UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2016

Dynavax Technologies Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34207

|

Delaware |

|

33-0728374 |

|

(State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

2929 Seventh Street, Suite 100

Berkeley, CA 94710-2753

(Address of principal executive offices, including zip code)

(510) 848-5100

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On March 8, 2016, Dynavax Technologies Corporation ("Dynavax") issued a press release announcing its financial results for the quarter and year ended December 31, 2015. A copy of the press release is attached as Exhibit 99.1 to this current report and is incorporated herein by reference.

The information with respect to item 2.02 in this current report and its accompanying exhibit shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this current report and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Dynavax, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibit is furnished herewith:

99.1 Press Release, dated March 8, 2016, titled "Dynavax Reports Fourth Quarter and Year End 2015 Financial Results"

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Dynavax Technologies Corporation |

|

Date: March 8, 2016 |

|

|

By: |

|

/s/ DAVID JOHNSON |

|

|

|

|

|

|

David Johnson |

|

|

|

|

|

|

Vice President |

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

|

|

EX-99.1 |

|

Press Release, dated March 8, 2016, titled “Dynavax Reports Fourth Quarter and Year End 2015 Financial Results” |

Exhibit 99.1

DYNΛVAX

INNOVATING IMMUNOLOGY

2929 Seventh Street, Suite 100

Berkeley, CA 94710

|

|

|

|

Contact: |

|

|

|

Michael Ostrach |

|

|

|

Chief Financial Officer |

|

|

|

510-665-7257 |

|

|

|

mostrach@dynavax.com |

|

|

DYNAVAX REPORTS FOURTH QUARTER AND YEAR END 2015

FINANCIAL RESULTS

Cash Balance of $196 Million; BLA Submission on Target

BERKELEY, CA – March 8, 2016 – Dynavax Technologies Corporation (NASDAQ: DVAX) today reported financial results for the fourth quarter and year ended December 31, 2015.

The Company had $196.1 million in cash, cash equivalents and marketable securities as of December 31, 2015.

Total revenues for the year ended December 31, 2015, decreased by $7.0 million or 63 percent compared to the same period in 2014, primarily due to a $5.2 million decrease in collaboration revenue due to winding down of work performed for the AZD1419 program and expiration of our collaboration agreement with GSK in 2014.

Operating expenses increased by $6.8 million or seven percent during 2015 compared to 2014, primarily due to costs related to HBV-23, the Phase 3 clinical study of HEPLISAV-B™ completed in October 2015, preparation for the commercial launch of HEPLISAV-B in the United States and clinical trial expense for SD-101, Dynavax’s cancer immunotherapeutic product candidate.

The net loss allocable to common stockholders for the year ended December 31, 2015 was $106.8 million, or $3.25 per share, compared to $90.7 million, or $3.45 per share for the year ended December 31, 2014.

“During 2015, we completed HBV-23 and significantly strengthened the Company’s cash position. Earlier this year we reported that this third pivotal study had met both co-primary endpoints. We plan to resubmit the HEPLISAV-B BLA (Biologics License Application) to the FDA by the end of this month. Based on our expectation of a six-month review, if our application is approved we expect to launch this product in the fourth quarter of this year,” said Eddie Gray, chief executive officer of Dynavax.

About Dynavax

Dynavax, a clinical-stage biopharmaceutical company, uses TLR biology to discover and develop novel vaccines and therapeutics in the areas of infectious and inflammatory diseases and oncology. Dynavax's lead product candidates are HEPLISAV-B, a Phase 3 investigational adult hepatitis B vaccine, and SD-101, an investigational cancer immunotherapeutic currently in several Phase 1/2 studies. For more information visit www.dynavax.com.

Forward Looking Statements

This release contains forward-looking statements, including statements regarding expected timing of the HEPLISAV-B BLA resubmission, possible approval, and expected launch. These statements are subject to a number of risks and uncertainties that could cause actual results to differ materially, including whether there will be the need for additional studies, further manufacturing enhancements or other activities, or other issues will arise that will delay the BLA resubmission and/or negatively impact the acceptance, review, duration of review and approval of the BLA by the FDA; whether we will successfully launch the product, possible claims against us, including enjoining sales of HEPLISAV-B based on the patent rights of others, and the potential size and value of approved indications addressable with HEPLISAV-B; initiation and completion of pre-clinical studies and clinical trials of our other product candidates, including SD-101, in a timely manner; the results of clinical trials and the impact of those results on the initiation or continuation of subsequent trials and issues arising in the regulatory process; achieving the objectives of and maintaining our collaborative and licensing agreements; our ability to execute on our commercial strategies; whether our financial resources will be adequate without the need to obtain additional financing and other risks detailed in the "Risk Factors" section of our most recent current periodic report filed with the SEC. These statements represent our estimates and assumptions only as of the date of this release. We do not undertake any obligation to update publicly any such forward-looking statements, even if new information becomes available.

