|

-9.2 |

% |

|

-4.8 |

% |

|

5.4 |

% |

|

- |

|

|

- |

|

|

Operating Income (Loss) (US$mln) (Non-GAAP) |

$ |

4.4 |

|

$ |

4.6 |

|

$ |

4.9 |

|

|

-4.0 |

% |

|

-9.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses in the fourth quarter

were $13.9 million, compared with $3.0 million in the same quarter

of 2014. The increase in total operating expenses was due to

increased stock compensation expense, which was $9.8 million in the

fourth quarter, compared with $2.0 million in the same quarter last

year. Excluding stock compensation, operation expenses in the

fourth quarter of 2015 were $4.0 million, compared with $1.0

million in the same quarter last year. The increase was mainly due

to research and development expenses for new EV product models,

such as K12 and K17, and for new battery packs, as well as the

accrual for compensation expense.

|

|

|

2015 |

|

|

2014 |

|

Y-o-Y% |

|

Operating Expenses (US$mln) |

$ |

32.4 |

|

$ |

18.2 |

|

|

78.3 |

% |

|

Operating Income (Loss) (US$mln) |

($ |

4.0 |

) |

$ |

5.2 |

|

|

-175.4 |

% |

|

Operating Margin |

|

-2.0 |

% |

|

3.1 |

% |

|

-163.8 |

% |

|

Operating Income (Loss) (US$mln) (Non-GAAP) |

$ |

18.4 |

|

$ |

13.7 |

|

|

34.5 |

% |

| |

|

|

|

|

|

|

|

|

|

Total operating expenses in 2015 were $32.4

million, compared with $18.2 million in 2014. The significant

increase in total operating expenses was due to increased stock

compensation expense in 2015, which was $22.4 million, compared

with $8.5 million in 2014. Excluding stock compensation, operation

expenses in 2015 were $10.0 million, slightly higher than $9.7

million in 2014.

GAAP Net Income

|

|

4Q15 |

3Q15 |

4Q14 |

Q-o-Q% |

Y-o-Y% |

|

Net Income (US$mln) |

$ |

0.8 |

|

$ |

2.3 |

|

$ |

1.7 |

|

|

-67.3 |

% |

|

-54.1 |

% |

|

Earnings per Weighted Average Common Share |

$ |

0.02 |

|

$ |

0.05 |

|

$ |

0.07 |

|

|

- |

|

|

- |

|

|

Earnings per Weighted Average Diluted Share |

$ |

0.02 |

|

$ |

0.05 |

|

$ |

0.07 |

|

|

- |

|

|

- |

|

|

Stock award expenses |

$ |

9.8 |

|

$ |

7.0 |

|

$ |

2.0 |

|

|

39.7 |

% |

|

390.6 |

% |

|

Change of the fair value of financial derivatives |

$ |

3.3 |

|

($ |

3.0 |

) |

$ |

0.3 |

|

|

-207.7 |

% |

|

1058.7 |

% |

|

Non-GAAP net income from continuing operations |

$ |

13.9 |

|

$ |

6.3 |

|

$ |

4.0 |

|

|

119.4 |

% |

|

250.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income was $0.8 million in the fourth quarter,

compared with $1.7 million in the same quarter of 2014. Net

income was affected by significant increases in stock compensation

expense and the change of the fair value of financial derivatives,

which together were $10.8 million more in the fourth quarter of

2015 than in the fourth quarter of 2014. Non-GAAP net income in the

fourth quarter was $13.9 million, a 250.9% increase from $4.0

million in the same quarter of 2014, mainly due to revenue growth,

margin improvement, and the increased net income contribution from

the JV Company.

