Excerpts: Report on Financial Crisis

March 13 2016 - 6:34PM

Dow Jones News

New documents on the 2008 financial crisis reveal some unusually

frank assessments and admissions by key figures. Here are some

excerpts from the documents, released Friday by the National

Archives following a five-year embargo.

Warren Buffett didn't see the bubble

Of the nearly 200 interview transcripts released Friday, one of

the most striking is the full transcript of a May 26, 2010,

interview with Warren Buffett on the causes of the financial

crisis. Mr. Buffett said he missed the housing bubble like most

other Americans: "If I had seen what was coming, I would have

behaved differently," he told the commission. Asked whether

monetary policy caused the financial crisis, Mr. Buffett said no.

"I think the primary cause was an almost universal belief, among

everybody and I don't ascribe particular blame to any part of

it--whether it's Congress, media, regulators, homeowners, mortgage

bankers, Wall Street, everybody--that house prices would go

up."

Paulson blasts Fannie, Freddie

Former Treasury Secretary Henry Paulson called the business

model for Fannie Mae and Freddie Mac--private housing-finance

companies with government charters--"perverse" and seemingly

inconceivable. Their flaws, he said, were "flimsy capital" and a

regulator with no power. The companies had a "very bad model with

very bad incentives...it's not just that the elephant was too big

for the tent--the elephant was ugly!" he said.

Greenspan unbowed

Former Federal Reserve Chairman Alan Greenspan defended the

central bank's actions in the lead-up to the financial crisis,

saying Fed officials are often no better at predicting the future

than the rest of us. "Could we have done better? Yes, if we could

forecast better. But we can't," he told the commission's staff,

adding that the Fed's Board of Governors had got a bad rap. "Who

was not culpable?" he asked. "If you wrote them down, you'd have a

blank sheet of paper."

Did Ken Lewis save the world?

That's Mr. Buffett's view. He points out that if the Bank of

America CEO hadn't bought Merrill Lynch in the days following the

failure of Lehman Brothers, "the system would have stopped." He

muses about writing a fictional book titled "If Ken Lewis Hadn't

Answered the Phone," telling a story about what would have

happened. "It would be a hell of a book. I'm not sure what the

ending would be."

Blankfein confronts leverage

Goldman Sachs CEO Lloyd Blankfein acknowledged he didn't

understand leverage as a "meaningful metric" to gauge the financial

condition of his company, according to a paraphrased June 2010

interview. "Until recently, I wasn't even conscious of what our

leverage was, in the sense of, the amount of our gross assets

versus our equity," he said. "I always thought of it in terms of

risk of the way our balance sheet was run."

Tell us how you really feel

I n a 2010 interview with the commission, John Reed, the former

Citigroup chief executive, let loose. Among his opinions: The

structure of combining retail and investment banking--basically,

Citigroup's entire model--is questionable. Sandy Weill wasn't the

right person to be CEO. And neither was Chuck Prince. Neither Mr.

Weill nor Mr. Prince was available for comment.

Perceptions become reality

Former Citigroup CEO Vikram Pandit said he watched as the stock

price of his bank dropped from $10 to $3 from one Friday to the

next. Mr. Pandit said the lesson for him was that capital strength

mattered. He thought Citi had enough capital, but in a

dysfunctional market it wasn't enough.

Hide the ball

Regulatory conflict may have been worse than understood. One

document reveals how regulatory turf battles created the conditions

that allowed excessive risk to build in the financial system. Mike

Macchiaroli, director of trading and markets at the Securities and

Exchange Commission, said Fed staff "hid some documents from the

SEC," according to a summary of his interview, because the Fed

staff was worried that documents would be viewed by SEC examination

staff. Fed General Counsel Scott Alvarez told investigators that

part of the problem stemmed from Fed officials' worries that if

they divulged information uncovered in a bank exam, it could end up

coming back to bite the firm when the SEC examined its financial

disclosures.

"We were concerned that our examiners' judgments, how we should

rate someone on an exam, would affect how the SEC would look at the

proxy statements for the broker company," he said, according to a

transcript.

--Ryan Tracy, Donna Borak, Christina Rexrode, Rachel Witkowski

and David Harrison

(END) Dow Jones Newswires

March 13, 2016 18:19 ET (22:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

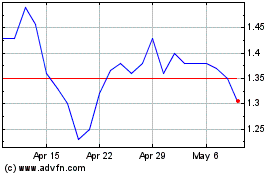

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024