DYNAVAX TECHNOLOGIES CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

|

|

Three Months Ended |

|

|

Years Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration revenue |

$ |

535 |

|

|

$ |

1,734 |

|

|

$ |

2,765 |

|

|

$ |

7,933 |

|

|

Grant revenue |

|

75 |

|

|

|

142 |

|

|

|

683 |

|

|

|

2,688 |

|

|

Service and license revenue |

|

75 |

|

|

|

401 |

|

|

|

602 |

|

|

|

411 |

|

|

Total revenues |

|

685 |

|

|

|

2,277 |

|

|

|

4,050 |

|

|

|

11,032 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

20,932 |

|

|

|

19,638 |

|

|

|

86,943 |

|

|

|

84,580 |

|

|

General and administrative |

|

6,699 |

|

|

|

5,052 |

|

|

|

22,180 |

|

|

|

17,377 |

|

|

Unoccupied facility expense |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

386 |

|

|

Total operating expenses |

|

27,631 |

|

|

|

24,690 |

|

|

|

109,123 |

|

|

|

102,343 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(26,946 |

) |

|

|

(22,413 |

) |

|

|

(105,073 |

) |

|

|

(91,311 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

127 |

|

|

|

29 |

|

|

|

205 |

|

|

|

191 |

|

|

Interest expense |

|

- |

|

|

|

(35 |

) |

|

|

(572 |

) |

|

|

(35 |

) |

|

Other income (expense), net |

|

(43 |

) |

|

|

133 |

|

|

|

317 |

|

|

|

433 |

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

(1,671 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(26,862 |

) |

|

$ |

(22,286 |

) |

|

$ |

(106,794 |

) |

|

$ |

(90,722 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock deemed dividend |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss allocable to common stockholders |

$ |

(26,862 |

) |

|

$ |

(22,286 |

) |

|

$ |

(106,794 |

) |

|

$ |

(90,722 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share allocable to common stockholders |

$ |

(0.70 |

) |

|

$ |

(0.85 |

) |

|

$ |

(3.25 |

) |

|

$ |

(3.45 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used to compute basic and diluted net loss per share allocable to common stockholders |

|

38,429 |

|

|

|

26,298 |

|

|

|

32,881 |

|

|

|

26,289 |

|

DYNAVAX TECHNOLOGIES CORPORATION

SELECTED BALANCE SHEET DATA

(In thousands)

(Unaudited)

|

|

December 31, |

|

|

December 31, |

|

|

|

2015 |

|

|

2014 |

|

|

Assets |

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

$ |

196,125 |

|

|

$ |

122,652 |

|

|

Property and equipment, net |

|

13,804 |

|

|

|

7,924 |

|

|

Goodwill |

|

2,043 |

|

|

|

2,277 |

|

|

Other assets |

|

4,661 |

|

|

|

5,437 |

|

|

Total assets |

$ |

216,633 |

|

|

$ |

138,290 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

Deferred revenues |

$ |

2,654 |

|

|

$ |

12,765 |

|

|

Other liabilities |

|

26,900 |

|

|

|

15,484 |

|

|

Long-term debt |

|

- |

|

|

|

9,559 |

|

|

Total liabilities |

|

29,554 |

|

|

|

37,808 |

|

|

Stockholders’ equity |

|

187,079 |

|

|

|

100,482 |

|

|

Total liabilities and stockholders’ equity |

$ |

216,633 |

|

|

$ |

138,290 |

|

# # #

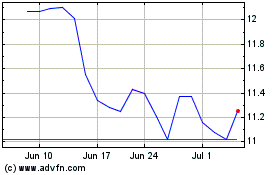

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

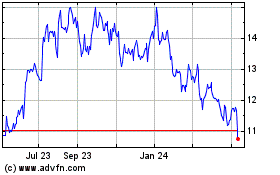

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Apr 2023 to Apr 2024