|

|

|

2015 |

|

|

2014 |

|

Y-o-Y% |

|

Net Income (US$mln) |

$ |

14.7 |

|

$ |

12.3 |

|

|

19.5 |

% |

|

Earnings per Weighted Average Common Share |

$ |

0.31 |

|

$ |

0.29 |

|

|

- |

|

|

Earnings per Weighted Average Diluted Share |

$ |

0.31 |

|

$ |

0.29 |

|

|

- |

|

|

Stock award expenses |

$ |

22.4 |

|

$ |

8.5 |

|

|

164.7 |

% |

|

Change of the fair value of financial derivatives |

($ |

8.5 |

) |

($ |

6.5 |

) |

|

30.4 |

% |

|

Non-GAAP net income from continuing operations |

$ |

28.5 |

|

$ |

14.2 |

|

|

100.9 |

% |

| |

|

|

|

|

|

|

|

|

|

Net income in 2015 was $14.7 million, compared with

$12.3 million in 2014. The increase in net income was mainly due to

revenue growth and margin improvement, increased net income

contribution from the JV Company, and gain from financial

derivatives, offset by the increase from stock compensation

expense. Non-GAAP net income in 2015 was $28.5 million, a 100.9%

increase from $14.2 million in 2014, mainly due to revenue growth,

margin improvement, and increased net income contribution from the

JV Company.

JV Company Financial Results

In the fourth quarter, the JV Company sold 12,100

EV products, a 231.0% increase from the same period last year.

Total EV product sales comprised 6,474 EV products to the MPT

program and 5,626 EV products through the distribution channel

under the direct sales program, with the latter being a significant

sequential increase over the 3,004 EV products sold through the

distribution channel under the direct sales program in the third

quarter.

The condensed financial income statement of the JV

Company in the fourth quarter is as below:

|

|

4Q15 |

3Q15 |

4Q14 |

Q-o-Q% |

Y-o-Y% |

|

Net Revenues (US$mln) |

$ |

164.8 |

|

$ |

98.4 |

|

$ |

88.8 |

|

|

67.3 |

% |

|

85.6 |

% |

|

Gross Profit (US$mln) |

$ |

27.7 |

|

$ |

13.3 |

|

$ |

27.9 |

|

|

107.7 |

% |

|

-1.0 |

% |

|

Gross Margin |

|

16.8 |

% |

|

13.5 |

% |

|

31.5 |

% |

|

- |

|

|

- |

|

|

Net Income |

$ |

19.3 |

|

$ |

1.6 |

|

$ |

0.7 |

|

|

1098.9 |

% |

|

2497.5 |

% |

|

% of Net revenues |

|

11.7 |

% |

|

1.6 |

% |

|

0.8 |

% |

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the full year 2015, the JV Company sold 24,220

EV products, a 121.5% increase from 2014. Total EV product sales

comprised 14,947 EV products to the MPT program and 9,273 EV

products through the distribution channel. Total EV products sold

in 2015 included 11,801 units of model K10, 10,472 units of model

K11, 1,945 units of model K17 and 2 units of model K30.

The condensed financial income statement of the JV

Company in full year 2015 is as below:

|

|

|

2015 |

|

|

2014 |

|

Y-o-Y% |

|

Net Revenues (US$mln) |

$ |

362.7 |

|

$ |

215.5 |

|

|

68.3 |

% |

|

Gross Profit (US$mln) |

$ |

59.6 |

|

$ |

41.9 |

|

|

42.4 |

% |

|

Gross Margin |

|

16.4 |

% |

|

19.4 |

% |

|

- |

|

|

Net Income |

$ |

23.3 |

|

$ |

7.5 |

|

|

209.9 |

% |

|

% of Net revenues |

|

6.4 |

% |

|

3.5 |

% |

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Gross margin for the full year 2015 was 16.4%

compared with 19.4% in 2014. The margin decrease in 2015 was mainly

due to the product price decline and the lower selling price to a

strategic partner during the year.

Kandi’s investments in the JV Company are accounted

for under the equity method of accounting, as Kandi has a 50%

ownership interest in the JV Company. As a result, Kandi recorded

50% of the JV Company’s profit for $9.7 million for the fourth

quarter and $11.7 million for the full year 2015. After eliminating

intra-entity profits and losses, Kandi’s share of the after tax

profit of the JV Company was $9.9 million for the fourth quarter

and $11.8 million for the full year of 2015.

Outlook

For the first quarter of 2016, Kandi expects net

revenues to be in the range of $46.0 million to $48.0 million, with

gross margin in the range of 13.5% to 14.5%. For full year 2016,

Kandi expects net revenues to be in the range of $270 million to

$300 million.

The Company also expects the JV Company to

deliver a total of 35,000 or more EV products in the full year of

2016.

This outlook reflects the current view of the

management, which is subject to change.

Fourth Quarter and Full

Year 2015 Conference Call Details

The Company has scheduled a conference call and

live webcast to discuss the financial results at 8:00 AM (U.S.

Eastern time) on March 14, 2016 (8:00 PM Beijing time on March 14,

2016). Mr. Hu Xiaoming, Chief Executive Officer and Mr. Wang Cheng

(Henry), Chief Financial Officer, will deliver prepared remarks,

followed by a question and answer session.

The dial-in details for the conference call are

as follows:

- Toll-free dial-in number: +1 877-407-3982

- International dial-in number: +1 201-493-6780

- Conference ID: 13631514

- Webcast and replay:

http://public.viavid.com/index.php?id=118533

The live audio webcast of the call can also be

accessed by visiting Kandi's Investor Relations website at

http://ir.kandivehicle.com. An archive of the webcast will be

available on the Company's website following the live call.

About Kandi Technologies Group,

Inc.

Kandi Technologies Group, Inc. (KNDI),

headquartered in Jinhua, Zhejiang Province, is engaged in the

research and development, manufacturing and sales of various

vehicle products. Kandi has established itself as one of China's

leading manufacturers of pure electric vehicle ("EV") products

(through its joint venture), EV parts and off-road vehicles. More

information can be viewed at the Company's corporate website at

http://www.kandivehicle.com. The Company routinely posts important

information on its website.

Safe Harbor Statement

This press release contains certain statements

that may include "forward-looking statements." All statements other

than statements of historical fact included herein are

"forward-looking statements." These forward-looking statements are

often identified by the use of forward-looking terminology such as

"believes," "expects" or similar expressions, involving known and

unknown risks and uncertainties. Although the Company believes that

the expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. You should not

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. The Company's

actual results could differ materially from those anticipated in

these forward-looking statements as a result of a variety of

factors, including the risk factors discussed in the Company's

periodic reports that are filed with the Securities and Exchange

Commission and available on the SEC's website (http://www.sec.gov).

All forward-looking statements attributable to the Company or

persons acting on its behalf are expressly qualified in their

entirety by these risk factors. Other than as required under the

securities laws, the Company does not assume a duty to update these

forward-looking statements.

Follow us on Twitter: @ Kandi_Group

1 Non-GAAP measures, including the Non-GAAP

net income and Non-GAAP EPS are defined as the financial measures

excluding the change of the fair value of financial derivatives and

the effects of the stock award expense. We supply non-GAAP

information because we believe it allows our investors to obtain a

clearer understanding of our operations. Any non-GAAP

measures should not be considered as a substitute for, and should

only be read in conjunction with, measures of financial performance

prepared in accordance with GAAP.

- Tables Below -

| KANDI

TECHNOLOGIES GROUP, INC. |

| AND

SUBSIDIARIES |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| |

|

ASSETS |

| |

|

December 31, 2015 |

|

December

31, 2014 |

| |

|

|

|

|

|

Current assets |

|

|

|

|

| Cash and

cash equivalents |

$ |

|

16,738,559 |

|

$ |

26,379,460 |

|

Restricted cash |

|

|

16,172,009 |

|

|

13,000,731 |

| Short

term investment |

|

|

1,613,727 |

|

|

- |

| Accounts

receivable |

|

|

8,136,421 |

|

|

15,736,805 |

|

Inventories (net of provision for slow moving inventory of 485,901

and 315,584 as of December 31, 2015 and December 31, 2014,

respectively |

|

|

17,773,679 |

|

|

15,403,840 |

| Notes

receivable |

|

|

13,033,315 |

|

|

9,060,441 |

| Other

receivables |

|

|

332,922 |

|

|

238,567 |

|

Prepayments and prepaid expense |

|

|

181,534 |

|

|

120,761 |

| Due from

employees |

|

|

34,434 |

|

|

34,475 |

| Advances

to suppliers |

|

|

71,794 |

|

|

6,901,505 |

| Amount

due from JV Company, net |

|

|

76,172,471 |

|

|

51,450,612 |

| Amount

due from related party |

|

|

40,606,162 |

|

|

- |

| Deferred

taxes assets |

|

|

- |

|

|

- |

|

TOTAL CURRENT ASSETS |

|

|

190,867,027 |

|

|

138,327,197 |

| |

|

|

|

|

|

LONG-TERM ASSETS |

|

|

|

|

| Plant

and equipment, net |

|

|

20,525,126 |

|

|

26,215,356 |

| Land use

rights, net |

|

|

12,935,121 |

|

|

15,649,152 |

|

Construction in progress |

|

|

54,368,753 |

|

|

58,510,051 |

| Long

Term Investment |

|

|

1,463,182 |

|

|

- |

|

Investment in JV Company |

|

|

90,337,899 |

|

|

83,309,095 |

|

Goodwill |

|

|

322,591 |

|

|

322,591 |

|

Intangible assets |

|

|

495,306 |

|

|

577,401 |

| Other

long term assets |

|

|

154,019 |

|

|

162,509 |

|

TOTAL Long-Term Assets |

|

|

180,601,997 |

|

|

184,746,155 |

| |

|

|

|

|

|

TOTAL ASSETS |

$ |

|

371,469,024 |

|

$ |

323,073,352 |

| |

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

| Accounts

payables |

$ |

|

73,957,969 |

|

$ |

45,772,481 |

| Other

payables and accrued expenses |

|

|

9,544,909 |

|

|

5,101,740 |

|

Short-term loans |

|

|

36,656,553 |

|

|

35,589,502 |

| Customer

deposits |

|

|

94,026 |

|

|

2,630,723 |

| Notes

payable |

|

|

3,850,478 |

|

|

5,702,121 |

| Income

tax payable |

|

|

624,276 |

|

|

1,835,685 |

| Due to

employees |

|

|

9,423 |

|

|

15,787 |

| Deferred

taxes liabilities |

|

|

2,374,924 |

|

|

230,864 |

|

Financial derivate - liability |

|

|

3,823,590 |

|

|

2,245,610 |

| Deferred

income |

|

|

13,726 |

|

|

- |

|

Total Current Liabilities |

|

|

130,949,874 |

|

|

99,124,513 |

| |

|

|

|

|

|

LONG-TERM LIABILITIES |

|

|

|

|

| Deferred

taxes liabilities |

|

|

1,593,582 |

|

|

2,266,725 |

|

Financial derivate - liability |

|

|

- |

|

|

10,097,275 |

|

Total Long-Term Liabilities |

|

|

1,593,582 |

|

|

12,364,000 |

| |

|

|

|

|

|

TOTAL LIABILITIES |

|

|

132,543,456 |

|

|

111,488,513 |

| |

|

|

|

|

|

STOCKHOLDER'S EQUITY |

|

|

|

|

| Common

stock, $0.001 par value; 100,000,000 shares authorized; 46,964,855

and 46,274,855 shares issued and outstanding at December 31,2015

and December 31,2014, respectively |

|

|

46,965 |

|

|

46,275 |

|

Additional paid-in capital |

|

|

212,564,334 |

|

|

190,258,037 |

| Retained

earnings (the restricted portion is $4,172,324 and $4,172,324 at

December 31,2015 and December 31,2014, respectively) |

|

|

31,055,919 |

|

|

16,390,424 |

|

Accumulated other comprehensive income(loss) |

|

|

(4,741,650 |

) |

|

4,890,103 |

|

TOTAL STOCKHOLDERS' EQUITY |

|

|

238,925,568 |

|

|

211,584,839 |

| |

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

$ |

|

371,469,024 |

|

$ |

323,073,352 |

| |

|

|

|

|

|

|

| KANDI

TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND |

|

COMPREHENSIVE INCOME (LOSS) |

| |

| |

|

December 31, 2015 |

% of Revenue |

|

December 31, 2014 |

% of Revenue |

|

December 31, 2013 |

% of Revenue |

| |

|

|

|

|

|

|

|

|

|

| REVENUES,

NET |

$ |

|

201,069,173 |

|

|

100.0 |

% |

$ |

|

170,229,006 |

|

|

100.0 |

% |

$ |

|

94,536,045 |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

| COST OF GOODS SOLD |

|

|

172,649,955 |

|

|

85.9 |

% |

|

|

146,825,073 |

|

|

86.3 |

% |

|

|

72,793,517 |

|

|

77.0 |

% |

| |

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

28,419,218 |

|

|

14.1 |

% |

|

|

23,403,933 |

|

|

13.7 |

% |

|

|

21,742,528 |

|

|

23.0 |

% |

| |

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

3,482,511 |

|

|

1.7 |

% |

|

|

2,755,637 |

|

|

1.6 |

% |

|

|

3,728,730 |

|

|

3.9 |

% |

| Selling and marketing |

|

|

633,863 |

|

|

0.3 |

% |

|

|

1,345,588 |

|

|

0.8 |

% |

|

|

399,504 |

|

|

0.4 |

% |

| General and administrative |

|

|

28,255,267 |

|

|

14.1 |

% |

|

|

14,058,548 |

|

|

8.3 |

% |

|

|

16,056,107 |

|

|

17.0 |

% |

| Total Operating

Expenses |

|

|

32,371,641 |

|

|

16.1 |

% |

|

|

18,159,773 |

|

|

10.7 |

% |

|

|

20,184,341 |

|

|

21.4 |

% |

| |

|

|

|

|

|

|

|

|

|

| INCOME(LOSS) FROM

OPERATIONS |

|

|

(3,952,423 |

) |

|

-2.0 |

% |

|

|

5,244,160 |

|

|

3.1 |

% |

|

|

1,558,187 |

|

|

1.6 |

% |

| |

|

|

|

|

|

|

|

|

|

| OTHER

INCOME(EXPENSE): |

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

3,138,717 |

|

|

1.6 |

% |

|

|

1,701,121 |

|

|

1.0 |

% |

|

|

1,516,477 |

|

|

1.6 |

% |

| Interest expense |

|

|

(2,214,635 |

) |

|

-1.1 |

% |

|

|

(3,480,646 |

) |

|

-2.0 |

% |

|

|

(4,395,353 |

) |

|

-4.6 |

% |

| Change in fair value of financial

instruments |

|

|

8,519,295 |

|

|

4.2 |

% |

|

|

6,531,308 |

|

|

3.8 |

% |

|

|

(16,647,283 |

) |

|

-17.6 |

% |

| Government grants |

|

|

1,645,032 |

|

|

0.8 |

% |

|

|

288,498 |

|

|

0.2 |

% |

|

|

228,396 |

|

|

0.2 |

% |

| Share of profit (loss) in

associated companies |

|

|

- |

|

|

0.0 |

% |

|

|

(54,308 |

) |

|

0.0 |

% |

|

|

(69,056 |

) |

|

-0.1 |

% |

| Share of profit after tax of

JV |

|

|

11,841,855 |

|

|

5.9 |

% |

|

|

4,490,266 |

|

|

2.6 |

% |

|

|

(2,414,354 |

) |

|

-2.6 |

% |

| Other income, net |

|

|

1,814,882 |

|

|

0.9 |

% |

|

|

(34,649 |

) |

|

0.0 |

% |

|

|

676,257 |

|

|

0.7 |

% |

| Total other income,

net |

|

|

24,745,146 |

|

|

12.3 |

% |

|

|

9,441,590 |

|

|

5.5 |

% |

|

|

(21,104,916 |

) |

|

-22.3 |

% |

| |

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

|

|

20,792,723 |

|

|

10.3 |

% |

|

|

14,685,750 |

|

|

8.6 |

% |

|

|

(19,546,729 |

) |

|

-20.7 |

% |

| |

|

|

|

|

|

|

|

|

|

| INCOME TAX EXPENSE |

|

|

(6,127,228 |

) |

|

-3.0 |

% |

|

|

(2,414,412 |

) |

|

-1.4 |

% |

|

|

(1,593,994 |

) |

|

-1.7 |

% |

| |

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

|

14,665,495 |

|

|

7.3 |

% |

|

|

12,271,338 |

|

|

7.2 |

% |

|

|

(21,140,723 |

) |

|

-22.4 |

% |

| |

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

|

|

| Foreign currency translation |

|

|

(9,631,753 |

) |

|

|

|

(2,725,143 |

) |

|

|

|

2,112,902 |

|

|

| |

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE INCOME(LOSS) |

$ |

|

5,033,742 |

|

|

$ |

|

9,546,195 |

|

|

$ |

|

(19,027,821 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES

OUTSTANDING BASIC |

|

|

46,744,718 |

|

|

|

|

42,583,495 |

|

|

|

|

34,707,973 |

|

|

| WEIGHTED AVERAGE SHARES

OUTSTANDING DILUTED |

|

|

46,925,554 |

|

|

|

|

42,715,818 |

|

|

|

|

34,707,973 |

|

|

| |

|

|

|

|

|

|

|

|

|

| NET INCOME PER SHARE, BASIC |

$ |

|

0.31 |

|

|

$ |

|

0.29 |

|

|

$ |

|

(0.61 |

) |

|

| NET INCOME PER SHARE, DILUTED |

$ |

|

0.31 |

|

|

$ |

|

0.29 |

|

|

$ |

|

(0.61 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| KANDI

TECHNOLOGIES GROUP, INC. |

| AND

SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| |

| |

|

December 31, 2015 |

|

December 31, 2014 |

|

December 31, 2013 |

| |

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

| Net

income(loss) |

$ |

|

14,665,495 |

|

$ |

|

12,271,338 |

|

$ |

|

(21,140,723 |

) |

|

Adjustments to reconcile net income to net cash provided by

operating activities |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,788,780 |

|

|

|

5,571,465 |

|

|

|

7,708,923 |

|

| Assets

Impairments |

|

|

194,366 |

|

|

|

- |

|

|

|

355,876 |

|

| Deferred

taxes |

|

|

1,446,345 |

|

|

|

1,579,855 |

|

|

|

876,255 |

|

| Change

in fair value of financial instruments |

|

|

(8,519,295 |

) |

|

|

(6,531,308 |

) |

|

|

16,647,283 |

|

| Loss

(income) in investment in associated companies |

|

|

- |

|

|

|

54,308 |

|

|

|

69,056 |

|

| Share of

profit after tax of JV Company |

|

|

(11,841,855 |

) |

|

|

(4,490,266 |

) |

|

|

2,414,354 |

|

| Decrease

in reserve for fixed assets |

|

|

- |

|

|

|

(302,023 |

) |

|

|

- |

|

| Stock

Compensation cost |

|

|

22,306,987 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

Changes in operating assets and liabilities, net of effects

of acquisition: |

|

|

|

|

|

|

|

(Increase) Decrease In: |

|

|

|

|

|

|

| Accounts

receivable |

|

|

7,052,626 |

|

|

|

15,445,962 |

|

|

|

3,251,168 |

|

|

Inventories |

|

|

(3,497,460 |

) |

|

|

(6,280,502 |

) |

|

|

(1,287,045 |

) |

| Other

receivables |

|

|

(193,954 |

) |

|

|

315,071 |

|

|

|

(38,491 |

) |

| Due from

employee |

|

|

(7,596 |

) |

|

|

5,139 |

|

|

|

10,797 |

|

|

Prepayments and prepaid expenses |

|

|

6,664,779 |

|

|

|

(5,360,637 |

) |

|

|

(3,810,447 |

) |

| Amount

due from JV Company |

|

|

(28,519,360 |

) |

|

|

(48,593,522 |

) |

|

|

(2,877,972 |

) |

| |

|

|

|

|

|

|

|

Increase (Decrease) In: |

|

|

|

|

|

|

| Accounts

payable |

|

|

31,814,545 |

|

|

|

23,095,825 |

|

|

|

13,699,528 |

|

| Other

payables and accrued liabilities |

|

|

5,300,095 |

|

|

|

2,694,689 |

|

|

|

(746,838 |

) |

| Customer

deposits |

|

|

(2,496,382 |

) |

|

|

2,588,830 |

|

|

|

(254,151 |

) |

| Income

Tax payable |

|

|

(1,039,187 |

) |

|

|

482,020 |

|

|

|

651,124 |

|

| Due from

related party |

|

|

(42,249,905 |

) |

|

|

- |

|

|

|

(841,251 |

) |

|

Net cash (used in ) provided by operating

activities |

$ |

|

(3,130,976 |

) |

$ |

|

(7,453,756 |

) |

$ |

|

14,687,446 |

|

| |

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

(Purchases)/Disposal of plant and equipment, net |

|

|

(827,059 |

) |

|

|

(2,101,355 |

) |

|

|

(158,830 |

) |

|

(Purchases)/Disposal of land use rights and other intangible

assets |

|

|

1,589,165 |

|

|

|

(1,668,534 |

) |

|

|

- |

|

|

(Purchases)/Disposal of construction in progress |

|

|

1,128,443 |

|

|

|

(50,891,170 |

) |

|

|

(16,134 |

) |

| Deposit

for acquisition |

|

|

- |

|

|

|

- |

|

|

|

(39,673,000 |

) |

| Disposal

of associated company |

|

|

- |

|

|

|

(96,299 |

) |

|

|

64,535,177 |

|

| Issuance

of notes receivable |

|

|

(131,852,319 |

) |

|

|

(24,705,489 |

) |

|

|

(4,174,247 |

) |

|

Repayment of notes receivable |

|

|

127,226,115 |

|

|

|

29,354,592 |

|

|

|

311,844 |

|

| Long

Term Investment |

|

|

(1,522,411 |

) |

|

|

- |

|

|

|

(80,668,972 |

) |

| Short

Term Investment |

|

|

(1,679,051 |

) |

|

|

- |

|

|

|

- |

|

| Cash

acquired in acquisition |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net cash provided by (used in) investing

activities |

$ |

|

(5,937,117 |

) |

$ |

|

(50,108,255 |

) |

$ |

|

(59,844,162 |

) |

| |

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

Restricted cash |

|

|

(4,006,346 |

) |

|

|

(13,010,291 |

) |

|

|

16,135,044 |

|

| Proceeds

from short-term bank loans |

|

|

50,640,214 |

|

|

|

48,306,743 |

|

|

|

52,918,845 |

|

|

Repayments of short-term bank loans |

|

|

(47,595,391 |

) |

|

|

(46,517,604 |

) |

|

|

(52,596,170 |

) |

| Proceeds

from notes payable |

|

|

13,781,830 |

|

|

|

18,718,944 |

|

|

|

83,251,992 |

|

|

Repayment of notes payable |

|

|

(15,398,471 |

) |

|

|

(29,602,112 |

) |

|

|

(92,609,593 |

) |

| Proceeds

from bond payable |

|

|

- |

|

|

|

- |

|

|

|

12,907,035 |

|

|

Repayment of bond payable |

|

|

- |

|

|

|

(13,011,917 |

) |

|

|

(12,907,035 |

) |

| Fund

raising through issuing common stock and warrants |

|

|

0 |

|

|

|

78,358,991 |

|

|

|

26,387,498 |

|

| Option

exercise, stock awards & other financing |

|

|

- |

|

|

|

8,431,247 |

|

|

|

9,659,103 |

|

| Warrant

exercise |

|

|

- |

|

|

|

21,101,039 |

|

|

|

3,171,259 |

|

| Common

stock issued for acquisition, net of cost of capital |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net cash (used in) provided by financing

activities |

$ |

|

(2,578,164 |

) |

$ |

|

72,775,040 |

|

$ |

|

46,317,978 |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE IN CASH AND CASH EQUIVALENTS |

|

|

(11,646,257 |

) |

|

|

15,213,029 |

|

|

|

1,161,262 |

|

| Effect

of exchange rate changes on cash |

|

|

2,005,356 |

|

|

|

(1,595,938 |

) |

|

|

(533,989 |

) |

| Cash and

cash equivalents at beginning of year |

|

|

26,379,460 |

|

|

|

12,762,369 |

|

|

|

12,135,096 |

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD |

|

|

16,738,559 |

|

|

|

26,379,460 |

|

|

|

12,762,369 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Contact:

Ms. Kewa Luo

Kandi Technologies Group, Inc.

Phone: 1-212-551-3610

Email: IR@kandigroup.com

IR Contact:

The Piacente Group

Phone: 1-212-481-2050

Email: kandi@tpg-ir.com

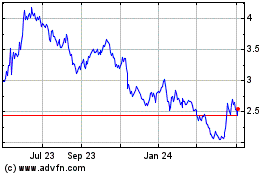

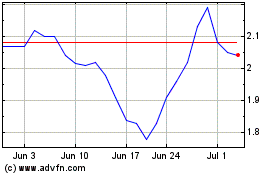

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Apr 2023 to Apr 2024